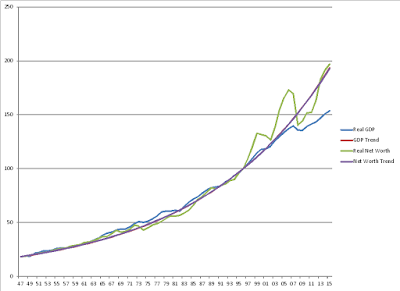

For nearly a half a century, from 1947 to 1996, real GDP and real Net Worth of Households and Non-profit Organizations (in 2009 dollars) both increased at a compound annual rate of a bit over 3.5%. GDP growth, in fact, was just a smidgen faster — 0.016% — than growth of Net Household Worth. From 1996 to 2015, GDP grew at a compound annual rate of 2.3% while Net Worth increased at the rate of 3.6%. Responding to an editorial in the New York Times, Jared Bernstein reprised a theme that Dean Baker has been stressing for a while — that productivity and investment measures don’t support the “robots are stealing jobs” story. I agree with Jared and Dean that it is policy, not robots that are stealing the jobs. But I am skeptical about using productivity numbers as evidence against the role of labor-saving technology in displacing people from employment. The reason for my skepticism is that labor productivity is a ratio between two very broad aggregates — GDP and hours worked — that lump together a myriad of disparate economic factors. Here is the argument I made to Dean back in December.

Topics:

Sandwichman considers the following as important: Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

From 1996 to 2015, GDP grew at a compound annual rate of 2.3% while Net Worth increased at the rate of 3.6%.

Responding to an editorial in the New York Times, Jared Bernstein reprised a theme that Dean Baker has been stressing for a while — that productivity and investment measures don’t support the “robots are stealing jobs” story. I agree with Jared and Dean that it is policy, not robots that are stealing the jobs. But I am skeptical about using productivity numbers as evidence against the role of labor-saving technology in displacing people from employment.

The reason for my skepticism is that labor productivity is a ratio between two very broad aggregates — GDP and hours worked — that lump together a myriad of disparate economic factors. Here is the argument I made to Dean back in December. He was not persuaded:

The difficulty I have with the evidence you [Dean] use for your argument has to do with the changing composition of the aggregate measures that make up the productivity calculation and the possibility that confounding variables in each of those aggregates may be “compounding the confounding” when used for year-to-year comparison.

As Block and Burns pointed out, the National Research Project that developed the original productivity estimates argued that “no such thing exists in reality” as the productivity of a group of diverse products. Instead they presented two calculations of productivity, using different weighting, to show that the “measurement” depended in part on the weighting of the variables.

The shift from physical output to GDP measures obscured the fact that there is “no such thing” as the productivity of a diverse collection of products. Monetary value converts those diverse products into so much “leets” — to use Joan Robinson’s sarcastic term. Obviously the mix of goods and services that make up the GDP differs from year to year. The GDP deflator is intended to adjust for price changes and quality improvements but doesn’t deal with distributional changes and product substitution.

The government services component of national income has been a particular issue, the critique of which goes back to Kuznets’s 1947 criticism of the Commerce Department’s GNP and Kaldor’s statistical appendix to Wm. Beveridge’s Full Employment in a Free Society. Kuznets argued that much of government services should be treated as intermediate goods rather than final consumption goods. Kaldor considered the inflationary affects of government deficit spending, arguing that some of that “inflation” simply reflected the increased share of collective consumption. Warsh and Minard offered a critique of “inflation” in the 1970s that could easily have referenced Kuznets’sand Kaldor’s arguments. Their idea was basically that as government expenditure increases as a percentage of GDP, much of the taxation to pay for it is passed on to the consumer in the form of higher prices. It is an argument about the incidence of taxation.

Finally, there is the question of the “productivity” of hours of work themselves. Presumably there is an optimal length (or innumerable optimal lengths) of the working day, workweek or year and variation above or below that optimum will result in lower output per hour. Aggregate hours of work and average annual or weekly hours do not reflect changes in the dispersion of hours of work that may in turn be affecting the productivity of hours. Computationally, this injects a circular reference into the measurement of productivity. If you tried to do this on an Excel spreadsheet you would get an error message. It is only by ignoring the feedback effect of changes in hours and changes in dispersal of hours that productivity can be calculated as GDP/Hours.

By definition, new technology introduces changes in product mix and changes in work arrangements. But also, by definition, the two components of the productivity calculation assume “no change” in product mix or work arrangements. So I’m having trouble seeing how a ratio that relies on an assumption of no change could be adequate to measure the effects of change.

When Jared posted his commentary, I wanted a quantitative illustration of the point I was trying to make. I had already been wondering about the question raised by Bill Gates about taxing robots and the idea that wealth creation might be “bypassing” income, so I looked up the net worth statistics.

After a bit of number crunching, I am astonished at what I see in the numbers. It is not just the discrepancy between GDP and net worth that impresses me but also the long period prior to 1996 during which the two numbers grew at a very similar rate. In the chart below, I have indexed both series to 100, with 1996 as the reference date. The smooth curve is actually two trend lines based on the 1947 to 1996 trend for each series:

Logically speaking, and using the plain language meaning of the terms, wealth is something that is produced. So increases in wealth presumably are predicated on increases in production. It makes intuitive sense that over the long run there would some sort of stable relationship between the growth rates of GDP and of wealth. I was not anticipating, however, such a close fit between the two series from 1947 to 1996. It only accentuates the disjuncture between GDP growth and growth of Net Worth after 1996.

The above chart only goes to the end of 2015, so it doesn’t include the recent stock market boom. Nevertheless, it presents an unsettling picture.

Returning to the puzzle of productivity, the point that I was trying to illustrate is that the comparability of the productivity measure requires a good deal of faith in the proportional stability of the economic relationships over time. If there are significant shifts in employment by sector, technology, resource availability, trade arrangements and/or consumption tastes, then comparing productivity between periods is futile. There is too much noise in the component aggregates to begin with — but using a ratio between them amplifies the noise.