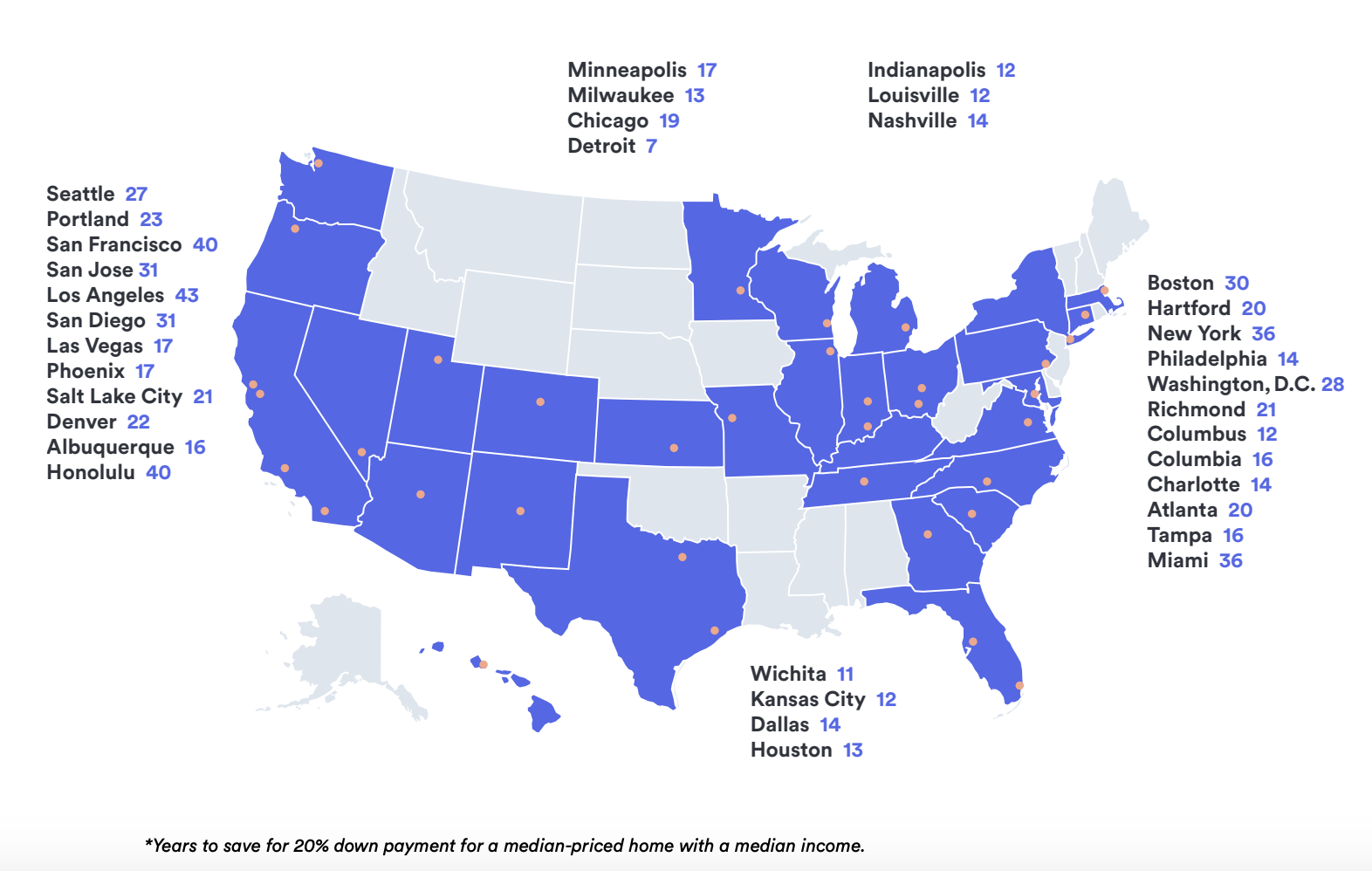

We’ve lost the plot on the classic life arc of yesteryear. Places where real estate is cheap don’t have many good jobs. Places with lots of jobs, primarily coastal cities, have seen their real-estate markets go absolutely haywire. The most recent evidence of this remarkable change comes in a new report by the real-estate firm Unison. The company, which provides financing to homebuyers by “co-investing” with them, calculated how long it would take to save up a 20 percent down payment on the median home in a given city by squirreling away 5 percent of the city’s gross median income per year. Nationally, the gap between income and home value has been rising. Using “Unison’s methodology“, it took nine years to save up a down payment in 1975. Now it takes 14. •

Topics:

run75441 considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

We’ve lost the plot on the classic life arc of yesteryear. Places where real estate is cheap don’t have many good jobs. Places with lots of jobs, primarily coastal cities, have seen their real-estate markets go absolutely haywire. The most recent evidence of this remarkable change comes in a new report by the real-estate firm Unison. The company, which provides financing to homebuyers by “co-investing” with them, calculated how long it would take to save up a 20 percent down payment on the median home in a given city by squirreling away 5 percent of the city’s gross median income per year.

Nationally, the gap between income and home value has been rising. Using “Unison’s methodology“, it took nine years to save up a down payment in 1975. Now it takes 14.

• The typical Los Angeles resident will spend 43 years saving for a 20% down payment and can look forward to moving into a new home in 2061.

• In 2018, the monthly mortgage payment on a median home grew twice as fast as incomes.

• When adjusting for inflation, today’s average real wages have the same purchasing power as 40 years ago.

• Only half of today’s 30-year-olds earn more than their parents did.

Clearly, the old rules of buying a home don’t apply anymore.

This is the new rule: home co-investment.

Unison connects aspiring homebuyers and existing homeowners with institutional investors who offer debt-free access to cash for the chance to share in a home’s appreciation. Our HomeBuyer program provides cash to our partners – you – to supplement a down payment on a new home. Our HomeOwner program allows homeowners to unlock equity in their home to pay off debt, remodel or fund a major purchase.

This isn’t a loan, which means there are no monthly payments and no interest. If the home depreciates, then Unison shares in the loss.

The aggregate numbers make the decrease in access to the real-estate market seem gradual, albeit troubling, and underplay the spikiness of the country. In Los Angeles, it would take 43 years to save up for a down payment. In San Francisco, 40. In San Jose and San Diego, 31. In Seattle and Portland, 27 and 23, respectively. In the east, New York and Miami topped the list, requiring 36 years to save up that down payment. Only Detroit, at seven years, was under the national average from 1975.

The aggregate numbers make the decrease in access to the real-estate market seem gradual, albeit troubling, and underplay the spikiness of the country. In Los Angeles, it would take 43 years to save up for a down payment. In San Francisco, 40. In San Jose and San Diego, 31. In Seattle and Portland, 27 and 23, respectively. In the east, New York and Miami topped the list, requiring 36 years to save up that down payment. Only Detroit, at seven years, was under the national average from 1975.

Generationally, this has huge consequences. Imagine you’re a 30-year-old in Los Angeles with the median income. By Unison’s math, you can imagine buying a home at 73. For young people in high-opportunity metro areas, the route to home ownership is basically blocked without the help of a wealthy family member or some stock options. Meanwhile, older people who bought under much more favorable circumstances have seen their equity stakes grow and grow and grow.

Many of these policies served to restrict the number of affordable homes. So, now, decades later, in many cities with good economies that have drawn new residents, increased demand has not been met with commensurate supply. Young people of all races are experiencing the consequences of these policies, but given the compounding nature of wealth, the relative inaccessibility of home prices is an ongoing disaster for the racial wealth gap.

This is a well written C&P which can be found at The Atlantic, Technology “Why Housing Policy Feels Like Generational Warfare (To Millennials, at least), ” Alexis C. Madrigal

The excuse I have heard as a township planner for not building affordable housing is: “it is only cheap once!” In 2009 many of us saw our housing drop by up to 50% in value.