The Usual Deficit Blather from the New York Times The Times today ran a truly execrable article warning us that, once the virus has passed, we will suffer dire consequences from the runup of government debt. As most readers know, this argument is theoretically illiterate, derived from the false comparison between household and government debt. We’ve been through this many times before, and I have nothing to add. I do want to focus on one sentence, however, to illustrate how intellectual blinders can lead to absurd conclusions. To quote the author, Carl Hulse, “In other words, the bill will come due, as it always does.” Does it? Check out total Federal debt measured as a percent of GDP: As you can see, it skyrocketed during the 1940s, when the US went

Topics:

Peter Dorman considers the following as important: politics, Taxes/regulation, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

The Usual Deficit Blather from the New York Times

The Times today ran a truly execrable article warning us that, once the virus has passed, we will suffer dire consequences from the runup of government debt. As most readers know, this argument is theoretically illiterate, derived from the false comparison between household and government debt. We’ve been through this many times before, and I have nothing to add.

I do want to focus on one sentence, however, to illustrate how intellectual blinders can lead to absurd conclusions.

To quote the author, Carl Hulse, “In other words, the bill will come due, as it always does.”

Does it? Check out total Federal debt measured as a percent of GDP:

As you can see, it skyrocketed during the 1940s, when the US went to war against Germany, Italy and Japan. By the time the war was over it was at an all-time high. Yes, we had to borrow to produce all the war materiel and send millions of troops around the world; no one doubts that. But after V-E and V-J, how were public finances affected?

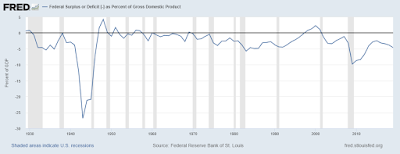

For the answer, take a look at the federal budget surplus or deficit as a percent of GDP:

Well, we ran a surplus for a few years after the war, hardly of the same caliber as the wartime deficits, and then it was business as usual: mostly modest deficits with the occasional surplus or breakeven year. So when did we “pay off” all those war bonds? Never. We just rolled them over and regularly added more debt along the way. Nominal growth took care of it.

So no, the bill will not come due, as it didn’t before.