Alan Collinge of StudentLoanJustice.Org” and I go back a long ways. I have sponsored his posts at Angry Bear. Other sites have done the same. The point to all of his words in unfair practices by nonprofit and for profit higher education schools with regards to student loans before and after college. There is no escape from Student Loans. Thank you Joe Biden. The Wall Street Journal editors recently published an editorial, The Great Student Loan Write-Down, in which they cite a recent Congressional Budget Office report claiming the government is going to be forgiving over 0 Billion in student loan debt over the next decade. They also cites another CBO report which uses so-called “fair value” accounting to claim the government will be losing Billion

Topics:

run75441 considers the following as important: Hot Topics, politics, Taxes/regulation

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Alan Collinge of StudentLoanJustice.Org” and I go back a long ways. I have sponsored his posts at Angry Bear. Other sites have done the same. The point to all of his words in unfair practices by nonprofit and for profit higher education schools with regards to student loans before and after college. There is no escape from Student Loans. Thank you Joe Biden.

The Wall Street Journal editors recently published an editorial, The Great Student Loan Write-Down, in which they cite a recent Congressional Budget Office report claiming the government is going to be forgiving over $200 Billion in student loan debt over the next decade. They also cites another CBO report which uses so-called “fair value” accounting to claim the government will be losing $11 Billion from the lending system over roughly the next decade. Judging from the angry vitriol in the comments under this editorial, the WSJ certainly succeeded in awakening the indignation of its conservative readership.

The Wall Street Journal editors recently published an editorial, The Great Student Loan Write-Down, in which they cite a recent Congressional Budget Office report claiming the government is going to be forgiving over $200 Billion in student loan debt over the next decade. They also cites another CBO report which uses so-called “fair value” accounting to claim the government will be losing $11 Billion from the lending system over roughly the next decade. Judging from the angry vitriol in the comments under this editorial, the WSJ certainly succeeded in awakening the indignation of its conservative readership.

The astonishing truth is the assumptions upon which the WSJ and the CBO reports are resting their claims on are false. In fact, the opposite of what they are claiming is true. WSJ readers, and the public at large should be very concerned by what follows. Past the leap, IBRs and “fair value” costing.

First, the government and its contractors are disqualifying the overwhelming majority of borrowers from participation in income-driven repayment programs. For example, we know that over 99% of the people who applied for Public Service Loan Forgiveness have been rejected to date. These borrowers aren’t getting their loans forgiven, instead most are now stuck with debts far larger than what they if they never tried for the forgiveness promised in the first place.

Similarly, we now know 57% of the people enrolled in IBR were being disqualified out of the program as of 2015 for administrative reasons related to income verification, and an annual burdensome process the Department of Education could easily do through the IRS, but doesn’t. This is only one of a myriad of ways borrowers are kicked out of these programs. It will be astonishing if even 10% of the people in IBR actually make it through. The lucky few who do make it through will be faced with a tax liability that could easily equal or exceed what they originally borrowed. Similar occurs with the public service program, the vast majority who don’t successfully navigate the minefield of bureaucratic obstacles the Department of Education and its contractors have planted in front of them will be left owing far more than had they never tried the program in the first place.

So on balance, it is likely that instead of costing the government money, these “forgiveness” programs will, perversely, succeed in creating net revenue for the Department of Education.

Second: The CBO uses a deeply flawed “fair-value” accounting method which erroneously over-estimates the government’s costs for the federal loan program. Fair value accounting, in principle, is a straightforward process where one looks to private markets (if they exist) to arrive at a reasonable, market value of an asset. For federal student loans, there is indeed a mature, stable market where federal student loans are bought and sold. Fair value accounting rules require that this market be used as a benchmark for pricing the government’s loans. The CBO does not do this. Instead they break the first rule of FVA and use private student loans as a benchmark. What is most baffling: They don’t even look at the private loan securities market, they instead consider only the interest rates of the loans.

“Private student loans” are typically a loan of “last-resort” for students who have already reached their borrowing limits on federal loans. As such, these loans have significantly higher interest rates. Also, the size of the private student loan market is only about a tenth the size of the federal loan portfolio. The CBO goes on to discount the value of the federal loan portfolio based upon the large difference in interest rates, and uses this result to claim that rather than making a profit on federal student loans, the government is losing money on the federal loan program.

To illustrate how outrageously wrong this is, consider the following:

Suppose Exxon sells gas for $3 per gallon. Further down the road, another company sells biodiesel out of its site for $5 per gallon. What if Exxon were to point to this guy and the higher prices he charges, use it as a reason to claim the company is actually losing $2 for every gallon of gas it sells, subtract this aggregate “loss” from its annual financial statements; would this be a fair practice? Of course not!

What is most disturbing about this accounting method (to extend the Exxon analogy): If the guy selling biodiesel were to suddenly raise his price to $10/gallon, this would enable Exxon to claim a $2/gallon loss, but rather a $7/gallon loss. Fair value accounting gives the private student lenders the power to make the government’s lending program look arbitrarily expensive by simply raising their interest rates! How convenient.

This is not true fair value accounting. This is like Bill Gates pointing to Jeff Bezos as proof he is actually poor or King Kong pointing to Godzilla as proof that he is short. I refer to it as “envy” accounting.

Whatever one might call this, there is another name for it: fraud. Any fair minded accountant or economist who remembers Enron and their over-valued Nigerian barges should agree. The only difference is that Enron’s fraud amounted to tens of millions in bad valuation, whereas CBO’s misvaluation amounts to hundreds of billions, or even trillions of dollars.

Decades of White House Budget data show clearly that in the absence of bankruptcy protections, statutes of limitations, and other bedrock consumer protections; the federal government, overall is actually making money and not losing money on defaulted loans. This is something that no other lender for any other type of loan can claim. Even the Wall Street Journal reported this fact as far back as 2004. Given this, it is hard- if not impossible- to imagine how the federal government could be doing anything but making money- and a lot of it- on their loan portfolio. The fact that profits on these loans are used, in part, to subsidize Obamacare, provide further evidence that the government views this lending program as a revenue source.

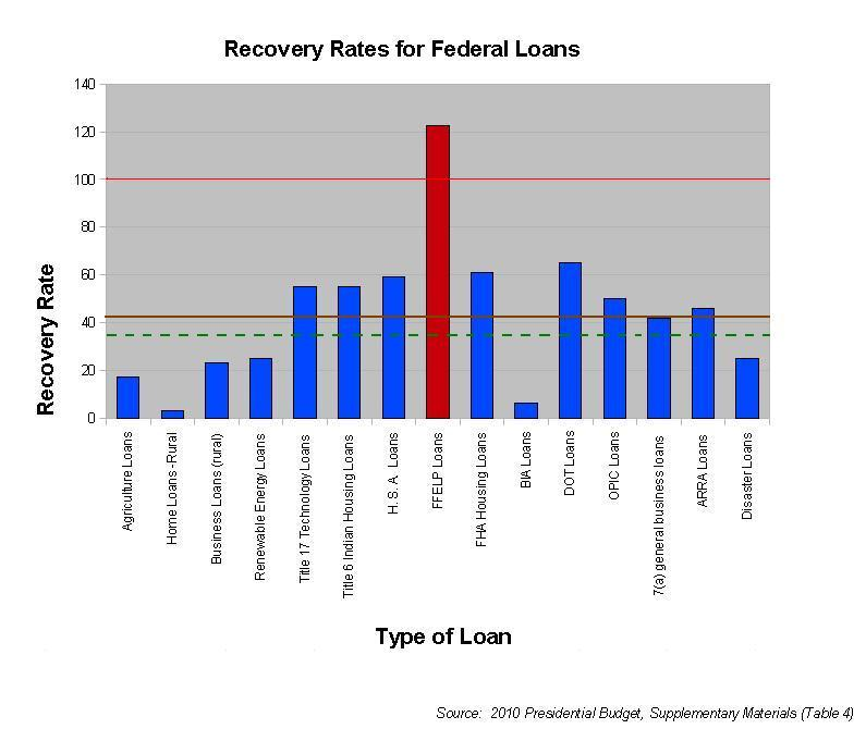

Recovery rates for Federal Loans (2010) reveal the federal government is recouping more than it pays out on defaulted loans. More recent budget data show that this recovery rate has diminished slightly as college prices (and borrowing) has exploded over the past decade; but for most types of defaulted student loans, the government is still eking out a modest profit.

The removal of bankruptcy protections, statutes of limitations, and other consumer protections have allowed the government to get blood from a stone. As a result, tens of millions of people are being crushed or indentured under the burden of this lending system. Those who don’t borrow and as you go for tuition, are also being harmed by the hyperinflation this lending scam has induced.

The Founders called for bankruptcy protections ahead of the power to raise an army and declare war in the Constitution. The unique violation of this for student loans proves their wisdom in spades.

Given that the WSJ editors claim to be committed to “free markets, and free people,” they have clearly lost their way. Rather than defend and perpetuate this big-government monstrosity which is indenturing and beggaring the citizens, they should look to people from the Cato Institute, The National Review, The American Conservative, and many other conservative places, who are calling unambiguously for the return of bankruptcy protections, and do the same.

Similarly, President Trump should issue an executive order calling on the Department of Education and its contractors to stop opposing citizens with student loans who file for bankruptcy in court. That is the only way to drain this swamp.

Alan Collinge is Founder of StudentLoanJustice.Org, and author of The Student Loan Scam (Beacon Press).