An Intro and some history: Alan Collinge at Student Loan Justice Organization. Alan has collected 1,065,931 signatures on his petition asking President Joe Biden to cancel student loan debt. His new goal is to reach 1.5 million signatures. If you believe in the cause you should sign his petition. Petition · President Biden: Cancel Federal Student Loans, and Return Bankruptcy Rights to the Rest. · Change.org Just a signature is all Alan is asking from you. I have known Alan Collinge for well over a decade. Angry Bear has always featured his words on student loans. Canceling student loan debt should not be so arduous. In support of the previous comment, I am making some rather broad assumptions believing they are mostly true. Repeatedly, I am

Topics:

run75441 considers the following as important: Alan Collinge, Education, politics, Student Loan Justice Org, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

An Intro and some history:

Alan Collinge at Student Loan Justice Organization. Alan has collected 1,065,931 signatures on his petition asking President Joe Biden to cancel student loan debt. His new goal is to reach 1.5 million signatures. If you believe in the cause you should sign his petition. Petition · President Biden: Cancel Federal Student Loans, and Return Bankruptcy Rights to the Rest. · Change.org

Just a signature is all Alan is asking from you.

I have known Alan Collinge for well over a decade. Angry Bear has always featured his words on student loans. Canceling student loan debt should not be so arduous. In support of the previous comment, I am making some rather broad assumptions believing they are mostly true. Repeatedly, I am reading comments about student loans being far larger than the original principal.

Going Forward

In was a while back when I put forth a broad-based “assumption” of interest, penalties, consolidation fees, and interest on top of interest having surpassed the original principal of the loans. Much of this is strictly based on observation and commentary of student loan holders who have experienced their loans increasing and doubling due the factors and penalties I have mentioned.

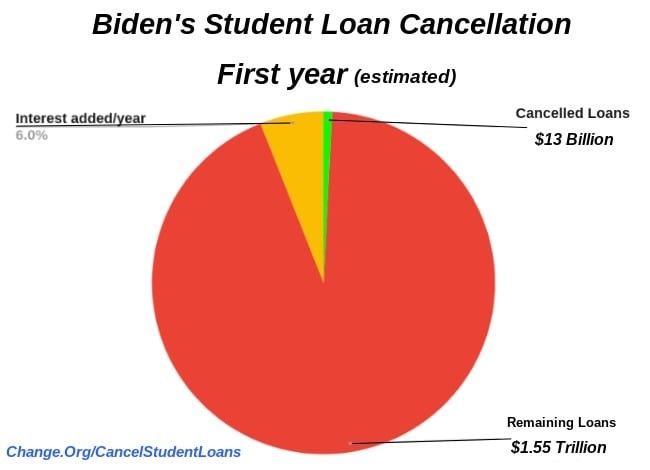

The recent cancellation of some Student Loans for people who worked in public positions has resulted in $13 billion (shown in green), a small part of the $1.55 trillion in student loan debt. Meanwhile interest on student loans on the balance is accruing at approximately 6% with older borrowers paying higher interest rates (8%). Correct me if my math is wrong . . . the yearly interest would equal $60 Billion on $1 trillion or in this case ~$95 billion annually.

Student loans are the gift that keeps on giving, if paid.

So who is holding the bulk of this debt?

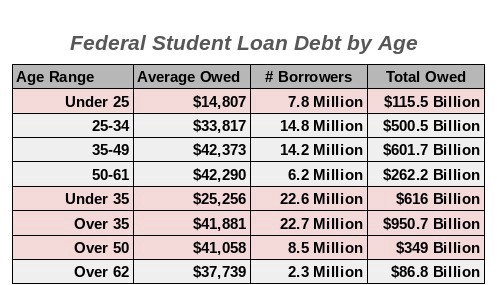

Another chart used by Alan Collinge breaks Student Loan Debt by Age bracket. Roughly two thirds of the debt (~$951 billion) is being held by those 35 and older. Thirty-six percent ($349 billion) is being held by those over fifty years of age. The chances of those over 50 and going into retirement dwindles with each year passing. The total dollar amount held by those 62 and older has not dwindled much.

Indeed, many of holders of these loans will have a portion of their Social Security disposable income attached by the Federal Government to continue paying student loans. And again, If there were penalties, consolidation and recasting fees, interest in forbearance and interest on top of these additional costs; more than likely it has equaled the principal of the loan or a significant amount of it. At this point, it makes little sense to chase loan holders to the grave.

Some Points:

run75441: Would it hurt the government, if these fees were wiped away as they were not a part of the original loan and are what I would call usurious or just plain outrageous? Normal and every day loans do not face the same penalties. In the end, the nation wastes more money on Defense and gives away more in tax breaks. More giveaways than what student loan holders owe and who are having their feet held to the fire.

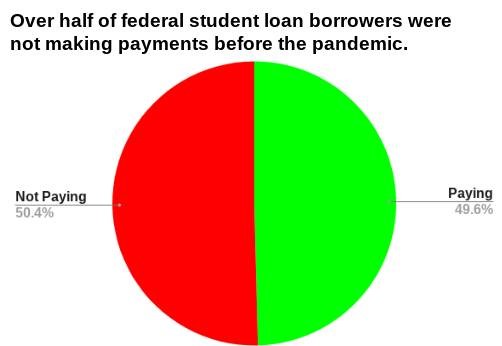

As I have alluded to in the past. Student loan holders have paid more interest, penalties, and fees than deserved which appears to have surpassed principal. Many have just stopped paying their student loans.

More Conversation:

It appears Democrats have given up on helping . . .

Alan: We don’t know how much of the $1.566 Trillion is actual, unpaid principal vs interest. We also don’t know the repayment history. My best guess is that only a couple hundred billion are actual unpaid principal. It could even be that the loans could be cancelled entirely with no net-loss to the government (although I think this may be unlikely).

It is just that due to lost loan repayment histories, buying and selling of the loans consolidation rehabilitation, etc, no one can say for sure. So our opposition simply says “we don’t know”

run75441: Senseless . . . This has been handed off by both Republican and Democratic led administrations over the decades.

Alan: My best guess is that only a couple hundred billion are actual unpaid principal. It could even be that the loans could be cancelled entirely with no net-loss to the government (although I think this may be unlikely).

I would also suspect far fewer than the 49.6% paying their loans back now would continue after the pandemic.

- Pie Charts and Table provided by Student Loan Justice Org,