Improving Medicare Coverage Act – H.R. 5165 Medicare – Improving Medicare Coverage Act; H,R, 5165, September 3, 2021 130+ House Democrats are co-sponsoring a bill by Pramila Jayapal, the Improving Medicare Coverage Act. The impact of which would drop the Medicare eligibility age to 60 years of age. All well and good, it is about time something is changing. Healthcare Insurance and medical costs are exceeding high in the US. Pricing of healthcare exceeds the actual cost of it. Today, sixty-year-olds can pay a penalties under the ACA for just being old. The ACA was designed to allow for such the same as for smokers. Oldsters are told they could get better coverage under Medicare which is true. It too comes with a price which I have written

Topics:

run75441 considers the following as important: Age 60, Featured Stories, Healthcare, Medicare, politics, Pramila Jayapal, social security

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Improving Medicare Coverage Act – H.R. 5165

Medicare – Improving Medicare Coverage Act; H,R, 5165, September 3, 2021

130+ House Democrats are co-sponsoring a bill by Pramila Jayapal, the Improving Medicare Coverage Act. The impact of which would drop the Medicare eligibility age to 60 years of age.

All well and good, it is about time something is changing. Healthcare Insurance and medical costs are exceeding high in the US. Pricing of healthcare exceeds the actual cost of it. Today, sixty-year-olds can pay a penalties under the ACA for just being old. The ACA was designed to allow for such the same as for smokers. Oldsters are told they could get better coverage under Medicare which is true. It too comes with a price which I have written about Medicare costs.

Why Would Jayapal’s H.R. 5165 Matter?

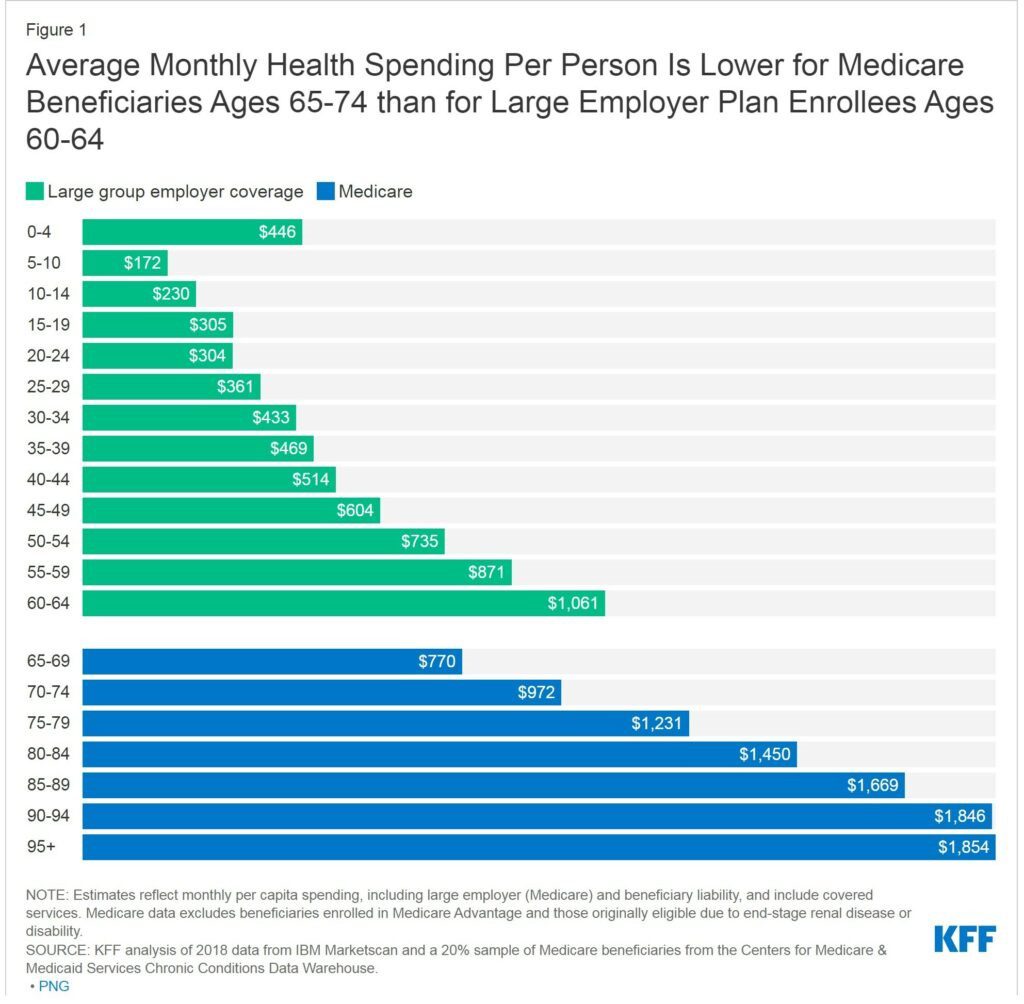

A recent Kaiser Family Foundation analysis found health care spending generally rises as people age. While under Medicare, costs decreases when people switch from private insurance to Medicare. Monthly costs average $770 for 65- to 69-year-olds under Medicare compared with $1061 for the younger group of 60- to 64-year-olds under employer-based insurance.

What about the American Rescue Plan? The act lowers ACA insurance rates for all below 200% FPL. This is helpful for the lower income population. It is important to remember, healthcare insurance is a reflection of healthcare pricing plus 15-20% of the price. The cost of healthcare may remain the same and the price may still increase. Do not interchange costs with prices as they may not or do are not mean the same in the end.

As was pointed out in Again, Healthcare Cost Drivers Pharma, Doctors, and Hospitals, pricing increases were large part of healthcare. “Health care spending increased by $933.5 billion from 1996 to 2013. Service price and intensity alone accounted for more than 50% of the spending increase.”

Pricing increases are a major part of the increasing Healthcare dynamics. The healthcare industry hopes to ameliorate negativity from pricing increases by claiming increasing value of the drugs due to new uses etc. thereby justifying the price increases even though there is little or no cost increases. To which I would say, most of these are older drugs and the costs of bringing them to market have been recouped at 5 years, And also add, increased usage provides greater profits too!

Back to the topic

Dropping Medicare eligibility age to 60 would be helpful for many if this was all they have to depend upon. There is the ACA which many can use if they can afford it. As I have said before in early commentary, Medicare is not as low cost as many think. However,

How Jayapal’s IMC H.R. 5165 Act lowers costs

Jayapal’s bill will change the Medicare pricing dynamics by making all enrollees with income below 200% FPL eligible for a new Medicare Assistance Program zeroing out premiums, coinsurance, and deductibles for Medicare Parts A (hospital) and B (physician and outpatient). It subsidizes Part D prescription drug coverage, the Part D premium, and prescription copays reducing the latter to single-digit dollar amounts.

An important note along with providing less costly benefits for those below 200% FPL, the IMC Act removes the administration of healthcare benefits from state Medicaid programs. The federal government assumes 100% of costs now being shared with states.

Think about this change for a moment. States not expanding Medicaid to 138% FPL and Medicaid are no longer a part of states. States can no longer have requirements hold having employment over the heads of the unemployed or the jobless as a requirement for healthcare. The administration of the IMC Act causes Medicaid to come under the auspices of Medicare and eliminates the fifty political entities with different and varying motives for healthcare.

The IMC Act also goes well beyond the ACA in implementing one of the four prongs of Single Payer healthcare by using Medicare to pay hospitals, etc.. The healthcare insurance industry will be squealing about this. Hospitals and doctor organizations would oppose it. Republicans will do their political best to oppose it. Manchin may be the new Lieberman holding it for ransom as he is doing the proposed $3.5 trillion 10 year spending plan.

Similar to Medicare Efforts

The Medicare Cost Assistance is equivalent to today’s Qualified Medicare Beneficiary (QMB) program. QMB pays enrollees’ Medicare Part A and B enrollees’ costs in full. The QMB program is the strongest of four Medicare Special Programs (MSPs) presently. It is available to low-income and negligible asset enrollees having a current income eligibility limit of $1,094 per month for individuals and $1,472 for couples. Asset restrictions are set at $7,970 for an individual and $11,960 for couples.

Another plus beyond Medicare, the IMC Act doubles the income limits to approximately $2,147/month for an individual, $2,903 for a couple, and eliminates asset limits. Many beneficiaries over the age of 65 would benefit.

There is a lot going on here with Biden’s American Rescue Plan for the ACA and Jayapal’s Improving Medicare Coverage Act – H.R. 5165. One places an emphasis on incomes below 250% FPL and Jayapal’s plan lowers the age limit for Medicare and increases the amount of income for eligibility.

So which would you or should you take?

It still depends on your circumstance. Traditional FFS Medicare is not cheap.

As xpostfactoid determines, those with incomes up to 200% of the Federal Poverty Level (FPL) will likely find lower costs in the ACA marketplace. Providing they are not dually eligible for Medicare and Medicaid. Those with incomes over 400% FPL will likely favor Medicare. In between each program is a gray area, with tradeoffs that are charted and discussed below.

Whether one chooses a Medicare Advantage plan or FFS Medicare, the choice should be carefully reviewed. As I explained in an early post, MA plans have been shown to over-diagnose their participants to gain extra charges. Similarly, they have rejected visits from their participants. In both instances, MA plans are being over paid and the US keeps fumbling around with it.

Xpostfactoid, “Those who can afford Medigap plans, or whose employer offers them, hold the keys to the U.S. healthcare kingdom.

A virtually unlimited choice of provider and minimal out-of-pockets costs with the notable exception of the prescription drug Achilles-Heel. Medigap plans combine sit on top of traditional Medicare. They are not available in combo with Medicare Advantage plans. They usually cost $100-200 per month on top of Medicare Parts B&D premiums, for a total of about $300-400/month per person.”

The “only” sure roadblock to obtaining either “improved” program is West Virginia Senator Joe Manchin a relatively wealthy energy industrialist individual who is worried people will not go back to work. and we are on the way to become a socialist country rather than a corpocracy. Calling Joe Manchin a moderate is laughable.

I left my references below for anyone wishing more information can look to this list.

xpostfactoid: Dropping the Medicare age to 60 also requires…

Uninsured Rate Steady But High; More Work Needed | Health Affairs

IMC Act: Amend titles II and XVIII of the Social Security Act to lower the Medicare eligibility age to 60

How the American Rescue Plan Act will boost marketplace premium subsidies | healthinsurance.org

ARP puts more ‘affordable’ in the Affordable Care Act | healthinsurance.org

H.R. 5165 (IH) – Improving Medicare Coverage Act – Content Details – BILLS-117hr5165ih (govinfo.gov)