Everybody talks about Medicare, Medicare4All, Medicare Advantage. Few talk about costs or what Medicare consists of for those who qualify for it. How can someone be in favor of Medicare4All, if you do not understand what regular Medicare consists and what it costs. I am guessing most people believe it would be free. What if it isn’t and you paid what many people pay today for Medicare and its supplements? Some Absolutes: Traditional Medicare Part B: What Part B covers | Medicare Based on 3 main factors. Federal and state laws, Medicare national coverage decisions, and local coverage decisions made by companies in each state that process claims for Medicare deciding what is covered.1. Part B Traditional: No matter if you choose traditional

Topics:

run75441 considers the following as important: Featured Stories, Healthcare, Medicare, politics, social security

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Everybody talks about Medicare, Medicare4All, Medicare Advantage. Few talk about costs or what Medicare consists of for those who qualify for it. How can someone be in favor of Medicare4All, if you do not understand what regular Medicare consists and what it costs.

I am guessing most people believe it would be free. What if it isn’t and you paid what many people pay today for Medicare and its supplements?

Some Absolutes:

Traditional Medicare Part B:

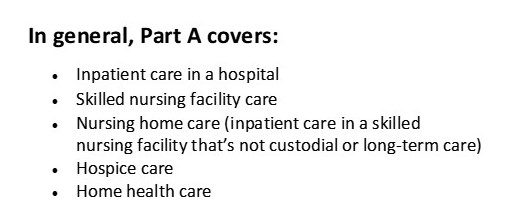

1. Part B Traditional: No matter if you choose traditional or Advantage, you will pay a Medicare Part B monthly premium which is deducted from your SS benefit. Part B premiums can vary by income. One big difference between traditional and Advantage is; Traditional Medicare is Single Payer and Advantage (MA) is not. MA is commercial insurance and each company pays the hospital or doctor’s bill. Traditional Medicare admin pays all the bills which reduces administrative costs.

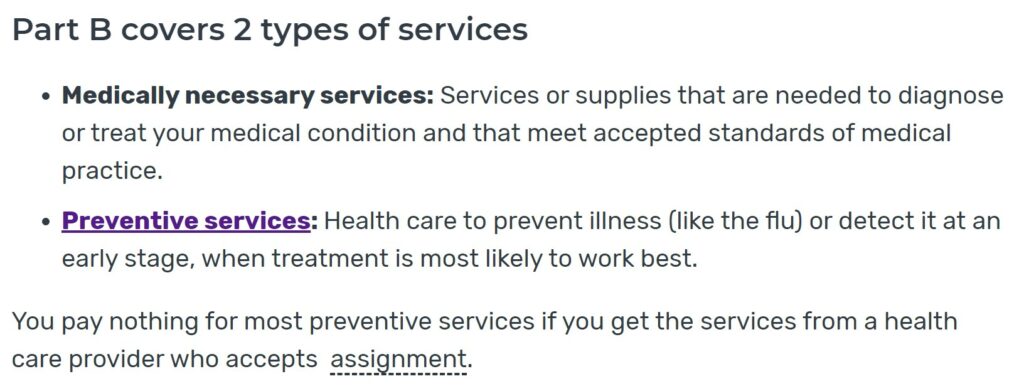

2. Traditional, will have a monthly premium ($148.50/month – 2021) for Part B and a deductible of $203 in 2021. Also with satisfying the Part B deductible, there is a 20% CoPay of the approved amount. MediGap covers the 20%:

- Most doctor services (including most hospital doctor services)

- Outpatient therapy

- Durable Medical Equipment (Dme)

MediGap or Part G covers much of the 20% not covered in Traditional Part B or Part A.

3. Traditional Medicare has a base monthly premium of $148.50/month (2921) for Part B besides a 20% Co-Pay for approved billings.

The cited base monthly premium is set using taxable income. I was citing the a premium for those making less than $88,000 for a single person or $176,000 for a couple. If your modified adjusted household gross income (MAGI) exceeds $88,000 (single) or $176,000 (couple), the Part B premium will be higher ($207.90).

Approximately 5% all Traditional Medicare beneficiaries currently pay higher Part B premiums.

Traditional Medicare Part A:

Traditional Medicare Part A will not completely cover OBSERVATIONAL hospital stays. You have to be admitted to the hospital for full coverage.

Premiums are based upon quarters of years of WORK history.

- No premium if you have 40 quarters of work history pre-Social Security (Detail here Medicare Part A costs [2021])

- A premium of $259 If you have worked 30 to 40 quarters.

- A premium of $471 If you have worked less than 30 quarters.

1. You will pay Federal Income Tax for Social Security above a certain income.

- Individuals with a combined income between $25,000 and $34,000 are taxed on 50% of their Social Security benefit. If your combined income exceeds $34,000, 85% of your Social Security income could be taxable

- Married couples face tax on 50% of their Social Security benefit if their combined income is between $32,000 and $44,000. Up to 85% of Social Security income is taxable for married couples with a combined income that exceeds $44,000.

2. Traditional Medicare is Single Payer: It pays all approved bills submitted by doctors, hospitals, etc. However, It does not establish hospital budgets, set doctor fees, or regulate pharmaceutical costs/pricing.

Commentary

Traditional Medicare sounds expensive, yes? It is expensive as it is not complete and uses Commercial Healthcare insurance to fill the gaps. Paying Part A and Part B deductibles if you have no MediGap insurance. The link will detail each.

What About the Part A and B Deductibles? If you do not have MediGap (Part G), the deductibles and other costs become yours to pay.

MediGap Part G

- To cover the Part A deductibles, Part B deductibles, and get additional coverage for hospital and Hospice; you buy a MediGap plan. You may not need the best plan (G or F) and you can look at the other plans. MediGap Plan N is a good plan one and less expensive. It will cover Part A deductibles and much of the Part B deductibles. MediGap Plan N will have doctor copay of $20 and an ER copay of $50..

2. AARP uses United Healthcare for MediGap. You get a decreasing reduction in monthly premium payments for the first 10 years. There may also be other plans which are similar. The VA covers me also. There is also Blue Cross and Blue Shield as well as other plans.

Pharmaceuticals Part D

- Under traditional Medicare, you will also need a drug plan called Part D. Your selection will depend upon what type of drugs you take. Plans will cover Tier 1 drugs for free. Many plans will cover Tier 2 with a copay of ~$6.00 per 30 days of drugs.

- If you have Tier 3 or 4 drugs, your costs will be higher in Traditional and you should get a different plan to cover the higher deductibles.

Commentary

Again, is Traditional Medicare expensive? Yes it is. If you start looking at the costs of Part B, Medigap and Part D plans, you may be paying ~$320/month or more per month for good coverage. Medicare Advantage may not have premiums and also will offer the same.

Why Medicare?

- You can go anywhere in the nation with Traditional Medicare. MA plans can have narrow or limited healthcare providers within a region. If you go out of network – Advantage can charge out-of-network fees.

2. With Traditional, the monthly fees are always the same. If you fall into an upper income bracket you will pay more in monthly Part B fees to the Gov.. If you have a disorder or disease, your copays etc. will not increase, and neither will they kick you out of the hospital early. However, your MediGap premium may increase a small amount.

3. Advantage can have or it can increase costs to you in the form of CoPays, deductibles, etc. It can limit where you can go for care. Remember, this is Commercial Healthcare Insurance in disguise as a form of Medicare. MA is not Single Payer and it incurs the same costs in administering it as Commercial healthcare.

4. If you go with a MA plan, you can “probably” find a plan which may be free when it comes to monthly payments (more later) other than Part B.

5. MA has been overcharging Medicare by assigning higher risk determinations which are used to charge higher charges for patient care. I documented the issue in Medicare Advantage and Medicare Issues, for over assigning risk, denying coverage, etc. It is estimated $30 billion in over payments paid to MA programs.

Two doses of an IVIG infusion over two of the 4 days at $28,000 a dose (list). Platelets increasing to ~40,000 and was discharged. Scheduled for more infusions of Rituxan to be done at the Cancer Center an eerie place as everyone there is stricken although they may not look so. Weekly visits of 4-6 hours at ~$30,000/dose. Four doses.

Outcome and Information

If you choose Medicare Advantage when you sign up, you may lose the chance to ever get MediGap under Traditional Medicare without an exam and then they may refuse to cover pre-existing conditions.

The Medicare link I provided will answer many of your questions. There are help centers which will answer more. Reviewing the link will expand your understanding of Medicare.

Oh, and the guy who had all the infusions? I paid ~$20 for two lunches and parking fees. There were people there I talked with who were sicker and far younger than I. My 3rd bout.