November Durable Goods: New Orders up 2.5%, Shipments Up 0.7%, Inventories Up 0.6%, MarketWatch 666, RJS The Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for November (pdf) from the Census Bureau reported that the value of the widely watched new orders for manufactured durable goods increased by .5 billion or 2.5 percent to 8.3 billion in November, the 6th increase in seven months, after October’s new orders were revised from the 0.5% decrease to 0.1 billion reported last month to a 0.1% increase to 1.7 billion…however, year to date new orders are now 21.5% above those of 2020, a decrease from the 22.1% year over year change we saw in this report last month…. An increase in the volatile monthly

Topics:

run75441 considers the following as important: durable goods, MarketWatch 666, RJS, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

November Durable Goods: New Orders up 2.5%, Shipments Up 0.7%, Inventories Up 0.6%, MarketWatch 666, RJS

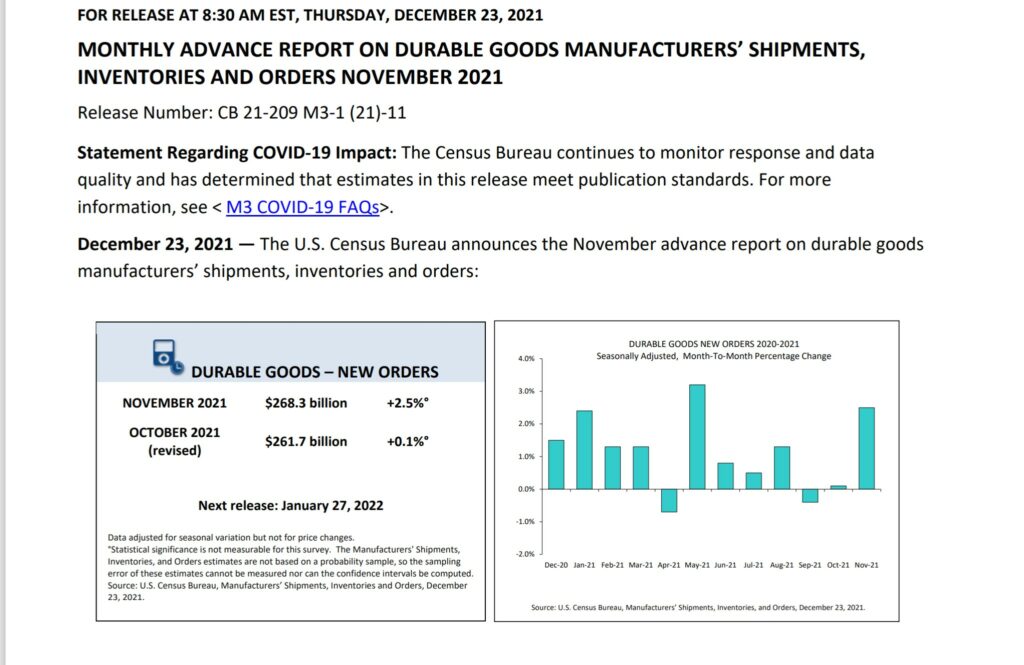

The Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for November (pdf) from the Census Bureau reported that the value of the widely watched new orders for manufactured durable goods increased by $6.5 billion or 2.5 percent to $268.3 billion in November, the 6th increase in seven months, after October’s new orders were revised from the 0.5% decrease to $260.1 billion reported last month to a 0.1% increase to $261.7 billion…however, year to date new orders are now 21.5% above those of 2020, a decrease from the 22.1% year over year change we saw in this report last month….

An increase in the volatile monthly new orders for transportation equipment was responsible for most of this month’s increase, as new transportation equipment orders rose $5.0 billion or 6.5 percent to $82.1 billion, on a 34.1% increase to $13,310 million in new orders for commercial aircraft and parts… excluding orders for transportation equipment, other new orders were up 0.8%, while excluding just new orders for defense equipment, new orders rose 2.0%….at the same time, new orders for nondefense capital goods less aircraft, a proxy for equipment investment, fell by $65 million or by 0.1% to $78,801 million, after rising by an upwardly revised 0.9% in October..

Meanwhile, the seasonally adjusted value of November’s shipments of durable goods, which will ultimately be included as inputs into various components of 4th quarter GDP after adjusting for changes in prices, increased for the sixth time in seven months, rising by $1.8 billion or 0.7 percent to $263.6 billion, after the value of October shipments was revised from from $248.7 billion to $249.4 billion, now up 1.7% from September, revised from the 1.5% increase to $261.5 billion reported last month…the value of shipments transportation equipment rose $0.7 billion or 1.0 percent to $76.4 billion, on a 1.7% increase in shipments of motor vehicles and parts, but shipments other than those of transportation equipment were also up 0.5% for the month…of those, shipments of nondefense capital goods less aircraft rose 0.3% to $76,332 million, their ninth consecutive monthly increase, after October capital goods shipments were revised from $76,034 million to $76,079 million, now a 0.4% increase from September……..

At the same time, the value of seasonally adjusted inventories of durable goods, also a major GDP contributor, rose for the tenth consecutive month, increasing by $2.9 billion or 0.6 percent to $469.6 billion, after October inventories were revised from $466.0 billion to $466,643 million, now up 0.7% from September… increased inventories of machinery led the November increase, rising $2.9 billion or 0.6 percent to $469.6 billion, while inventories of transportation equipment rose just 0.1% to 154,026 million due to a 0.4% decrease to $49,633 million in inventories of motor vehicles and parts….excluding inventories of transportation equipment, the value of all other durable goods inventories rose 0.9%, while inventories of capital goods less aircraft rose 1.0% to $139,917 million…

Finally, unfilled orders for manufactured durable goods, which are probably a better measure of industry conditions than the widely watched but volatile new orders, rose for the 10th consecutive month, increasing by $8.9 billion or 0.7 percent to $1,259.9 billion, after unfilled orders for October were revised from $1,249.7 billion to $1,250.9 billion, now a 0.3% increase from September….a $5.7 billion or 0.7 percent increase to $831.2 billion in unfilled orders for transportation equipment led the November increase, but unfilled transportation equipment orders other than transportation equipment also rose 0.8% to $428,651 million…compared to a year earlier, the unfilled order book for durable goods is 6.2% above its level of last November, with unfilled orders for transportation equipment just 2.2% above their year ago level, despite a 16.5% increase in the backlog of orders for motor vehicles and parts…