Income, spending, layoffs, and new home sales all point to a continuing expansion in 2022 We got our last batch of data before Christmas this morning. Almost all of the news was positive. I will be very brief.In the “coincident indicators” department, real personal income declined -0.2%, while real personal consumption expenditures increased less than 0.1%, although both remain well above their pre-pandemic levels: Comparing real personal consumption expenditures with real retail sales for November (essentially, both sides of the consumption coin) reveals both faltered, but not in any way worth being worried about: In the “short leading indicators” department, nobody continues to get laid off. Initial claims were unchanged for the week

Topics:

NewDealdemocrat considers the following as important: 2022 economy, Featured Stories, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Income, spending, layoffs, and new home sales all point to a continuing expansion in 2022

We got our last batch of data before Christmas this morning. Almost all of the news was positive. I will be very brief.

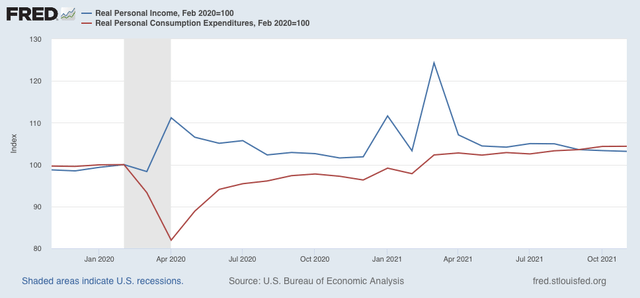

In the “coincident indicators” department, real personal income declined -0.2%, while real personal consumption expenditures increased less than 0.1%, although both remain well above their pre-pandemic levels:

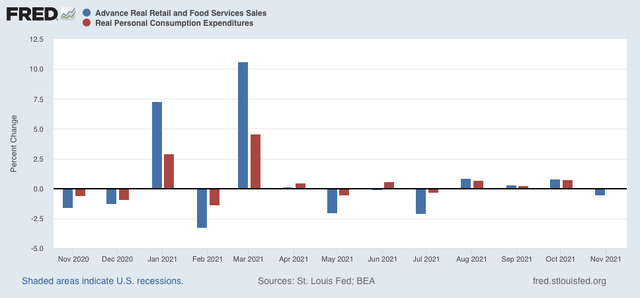

Comparing real personal consumption expenditures with real retail sales for November (essentially, both sides of the consumption coin) reveals both faltered, but not in any way worth being worried about:

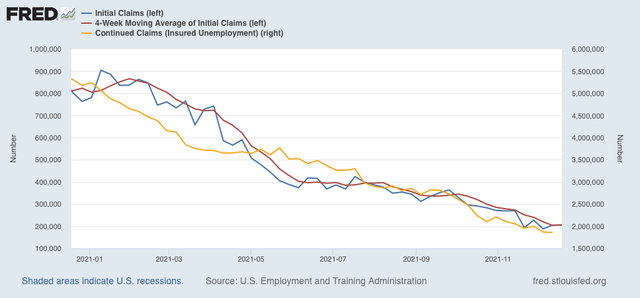

In the “short leading indicators” department, nobody continues to get laid off. Initial claims were unchanged for the week at 206,000, while the 4-week average rose slightly to 206,250. Continuing claims (right scale) declined to yet another pandemic low of 1,859,000:

The employment economy continues to be very “hot.” This is a very good sign for the next few months.

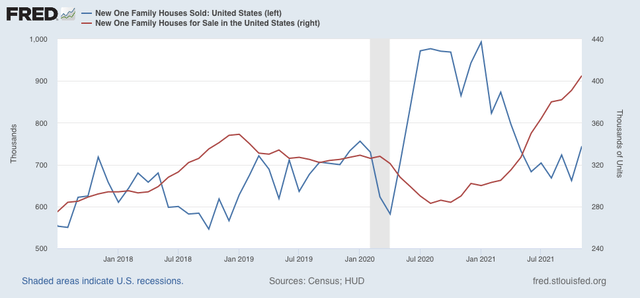

Finally, in the “long leading indicators” department, new home sales rose to a 6 month high, while the inventory of new homes for sale (which lag) rose to a 13 year high:

At least when it comes to a new house, the imbalance of inventory is being worked out, while the trough in sales from summertime is almost certainly behind us.

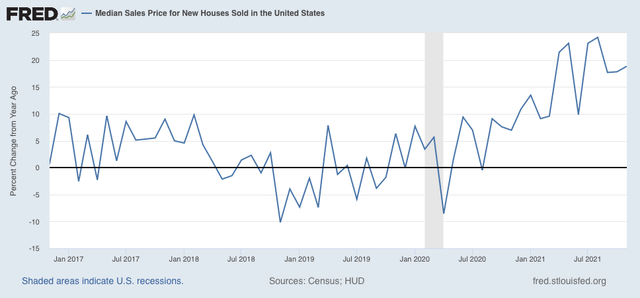

Meanwhile, the YoY growth in house prices continued to abate – a little – from late spring and summer highs:

The housing market, which had been a negative this summer, has turned back into a positive for year-end 2022.

In summary, the expansion should continue.