Commenter r. j. s. at MarketWatch666 Retail Sales Fell 3.0% in February After January Sales Were Revised 1.9% Higher Seasonally adjusted retail sales decreased 3.0% in February after retail sales for January were revised 1.9% higher . . . the Advance Retail Sales Report for February (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled 1.7 billion during the month, which was 3.0 percent (±0.5%) lower than January’s revised sales of 9.1 billion, but still 6.3 percent (±0.7 percent) above the adjusted sales in February of last year…January’s seasonally adjusted sales were revised up from 8.2 billion to 9.1 billion, while December’s sales were revised from 9.7 billion down

Topics:

run75441 considers the following as important: MarketWatch 666, RJS, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Commenter r. j. s. at MarketWatch666

Retail Sales Fell 3.0% in February After January Sales Were Revised 1.9% Higher

Seasonally adjusted retail sales decreased 3.0% in February after retail sales for January were revised 1.9% higher . . . the Advance Retail Sales Report for February (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled $561.7 billion during the month, which was 3.0 percent (±0.5%) lower than January’s revised sales of $579.1 billion, but still 6.3 percent (±0.7 percent) above the adjusted sales in February of last year…January’s seasonally adjusted sales were revised up from $568.2 billion to $579.1 billion, while December’s sales were revised from $539.7 billion down to $538,338 million; as a result, the December to January change was revised up from up 5.3 percent (±0.5 percent) to up 7.6% (±0.3%) . . . the downward revisions to December sales would indicate that 4th quarter personal consumption expenditures will be revised lower at about a $5.5 billion annual rate, which would thereby reduce 4th quarter GDP by about 0.11 percentage points…estimated unadjusted sales, extrapolated from surveys of a small sampling of retailers, indicated sales were down 5.4%, from $519,588 million in January to $491,356 million in February, while they were up 2.4% from the $479,868 million of sales in February of a year ago . . .

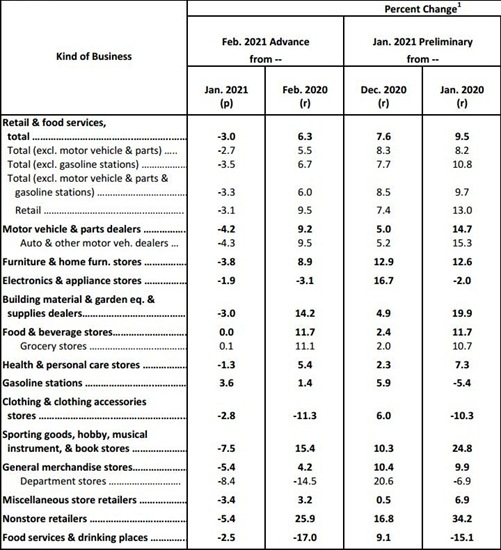

Included below is the table of the monthly and yearly percentage changes in retail sales by business type taken from the February Census Marts pdf . . . the first pair of columns below gives us the seasonally adjusted percentage change in sales for each kind of business from the January revised figure to this month’s February “advance” report in the first sub-column, and then the year over year percentage sales change since last February is in the 2nd column…the second double column pair below gives us the revision of the January advance estimates (now called “preliminary”) as of this report, with the new December to January percentage change under “Dec 2020 (r)” (revised) and the January 2020 to January 2021 percentage change as revised in the last column shown…for your reference, our copy of the table of last month’s advance estimate of January sales, before this month’s revisions, is here, should you be interested in more detail in how January sales were revised . . .

To compute February’s real personal consumption of goods data for national accounts from this February retail sales report, the BEA will use the corresponding price changes from the February consumer price index, which we reviewed last week…to estimate what they will find, we’ll first separate out the volatile sales of gasoline from the other totals…from the third line on the above table, we can see that February retail sales excluding the 3.6% price-related increase in sales at gas station were down by 3.5%….then, subtracting the figures representing the insignificant increase in grocery & beverage store sales and the 2.5% decrease in food services sales from that total, we find that core retail sales were down by roughly 4.25% for the month…since the CPI report showed that the composite price index for all goods less food and energy goods was 0.1% higher in February, we can thus approximate that real retail sales excluding food and energy will on average be down by roughly 4.35%…..however, the actual adjustment in national accounts data for each of the types of sales shown above will vary by the change in the related price index…for instance, while nominal sales at motor vehicle and parts dealers were down 4.2%, the price index for transportation commodities other than fuel was 0.4% lower, which would suggest that real sales at vehicle and parts dealers fell by roughly 3.8%…similarly, while nominal sales at clothing stores were 2.8% lower in February, the apparel price index was 0.7% lower, which means that real sales of clothing fell around 2.1%…on the other hand, while nominal sales at sporting goods, hobby, music and book stores fell 7.5%, the price index for recreational commodities rose 0.5%, so we can figure real sales of recreational goods were down by roughly 8.0% . . .

In addition to figuring those core retail sales, we should also adjust food and energy retail sales for their price changes separately…the February CPI report showed that the food price index was 0.4% higher, with the index for food purchased for use at home 0.3% higher, while prices for food bought to eat away from home (other than at employee sites and schools) were 0.4% higher… thus, while nominal sales at food and beverage stores were unchanged, real sales of food and beverages would be roughly 0.3% lower in light of the 0.3% higher prices…meanwhile, the 2.5% decrease in nominal sales at bars and restaurants, once adjusted for 0.4% higher prices, suggests that real sales at bars and restaurants fell about 2.9% during the month….on the other hand, while sales at gas stations were up 3.6%, there was a 6.4% increase in the retail price of gasoline during the month, which would suggest that real sales of gasoline were down on the order of 2.6%, with the caveat that gasoline stations do sell more than gasoline, and we haven’t accounted for those other sales….averaging real sales that we have thus estimated together, but leaving out real restaurant and bar sales, we can then estimate that the income and outlays report for February will show that real personal consumption of goods fell by more than 3.6% in February, after rising by a revised 7.4% in January, but after falling by a revised 2.1% in December…at the same time, the 2.9% decrease in real sales at bars and restaurants would reduce the growth rate of February’s real personal consumption of services by almost 0.3% . . .