Farmer and Agriculture Economist Michael Smith “[Land profits] are a species of revenue which the owner, in many cases, enjoys without the care and attention of his own” -Adam Smith In other words, land appreciates not by the owners doing, but his neighbors. Sure, there are certain things that can be done to improve land, build a house, clear the brush and trees, install utilities. Or choose none of the above and wait. The post pandemic land grab has been a whirlwind of anxiety, excitement, and free markets showing how they work best. Until they don’t. The pandemic is only partly to blame, as people have reassessed the meaning of work and as companies have allowed remote work possibilities (finally) the where to live has become a

Topics:

run75441 considers the following as important: agricultural economics, Farming, Hot Topics, Michael Smith, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Farmer and Agriculture Economist Michael Smith

“[Land profits] are a species of revenue which the owner, in many cases, enjoys without the care and attention of his own” -Adam Smith

In other words, land appreciates not by the owners doing, but his neighbors.

Sure, there are certain things that can be done to improve land, build a house, clear the brush and trees, install utilities. Or choose none of the above and wait.

The post pandemic land grab has been a whirlwind of anxiety, excitement, and free markets showing how they work best. Until they don’t.

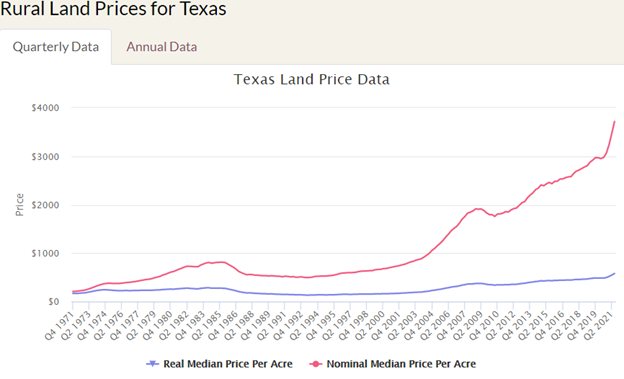

The pandemic is only partly to blame, as people have reassessed the meaning of work and as companies have allowed remote work possibilities (finally) the where to live has become a major consideration for people. The beginning of the pandemic in central Texas, someone wanting to move away from the city could buy small acreage for around $10,000 an acre about an hour to and hour and a half outside of major cities. Now we have property listings $30,000 an acre. Prices each quarter are getting better or worse, depending upon which side of the coin you are on.

In Texas alone, here has been the trend:

Now this isn’t all folks coming from the cities. A lot of it is corporations/other farms buying assets for tax and capital reasons. As the richest 1% have amassed a Fed Bank fortune, what to do with the cash has become the question. With the older generations (Boomer +) hanging up the reins, a lot of land has hit the market. A 300 acre cattle ranch can start at $4 million, or higher if the cattle and ag exemption is transferrable. Well tended 1,000 acres of fertile farmland in Iowa $20 million.

With every yin there is a yang. The cost of assets has brought a lot of attention to rural America from venture capitalists looking to “invest” in rural REITs, or start a few. We have collectively all told them to go to hell. They are looking at it all wrong.

Farmland takes half a generation to be paid for. Increasing this leaves the children with an inheritance saddled with debt. The whole benefit of dad farming is to inherit a piece of workable land that is paid for. That is only half the picture. Farmers rent land each season, and rent big. So much so that the USDA monitors it all here; USDA/NASS QuickStats Ad-hoc Query Tool, Rent, Cash and Crop Land Expense Measured in $ per Acre.

An irrigated acre in my neck of the woods is now up to $100 per acre, per year. It was $95 in 2020, and $92 in 2019. Essentially a 5% increase year over year. Cash rents rarely wane and as per acre sale prices rise, so do rents. This basis inflation makes it much harder to pull a crop successfully.

To put this in perspective let’s take a field sample from 2021 corn harvest.

Planted input costs $400 per acre. Cash rent $100 per acre

Yield average 174 bushels per acre

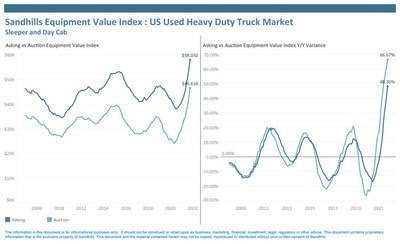

You can see where next year is going from this example alone coupled with potential additional 5% increase in cash rents, 210% increase in fertilizer, and equipment that, well, here’s the chart:

Asset bubbles always pop eventually, either by their own deflationary death spiral or by way of macroeconomic recessions. Crops are the basis of many, many materials. Free market theory would indicate if higher input costs, lower supply due to less planting, and therefore higher commodities . . . continued inflation in this environment.

To put it another way, we are all sitting on mountains of gold, but gold isn’t edible.

Thanks, neighbors.