Washington Equitable: Tax evasion at the top of the U.S. income distribution and How To Fight it. There is another version of the issue starting off with Senior fellow (Urban-Brookings Tax Policy Center of the Urban Institute), Steven M. Rosenthal taking on the issue; “If Congress Wants the IRS To Collect More Tax from The Rich, It Needs to Pass Better Laws.” Or you can go to NBER version of the Washington Equitible Working Paper; Tax Evasion at the Top of the Income Distribution: Theory and Evidence, March 2021. Your Choice. The question? “How much tax do high-income Americans evade? And what kinds of evasion tactics do they use?” Random audits miss two of the more common methods used to minimize taxes. The audits

Topics:

run75441 considers the following as important: law, politics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Washington Equitable: Tax evasion at the top of the U.S. income distribution and How To Fight it.

There is another version of the issue starting off with Senior fellow (Urban-Brookings Tax Policy Center of the Urban Institute), Steven M. Rosenthal taking on the issue;

“If Congress Wants the IRS To Collect More Tax from The Rich, It Needs to Pass Better Laws.”

Or you can go to NBER version of the Washington Equitible Working Paper; Tax Evasion at the Top of the Income Distribution: Theory and Evidence, March 2021.

Your Choice.

The question?

“How much tax do high-income Americans evade? And what kinds of evasion tactics do they use?”

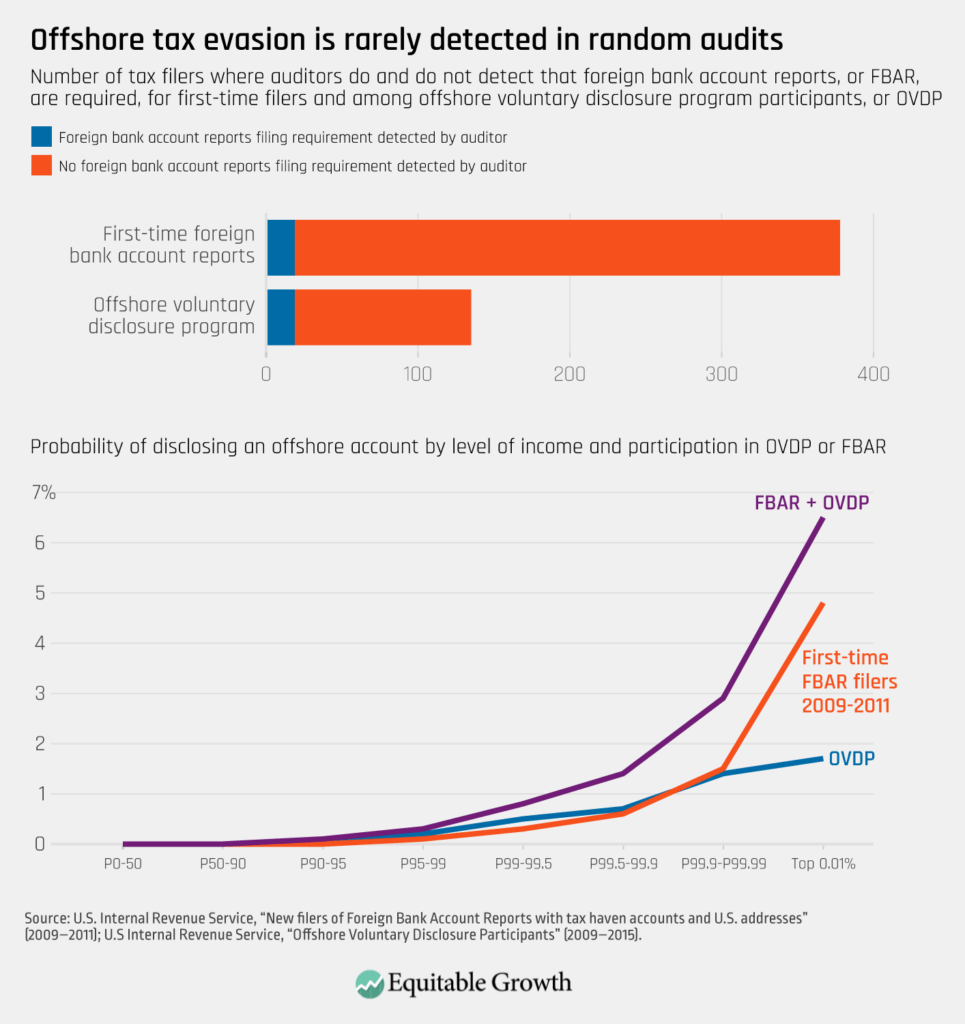

Random audits miss two of the more common methods used to minimize taxes. The audits underestimate tax evasion capturing little of the investor tax evasion by those using offshore accounts and pass-through businesses. Both methods present opportunities unlikely to be captured by the audits of income taxes and are significant to the top income brackets or the 1% of household taxpayers making greater that $500,000 annually (TPC).

In a July 2009 NYT article, it was determined Swiss bank UBS helped US citizens hide $20 billion. This is an old article and certainly later administrations did little to stifle tax avoidance.

After the February lawsuit, UBS eventually agreed to pay $780 million to settle charges that it helped wealthy Americans evade taxes on nearly $20 billion hidden in offshore accounts. One day later, the Justice Department filed a civil suit seeking to force UBS to disclose 52,000 client names.

Of the names on the agency’s original list, prosecutors are focused on several thousand wealthy Americans with offshore accounts containing tens to hundreds of millions of dollars.

Settlement Reached in UBS Tax Case, NYT, Lynnley Browning

Less than 1 in 1,000 individuals in the bottom 99 percent of the income distribution appear on the lists of taxpayers disclosing an offshore account. following the crackdown. In contrast, about 1 in 15 people in the top 0.01 percent appear on these lists—lists that, according to the prior study, probably only capture 10 percent to 15 percent of all offshore evasion. (See Figure 1.)

The paper and the more formal versions explore tax evasion at the top of the U.S. income distribution using IRS micro-data taken from:

(i) random audits,

(ii) targeted enforcement activities, and

(iii) operational audits.

Drawing on this combination of data, the results provide proof the use of empirically random audits underestimate tax evasion by those at the top of the income distribution. The random audits do not capture the tax evasion through the usage of offshore accounts and pass-through businesses.

The IRS estimates an ~16 percent of all federal taxes go unpaid. Or it can be said, $1 out of every $6 of taxes that should legally be paid is not paid.

It also estimates about 60 percent of the tax gap comes from underreporting of income on individuals’ tax returns. Researchers at the agency estimate this part of the tax gap using data from the random audits.

Again, the research shows random audits may paint an accurate picture of the tax gap for 99 percent of taxpayers. The audits miss the top 1 percent. According to random audit data, all groups of the population underreport about 4 percent to 5 percent of their income on average.

The only exception is the very top of the income distribution. Within the top 1 tenth of 1 percent or taxpayers with income of more than $1.7 million, detected tax evasion falls to extremely low levels. Naively interpreted, the superficial data suggests high-income people evade little when paying taxes.

Substantial evidence from other sources of data, and any headlines that readers might recall, suggest that high-income tax evasion is far from minimal. The new research provides concrete evidence that at least two types of tax evasion are quantitatively significant at the top of the U.S. income distribution and typically not detected through random audits.

What Can Be Done?

Effective tax enforcement at the very top of the U.S. income distribution requires a comprehensive efficient approach. Some suggested strategies to improve enforcement of tax evasion include:

- Greater scrutiny of pass-through businesses

- More comprehensive audits, such as those conducted in the IRS Global High Wealth program

- More thorough litigation of tax disputes

- New regulations to explicitly prohibit legally dubious “avoidance” strategies

- Programs to encourage whistle-blowing

The IRS already invests in enforcement strategies. Many of them have been curtailed by budget cuts limiting the IRS’s ability to conduct them extensively.

This brief article pulling data from the more extensive paper suggests increased enforcement to close the income tax gap for the top 1 percent could yield $175 billion in currently uncollected income tax revenue per year.

Putting this amount in perspective, it is enough revenue to make the American Rescue Plan’s $3,000 to $3,600 annual child allowance permanent and also make it about 50 percent more generous. Even modest success at enforcing taxes on the richest Americans could dramatically improve the fairness and progressivity of our tax system.