Farmer and Economist Michael Smith In this AgDaily piece, they do a great job of outlining the history of agriculture and sort of where it is headed, pretty much the same as it always has been, with a few caveats. Over time it has gotten much harder and now even more so with equipment prices up a little over 9% in just the past couple of years. Farm Machinery Cost Estimates for 2021 – AgFax This doesn’t seem to be ending any time soon. We have the following trifecta currently going into next year: A. Input costs such as seed, chemical, and equipment are all up and some at record highs.B. Land prices are astronomical and only getting worse as price of private sales makes rents less affordable. A lot of older folks are selling now

Topics:

run75441 considers the following as important: agriculture, Equipment, politics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Farmer and Economist Michael Smith

In this AgDaily piece, they do a great job of outlining the history of agriculture and sort of where it is headed, pretty much the same as it always has been, with a few caveats.

Over time it has gotten much harder and now even more so with equipment prices up a little over 9% in just the past couple of years. Farm Machinery Cost Estimates for 2021 – AgFax

This doesn’t seem to be ending any time soon.

We have the following trifecta currently going into next year:

- A. Input costs such as seed, chemical, and equipment are all up and some at record highs.

- B. Land prices are astronomical and only getting worse as price of private sales makes rents less affordable. A lot of older folks are selling now to avoid the dreaded “Biden tax” only to be scooped up by large corporations (see Gates) or by wealthy individuals looking for a tax hedge.

- C. Middlemen are squeezing excess profits anywhere they can. Commodities markets help, but only to smooth things out. The USDA helps as well, but aside from making a bunch of government cheese, there is little relief when Kraft makes the lions share of the cheese money.

What does the crystal ball show?

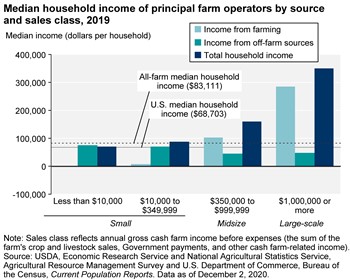

Not good times ahead. Specifically for the small and middle producers. Most of those are hedged by off farm jobs:

The larger corn, soybean, cotton, etc. growers should be able the fare the weather ahead since 2021 crop year was ideal. But, 2022 is less than ideal, and more so with the huge run up in fertilizer prices.

So where does this lead us? Inflation.

A lot of small guys will struggle or not even bother and rely on the bank branch job in town to pay the bills. The larger guys are now having contract shortages or inputs, and are forced to plant less acres going into the spring. Take in mind that those crops also feed into the $126 billion cattle and dairy market.

Food & Agricultural Policy Research Institute states that:

“Even though net farm income is projected 18.8% lower for 2022, FAPRI projects out to 2026 and shows net farm income dropping lower in 2023 to $91 billion then some slight increases along the way to 2026.”

To frame in perspective, the 10 year average is around $90 billion.

With input prices up, equipment prices up, and a lower per acre plant being planned it is less doom and gloom for the agricultural producer. Or as the old timers call it “normal bloodletting”. All points lead to increased inflation and the food side of CPI taking a kick in the backside.