I don’t know if I should try to make my contributions to AngryBear a noahpinion sub substack or if I should put this over at my personal blog, but I am always stimulated by Noah’s posts . His most recent “No one knows how much the government can borrow” is on a topic I’ve mentioned here (and here also Brad all following Blanchard): How much should we worry about the huge and rapidly growing US national debt ? Noah wrote that he doesn’t know and he doesn’t think anyone else does either. My comment is that Noah assumes things we don’t know. In particular, he assumes that we know something about how much the US Federal Government can borrow while paying record low interest rates. Noah write well, so it is hard to excerpt “If the U.S. federal

Topics:

Robert Waldmann considers the following as important: politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I don’t know if I should try to make my contributions to AngryBear a noahpinion sub substack or if I should put this over at my personal blog, but I am always stimulated by Noah’s posts . His most recent “No one knows how much the government can borrow” is on a topic I’ve mentioned here (and here also Brad all following Blanchard): How much should we worry about the huge and rapidly growing US national debt ?

Noah wrote that he doesn’t know and he doesn’t think anyone else does either. My comment is that Noah assumes things we don’t know. In particular, he assumes that we know something about how much the US Federal Government can borrow while paying record low interest rates. Noah write well, so it is hard to excerpt

“If the U.S. federal government keeps borrowing and borrowing and borrowing without limit, eventually foreigners and private companies and citizens are not going to want to buy all of those Treasuries. At that point the U.S. government can basically do one of two things:

It can offer higher interest rates, to make Treasuries more attractive, so that foreigners and U.S. private companies and citizens are willing to absorb larger amounts of debt.

It can have the Fed buy more of the Treasuries at a low interest rate.

But we have no way of knowing if we are anywhere close to the point where “foreigners and private companies and citizens” do not “want to buy all of those Treasuries”. In particular, the titanic gigantic issuance of Treasuries in 2020 did not drive interest rates significantly above record lows.

This is important as stressed in the linked posts here and elsewhere (including the AER) because if the treasury rates stay this low, the US Federal Government does not face a binding intertemporal budget constraint. The present value of future tax revenues would be infinite.

To me the question is how high does the US public debt have to go to drive Treasury interest rates above the rate of growth of GDP ? It was assumed that the super low rates of 2009-10-11- etc were a temporary effect of the great recession. It was also assumed that a few more Trillion in debt would have a large effect on the interest rates. Both assumptions sure look questionable now.

One of Blanchard’s many points is that Treasury rates have usually been lower than the rate of growth of GDP except for the period 1980-2000. It is possible that, except when Reagan and Volcker gang up, the US Federal Government usually has a slack intertemporal budget constraint.

Economists generally assume other wise, because we do maximization under constraint, and don’t like the idea that the constraint isn’t binding. We focus on finding optima and a slack buudget constraint can’t be optimal. But it is there in the data.

Here, I want to stress (as I have before) that statements about the US Federal intertemporal budget constraint are not entirely forecasts. The Treasury is selling 30 year inflation indexed bonds with a negative real yield. That rate is locked in for 30 years. Before worrying that investors might lose confidence in the Treasury if the debt increases, the Treasury can issue more long term bonds (and not short term notes and bills) and see the amount of long term bonds investors will buy at absurdly low interest rates. I mean this can be done quickly (both by the Treasury and by the Fed).

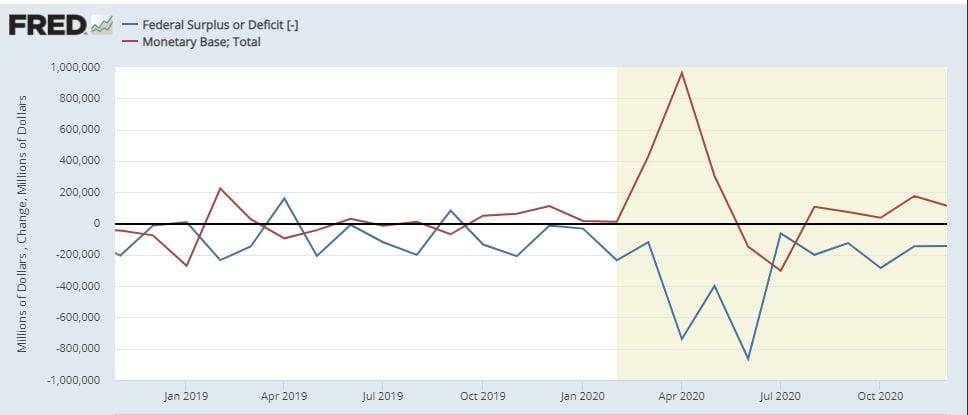

I have other comments. I think that Noah is influenced by trying to discuss economics with modern monetary theorists. They consider monetized debt and argue that the limit is unacceptable inflation. This is not all that happened in the USA in 2020. In June 2020 investors other than the Fed bought a Trillion more in Treasuries — there was a huge monthly deficit (huge for a yearly deficit) and the Fed sold assets (retired high powered money)

With that huge increase in the supply of treasuries, the price of a 30 year bond hit a record high (that is the yield was a record low).

The bottom line (quarterly not monthly) is that private investors were willing to buy more than an additional $ Trillion of Treasuries from Q1 2020 to Q3 2020 — this is not a state which is close to the point where it has to monetize its debt.

I’d say we have no idea how much the US Federal Government can borrow, but we can tell that we are nowhere near the limit.