It seems that many people have concerns about Larry Summers’s concerns about overdoing the Covid 19 Relief bill. My first reaction to his op-ed is here, but I realize that I had more nearly relevant things to say in the Debt and Taxes series and, in particular in debt and taxes I and debt and taxes II. (the one with plain ascii algebra and only 2 comments but I promise it is relevant). I’m going to try to focus. First, Summers really criticizes giving an additional 00 to most US citizens. He discussed the bill in general, but his concerns are about the wisdom of that (huge) provision and not the money for supplementary unemployment insurance, unemployment insurance for people not eligible for regular unemployment insurance, money for vaccine

Topics:

Robert Waldmann considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

It seems that many people have concerns about Larry Summers’s concerns about overdoing the Covid 19 Relief bill. My first reaction to his op-ed is here, but I realize that I had more nearly relevant things to say in the Debt and Taxes series and, in particular in debt and taxes I and debt and taxes II. (the one with plain ascii algebra and only 2 comments but I promise it is relevant).

I’m going to try to focus. First, Summers really criticizes giving an additional $1400 to most US citizens. He discussed the bill in general, but his concerns are about the wisdom of that (huge) provision and not the money for supplementary unemployment insurance, unemployment insurance for people not eligible for regular unemployment insurance, money for vaccine distribution, money for schools or general aid to state and local governments (indeed he could have been clearer in his op-ed).

On this he has two concerns

- The huge deficits might overstimulate the economy

- There are other better uses of the money so the bill is a waste of economic and political resources.

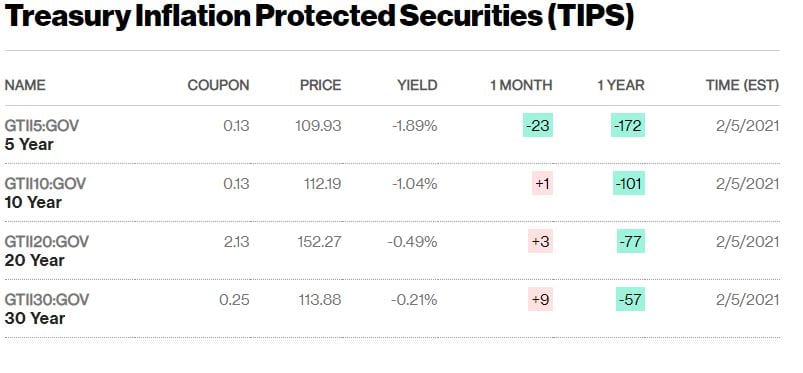

This time, I am going to address them in reverse order. Concern 2 really regards the $1400 checks only. On economic resources, I question the absolutely standard argument that one must decide if some spending is the best use of limited available funds. The key issue (as in the debt and taxes series) is that the US Federal Government can borrow at extremely low interest rates — the 30 year real interest rate is currently negative . Since it will change, I am going to screen cap.

Investors are glad to pay the Treasury to keep their wealth safe. Now consider the US Federal Government intertemporal budget constraint — the present value of spending must be less than or equal to the present value of revenue. What is the present value of revenue ? It is calculated by discounting revenues which grow approximately proportional to GDP by the inflation rate which hmm carry the one, round off a bit works out to roughly INFINITY.

If the Treasury can borrow at an interest rate lower than the trend rate of GDP growth (r<n), then the US Federal Government does not have a binding intertemporal budget constraint. This is the point of debt and taxes I, which turns out to be highly relevant to the Washington Post opinion page printed the day before yesterday. A totally standard calculation implies that there is not now a limit to “economic space” now. This is the normal pattern post WWII except for the period 1980-2000 — indeed the US managed the huge WWII debt with no noticeable trouble. Another way of putting this is that, if r<n then debt never has to be repaid. It can be rolled over forever and will shrink as a fraction of GDP until it is negligible. This is not a heterodox position — the link is to an AEA Presidential Address which is the epitome of orthodoxy.

Summers is also concerned about political limits to other spending. That is the real issue. It is outside of my field of expertise (it is also outside of his officially credentialed field of expertise, but he is clearly generally expert). Many people (too many to link so I will stick to Waldman) have argued that the political limit is public approval of Democrats and is relaxed by giving people what they want. I think it is clear that Democrats suffered in 2009 and 2010 from reckless caution — the backlash was related to doing too little and caring too much about keeping the public debt low. Notably Summers argued this repeatedly from 2010 through 2020 (I just googled [Summers fiscal).

OK now the hard part: what about overstimulating ? The first point is that we will not have to accept inflation higher than we desire. The Federal Reserve Open Market Committee (FOMC) can cool down an overheated economy by raising the target Federal funds rate. It is clear from bond prices that investors don’t expect this — bond prices would fall if they did and they have increased even as Democrats won control of the Senate and turned out to be very determined to add to the deficit. Low nominal yields imply that investors don’t expect interest rates to go up. The lack of much change in the difference between nominal ant TIPS yields implies they don’t expect inflation to increase and their expectations about inflation have changed little. Before going on, I note that the high interest rates used to cool down an overheated economy have some but very little relevance for the infinite present value of future revenues calculation — a few months of high interest have a finite effect on the calculation which, again, yields the answer infinity. Just to repeat what is often noted by Summers and others (especially Krugman) the risk of stimulating the wrong amount is extremely asymmetric — the FOMC can raise interest rates and prevent overheating. it can’t lower interest rates much, because the current safe short term interest rate is 0.08%. It is, as Summers notes in his op-ed, much better to err on the side of excessive stimulus.

The real issues are that loose fiscal and tight monetary policy will crowd out private investment and drive up the value of the dollar. In my debt and taxes series, I considered a closed economy, so I will just note that the FOMC absolutely can keep the value of the US dollar down. The Fed just has to sell it’s dollar denominated assets and buy foreign currency denominated assets. A monetary authority which is trying to prevent depreciation of the national currency can run out of foreign exchange reserves — a monetary authority which is trying to prevent appreciation can’t run out of domestic reserves — it can create unlimited amounts at will.

So should we worry about crowding out private investment ? The first point is that the investment which will be crowded out is investment in structures (not equipment and software). High interest rates reduce the value of long lived assets which, in the real world, means buildings — mostly houses. The investment relevant to macroeconomists and IS curves and such is mostly to almost entirely residential investment which is left out of almost all macroeconomic models (all models I know of the weasel word “almost” was added from an abundance of caution). Even huger houses are not the way the US will deal with slow productivity growth or stagnant real wages.

But also, the fact that the *safe* interest rate is below the trend rate of GDP growth implies that higher welfare can be obtained with lower private investment. The fact that the expected return on the private investments is greater than the trend growth rate does not rule this out. This is the point of debt and taxes II

Importantly. In that model, it is simply assumed that the economy is always at full employment. There is no possible role for stimulus, in fact no way to drive up output in the short run. It is simply assumed that public debt crowds out private investment one for one. Furthermore it is assumed that all private investment causes higher wages, because all private investment is in plant and equipment used by workers. In spite of all those crazy assumptions (which hurt the case for more public debt) it is shown how to make everyone (in the simple model) better off with a policy which starts with the government just borrowing and giving the money equally to everyone.

The model exactly addresses the question of whether it is good policy to send everyone a check even if there is no need to stimulate, no GDP effect of stimulation, and a fiscal multiplier of zero. The answer is that yes it is good policy so long as the government pays an interest rate lower than the trend rate of growth of GDP, and so long as the distributional effects are handled by increasing taxation of capital income and reducing taxation of labor income (a policy for which there is an abundance of political space and also one which Republicans will resist even at the cost of electability which uh is a cost I am eager to let them bear).

After the jump, I will go on and on about the model

There is a puzzle as to how can the safe interest rate be so low while the average return on physical capital is so high. This is called the Mehra Prescott puzzle and also called the equity premium puzzle. Models in which it is assumed that there is one representative consumer can not fit this fact.

In those models, people live forever so they don’t ever have to sell their shares of stock. They are rational and hold the market. They don’t have to think about the price of stock — they hold it for the dividends. It is a stylized fact that the present value of future dividends grows smoothly over time. Any explanation of the puzzle must rely on the fact that people plan to sell stock and care (a whole lot) about its price. It is absolutely possible to model this using an OLG model (the same sort of model as in Debt and Taxes II). The key second modification of the standard model is eliminating the assumption that everyone has rational expectations and introducing irrational investors or “noise traders”.

Interestingly Summers and friends (especially including Brad DeLong) did exactly this 30 and 31 years ago. The 31 year old model is, I think, the right model to use to address the question. It can be modified to create an argument for the $1400 checks.

Also, the model (or the even more standard model in Debt and Taxes II) implies that the really smart policy is for the government to sell bonds and use the money to buy stock (randomly or an equal share of all firms). This is the proposal for a sovereign wealth fund. I am reasonably confident that there must be some argument against doing this, but I have never seen one.