August JOLTS report: the game of reverse musical chairs in the jobs market is ending – by New Deal democrat Since early this year I’ve been making the point that, because of the pandemic, there have been several million fewer persons looking for work, leaving a huge number of unfilled job vacancies, particularly in the face of a roughly 10% higher jump in demand. This has given employees the upper hand, as there are almost always higher paying jobs on offer for which they can apply. I‘ve also posited that the dynamic would only slow down once some employers throw in the towel, and the number of job openings signficantly declines. I’ve called this “reverse musical chairs.” This morning we got some very potent news that the game is entering

Topics:

run75441 considers the following as important: jobs market, New Deal Democrat, politics, Unemployment, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

August JOLTS report: the game of reverse musical chairs in the jobs market is ending

– by New Deal democrat

Since early this year I’ve been making the point that, because of the pandemic, there have been several million fewer persons looking for work, leaving a huge number of unfilled job vacancies, particularly in the face of a roughly 10% higher jump in demand. This has given employees the upper hand, as there are almost always higher paying jobs on offer for which they can apply. I‘ve also posited that the dynamic would only slow down once some employers throw in the towel, and the number of job openings signficantly declines. I’ve called this “reverse musical chairs.”

This morning we got some very potent news that the game is entering its closing phases, at least for this cycle.

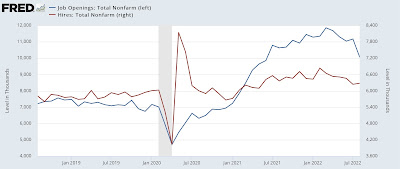

Almost certainly openings peaked in March. In August alone, openings declined -10% to 10.053 million, for a total – and accelerating – decline of 1.8 million, or over -15% since the peak:

At their average rate since March, openings will return to their pre-pandemic level by next April. At the rate they’ve declined in August, they’ll be at that level by November.

Meanwhile actual hires, as shown in the above graph, increased slightly m/m, but the decelerating trend since the beginning of this year is clear. This is simply more confirmation that consumption leads employment, and we should expect monthly jobs numbers to decelerate further, and go to virtually zero m/m by early next year.

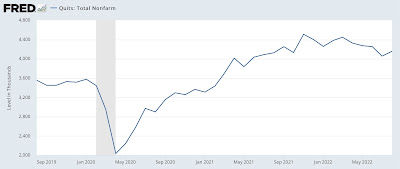

Voluntary quits, which are an important measure of employee confidence in finding another job, increased 2.5% for the month, but again the overall declining trend since last autumn is clear:

The story is the same for total separations. There was a 3.1% increase for the month, but a clear decelerating trend since the end of last year.

Finally, layoffs and discharges increased 5.0% for the month, to their highest level since March 2021:

The game of reverse musical chairs is slowing down. It is most likely within months of ending.

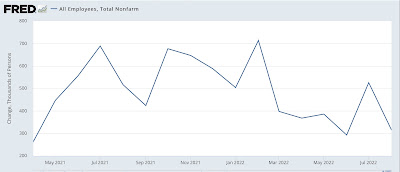

Because consumer spending as measured by real retail sales has been flat for over a year, and real personal consumption expenditures are up only 0.7% in the past 10 months, monthly jobs gains in the coming months are going to slow down or even stop. Here’s the graph of monthly jobs gains for the past 2+ years:

While any month’s number will be variable, in general this Friday I would expect a gain of less than 400,000 for September, and most likely below 300,000 – possibly below 200,000. We’ll see then.