Angry Bears New Deal democrat; July jobs report: Establishment survey weak (but still positive), Household survey (even more) recessionary. Last week: “In the past few months, my focus has been on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing. In the last several months I have also pointed out that the Household Survey is probably understating growth because of its...

Read More »December jobs report: consistent with a “soft landing,” despite discordance in household data

December jobs report: consistent with a “soft landing,” despite discordance in household data – by New Deal democrat My focus remains on whether jobs gains are most consistent with a “soft landing,” i.e., no further deterioration, or whether deceleration is ongoing; and more specifically: Whether there is further deceleration in jobs gains compared with the last 6-month average Whether the unemployment rate is neutral or decreasing; or...

Read More »ISM manufacturing index remains in contraction, and the trend in vehicle sales may have turned down as well

ISM manufacturing index remains in contraction, and the trend in vehicle sales may have turned down as well by New Deal democrat The ISM manufacturing index, where any value below 50 indicates contraction, once again came in negative for both the total index, at 47.4, and the more leading new orders subindex, at 47.1. Both have been indicating contraction for more than a year: Which begs the question. Because, despite a nearly flawless 75...

Read More »Construction spending continued to increase in November

Construction spending continued to increase in November – by New Deal democrat I’m feeling a little under the weather today, so I am going to keep this brief. Total construction spending rose 0.4% in November, while residential construction rose 1.1%: Keep in mind that these are nominal numbers, affected by the cost of construction materials. Typically residential construction moves in tandem with building units under construction....

Read More »New Deal democrats Weekly Indicators for December 25 – 30 2023

– by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. 2023 has been a year of improvement, and that improvements continued in the final installment, as ever so slowly more and more indicators flip neutral or positive. As usual, clicking over and reading will bring you up to the virtual moment, and reward me a little bit for my efforts throughout the year. Next week, as we begin a new year, I anticipate adding a...

Read More »Jobless claims end the year on a solidly positive note

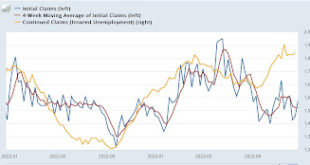

Jobless claims end the year on a solidly positive note – by New Deal democrat For our last data of 2023, initial jobless claims remained at a very low level, up 12,000 from one week ago to 218,000. The four week average declined 250 to 212,000. With the usual one week delay, continuing claims rose 14,000 to 1.875 million: On a YoY% basis, initial claims are up only 2.3%, while the more important four week average is up a mere 0.1%....

Read More »Completing the housing market picture for November, sales decline bigly, and prices remain down YoY

More economic news an d this time new single family housing. Completing the housing market picture for November, sales decline bigly, and prices remain down YoY – by New Deal democrat Our final important pre-year end release was also the final item of housing data for the month, new home sales. To reiterate, the value of this metric is that it is the most leading of all housing metrics. Its big drawback is that it is very noisy and...

Read More »New Deal democrats Weekly Indicators for December 11 – 15 2023

– by New Deal democrat My “Weekly Indicators” post is up at Seeking Alpha. The big decline in long term interest rates this week in the wake of the Fed’s announced “pivot” towards lowering rates created one of the biggest changes in the long leading indicators for several years. Meanwhile most of the coincident indicators continue to speak of a strong economy. The intersection that is going to tell the tale going forward in the next 6...

Read More »New Deal democrats Weekly Indicators for December 4 – 8 2023

Weekly Indicators for December 4 – 8 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The coincident data keeps getting better and better, while interest rates remain very negative. The question, as it has been for months, is whether those interest rates finally case the short leading indicators to roll over. As usual, clicking over and reading will bring you up to the virtual moment as to the...

Read More »A big increase holds up construction spending in October; and construction spending is holding up the economy

On a YoY basis manufacturing is the star of the show. But note from the historical graph that residential construction previously has turned down first, with manufacturing and other non-residential construction lagging (likely because of long lead times and the extended duration of completing projects). A big increase holds up construction spending in October; and construction spending is holding up the economy – by New Deal democrat...

Read More » Heterodox

Heterodox