As I read Dean Baker’s perspective on Low Income families, I find it hard to believe. The market in the Southwest has dried up due to high prices and interest rates. One or the other has to be lower to attract buyers. Builders have not lower prices and bank rates have remained high. One builder was complaining of a lack of interest in a rate at 6%. Coupling to a higher price this is very true. It is also taking anywhere from 6 to 12 months to build a home. You could have closed in November of last year at which point pricing was increasing again as was interest rates. “Census and WaPo at Odds Over Effect of Inflation on Low-Income Families,” Center for Economic and Policy Research, Dean Baker It is getting almost as bad as propaganda from

Topics:

run75441 considers the following as important: Dean Baker, Hot Topics, housing, Low Income, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

As I read Dean Baker’s perspective on Low Income families, I find it hard to believe. The market in the Southwest has dried up due to high prices and interest rates. One or the other has to be lower to attract buyers. Builders have not lower prices and bank rates have remained high. One builder was complaining of a lack of interest in a rate at 6%. Coupling to a higher price this is very true.

It is also taking anywhere from 6 to 12 months to build a home. You could have closed in November of last year at which point pricing was increasing again as was interest rates.

“Census and WaPo at Odds Over Effect of Inflation on Low-Income Families,” Center for Economic and Policy Research, Dean Baker

It is getting almost as bad as propaganda from an authoritarian regime. We keep hearing major news outlets tell us that inflation is whacking lower-income families. The Washington Post did it yesterday in an editorial demanding more rate hikes from the Fed to throw people out of work.

Lower-income people, like everyone else, are paying more for food, gas, and rent. The argument is that these items are a larger share of the budget of lower-income people, so they are hit harder by inflation than higher-income households.

The problem with telling this simple story is that wages have been growing most rapidly at the bottom end of the wage distribution, substantially outpacing inflation since the start of the pandemic. Also, in a tight labor market, more people are likely working in many households. They are also more likely to be able to find a job that has lower commuting costs or might allow them to work part-time to deal with childcare or family needs.

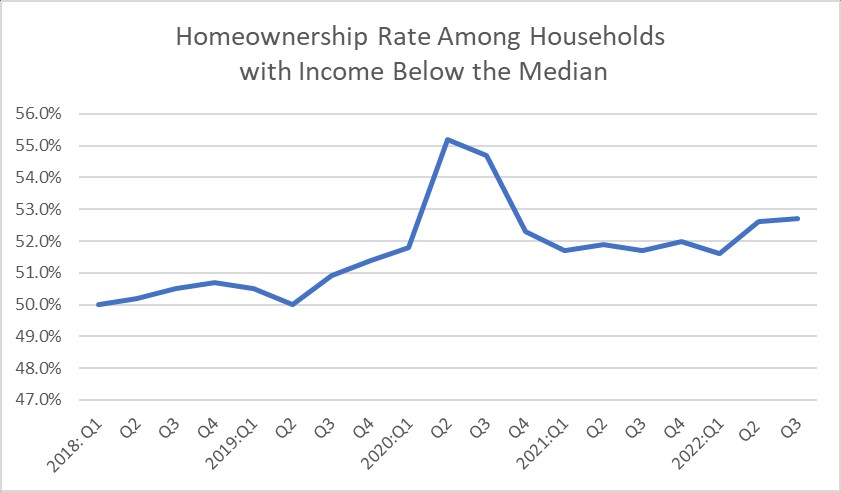

One way to assess how these things balance out is to look at what has happened to homeownership rates. More homeownership is not always better, as some of us warned during the housing bubble years, but people who have the option to buy a home generally choose to do so.

Contrary to the propaganda here and here coming from the media, homeownership rates have actually risen rapidly since the pandemic for households with incomes below the median, as shown below. (The big jump in 2020, which was partially reversed, is likely due to a skewing in responses, as the pandemic sent response rates plummeting.)

Homeownership rates have also risen for Black and Hispanic households and those headed by someone under age 35. It is more than a bit bizarre that the media have been almost uniformly insisting that these are horrible times for lower-income people despite data that say the opposite.