Inflation Reduction Act The Inflation Reduction Act drug price negotiation is small in returns, low in the number of drugs initially impacted, and slow to start. Ten drugs will be selected and the impact of the act begins in 2026. It rises to 20 drugs to be negotiated in 2029. The new act ignores European reference pricing and instead caps prices at a set discount of average U.S. prices. The act establishes an initial standard in which the scope and terms of negotiation can be expanded and strengthened over time. This is going to be a slog and I wonder what drugs will be chosen initially. Technology changes, and I also wonder how many drugs will be classified as generic by then. Also, pharmaceutical companies may find new uses which typically

Topics:

run75441 considers the following as important: expostfactoid, Healthcare, ICER, Inflation Reduction Act?, law, Pharmaceuticals, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Inflation Reduction Act

The Inflation Reduction Act drug price negotiation is small in returns, low in the number of drugs initially impacted, and slow to start. Ten drugs will be selected and the impact of the act begins in 2026. It rises to 20 drugs to be negotiated in 2029. The new act ignores European reference pricing and instead caps prices at a set discount of average U.S. prices. The act establishes an initial standard in which the scope and terms of negotiation can be expanded and strengthened over time.

This is going to be a slog and I wonder what drugs will be chosen initially. Technology changes, and I also wonder how many drugs will be classified as generic by then. Also, pharmaceutical companies may find new uses which typically get price increases.

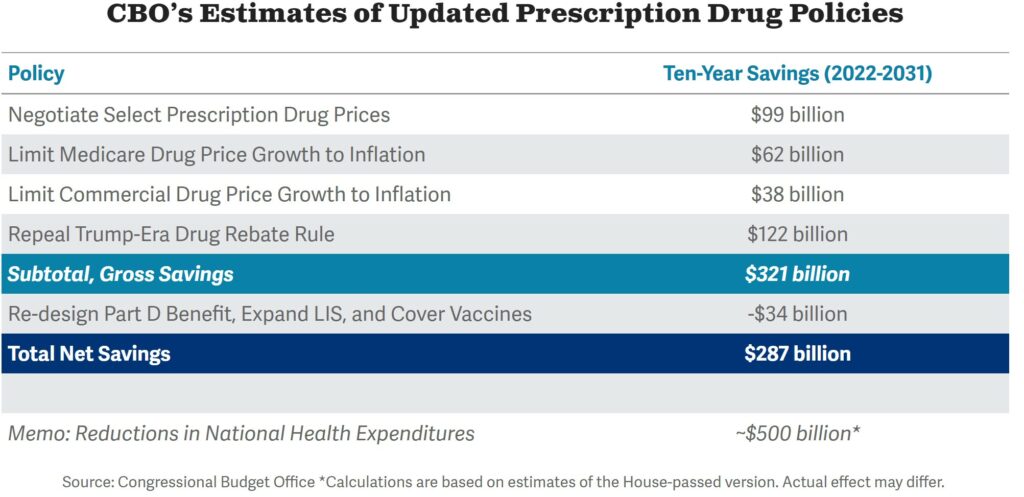

With the Inflation Reduction Act, a low-profile provision starts in 2023. It is projected by the CBO to save/raise roughly as much money as drug negotiation. Rather than try to spell this out, I have attached the related CBO chart depicting the cost saves and costs.

Caps on the prices of drugs are currently on the market and are not low. If a drug manufacturer raises the average price charged for a given drug by an amount that exceeds the consumer price index for urban consumers (CPI-U) it must rebate the difference to Medicare. The provision starts right away and also applies to employer-sponsored, individual market health plans, and Medicare (the rebates accrue from all drugs sold but are paid only to the federal government). CBO projects the inflation caps will generate $62 billion in savings and $38 billion in revenue over ten years.

Ok, you have the picture on the Inflation Reduction Act bill which was contested with the Democrats (Manchin and Sinema) holding the rest of the party hostage as well as the nation. I think I am going to go rogue here and go off in a different direction utilizing ICER information. It is far more organized, giving greater information, and targets as to whether price increases are justified using the data provided by each pharmaceutical. company.

A different approach by the ©Institute for Clinical and Economic Review, 2021, ICER. entitled “Unsupported Price Increase Report,” Prices occurring in 2020. I captured similar ICER data a year or so ago. With the passage of the Inflation Reduction Act, this may be an opportune time to introduce the ICER format for judging price increases. One caveat for this process being pharmaceutical companies must justify an increase.

An Introduction:

The ICER reviews drug prices for legitimacy and makes recommendations. Previously, ICER has published UPI (Unsupported Price Increase Assessment) reports for increases occurring during the two-year period of 2017-2018, and separately for 2019, and 2020. A new report by the ICER (Institute for Clinical and Economic Review) Unsupported Price Increases Occurring in 2021 – ICER will occur December 2022. I would urge readers to review some of the numbers cited by the ICER in their reports.

The price of many existing brand and generic drugs can greatly increase over time to which questions are raised regarding whether these price increases are justified. State policymakers, VA, etc. have been particularly active in seeking measures to address this issue.

In 2019, the Institute for Clinical and Economic Review (ICER) published its first Unsupported Price Increase (UPI) Report. A multi-stakeholder advisory group was organized to provide input into the design of an approach for such reports. The advisory group was comprised of representatives from patient groups, drugmakers, and insurers representing Medicaid and the private market. The first report looked back at two years of price increases and three years of new evidence.

The report was later revised, changes made which are reflected in this 2021 report on year 2020 drugs.

Important note, the ICER does not have the capacity to perform full economic analyses on the therapies evaluated in this report. The time needed to develop full ICER Reports of at least eight months provide information in a useful timeframe for the public and policymakers. Therefore, this UPI Report is not intended to determine whether a price increase for a drug is fully justified by new clinical evidence or meets an ICER health-benefit price benchmark.

Instead, the analyses focuses on whether substantial new evidence exists to justify a price increase. A more detailed Introduction is provided on the 2021 review of 2020.

Selection of Drugs to Review:

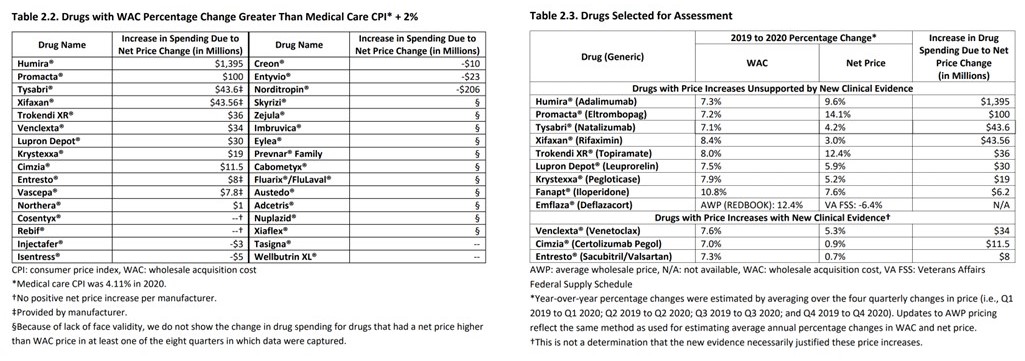

The ICER obtains a list of the 250 drugs (Table 2.1) with the largest net sales revenue in the US in 2020. The information came from the SSR Health, LLC, an independent investment research firm. For each drug, the ICER determines the average Wholesale Acquisition Cost (WAC) over a one-year period. For this UPI Report, the average price in 2020 was compared with the average price in 2019.

As determined in 2021, the drugs in Table 2.2 (below) were identified by the ICER as having the highest price increases. Table 2.2 chart to the left identifies spending due to net price change per drug. The chart to the right identifies price increases without and with clinical evidence. Documentation gives a reason for a price increase. The ICER determines whether the reason is sufficient to support an increase or not.

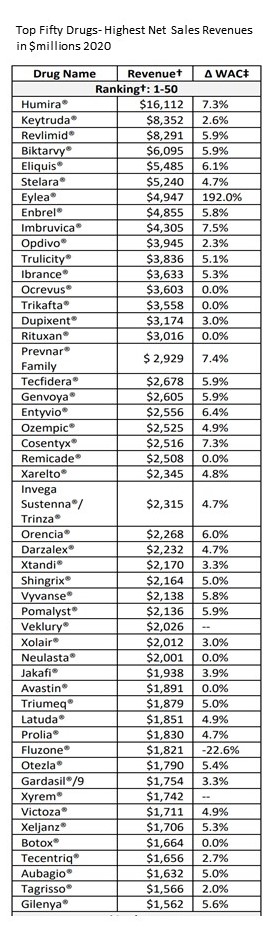

The selection above on the left is taken from a list of 250 drugs. Table 2.1. “List of Top 250 Drugs with the Highest Net Sales Revenue (in $Millions) in the US in 2020.” Below and to the left, I have added a column of the top 50 drugs of the 250 drugs showing Net Sales Revenue. The idea is to show just how big the issue is in the numbers of drugs and $dollar involved. As usual, clicking on images enlarges or embiggens them.

Table 2.3 above and to the right shows 12 drugs selected for assessment. “This includes the top 10 drugs taken from Table 2.2. The UPI (Unsupported Price Increase Assessment) process also allows for three additional drugs to be reviewed based on public input. Feedback was received asking ICER to review deflazacort (Emflaza®) and iloperidone (Fanapt®).

Each company submits documentation justifying the price increases.

I believe I have over explained this portion to be sure the reader is up on this as briefly as possible. I am going to choose one drug of the 12 examined by the ICER and then explain briefly as to why this appears to be a good approach.

ICER will determine which of these drugs have had a WAC price increase over the one-year Price Increase Period that exceeding the rate of medical CPI by more than 2%.

3.1 Humira® (Adalimumab, AbbVie)

Humira® (adalimumab, AbbVie) is a humanized monoclonal antibody that binds specifically to

tumor necrosis factor (TNF). It was approved by the Food and Drug Administration (FDA) in 2002. Humira® is indicated for the treatment of nine different chronic diseases: rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, juvenile idiopathic arthritis, adult and pediatric Crohn’s disease, adult and pediatric ulcerative colitis, plaque psoriasis, adult and adolescent hidradenitis suppurativa, and adult and pediatric noninfectious uveitis. Additional information can be found on page 8 of the ICER_UPI_2021_Assessment_031522.pdf.

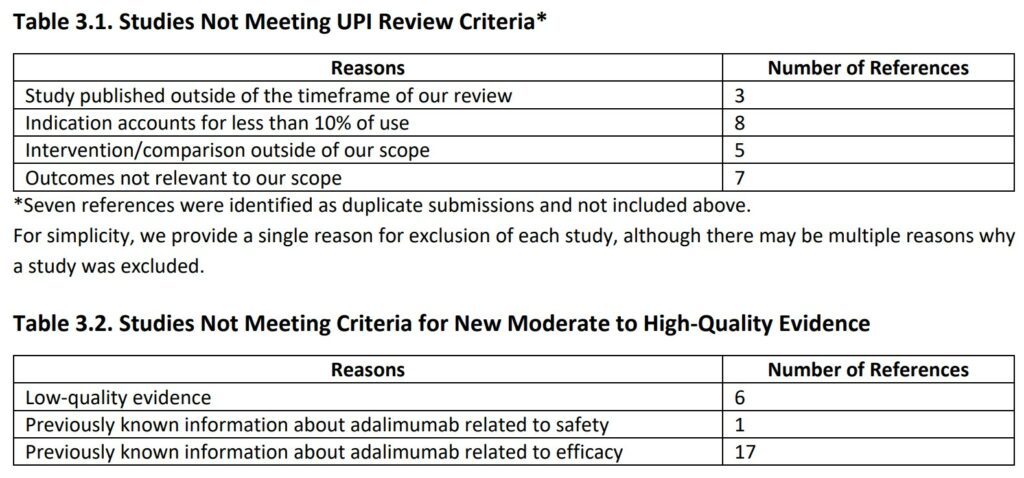

Of the 54 references submitted by the manufacturer, seven articles were duplicates, and 23 articles were excluded because they did not meet our UPI review criteria.

The primary reasons for excluding these studies are provided in Table 3.1 (Appendix A provides additional information on each study). Of the remaining 24 articles, 18 presented previously known information about adalimumab, while the remaining six studies were considered low quality. As an example, we highlighted one of the submitted articles (Chambers 2019) we classified as low-quality evidence.

The ICER highlighted one of the submitted articles (Chambers 2019) classified as low-quality evidence. It is found on page 8 of the ICER_UPI_2021_Assessment_031522.pdf

Using GRADE criteria, the ICER concludes low-quality evidence was provided for assessing a change in conclusions about the net harms of adalimumab in pregnancy. Under the UPI Protocol, the ICER will not assess the magnitude of

benefit in the absence of moderate or high-quality evidence.

I wonder what Congress is going to put in place to assess drug price increases year over year. What I have presented here is a brief review of how the ©Institute for Clinical and Economic Review, (ICER) reviews drugs. I feature one drug by the name of Humira® having 54 documents submitted in support of a net price increase of 9.6% equating to ~$1.3 billion.

As we all know SCOTUS was upset when agencies were properly empowered by Congress to regulate environmental quality and subsequent issues concerning quality. I see the approach the ICER is using and believe it should be a similar approach for regulating pharmaceutical pricing with regard to costs. Congress will not have the stength to keep up with regulating prices and it is starting way to late.

References

xpostfactoid: “How much drug price control are we getting in the Inflation Reduction Act?“

“ICER Publishes 2022 Research Protocol for Assessing Unsupported Price Increases on Prescription Drugs” – ICER

ICER_UPI (Unsupported Price Increase Assessment) 2021_Assessment ICER 031522.pdf

Some Definitions

WAC: Wholesale acquisition cost; For each drug, the ICER determines the average WAC price changes over a one-year period. For this UPI Report, the ICER looked at the average price in 2020 compared with the average price in 2019.

AWP: Average Wholesale Price; The year-over-year average wholesale price.

Medical CPI; BLS supplies this. Before being analyzed Drug Price must exceed Medical CPI (pharmaceuticals) by 2%.

GRADE: A transparent framework for developing and presenting summaries of evidence and provides a systematic approach for making clinical practice recommendations. It is the most widely adopted tool for grading the quality of evidence and for making recommendations.