As you “should” know by now, Alan Collinge is an activist and has organized the Student Loan Justice Org a number of years ago. The Organization attempts to represent those student loan borrowers who have no recourse for forgiveness or bankruptcy as every other person in the nation has when taking out a loan? Alan and his thousands of followers having gathered well over 1 million signatures on a petition seeking relief from these loans. The student loan business (and it is a business) has been messed up since the beginning. Congress was continuously changing the requirements of the loans even after the loans were paid out. I do not know of any commercial loan like student loans unless you are visiting a store front or a loan shark. When the loans

Topics:

run75441 considers the following as important: Alan Collinge, Education, GAO, politics, student loans, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

As you “should” know by now, Alan Collinge is an activist and has organized the Student Loan Justice Org a number of years ago. The Organization attempts to represent those student loan borrowers who have no recourse for forgiveness or bankruptcy as every other person in the nation has when taking out a loan? Alan and his thousands of followers having gathered well over 1 million signatures on a petition seeking relief from these loans.

The student loan business (and it is a business) has been messed up since the beginning. Congress was continuously changing the requirements of the loans even after the loans were paid out. I do not know of any commercial loan like student loans unless you are visiting a store front or a loan shark. When the loans came back from Sallie Mae and other makers of student loans during the Obama administration, they were devoid of history.

Over the last two years? It was a pandemic, the nation shut down, people were not working, and people were not being paid. Tax revenues were cut to a minimum and the government was funding healthcare, aid to children, additional unemployment. The government did not get its income tax and the cost of this will result in a loss on more than student loans. Again, people did not work and did not pay taxes. The nation shut down. Now why target students?

Students and their loans together are now profit centers? The returns to the government do not come from being a student or from gaining interest payments afterwards. The return comes from a student graduating, moving into the economy, and paying taxes. Taxes from having higher salaries. At best or worst, student loans should be breakeven endeavor with a chance of money being lost.

The biggest lie told to high school students is being told they will make more money if they get a college degree. Well maybe and maybe not! Hor now, pick one of these fields, go to a college, and sign on the dotted line over here . . . . . We will take care of all the rest.

Holding 18-year-olds responsible for a lifetime seems to be a cruel and unusual punishment. Then there are the Akers, Chingos, Delisles, Looneys who find such very acceptable.

“GAO Study claiming Government Losses on Federal Student Loan Program is flawed, deceptive” | by Alan Collinge | Aug, 2022 | Medium

The General Accounting Office (GAO) recently published a report claiming that the federal Direct Student Loan program was, on balance, a cost to the federal government, rather than an income source as was previously reported. In 2013, for example, the Congressional Budget Office said that in 2012, the government had profited $50 billion on the program, and that this would increase as the portfolio increased (and it has). The GAO’s most recent claim is the federal government made very little in 2012 ($600 million), and this profit turned into annual losses in subsequent years- to over $20 billion/year by 2017.

So why such a massive difference in profit/loss estimates?

The GAO study identifies the Income Driven Repayment (IDR) programs (where borrowers pay based upon their income for 15, 20, or 25 years, and their loan balances are cancelled at the end of the term), and also the cost of defaulted loans as 2 of the largest factors contributing to the overall program losses that they found.

Both of these assertions, however, are provably false.

First: The GAO assumes that a significant percentage of the borrowers in the IDR programs will ultimately receive loan cancellation by completing the IDR program or through Public Service Loan Forgiveness (they rely on the Department of Education’s claim, for example, that 58% of borrowers entering IDR’s in 2023 will successfully complete these plans and receive loan cancellation). But history shows that the overwhelming majority (99%) of borrowers who try for these IDR programs are being disqualified out of the programs, and receive no loan cancellation.

For example: out of several million people who enrolled in the Income Contingent Repayment Program (ICR) since 1995, only 32 people had made it through as of 2021.

Similarly, it was reported in 2015 that 57% of the people enrolled in Income Based Repayment (IBR) had been disqualified in one year alone for failure to “verify their income”, an annual, onerous exercise required of the borrowers- and one of many ways the Department can and is disqualifying borrowers. Given that 30% of these income verification forms are rejected per year, simple math would predict that the chances of making it through 20 consecutive years shrinks to 0.08%- a vanishingly small percentage.

For the Public Service Loan Forgiveness Program (PSLF), the disqualification rate was 99% as of 2018. It remains to be seen what results an “overhauled” version of this plan will yield, but anecdotally, stories from borrowers who are still being denied abound. It would be surprising, frankly, if even 10% of those who thought they would get forgiveness through this program actually do.

The Department of Education clearly has no desires or intentions of actually cancelling any loans, and there is no reason to believe that a significant percentage of federal student loans will ever, actually be cancelled.

Ironically: Most people enrolled in IDR’s have increasing loan balances throughout the term of their repayment. When they are disqualified out of these programs, they are usually left owing a far larger balance than had they never tried in the first place. At least on the books- the Department of Education should be booking a profit rather than incurring a cost due to these non-functioning IDR plans.

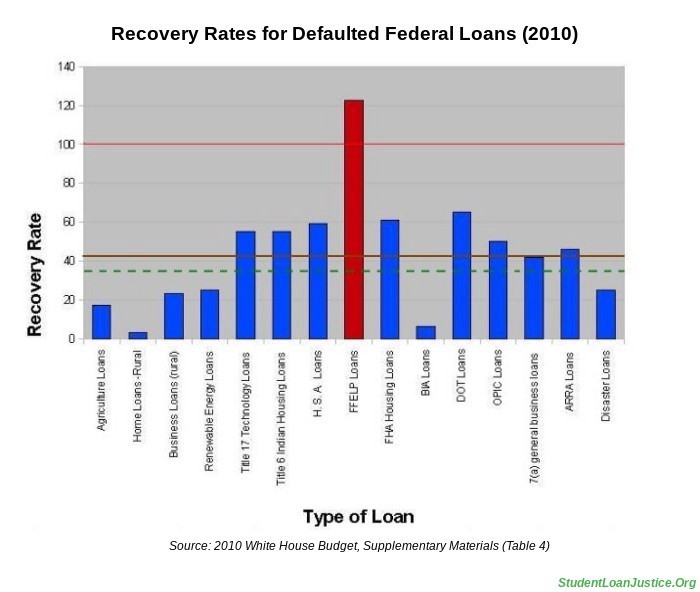

Second: Decades of White House Budget data show that the government actually makes a profit- not a loss- on defaulted student loans. This was true in 2010, when the White House reported a recovery rate on defaulted FFELP (federally guaranteed) loans of 122% (all other loans the government made or insured that year had an average recovery rate of about 34%). It is still true- in fact more true- today.

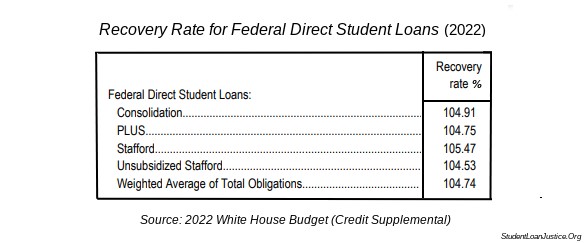

More recent White House Budget Data (2022), shows that this trend has continued for the Direct Loan Program, with an average recovery rate of over 100%. Similar to the 2010 data, student loans were the only type of loan that could be found in the federal portfolio for which the recovery rate exceeded 100%.

A key point: While the recovery rate for Direct Loans is lower than for FFELP (federally guaranteed) loans, Direct Loan recoveries are inherently far more profitable than FFELP loans. For defaulted FFELP loans, the government pays a claim amounting to the entire balance of the loan at the time of default, which includes both unpaid principal and interest. For Direct, Loans, however, the government only paid the original loan amount, whereas the value of the loan at the time of default typically includes a large amount of interest. The recovery rate for both, however is calculated by comparing the amount recovered to the balance of the loan at the time of default.

So while the recovery rate for Direct loans are lower than that for FFELP loans, the profitability of these recoveries is actually far greater than that of FFELP loans.

Therefore, the federal student loan program will not be losing money from the IDR programs. Rather, they should be booking a significant profit from the disqualifications. Similarly not only is the government not losing money on defaulted loans, they are actually making money (and likely a lot of it for Direct Loans).

In a lending environment where defaults are actually profitable, and almost no loans are being cancelled, it is literally impossible to lose money on the loans. In fact, the program can only be making money from the program…and a lot of it

The GAO is (or should be) well aware of the disqualification rates for IDRs and the profitability of Direct Loan defaults. That they chose to ignore these facts in their analysis constitutes gross neglect at best. At worst, their blatant disregard for these key facts constitutes professional malpractice and willful deception

Congress should immediately investigate the principals involved in producing this flawed analysis (including those in Congress who ordered the study), and call for a revision of the study, to reflect the profitability of defaults, and the true disqualification rate for IDR’s. This will clearly show that the government has, in fact, been making a huge profit on these loans, rather than incurring losses.