There is a lot of noise about the shortage of semiconductors. I am not going to explain it all here. You will find the explanation of manufacture in the articles. It takes weeks to grow wafers and then Fab semi-conductors. Not maintaining orders for semiconductors creates shortage when production starts up again. The purchase of semiconductors has changed since I was in it in 2008 chasing automotive OEM caused shortages. Growing the wafers could be done in the US. The fabrication also in the US. Th wafers could also be sent to places such as Malaysia, Philippines, etc. or closer. China is on the move to take over or impact the whole industry with its eye on Taiwan. This is a simplified depiction of a two-part process with many functions in each.

Topics:

run75441 considers the following as important: politics, semiconductors, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

There is a lot of noise about the shortage of semiconductors. I am not going to explain it all here. You will find the explanation of manufacture in the articles. It takes weeks to grow wafers and then Fab semi-conductors. Not maintaining orders for semiconductors creates shortage when production starts up again.

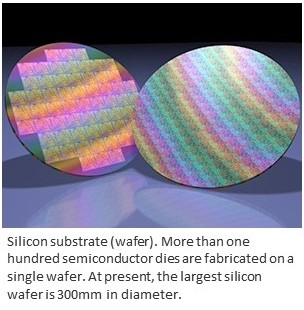

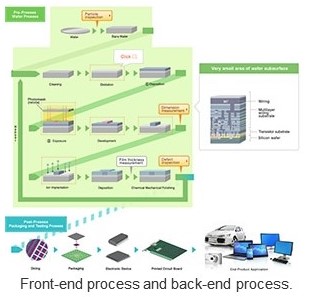

The purchase of semiconductors has changed since I was in it in 2008 chasing automotive OEM caused shortages. Growing the wafers could be done in the US. The fabrication also in the US. Th wafers could also be sent to places such as Malaysia, Philippines, etc. or closer. China is on the move to take over or impact the whole industry with its eye on Taiwan. This is a simplified depiction of a two-part process with many functions in each. Typically, this is done in two plants. One to grow wafers and the other to Fab semiconductors. Click on the images to enlarge.

Silicon substrate (wafer)

“Biden’s Uphill Battle to Restructure the Global Semiconductor Sector – The Diplomat, Tian He and Anton Malkin “Understand one term, fabless manufacturing is the design and sale of hardware devices and semiconductor chips while outsourcing their fabrication (or fab) to a specialized manufacturer or semiconductor foundry. The US is the leader in Fabless manufacturing, the design and sale of semiconductors. Biden’s plan necessitates the U.S. to pay attention to the middle and lower ends of the GVC (global value chain), the sourcing and manufacture pf semiconductors to US aligned countries and eventually the US. The administration’s plan is to build manufacturing facilities in the US and also attract foreign companies such as (TSMC, Samsung, etc.) to source manufacturing in the US.

This strategy is currently being pursued in two ways. The first is to ally with global semiconductor firms to re-shore production by building domestic manufacturing facilities. The second is the Biden administration’s intention to work with “like-minded” countries to build a more reliable semiconductor supply chain not involving China.”

“Strengthening a Transnational Semiconductor Industry” | Center for Strategic and International Studies (csis.org), James Andrew Lewis “the problem is China, its industrial policies, and its intentions regarding Taiwan, not offshore production.

Front and back-end process

The politics of the chip industry are generally favorable to the United States. One leading producer, South Korea, is a treaty ally and faces less risk of disruption from China than does Taiwan. Another leading producer, Japan, is one of the most important U.S. security partners and, with the United States, dominates the production of semiconductor manufacturing equipment (SME). ASML, another leading producer of SME, based in the Netherlands, is also an important ally. Singapore, while it would prefer not to be caught in a battle between giants, is also a dependable partner. These countries share democratic values and in many instances are treaty allies.

Taiwan Semiconductor Manufacturing Company, or TSMC, has a 50 percent share in the fabless market. However, TSMC’s proximity to China, which has routinely threatened to invade and absorb Taiwan, creates a potential security risk.”

“Semiconductor industry | Strategy&” (pwc.com) Strategies for growth in the Internet of Things era. The Internet of Things (IoT), once again transforming the semiconductor industry.

“The semiconductor industry is no longer dominated by a handful of the largest players. Companies must now follow a different path, competing not so much on their performance edge or lower price, but on making the best chips for specific purposes, what data capture and communications services their chips enable, and their ability to collaborate with other players across the IoT (Internet of Things) value chain.

This, in turn, is putting an increasingly large premium on how semiconductor companies decide to approach their markets — what their “way to play” is — and on the distinctive capabilities they deploy to carry out that approach. With the IoT, semiconductor innovation is no longer driven primarily by Moore’s Law. Moore’s Law predicted the rapid escalation in the number of transistors on each chip and the concomitant increase in performance speed and decline in cost. The value of the chips required to power the IoT is not measured in sheer speed; other factors, such as power consumption, miniaturization, software, configurability, and durability, are more important.”

A Deep Dive Into The Semiconductor Industry | Seeking Alpha, Kenneth Mell

“Most people are familiar with Moore’s Law, which I described in the previous section. However, fewer people are familiar with Moore’s Second Law, which states that the cost of a foundry doubles every four years. This law intuitively makes sense because as chips get smaller, they get more expensive and complex to create. For example, it now costs $150 million just to purchase an EUV machine from ASML. Not many startups have that kind of cash lying around, so the largest foundries have a narrow moat from that especially as chips continue to get more advanced.

Taken to its logical conclusion, Moore’s Second Law means there will be fewer and fewer foundries over time. This seems to be the case historically. An innovation called FinFET eliminated all but six foundries from mass producing chips in the aughts. Then in 2015, GlobalFoundries and UMC gave up on sizes smaller than 14nm, leaving only Intel, Samsung, and TSMC capable of mass-producing cutting-edge nodes. Intel’s recent struggles leave only two companies still on the cutting edge at 5nm: TSMC and Samsung.”

I hope this helps . . .