Medicare Advantage Over Payments In the conclusive summation of the latest KFF report on Medicare Advantage Healthcare plans which KFF also has in place, is this: Historically, one goal of the Medicare Advantage program was to leverage the efficiencies of managed care to reduce Medicare spending. However, the program has never generated savings relative to traditional Medicare. In fact, the opposite is true. As a result, Medicare Advantage plans have been able to offer an increasingly robust set of extra benefits not available to beneficiaries in traditional Medicare. Medicare Advantage plans are to generate savings by bidding below the CMS benchmark for covering Part A and B services. The plans have been able to offer extra benefits not

Topics:

run75441 considers the following as important: Healthcare, Journalism, law, Medicare Advantage, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Medicare Advantage Over Payments

In the conclusive summation of the latest KFF report on Medicare Advantage Healthcare plans which KFF also has in place, is this:

Historically, one goal of the Medicare Advantage program was to leverage the efficiencies of managed care to reduce Medicare spending. However, the program has never generated savings relative to traditional Medicare. In fact, the opposite is true. As a result, Medicare Advantage plans have been able to offer an increasingly robust set of extra benefits not available to beneficiaries in traditional Medicare.

Medicare Advantage plans are to generate savings by bidding below the CMS benchmark for covering Part A and B services.

The plans have been able to offer extra benefits not available to beneficiaries in traditional FFS Medicare. The annual cost of the rebate dollars used to pay for the extra benefits is ~$1,680 per Medicare Advantage enrollee for non-employer, non-SNP plans in 2021. Extra benefit costs offset any savings Medicare Advantage plans generate by bidding below the benchmark set by CMS for covering Part A and B services. By offering the extra benefits, Medicare Advantage plans have likely seen substantial increases in Medicare Advantage enrollment.

Under the quality bonus program, payments from the federal government to Medicare Advantage plans will total $11.6 billion in 2021, A portion paid as the rebate.

Over Coding Patients

MedPac reported $12 billion spent on Medicare Advantage plans due to over coding (Page 439). The overall impact of coding differences on payments to MA plans is was built on retrospective cohorts of beneficiaries enrolled in either FFS or MA for all of 2020. MedPac tracking each beneficiary backward for as long as continuously enrolled in the same program (FFS or MA) or to 2007. The first year payment to MA plans was based entirely on CMS–HCC risk scores. The analysis calculated differences in risk score growth by comparing FFS and MA cohorts with the same years of enrollment (e.g., 2007 through 2020, 2008 through 2020), adjusting for differences in age and sex.

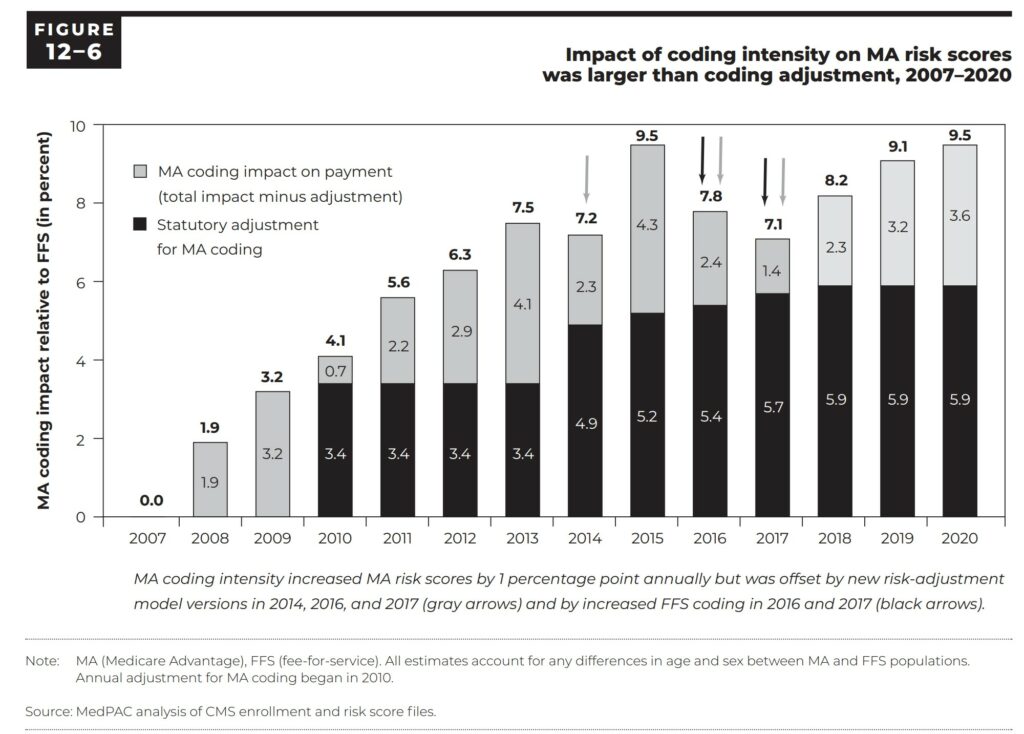

Figure 12-6 shows payment years 2007 through 2020. Figure 12-6 shows the impact of differences in coding intensity on MA risk scores relative to FFS and the size of the coding intensity adjustment (the amount by which CMS reduced MA risk scores to account for coding intensity).

For 2020, MA risk scores were 9.5 percent above FFS risk scores, and this difference was only partially offset by the coding intensity adjustment that reduced MA risk scores by 5.9 percent. The net effect was a 3.6 percent increase in MA risk scores, leading to nearly $12 billion in excess payments to MA plans (Page 440).

Briefly, I have touched upon two of the issues with Medicare Advantage plans. Plainly speaking, it is no better than commercial healthcare insurance in the type of insurance it provides at a hidden cost to its participants. (I have not discussed denial of care by MA plans either). All of these overcharges come out of the Medicare Trust fund which when depleted makes us open to Congressional interference.

Joe Biden was wrong to reduce monthly Medicare charges from $170 to $164. We might have built a bigger reserve. Joe Biden is also wrong about endorsing the “mandatory” switch to Medicare Advantage plans.

AARP

Matthew Cunningham-Cook at The Lever News discusses how one retired persons agency is advocating for MA Plans and making money off of its members joining the endorsed plan. While I have Part D, Dental, I do not have an MA plan.

Commonly known as AARP, the American Association of Retired Persons has also been endorsing its Medicare Advantage Plan over the less costly and more efficient FFS Medicare program.

This is occurring despite the recognized massive and systemic problems with for-profit Medicare plans denying care to seniors while costing the government more than $7 billion annually in excess fees. The leading advocacy group tasked with protecting older Americans is welcoming the privatization of the national health insurance program. This is occurring while earning as much as $814 million annually from insurers advertising the plans.

AARP is expected to advocate for the best interests of their 38 million members — and the 28.4 million Americans now covered by Medicare Advantage plans, or nearly half of all Medicare beneficiaries. Medicare Advantage plans are not in the best interest of its members or Medicare beneficiaries.

Don Berwick, an administrator of Centers for Medicare and Medicaid Services (CMS) in the Obama administration who has emerged as a prominent critic of the program.

“The AARP makes money through its own Medicare Advantage plans. It would be understandable that it would try to protect one of its major income sources.”

The Lever, AARP hardly touched on care denials, over coding, or higher costs as I have also mentioned above. Instead, it is recommending modest increases in transparency on issues like racial equity and telehealth funding — while championing the expansion of the privatized insurance program.

Starting in 2021, AARP also launched a lucrative partnership with the major Medicare outsourcing firm Oak Street Health. Oak Street is a participant in the ACO Realizing Equity, Access, and Community Health (REACH) program that privatizes Medicare benefits for seniors without their consent. This was reported by Kaiser Health News in June.

In 2021, AARP earned $814 million in “royalties” for its health care work, according to a recently released financial statement reviewed by The Lever. That figure is more than double what the organization collects in dues and is 20 percent higher than 2018.

As you can see, there is a lot going on with Medicare, the attempts to privatize it, and flawed overly expensive healthcare by Medicare Plans.

References

“Spending on Medicare Advantage Quality Bonus Program Payment Reached $10 Billion in 2022,” KFF, Jeannie Fuglesten Biniek, Meredith Freed, Anthony Damico, and Tricia Neuman.

“Chapter 12 MedPAC March 2022,” Report to the Congress

Why Is AARP Boosting Medicare Privatization? levernews.com, Matthew Cunningham-Cook.

“Some Medicare Advantage Organization Denials of Prior Authorization Requests Raise Concerns About Beneficiary Access to Medically Necessary Care” (OEI-09-18-00260) (hhs.gov)