Commenter and Blogger RJS, Focus on Fracking US oil supplies near a 10 year low; biggest hit to gasoline output & demand since 2020 lockdownStrategic Petroleum Reserve at a new 19 year low; total crude supplies near a 10 year low; gasoline production and gasoline demand fall by most in 21 months; gasoline supplies rise by most in 21 months; distillate supplies rise by most in a year US oil data from the US Energy Information Administration for the week ending December 31st showed that despite a major shift of “unaccounted for crude oil” from demand to supply, a concurrent drop in our oil imports meant we still needed to pull oil out of our stored commercial crude supplies for the sixth week in a row and for the 22nd time in the past thirty-two

Topics:

run75441 considers the following as important: MarketWatch 666, Oil, RJS, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Commenter and Blogger RJS, Focus on Fracking

US oil supplies near a 10 year low; biggest hit to gasoline output & demand since 2020 lockdown

Strategic Petroleum Reserve at a new 19 year low; total crude supplies near a 10 year low; gasoline production and gasoline demand fall by most in 21 months; gasoline supplies rise by most in 21 months; distillate supplies rise by most in a year

US oil data from the US Energy Information Administration for the week ending December 31st showed that despite a major shift of “unaccounted for crude oil” from demand to supply, a concurrent drop in our oil imports meant we still needed to pull oil out of our stored commercial crude supplies for the sixth week in a row and for the 22nd time in the past thirty-two weeks . . . our imports of crude oil fell by an average of 875,000 barrels per day to an average of 5,884,000 barrels per day, after rising by an average of 565,000 barrels per day during the prior week, while our exports of crude oil fell by an average of 375,000 barrels per day to an average of 2,554,000 barrels per day during the week, which together meant that our effective trade in oil worked out to a net import average of 3,330,000 barrels of per day during the week ending December 31st, 500,000 fewer barrels per day than the net of our imports minus our exports during the prior week . . . over the same period, production of crude oil from US wells was reportedly unchanged at 11,800,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 15,130,000 barrels per day during the cited reporting week…

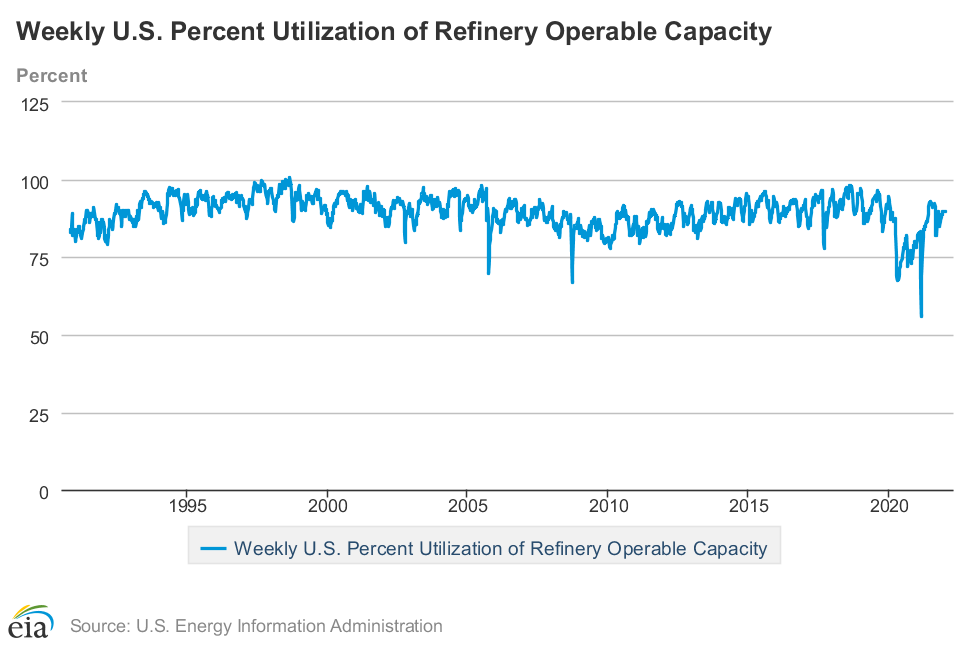

US oil refineries were operating at 89.8% of their capacity while using those 15,867,000 barrels of crude per day during the week ending December 31st, up from a utilization rate of 89.7% the prior week, but still lower than the historical utilization rate for late December refinery operations . . . the 15,867,000 barrels per day of oil that were refined this week were 10.4% more barrels than the 14,287,000 barrels of crude that were being processed daily during the pandemic impacted week ending January 1st of 2021, but 9.4% less than the 16,897,000 barrels of crude that were being processed daily during the week ending January 3rd. 2020, when US refineries were operating at what was then a more seasonal 93.0% of capacity…

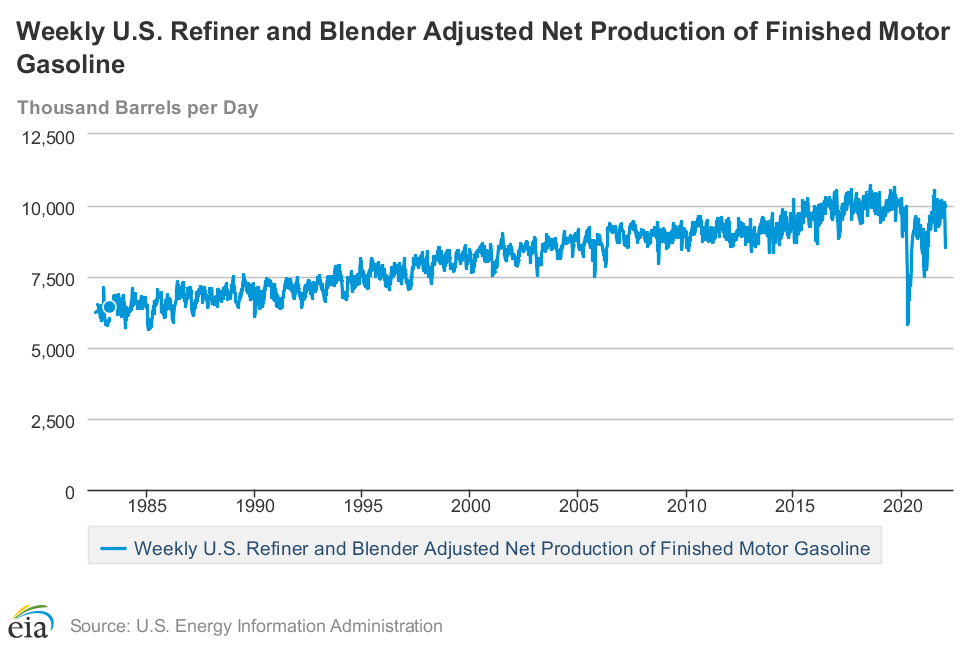

Even with the increase in oil being refined this week, the gasoline output from our refineries was quite a bit lower, decreasing by 1,607,000 barrels per day to 8,506,000 barrels per day during the week ending December 31st, the largest drop in 21 months, after our gasoline output had increased by 171,000 barrels per day over the prior week . . . this week’s gasoline production was still 6.2% more than the 8,010,000 barrels of gasoline that were being produced daily over the same week of last year, but 4.2% less than the gasoline production of 8,887,000 barrels per day during the week ending January 3rd. 2020, when gasoline output had also seen a steep drop at year end . . . on the other hand, our refineries’ production of distillate fuels (diesel fuel and heat oil) increased by 30,000 barrels per day to 4,965,000 barrels per day, after our distillates output had increased by 83,000 barrels per day over the prior week . . . after those increases, our distillates output was 3.8% more than the 4,785,000 barrels of distillates that were being produced daily during the week ending January 1st of 2021, but 6.5% less than the 5,310,000 barrels of distillates that were being produced daily during the week ending January 3rd. 2020…

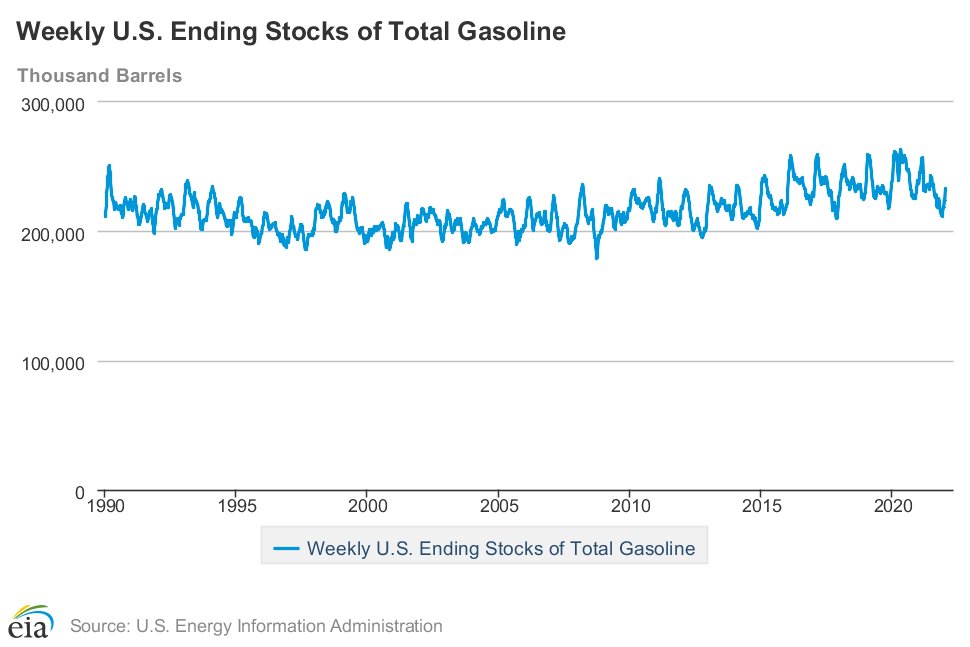

With the big drop in our gasoline production, our supplies of gasoline in storage at the end of the week rose for the fourth time in thirteen weeks, and by the most in 21 months, increasing by 10,128,000 barrels to 232,787,000 barrels during the week ending December 31st, after our gasoline inventories had decreased by 1,459,000 barrels over the prior week . . . our gasoline supplies increased this week because the amount of gasoline supplied to US users decreased by 1,552,000 barrels per day to 8,172,000 barrels per day, the largest drop in implied demand in 21 months, and because our imports of gasoline rose by 164,000 barrels per day to 596,000 barrels per day, while our exports of gasoline fell by 144,000 barrels per day to 470,000 barrels per day…after this week’s big inventory increase, our gasoline supplies were still 3.4% lower than last January 1st’s gasoline inventories of 241,081,000 barrels, and about 4% below the five year average of our gasoline supplies for this time of the year…

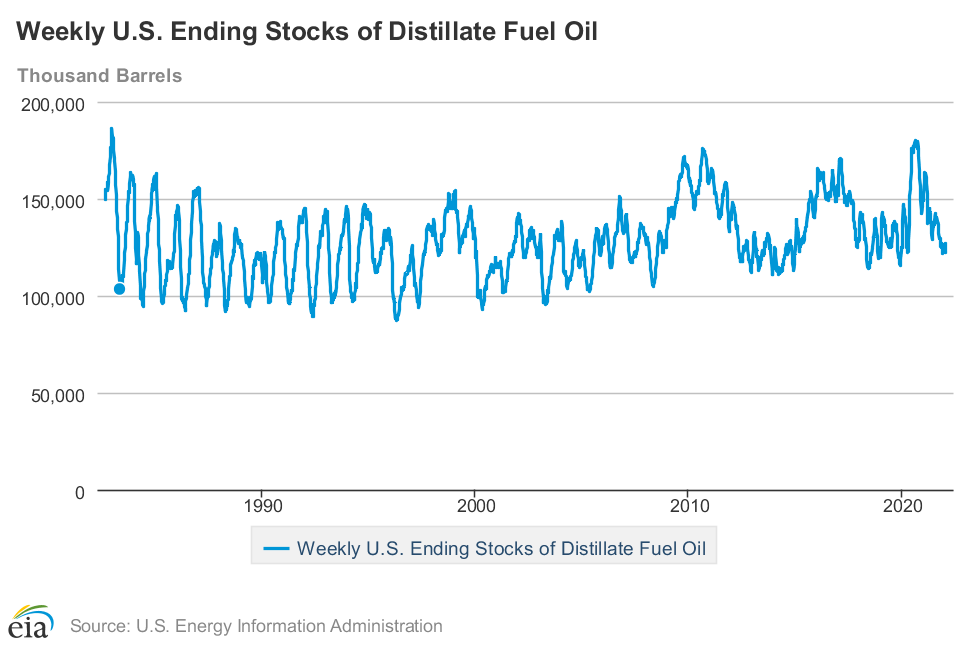

With the increase in our distillates production, our supplies of distillate fuels increased for the sixth time in nineteen weeks and by the most in 51 weeks, rising by 4,418,000 barrels to 126,846,000 barrels during the week ending December 31st, after our distillates supplies had decreased by 1,726,000 barrels during the prior week . . . our distillates supplies rose this week because the amount of distillates supplied to US markets, an indicator of our domestic demand, fell by 312,000 barrels per day to 3,739,000 barrels per day, and because our exports of distillates fell by 481,000 barrels per day to 811,000 barrels per day, and because our imports of distillates rose by 55,000 barrels per day to 217,000 barrels per day . . . but after twenty-six inventory decreases over the past thirty-nine weeks, our distillate supplies at the end of the week were 19.9% below the 158,419,000 barrels of distillates that we had in storage on January 1st of 2021, and about 16% below the five year average of distillates inventories for this time of the year…

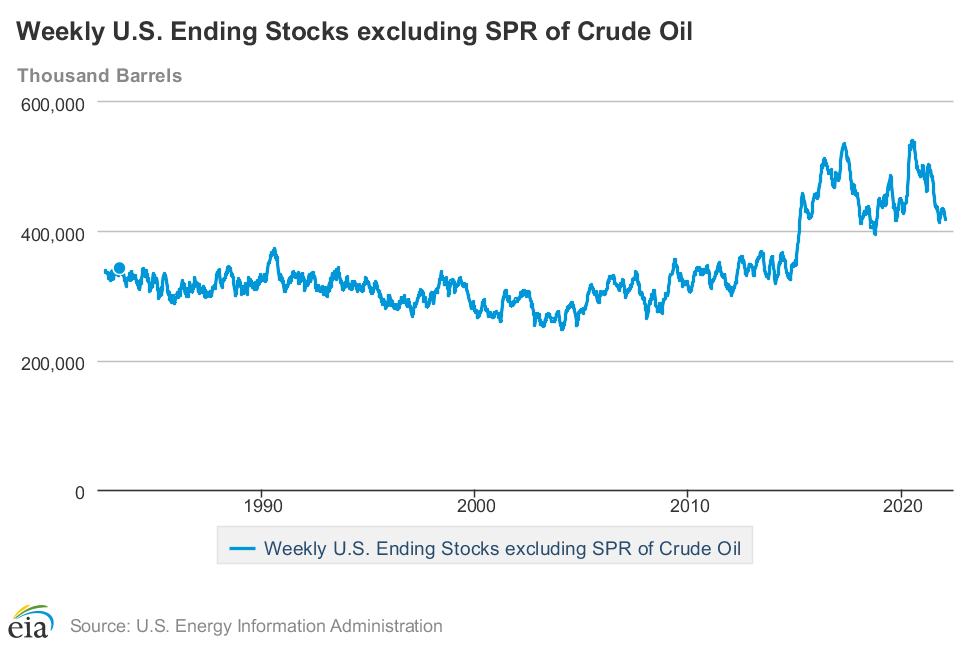

Meanwhile, with the big drop in our oil imports, our commercial supplies of crude oil in storage fell for the 15th time in 22 weeks and for the 34th time in the past year, decreasing by 2,144,000 barrels over the week, from 419,995,000 barrels on December 24th to 417,851,000 barrels on December 31st, after our commercial crude supplies had decreased by 3,576,000 barrels over the prior week . . . after this week’s decrease, our commercial crude oil inventories fell to about 8% below the most recent five-year average of crude oil supplies for this time of year, but were still around 28% above the average of our crude oil stocks as of year end over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels . . . since our crude oil inventories had jumped to record highs during the Covid lockdowns of last spring and remained elevated for most of the year after that, our commercial crude oil supplies as of this December 31st were 13.9% less than the 485,459,000 barrels of oil we had in commercial storage on January 1st of 2021, and are now 3.1% less than the 431,060,000 barrels of oil that we had in storage on January 3rd of 2020, and also 5.0% less than the 439,738,000 barrels of oil we had in commercial storage on January 4th of 2018…

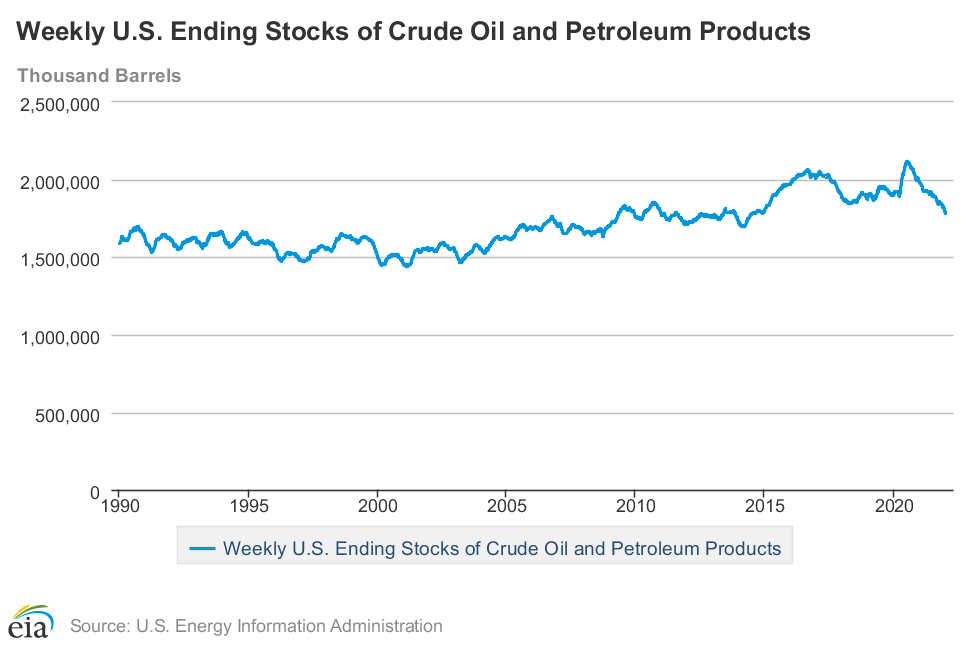

Finally, with our inventory of crude oil and our supplies of all products made from oil all near multi year lows, we are continuing to track the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR . . . the EIA’s data shows that total oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, rose by 8,819,000 barrels this week, from 1,779,614,000 barrels on December 24th to 1,788,433,000 barrels on December 31st, but still left our total inventories at the 2nd lowest level since August 29th, 2014…..