RJS, MarketWatch 666, Retail Sales Rose 3.8% in January; Prior Months’ Revisions Boost 4th Quarter GDP Seasonally adjusted retail sales increased 3.8% in January after retail sales for December were revised a bit lower, but November sales were revised somewhat higher…the Advance Retail Sales Report for January (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled 9.8 billion during the month, which was up 3.8 percent (±0.5%) from December’s revised sales of 6.3 billion and 13.0 percent (±0.9 percent) above the adjusted sales in January of last year….December’s seasonally adjusted sales were revised less than 0.1% lower, from 6.8 billion to 6.3 billion, while November’s sales were

Topics:

run75441 considers the following as important: politics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

RJS, MarketWatch 666, Retail Sales Rose 3.8% in January; Prior Months’ Revisions Boost 4th Quarter GDP

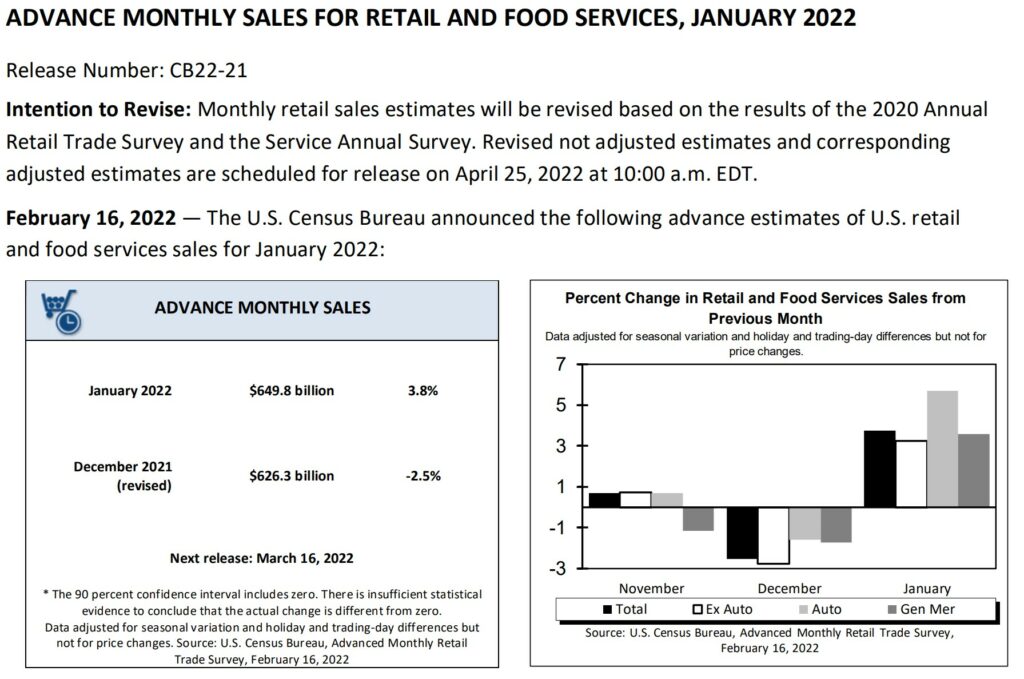

Seasonally adjusted retail sales increased 3.8% in January after retail sales for December were revised a bit lower, but November sales were revised somewhat higher…the Advance Retail Sales Report for January (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled $649.8 billion during the month, which was up 3.8 percent (±0.5%) from December’s revised sales of $626.3 billion and 13.0 percent (±0.9 percent) above the adjusted sales in January of last year….December’s seasonally adjusted sales were revised less than 0.1% lower, from $626.8 billion to $626.3 billion, while November’s sales were revised nearly 0.6% higher, from $639.1 billion to $642,636 million; as a result, the November to December change was revised from down 1.9 percent (±0.5%) to down 2.5 percent (±0.3 percent)*…..the revisions to November and December sales slightly offset each other but indicate that the 4th quarter’s personal consumption expenditures would be revised higher at an annual rate of around $12.1 billion, which should increase 4th quarter GDP by around 0.16 percentage points….estimated unadjusted retail sales, extrapolated from surveys of a small sampling of retailers, indicated sales actually fell 18.5%, from $712,682 million in December to $580,887 million in January, while they were 12.3% higher than the $517,119 million of sales in January a year ago, so we can see how the largest seasonal adjustment on record to post holiday sales altered the headline sales results, compared to the big sales drop that we would normally expect to see in January…

Included below is the table of the monthly and yearly percentage changes in retail sales by business type taken from the January Census Marts pdf….the first pair of columns below gives us the seasonally adjusted percentage change in sales for each kind of business from the revised December figure to this month’s January “advance” report in the first sub-column, and then the year over year percentage sales change since last January in the 2nd column…the second double column pair below gives us the revision of the December advance estimates (now called “preliminary”) as of this report, with the new November to December percentage change under “Nov 2021 r” (revised) and the December 2020 to December 2021 percentage change as revised in the last column shown…for your reference, the table of last month’s advance estimate of December sales, before this month’s revisions, is here…

To compute January’s real personal consumption of goods data for national accounts from this January retail sales report, the BEA will use the corresponding price changes from the January consumer price index, which we reviewed last week…to estimate what they will find, we’ll first separate out the volatile sales of gasoline from the other totals…from the third line on the above table, we can see that January retail sales excluding the 1.3% price-related decrease in sales at gas station were up by 4.2%…then, subtracting the figures representing the 1.1% increase in grocery & beverage store sales and the 0.5% decrease in food services sales from that total, we find that core retail sales were up by almost 5.7% for the month…since the CPI report showed that the composite price index for all goods less food and energy goods was 1.0% higher in January, we can thus approximate that real retail sales excluding food and energy will on average be close to our nominal core retail sales, or show an increase of 4.7%….however, the actual adjustment in national accounts data for each of the types of sales shown above will vary by the change in the related price index…for instance, while nominal sales at furniture stores were up 7.2%, the price index for household furnishings and supplies was 1.6% higher, which would suggest that real sales at furniture stores rose by roughly 5.5%…..on the other hand, while nominal sales at health and personal care stores were 0.7% lower in January, the medical commodities price index was 0.9% higher, which means that real sales at drug stores were actually around 1.6% lower…

In addition to figuring those core retail sales, we should also adjust food and energy retail sales for their price changes separately…the January CPI report showed that the food price index was 0.9% higher, with the index for food purchased for use at home 1.0% higher, while prices for food bought to eat away from home averaged 0.7% higher… thus, while nominal sales at food and beverage stores were 1.1% higher, real sales of food and beverages would be only 0.1% higher in light of the 1.0% higher prices…meanwhile, the 0.9% decrease in nominal sales at bars and restaurants, once adjusted for 0.7% higher prices, suggests that real sales at bars and restaurants fell about 1.6% during the month….in addition, while sales at gas stations were down 1.3%, there was also a 0.8% decrease in the retail price of gasoline during the month, which would suggest that real sales of gasoline were down on the order of 0.5%, with the caveat that gasoline stations do sell more than gasoline, and we haven’t accounted for those other sales…averaging real sales that we have thus estimated together, we can then estimate that the income and outlays report for January will show that real personal consumption of goods rose by about 3.7% in January, after falling by a revised 3.3% in December, and by a revised 0.6% in November…at the same time, the 1.6% decrease in real sales at bars and restaurants would subtract about 0.1% from January’s real personal consumption of services….note that in estimating December’s revised real goods consumption, we have incorporated both the revision to December’s real sales and last week’s 0.1% upward revision to December’s consumer prices, which would precipitate a similar upward revision to the December PCE price index for goods, and thus a corresponding downward change in December’s real goods consumption…