This is one of Alan Collinge’s associates who comment on many of his posts. This also reflects a point I bought up a while back on student loan debt. The size of the loan was large and probably could have been handled. The issue is not so much the loan as it is the interest fees, interest upon interest, paying back the interest first, etc. A ,000 forgiveness will go to the interest first on the student loan debt and never touch the principal. Name: Kate State: NY My husband and I owe over 0,000 in student loan debt. Half a million dollars. Let that sink in a minute. Most of this is interest due to the U.S. government for Parent Plus Loans we took out for our two daughters to get a college education. To be more precise, that includes

Topics:

run75441 considers the following as important: Education, politics, Student Loan Debt, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

This is one of Alan Collinge’s associates who comment on many of his posts. This also reflects a point I bought up a while back on student loan debt. The size of the loan was large and probably could have been handled. The issue is not so much the loan as it is the interest fees, interest upon interest, paying back the interest first, etc. A $10,000 forgiveness will go to the interest first on the student loan debt and never touch the principal.

Name: Kate

State: NY

My husband and I owe over $500,000 in student loan debt. Half a million dollars. Let that sink in a minute. Most of this is interest due to the U.S. government for Parent Plus Loans we took out for our two daughters to get a college education. To be more precise, that includes approximately $300,000 in interest. We are joined by the other 1.7 trillion dollars (and growing) in outstanding student loan debt in this country. As of today, my husband is 60 years old. I am 65. We’ve been together 37 years.

My husband is a blue collar worker with a decent union job. After many early years of barely scraping by, his salary in the past ten years or so has been a good one, comparatively to most of the working-class people in this country. I’m well aware that we’re fortunate in that regard. But as insane as that figure sounds, and it is, I am confident that we’re not the only ones in such a predicament.

The reason you don’t hear more horror stories like this one is because people are ashamed to admit it, or just terrified almost to say it aloud, because by talking about it, the reality of the situation is almost more ominous than one can bear. For all those who point fingers and declare –

“You should have gotten a degree in a more lucrative field, known your limits financially or gone to a state university”

– I say, you’ve had an easier time of it personally, or you just simply don’t know what you’re talking about.

If I had it to do all over again, I’d tell my daughters to either be artists or to go to trade school and to further their personal education by reading and studying on their own. I say this for their sake, not even ours, because they also have student loan debt that they’re trying valiantly to pay. As any boomer knows, college did not used to be so prohibitively expensive. People could get a degree, or even more than one, without being saddled with a lifetime of debt.

The state college that I and my siblings went to in the 1970s cost next to nothing to attend. But the system we have in place now doesn’t come anywhere near the cost of living. It’s grotesque and obscene. So, anyway, we have this enormous debt, and I can hear the moral scolds out there tsk-tsking. My husband, as I said is 60 years old. For 40 years he’s been working 40-60 (or more) hours a week, not including commuting time, in a physically demanding job. He never, ever complains about it. In the years just since our daughters started college, we have paid over $300,000 in federal income taxes and over $125,000 in state taxes. We pay for the salaries and security and benefits of congress and the president. We pay for wars we’re against as well as to bail out Wall Street and the airlines. So, I’d like to ask those scolds, what exactly would you have us do at this point?

Congress and the President back in the day made it nearly impossible for us to discharge this debt in bankruptcy – although if it were gambling debt or we were a big business, we could just walk away from it, despite whatever foolish decisions we made in the past. The plain fact is this debt will never be repaid. Never. The government itself and every institution and so-called responsible authority aided us, goaded us, and encouraged us to get into this debt. And once we were in it, refusing to even work out a rational, doable monthly payment. So what would you have us do? It is an insane amount for a blue-collar, working-class family. We lost our home to foreclosure in part due to these loans. So, I repeat, what would you have us do? If the government had said back in 2005 –

“Gee, buddy, you’re in your 40’s, you have a mortgage and bills – we can’t loan you this” –

I wouldn’t be writing this now.

The government takes no responsibility whatsoever for this national obscenity that they’ve created. This is what happened: Our daughters are 13 months apart in age – so it was back-to-back FAFSA’s and the college process – beginning about 2004 – 2005. We didn’t have much. An old 890 square foot house. When we were able to take a vacation, it was somewhere simple and local. We had used cars. We didn’t buy luxuries. I was a former actress. I waited tables. I worked retail. For many years I was a stay-at-home mom. I’d occasionally pick up a bit of side work here and there. But I was busy – with the girls, the home, health issues in the family, and trying to get a side-career going in the arts. Eventually when I tried to go back to work, because of physical issues, I could no longer do any work that I was woefully qualified for.

When we began researching college for our eldest daughter in 2004, I had a very uneasy feeling about it all. It was so expensive. So competitive. Everything was different from when I grew up. Still, everyone – from professionals on news shows, articles in newspapers and magazines, financial experts, government, the high school counselors, teachers, friends and relatives, the colleges where we visited – everyone assured us – loans were the way to get your child the college education best suited for them. If you didn’t, their future was pretty much screwed. So, filling out the first FAFSA – I kept wondering why they didn’t ask about our debt or expenses – but since this was a government form, I assumed they would know what we could afford. There was no clear explication of what the eventual payments would amount to, and even though the cost of tuition seemed insane, I convinced myself that it would all make sense and pay off in the end.

We picked Nellie Mae for most of our loans – we thought it was a government agency. It wasn’t. We found the schools that accepted their applications and that seemed right for their personalities and their aspirations. Quickly, after our oldest began college at a private university in the city, the bills started coming. At first, it was manageable. Less than $200 a month. Then it doubled, then tripled. It started to become harder to manage, so that’s when I juggled. As the years wore on, I became a full-time juggler. Then our youngest daughter started college, also in-state, but private. It was the right fit for her – for both of them – and we felt that was as important as anything else. During these years we paid thousands of dollars toward our Parent Plus loan debt – I realize now that most of it was probably just interest.

Now, this is where the scolds and my moral superiors will tell me that we should’ve pulled our daughters out of the schools they were thriving in and send them to one of the SUNY schools that cost less (not that much less, let me tell you – it still would’ve been unaffordable). Anyway, yeah, you go ahead and do that. Pull your kids out. All you want is better for your children. To provide them with a college education. To give them opportunities and possibilities. And at this point, you’re in so deep it wouldn’t have helped all that much.

And how were we to know they’d graduate right into the Great Recession – where the working and middle classes were pulverized while the banks and Wall Street were rescued with kisses upon their cheeks from our government. Our daughters and their graduating classes found that jobs were scarce – no matter how smart or capable you were, and pay was not enough to live on – then you throw in health insurance costs and all the rest. When our oldest did graduate from college – for several years we were paying to keep her on our insurance with COBRA. That was $600 a month to start and then rising to $682, on top of student loan payments, the mortgage and everything else.

I can give testimony on how even a decent monthly salary can vanish just by paying for the barest necessities of life. Her insurance was very important to us as she had a brain tumor as a child, and when you go through something like that, you never take your health care lightly. Especially for your children. So, we went on. I pushed nagging feelings of doom to the back of my mind as I went on automatic pilot and dealt with life’s many complexities and our daughters finding their ways in the world. As any person who has had to struggle in life understands, sometimes you just have to keep moving ahead. You don’t have the luxury of options or money to smooth over life’s difficulties. Sure, we also made some bad choices along the way. We’re human. But once you begin to drown, you just keep treading water trying to stay afloat. Trying to survive. To figure something out – to hope for a brighter day.

Eventually we had to file for bankruptcy, and also lost our house to foreclosure. I tried to get our bankruptcy attorney to at least try to get the student loans dismissed. He told us it was impossible. I insisted – we will never ever be able to pay this off. Surely a judge could see that. Our attorney had $400,000 of his own debt in Parent Plus loans so he was sympathetic, but he wouldn’t try. We tried repeatedly to renegotiate the interest (8.5%) or the balance, or the payments – any part of it – many times. It was ‘no thanks – put it in forbearance or hardship with 8.5% interest, over and over again.

A few years ago, supposedly, we became eligible for the Income Based Repayment (IBR) scheme. That would have mean initial payments of $2,379 a month – rising to $4,913 as we both got closer to our date with mortality. Maybe they were counting on the Social Security payments – as the government does garnish those from seniors who need them to survive. I’ve written to all the politicians over the course of the last 12 years. The Consumer Financial Protection Bureau, The Department of Education, journalists, even civil rights attorneys – all for naught. The truth is, for a long time now, you can’t have even a modicum of trust in professionals in any area.

As taxpaying citizens of this country we’re expected to be our own economists, contract experts, lawyers, have medical fluency and knowledge, be financial planners, guidance counselors, consumer law experts, pharmacologists, accountants, investment analysts, real estate investors and be expert in all these areas. If we should make a mistake in any area – by trusting the opinions of so-called experts in their field – then the blame and responsibility for these mistakes falls squarely on our own stupid shoulders. For all those fiscal scolds who insist the blame is ours for sending our daughters to private colleges (although not Ivy League) – and suggest State college would have sufficed – let me suggest you actually check the tuition and room and board at your state college. Let me remind you that it is drilled into students that the more prestigious the school, the more prosperous their future career opportunities will be. Why then too, do most people in prestigious positions go to Ivy Leagues? For instance, why then did Michele and Barack Obama go to Princeton, Columbia and Harvard and then send their daughter to Harvard too? Why did he, and nearly every president, stock his administration with graduates of places such as that?

So sure, you can fault me. We should have known better. Should have sent our kids to community college. Who did we think we were? Doesn’t matter how bright or ambitious your kid is, community college is the logical step. Now, even if I conceded that, which I don’t, the question remains, what do we do now? Our daughters have since gone to graduate school – our youngest for teaching. And then the scolds ask, why? The answer is, because with a graduate degree, your hopes of better pay increases, let alone in order to find employment in their chosen fields. For an example, a simple teaching degree will only get you so far, and some states even mandate a masters if you want to continue teaching.

The simple fact is, the U.S. government is in the loan shark business in order to make a profit off its citizens when it comes to the basic right of a good education in this country. The government insists you need a college education to “compete in the global economy and the jobs of the future.” So they then give out student and Parent Plus loans in the trillions, earning a profit on the interest incurred. Then the colleges, which are now big business institutions, increase their tuition hundreds of times over their initial costs – far beyond solid operating costs with lots of administrators for every conceivable niche need, build sports arenas and lush dorm rooms and lazy rivers. And the grift keeps on going. Everyone wins except the fools who take out the loans, and the young people who afterwards have to scramble and scrounge to make a living and flourish in their lives.

And no, our daughters cannot help us pay down our debt. They have their own debt. Stafford Loans for undergraduate and graduate school loans for Master’s. And this may come as a shock to the judges out there of the working class. We do not actually enjoy being in debt. For the most part, we try very hard not to be in debt. We’re not real estate investors or stock market players or businessmen or government officials – so debt to us is extremely stressful.

It’s not actually a breeze to file for bankruptcy. It’s a humiliating experience. When this all started, I had hoped that since my husband had a solid, union job – we would – we should – be able to afford this. What I didn’t understand until much later, is that this entire student loan business is a con and a hustle and a grift and we are the saps who get taken for a ride. So, on paper, perhaps you could try to argue that we can pay our debt. But that is not based in financial reality. Yes, we could afford several hundred dollars a month in payments – but Navient (the servicer that used to be Sallie Mae who I believe was somehow the evil twin of Nellie Mae) has told us (via the DOE that owns our loans) that this would be unacceptable. They’d rather place us in forbearance/hardship, and watch the interest grow.

According to the IBR calculations, if we entered the program today – the loans will be paid off in 2046. My husband will supposedly continue working in his physically demanding job until he’s 85 years old. By that time, we will have paid our government $1,059,365, of which $200,000 will have been spent on their actual education. Now, another argument is – why don’t you go live in a studio apartment somewhere and your 60 year old husband can continue to work 60 hour weeks until he drops dead or you pay off this government debt with loan shark interest? Don’t buy anything. Don’t go anywhere. Cancel your dang cable. Don’t visit your children. What then is the point of even being alive? How would this not be considered by any moral, reasonable or sane society to be indentured servitude?

Oh yes, it all sounds so very self-sacrificing and appropriate to the moral scolds who have skated through life (whether they want to admit it to themselves or not). To live like Mother Theresa in order to pay this government their undeserved interest amounting to 800,000 dollars is no life at all. We’ve never had much. We’ve lived simply.

This is the part where I might try uselessly to convince the hard-hearted moral superior that we are decent, honest people. But, you know what, to those people I say, they can stuff it. I’m not going to justify myself to anyone. I know who we are. There is no world in which this is a fair and just arrangement. As obscene as our situation is – my outrage doesn’t end there at all. My heart just breaks for all the young people, including my daughters, who have to begin their adult lives with this untenable and unnecessary debt burden hanging around their necks. No houses, children, or starting your own businesses for you!

What should be done going forward to straighten out this ulcerous mess is to:

1. Forgive all outstanding student loan debt. And this does not help out rich people. I’m sick of hearing that from pundits and politicians. Everyone knows it’s a lie. Rich people do not take out student loans. And if a few undeserving people get their loans forgiven in the great debt jubilee deluge – so be it. Deal with it. Nothing is perfect. I’m sure a few bankers didn’t “deserve” their government largesse either. This is not only the morally decent thing to do, but economically for society as a whole.

2. In conjunction with this – shut off the spigot to the colleges and universities from the Department of Education. The government should no longer be in the student loan, usury business.

Let’s see if that forces colleges to lower their tuition and other fees as they see the lack of freshman pushing open the doors. This is the only thing that could get them under control.

3. For those desirous enough, there are still private loans, scholarships or a continuation and increase of Pell grants. But these spiraling education costs have to end.

Other issues and details may have to be worked on and tweaked, perhaps having the government pay outright for medical or technical programs for individuals would be an investment in our entire society and of benefit for everyone. This all has to change and quickly, because this entire system is unsustainable.

Do I have hope in this? No, not really. Like all the other major issues in this country, problems are never really, actually, efficiently dealt with and solved. Our ridiculous government throws on a Band-Aid and kicks the problem down the road. I do wonder though, at what point, if ever, does Congress and the President actually deal with this national disgrace? When total student loan debt hits 2.5 trillion? 3 trillion? 5? This disaster isn’t going away because they want to hide their heads in the sand – it’s only growing more immense every single day. And seriously, for any moral critics and scolds out there of me or my family, or the millions of others like us, I repeat, go stuff it.

~~~~~~~~

AB: This is not the first time I have written on student loan debt. You can find more on the topic here, here, here, and here. These are not rich income people either. The debt here is far larger than many. You can find by age, avg. debt, and also number of debt holders here. Mary Jo’s story: One person’s detailed history of Paying off a Student Loan – Angry Bear (angrybearblog.com). Cherl’s story; Teacher with $300M of Student Loan Debt Says $10,000 is a Drop in the Bucket – Angry Bear (angrybearblog.com)

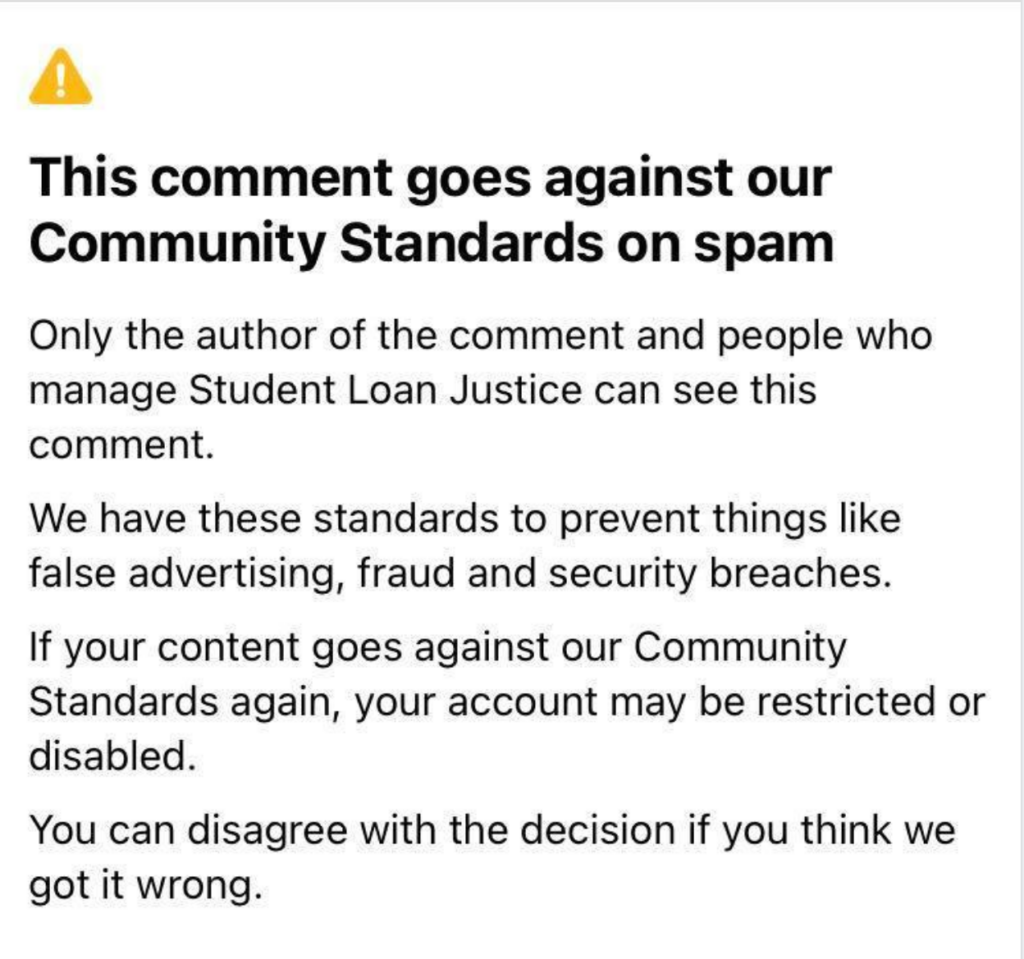

As far as Facebook?

I suspect the post was probably too long for Facebook to handle. Rather than say such, Facebook appears as the aggressor and accuses Student Loan Justice of making stuff up . . . Facebook always states no one else will ever see your words. Or at least, Facebook said similar for one of my comments. Except, I posted my comment here along with their comment to me. Facebook’s present comment:

AB: Of course, Facebook has standards. They make up the standards as they go along. They apply them without asking questions. Neither are they interested to know if the Facebook Post is true. And now, more than those who subscribe to Facebook will see Kate’s comment.