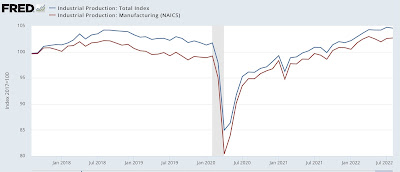

August industrial production declines; overall decelerating trend consistent with recession in 2023 – by New Deal democrat Finishing today’s data dump, industrial production, the King of Coincident Indicators, declined -0.2% in August, while manufacturing production increased 0.1%. July’s sharp gains in both were revised slightly (-0.1%) downward: While July remains the high water mark for overall production, manufacturing has not made a new high since April. What I see is a decelerating trend which will probably continue to worsen as the Fed raises rates. This adds to the evidence that a recession is likely next year. Tags: August 2022 industrial production

Topics:

NewDealdemocrat considers the following as important: August 2022 industrial production declines, Hot Topics, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

August industrial production declines; overall decelerating trend consistent with recession in 2023

– by New Deal democrat

Finishing today’s data dump, industrial production, the King of Coincident Indicators, declined -0.2% in August, while manufacturing production increased 0.1%. July’s sharp gains in both were revised slightly (-0.1%) downward:

While July remains the high water mark for overall production, manufacturing has not made a new high since April.

What I see is a decelerating trend which will probably continue to worsen as the Fed raises rates. This adds to the evidence that a recession is likely next year.