I was following the links in Dale’s latest commentary on Social Security and clicked in to see what Dale was discussing in his commentary. I was able to web capture the chart (below) which I believe accurately depicts what Dale is writing about in his commentary. The chart is a depiction of a one tenth of one percent increase yearly for the employer and the employee. There are other solutions to the short fall of Social Security funding. As pointed out, the US is monetarily sovereign and it could just print more dollars to cover the shortfall in funding. Dale’s point contesting the Monetarily Sovereign argument is Social Security is funded by the people. Social Security belongs to the people. In which case, printing more money incurs an

Topics:

Bill Haskell considers the following as important: 1 tenth of 1% yearly., Dale Coberly, Dale Coberly's Letter to SS, Dale Coberly's Letter to SS, Letter to Representative De Fazio 2018, social security, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

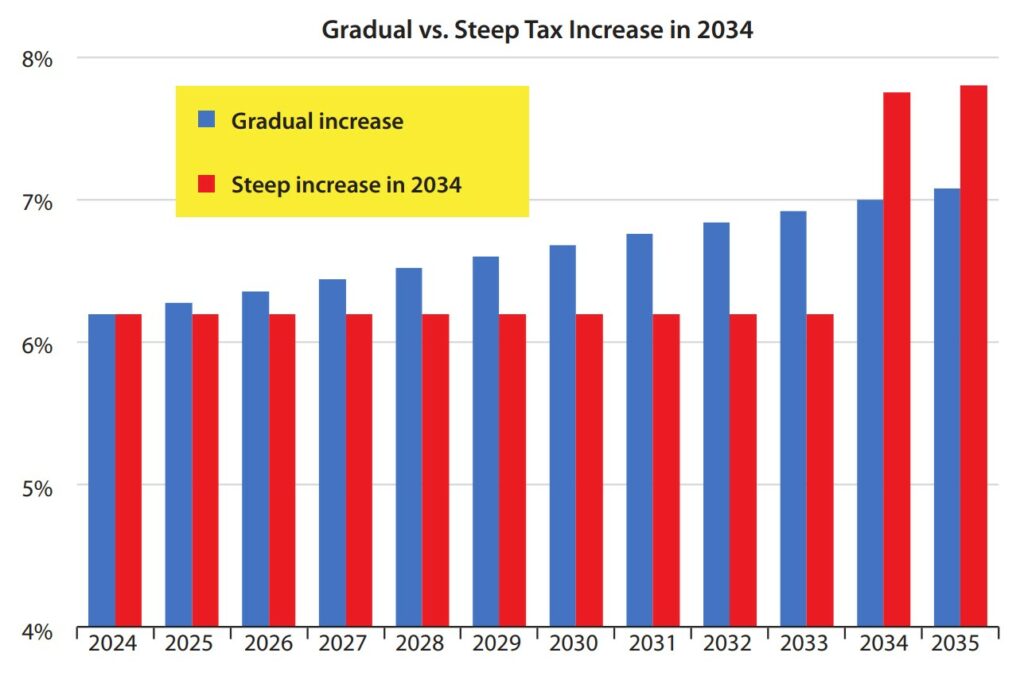

I was following the links in Dale’s latest commentary on Social Security and clicked in to see what Dale was discussing in his commentary. I was able to web capture the chart (below) which I believe accurately depicts what Dale is writing about in his commentary. The chart is a depiction of a one tenth of one percent increase yearly for the employer and the employee.

There are other solutions to the short fall of Social Security funding. As pointed out, the US is monetarily sovereign and it could just print more dollars to cover the shortfall in funding. Dale’s point contesting the Monetarily Sovereign argument is Social Security is funded by the people. Social Security belongs to the people. In which case, printing more money incurs an intervention of other funding which could include political control and cuts.

Reforming Social Security Sooner Rather Than Later, American Academy of Actuaries,

Authors; Linda K. Stone and Geralyn Trujillo.

Tax Increases

Options that help increase Social Security’s income (so it can pay all scheduled benefits) are:

1) Increase the payroll tax rate by 25% one tenth of 1% per year.

(AB Note: The 25% cited in the original article is the ratio of the increase to the original percentage of 6.2%. Using the percentage 25% from 2024 to 20235 creates a misconception of an immediate increase to 25%. One tenth of 1% for employees and also employers accurately portrays the yearly increase starting in 2024).

- This would raise the current 6.2% tax rate to 7.75%8 for both workers and employers, yielding enough to pay 100% of benefits in 2034.9

- Employee and employer payroll tax rates have never been increased by more than 0.5 percentage points of taxable payroll in any one year.10

- Increasing the tax rate will be financially difficult for some people with very low income. Unless the EITC (Earned Income Tax Credit) also increases. The EITC offsets the payroll tax for low-income people. Increasing the EITC would reduce income taxes and increase the national debt, so federal income taxes would need to be increased to make this revenue neutral.

- It would be less disruptive to employers and workers if increases in the tax rate were gradually phased in (e.g., by 0.1 percentage points per year as suggested in several provisions in E.1 analyzed by Social Security Administration [SSA] actuaries), but the approach would need to be enacted soon in order to pay all benefits in 2034. The graph below compares a gradual to a steep tax increase (last two bars).

8 It would raise the self-employed tax rate from 12.4% to 15.5%.

9 Even if the payroll tax rate increases to 7.75% in 2034, that would not cover all benefits in subsequent years as costs continue to increase faster than income (primarily due to people living longer and lower fertility rates). Table VI. G2 of the 2023 Trustees Report shows the cash shortfall gradually increases until 2077 when it is 5.06% of taxable payroll, so the tax rate would have to gradually increase to 8.73% in 2077 for both workers and employers. Benefit reductions could reduce these tax rates.

10 The self-employed payroll tax rate was increased by 0.95 percentage points in 1981 and 3.35 percentage points in 1983 (when that rate became twice the employee rate)

What is interesting about this article is Angry Bear’s Dale Coberly at offering of a similar solution to Social Security as written to Congressman DeFazio of Oregon in 2018 (?).

First an introduction by my friend Dan Crawford (recently deceased):

Dan here . . . Social Security is an issue that seems to generate a lot of firm beliefs and passion, as witness recent threads. It is rare that people refer to actuary material. On the other sides of the issue are people like Andrew Biggs, who is knowledgeable and smart in his arguments. I am posting this as a reminder to readers that contributors do usually go the extra mile . . . in this case even recently, and since 2008 with Dale, Bruce Webb, and Arne Larson.

Below is a copy of a response to Dale (and his letter to Representative DeFazio) from the Deputy Chief Actuary 2017.

Dear Mr. Coberly,

Representative DeFazio’s office forwarded your letter of August 5, 2017 to our office and asked that we respond to you. Your understanding of the financing of the Social Security Trust Funds is on target, including the implications for borrowing and debt. We appreciate your careful attention to the Trustees Report and the projections we develop for it in order to show policymakers the magnitude of any shortfall they will have to address.

We have looked at your thoughtful and detailed proposal for increasing the scheduled payroll tax rates for Social Security. As I’m sure you are aware, we have scored numerous comprehensive solvency proposals and other individual options for making changes to Social Security. These analyses are available on our website.

Proposals to Change Social Security (ssa.gov)

Your proposal would increase the payroll tax rate gradually, by 0.2 percentage point per year beginning in 2018 (a 0.1-percent increase for employees and employers, each). Based on the tables you provided, it appears you would propose an “automatic adjustment” to the rate in the future, allowing the tax rate increases to stop and then resume, applying a 0.2 percentage point increase whenever the 10th year subsequent would otherwise have a trust fund ratio (TFR) less than 100 percent of annual cost. The intent appears to be that TFR would not fall below 100 percent. If we are understanding your proposal correctly, this type of adjustment would very likely maintain trust fund solvency for the foreseeable future, based on the Trustees’ intermediate assumptions.

Also, based on our rough estimates, a 0.2 percentage point increase in the payroll tax rate each year from 2018 to 2035, reaching an ultimate rate of 16.0 percent in 2035 and later, would eliminate the actuarial deficit and keep the TFR above 100 for each year thereafter. An increase to 15.8 percent in 2034 would fall just short of both goals. Note that these rough estimates do not include any additional “automatic adjustments” such as the one you propose.

We hope this information is helpful. Please let us know if you have further questions. We are also copying Rina Wulfing from Rep. DeFazio’s office on this email.

Karen P. Glenn

Deputy Chief Actuary

Office of the Chief Actuary

Social Security Administration

(update) Hmmm, if you have not noticed the original year of the start of the increases was 2018. Six years later, we are now discussing 2024 as the start. Note also there will need to be another increase some seventy years out. This comes as a result on not starting in 2018.

Reposted from Jan. 2018: Social Security and conversation, Angry Bear, Dan Crawford

Social Security and conversation, Angry Bear, Dan Crawford

Reforming Social Security Sooner Rather Than Later, American Academy of Actuaries