I read through this short report on Laboratory Benefit Managers which included commentary on Pharmacy Benefit Managers. My overall opinion is they are middlemen and as such they add cost to the delivery of healthcare. The explanation does provide insight. The Time is Now for Laboratory Benefit Management, Managed Heathcare Executive, April 2022. PBMs Explained We have Pharmacy Benefit Managers (Pharmacist Society of the State of New York) developing and maintaining the formulary, contracting with pharmacies, negotiating discounts and rebates with drug manufacturers, and processing and paying prescription drug claims. In simpler terms they are third-party administrators contracted by health plans, large employers, unions and government

Topics:

run75441 considers the following as important: Healthcare, Hot Topics, Laboratory Benefit Managers, Pharmacy Benefit Managers, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I read through this short report on Laboratory Benefit Managers which included commentary on Pharmacy Benefit Managers. My overall opinion is they are middlemen and as such they add cost to the delivery of healthcare. The explanation does provide insight.

The Time is Now for Laboratory Benefit Management, Managed Heathcare Executive, April 2022.

PBMs Explained

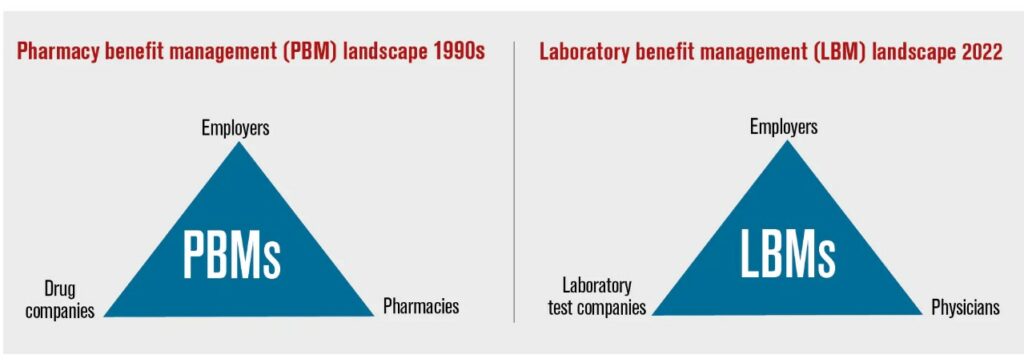

We have Pharmacy Benefit Managers (Pharmacist Society of the State of New York) developing and maintaining the formulary, contracting with pharmacies, negotiating discounts and rebates with drug manufacturers, and processing and paying prescription drug claims. In simpler terms they are third-party administrators contracted by health plans, large employers, unions and government entities to manage prescription drug benefits programs. They were created in the 1960s to process claims for insurance companies.

In the 1970s, PBMs were serving as fiscal intermediaries adjudicating prescription drug claims. And today, PBMs not only adjudicate claims but also develop and manage pharmacy networks, determine drug formularies, set co-pays, and set criteria for prior authorizations and the patient’s choice of pharmacy.

Intended to process claims on behalf of clients within a set fee structure, they are often called the “invisible middleman.” They are hidden between the patient’s insurance company, who the PBM works for, and the pharmacy, who the PBM reimburses for dispensing the prescription. The three largest PBMs – CVS Caremark, Express Scripts and OptumRx (division of United Healthcare) hold nearly 80% of the prescription benefits market in the U.S.

LBMs Explained

Laboratory Benefit Managers (LBMs) fill the need to manage laboratory testing for payers, which include employers who are self-insured and health insurers. LBMs offering a range of services are gaining influence over clinical lab testing in important ways. They perform several functions, ranging from educating, obtaining prior authorization, setting formularies, and determining coverage policies. They also manage claims, the utilization of lab tests, and often review medical necessity.

Payers adopt LBM coverage policies wholesale, whereas others check their own internally developed policies against LBM policies to see whether their own policies might be improved. The split explanation between pharmaceutical and laboratory would be as follows in the next chart.

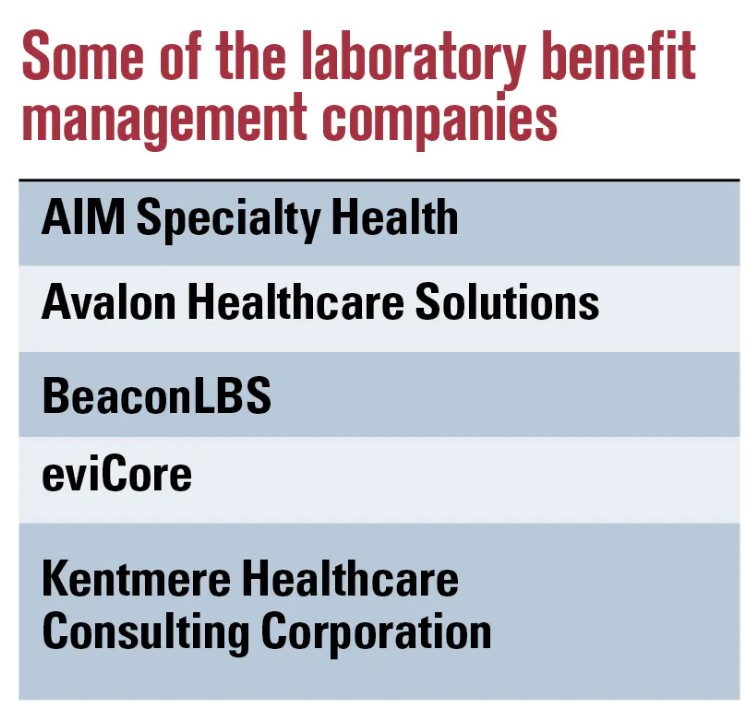

PBMs being CVS Caremark, Express Scripts and OptumRx and LBMs being AIM, AVALON, BeaconLBS, eviCare and Kentmere. Understanding here, the Laboratory side is still in development to my present knowledge.

Types of Tests

Routine tests make up most of the market, including common lab tests such as complete blood count, lipid and liver panels, urinalysis and cultures for infectious diseases. However, recent growth is in the number and expense of laboratory tests relating to specific conditions such as cancer, cardiovascular disease and diabetes.

Tests are reimbursed according to current procedural terminology coding. There are ~1,860 codes. The prices of tests can vary greatly, ranging between $2,000 and $12,000. The high prices and the number of tests clinicians are ordering can make lab tests a cost burden for payers. And the payers are seeking ways to better manage the use and reimbursement of such tests. However, the soaring number of tests is outpacing formularies, billing code sets, and clinical utility evidence. All of which are necessary for coverage determinations.

Professional societies have issued guidelines spelling out which tests are medically necessary. However, in reality there is minimal adherence to these stated guidelines. In addition, there is little agreement on when these tests should be completed.

How Are Tests being Ordered?

Depends on who is in charge . . .

If I read this correctly. There can be confusion about which tests get ordered and why. Some tests physicians order are determined by the pathology laboratories doing the tests. Some are done in-house by the lab, whereas others are sent to an outside lab.

Certain payers have said the most efficient use of resources is to have an agreed-upon panel of tests set for each cancer type. The conflict comes with the pathology labs opposing standardization as it impedes their ability to differentiate their services and can affect profitability. Labs competing for market share want to be able to control the integrity of their profiling systems from both financial and performance standpoints. The competition can lead to fragmentation.

Payers (insurance companies) are contributing to the chaos due to a minimal understanding of the evolving technology of genetic testing. By limiting molecular testing to more traditional methods, as opposed to next-generation sequencing or cell-free DNA technologies; they believe costs can be controlled. Just the opposite may happen. In response to limiting reimbursement to older standards of practice, some laboratories have been known to resort to billing multiple gene codes, also known as stacked billing. As a result, it is not always apparent to the payer whether the tests were appropriate for the patient.

Can LBMs provide value?

According to them? Both Avalon Healthcare Solutions and Kentmere Healthcare Consulting Corporation state their services can cut the cost of clinical lab testing. Avalon has stated payers can cut costs from between 8% to 12%. Kentmere’s website says health plans can get a 20-to-1 return on their investment.

Several industry associations, such as AHIP, American Medical Association, and Blue Cross Blue Shield Association have reported that LBMs improved genetic test payment turnaround times but also prior authorization denials have increased. Same old issues on denials.

Testing can help ensure appropriate drug therapy as a part of precision medicine. It can also help in the avoidance of costly invasive exploratory procedures (e.g., biopsies) that are currently the standard of care.

Some Differences and a Summary

There are differences between PBMs and LBMs. Employers can transfer the lessons from one industry segment to another. For the most part, PBMs have appeared to provide value to employers in the form of formulary management, utilization management and lower drug costs through volume purchases and rebates. On the flip side, payers acknowledge that PBMs have their limitations and require oversight.

Employers could use a LBM to help manage the coverage, reimbursement, claims payment and utilization management of laboratory tests. As the market grows, employers should understand LBMs provide only a portion of the requirements for better precision medicine.

The same as PBMs, LPMs are not a solution to lower healthcare costs. The drug and test related healthcare industry has grown far bigger than what a company could handle. Insurance companies lack the expertise in their ranks also. It may be one on staff or consulting from time to time may be useful. However each of them are middle men in getting care to the patient from a doctor. We already know healthcare is costly.