Trump’s Tax Cuts and Jobs Act (TCJA) made significant changes to the federal tax code. The major changes were the lowering corporate and individual income tax rates, increasing the standard deduction, reforming child tax benefits, and reforming the corporate international tax system. In an effort to mask its true cost and fit it within cost limits, almost all of the individual and estate tax provisions were set to expire after 2025. Several business tax provisions are set to either expire, go into effect, or become less generous at various points also. CBO Estimates TCJA Extensions Could Cost Up to .7 Trillion, per the Committee for a Responsible Federal Budget, crfb.org. From where did the ,7 trillion come? Hopefully, this will give

Topics:

run75441 considers the following as important: politics, Taxes/regulation, TCJA Permanency, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Trump’s Tax Cuts and Jobs Act (TCJA) made significant changes to the federal tax code. The major changes were the lowering corporate and individual income tax rates, increasing the standard deduction, reforming child tax benefits, and reforming the corporate international tax system.

In an effort to mask its true cost and fit it within cost limits, almost all of the individual and estate tax provisions were set to expire after 2025. Several business tax provisions are set to either expire, go into effect, or become less generous at various points also.

CBO Estimates TCJA Extensions Could Cost Up to $2.7 Trillion, per the Committee for a Responsible Federal Budget, crfb.org.

From where did the $2,7 trillion come? Hopefully, this will give you an explanation.

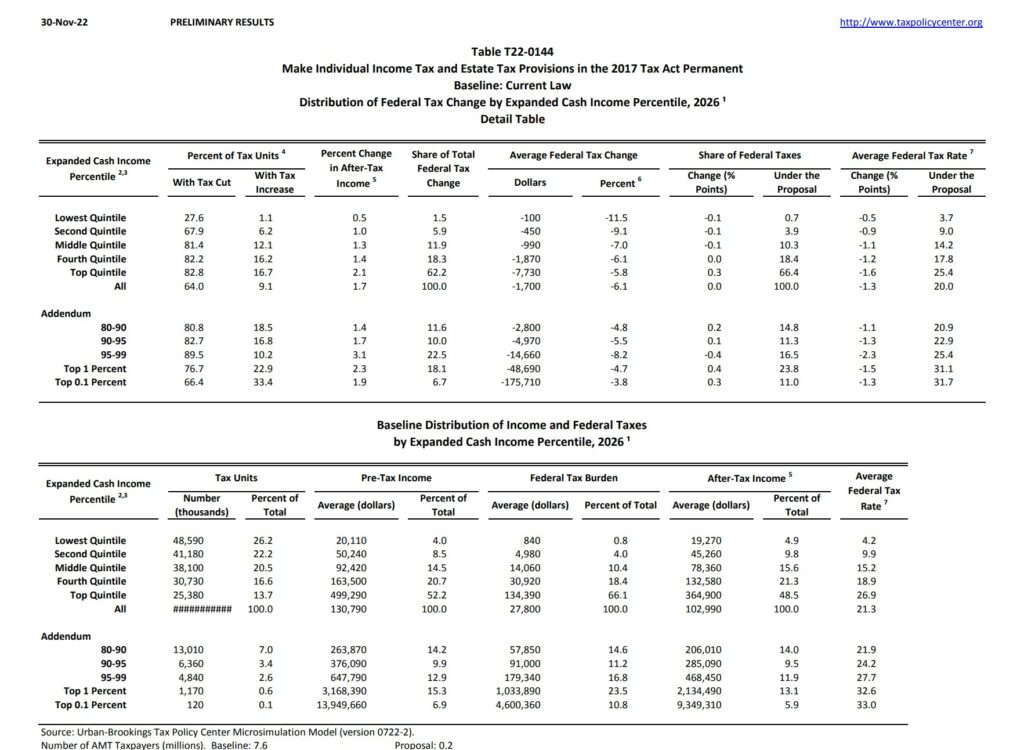

The Tax Policy Center Table T22-0144 (below) shows the change in the distribution of federal taxes, by expanded cash income percentiles in 2026, of making the individual income tax and estate tax provisions in the 2017 Tax Act (“The Tax Cuts and Jobs Act”) permanent.

T22-0144 – Make the Individual Income Tax and Estate Tax Provisions in the 2017 Tax Act Permanent, by ECI Percentiles, 2026, Tax Policy Center (below)

Common Dreams discusses the Tax Policy Centers findings as detailed in the 1st chart – Distribution of Federal Tax Change – above and in the Average Federal Tax Change column. The 1 tenth of one percent of the people would suffer a $175,710 gain in income if the TCJA was made permanent. This is on the far right of the table above, Expanded Cash Income. Note again. this extreme is for those in the one tenth of one percent bracket of taxpayers. The average pre-tax income for this group of ~ 120,000 taxpayers is ~$14 million.

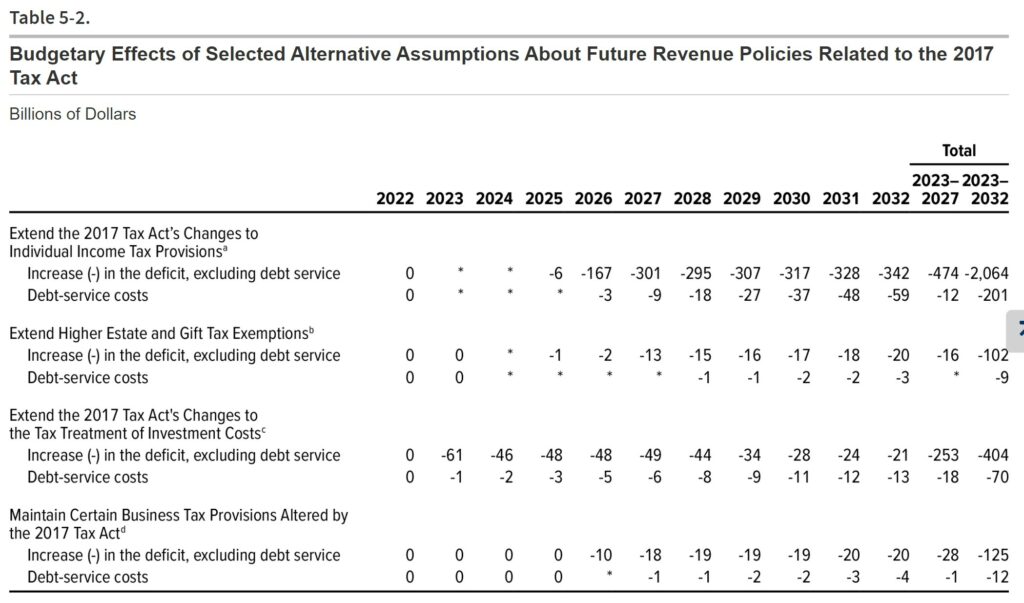

The Budget and Economic Outlook: 2022 to 2032 | Congressional Budget Office (cbo.gov)

Most of the individual income tax provisions of the 2017 tax act are slated to expire at the end of calendar year 2025. The expiring provisions affect major elements of the individual income tax code, including statutory tax rates and brackets, allowable deductions, the size and refundability of the child tax credit, the 20 percent deduction for certain business income, and the income levels at which the alternative minimum tax takes effect.

According to JCT’s estimates, if the expiring individual income tax provisions of the 2017 tax act were extended, deficits would be larger than those in CBO’s baseline, on net, by $2.1 trillion over the 2023–2032 period, excluding debt-service costs (see Table 5-2). Most of the effects would occur after 2026. Debt-service costs would add $201 billion to those deficit.

You can see the ~2.064 trillion in the first line of the chart directly above – entitled Extend the 2017 Tax Act. Adding the Debt Service Costs to this brings the amount to over $2.2 trillion. Upper Right Hand Corner of Chart 5.2 above.

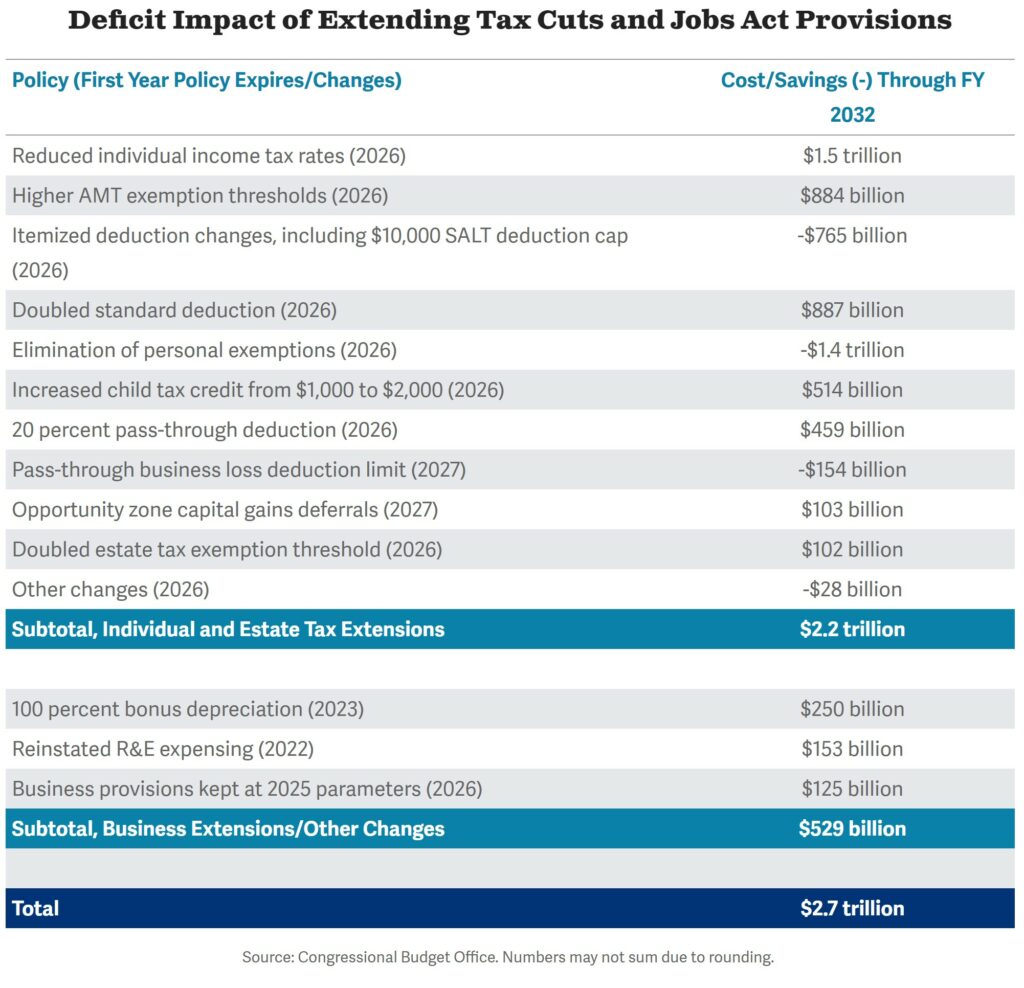

So, how did they arrive at $2.7 trillion? Drop down to the next chart Deficit Impact of extending TCJA to 2032. Under Cost/Savings Through FY2032. Subtotal is $2.2 Trillion most of the way down. It matches with the numbers above.

Add in 100% bonus depreciation, R&E expensing, and Business Provisions and we arrive at another at $529 billion. The two numbers together give you an approximate $2,7 trillion. If you drop below this chart, there is a more detailed explanation taken from the CBO.

CBO Estimates TCJA Extensions Could Cost Up to $2.7 Trillion, Committee for a Responsible Federal Budget (crfb.org)

In addition to this extension, the TCJA includes business tax provisions that are either temporary, revenue-raisers that go into effect with a delay, or set to become less generous at various points. The one expiring provision in this category is bonus depreciation, which allows businesses to deduct the cost of equipment immediately instead of over time. Bonus depreciation is set to phase down starting next year and phase out completely by 2027; extending the full policy would cost $250 billion through FY 2032. A revenue-raiser that takes effect with a delay is the TCJA’s elimination of R&E expensing, instead requiring R&E costs to be written off over five years. This policy already went into effect this year and would cost $153 billion to repeal permanently. The TCJA also contains a few policies that will become stricter after 2025, specifically tighter restrictions on meals deductions, a reduction in the foreign-derived intangible income (FDII) deduction from 37.5 to 21.875 percent, and an increase in the base erosion and anti-abuse tax (BEAT) rate from 10 to 12.5 percent. Avoiding these changes would cost $125 billion, with the majority coming from the FDII deduction.

Analysis of CBO’s May 2022 Budget and Economic Outlook, Committee for a Responsible Federal Budget (crfb.org)

What is the impact? The impact I can see is the drowning out of other more essential needs as expanding healthcare, Childcare so single parents can go to work, better funding for schools, infrastructure, etc, It is these programs which are under attack and claimed to be causing excessive deficit. In reality it is the skewing of tax breaks to one tenth of the population making ~$12 million or more per year., corporations, etc,