Durable goods orders: more deceleration, still no recession – by New Deal democrat I normally don’t pay too much attention to durable goods orders. That’s because they are very noisy. They don’t always turn down in advance of a recession (see 2007-08), although they may at least stall, and there are a number of false positives as well (see 2016) as shown in the graph below showing up until the pandemic: But in 2022 they were one of the last short leading indicators to be positive. As late as November of last year I still rated them as a “positive.” That has changed somewhat in the past several months. With the exception of December, durable goods orders have made no progress at all since last June, and while “core” durable goods orders

Topics:

NewDealdemocrat considers the following as important: Durable Goods 2023, Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Durable goods orders: more deceleration, still no recession

– by New Deal democrat

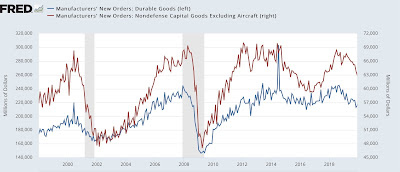

I normally don’t pay too much attention to durable goods orders. That’s because they are very noisy. They don’t always turn down in advance of a recession (see 2007-08), although they may at least stall, and there are a number of false positives as well (see 2016) as shown in the graph below showing up until the pandemic:

But in 2022 they were one of the last short leading indicators to be positive. As late as November of last year I still rated them as a “positive.”

That has changed somewhat in the past several months. With the exception of December, durable goods orders have made no progress at all since last June, and while “core” durable goods orders excluding aircraft (Boeing) and defense increased in January, it remains below the level of last August, and has generally been flat since then as well:

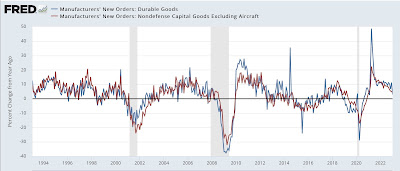

A YoY view shows that both measures of durable goods are decelerating, but neither are have deteriorated as much as before the last 3 recessions:

But if they continue at their current rate of deceleration, core capital goods will be negative YoY by about mid year.

This has been a dominant theme in the data – especially some short leading and coincident indicators – for the past number of months: continuing deceleration, but not turning negative yet.

Durable goods orders come in mixed; only employment indicators are short term positives for the economy, angry bear, New Deal democrat