If you recall, I reported on a West VA. Federal Court Ruling in Favor of Drug Distributors last July. The City of Huntington and the County of Cabell sued three drug wholesalers responsible for distributing hydrocodone and oxycodone or opioids. The claim was AmerisourceBergen Drug Co., Cardinal Health Inc., and McKesson Corp. were responsible for the increase in Cabell county and the city of Huntington. Both have a total population of ~92,000. During a nine-year period, an average of 39.9 hydrocodone and oxycodone doses per person were shipped nationally in the US. An average of 72 doses per person were shipped to West Virginia. Within West Virginia. 122 doses per person were shipped to Cabell County and the city of Huntington. As you can see the

Topics:

run75441 considers the following as important: Healthcare, law, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

If you recall, I reported on a West VA. Federal Court Ruling in Favor of Drug Distributors last July. The City of Huntington and the County of Cabell sued three drug wholesalers responsible for distributing hydrocodone and oxycodone or opioids. The claim was AmerisourceBergen Drug Co., Cardinal Health Inc., and McKesson Corp. were responsible for the increase in Cabell county and the city of Huntington. Both have a total population of ~92,000.

During a nine-year period, an average of 39.9 hydrocodone and oxycodone doses per person were shipped nationally in the US. An average of 72 doses per person were shipped to West Virginia. Within West Virginia. 122 doses per person were shipped to Cabell County and the city of Huntington. As you can see the amount to Cabell County and Huntington was three times the nation amount and almost twice the state amount. Why?

West Virginia lost in a lawsuit against the three distributors. The point here is 85-90% of all drugs are shipped by these three wholesaler – distributors and the amounts far exceeded the needs of the population. The claim of the distributors was they had no idea why pharmacies order what they do, which is far fetched and unrealistic. The distributors claim is somewhat made up as most distributors and wholesalers know the demand of their product distributed and sold.

Some explanation. You will see my thoughts peppered through this article. Much of it I agree with and some I think differently.

Drug Wholesalers Elude Congress Scrutiny in Pricing Debate (1), bloomberglaw.com, Celine Castronuovo

Wholesalers distributing prescription drugs to pharmacies need scrutiny as Congress investigates the roles of supply chain middlemen in drug pricing, analysts say.

The companies are central for drugmakers to get their products to pharmacies, hospitals, and other health centers. Three wholesale companies are responsible for roughly 90% of US prescription drug distribution; AmerisourceBergen Corp., Cardinal Health Inc., and McKesson Corp.

There seems to be conflict over whether AmerisourceBergen Corp., Cardinal Health Inc., and McKesson Corp. are distributors or not. In my opinion they are. In recent opioid distribution settlement in Federal Court, all three companies were judged as being responsible for the illegitimate distribution of opioids. Distributors Approve Opioid Settlement Agreement, McKesson: “The settlement will provide thousands of communities across the United States with up to anapproximate $19.5 billion over 18 years. The three distributors will also implement injunctive relief terms, including establishing a clearinghouse that consolidates data from all three distributors. This data will be available to all settling states and territories to use as part of their anti-diversion efforts.

Wholesalers have gotten limited attention on Capitol Hill, even as tackling high drug costs has become a major priority among key lawmakers in both chambers. Various entities can benefit from higher list prices from drugmakers, researchers and analysts say. Any examination of how drug prices are formed should include wholesalers and all other components of the supply chain, they argue. Antonio Ciaccia, CEO of Ohio-based drug pricing data firm 46brooklyn Research and president of 3 Axis Advisors.

“Every layer of the drug supply chain deserves their time under the microscope, without question. “You have a system that is completely aligned to favor over-inflated prices for medicines, and so wholesalers are no different.”

The three major wholesalers also play a role in the insurance reimbursement side of the supply chain through pharmacy services administrative organizations, or PSAOs, which help independent pharmacies better negotiate with pharmacy benefit managers—the entities that manage prescription drug coverage for health plans, employers, and others.

A large component in the congressional effort to lower US drug costs is seeking greater transparency from PBMs about their business practices. PBMs argue that drugmakers alone are responsible for fueling high drug costs, while the manufacturers say rebates and fees collected by PBMs force them to increase list prices.

But fees from wholesalers “are absolutely part of inflating the cost of drugs as well,” said Trond Waerness, founding president of Atna Consulting, which advises small to medium-sized pharmaceutical companies.

The trade group representing the wholesale industry says the companies play an essential role in the supply chain.

The mission of wholesalers is “to make sure that the entities that are dispensing products or making products available or administering products have access to every product they need to treat the patients in their care,” said Patrick Kelly, executive vice president of government affairs for the Healthcare Distribution Alliance. The group represents the top three wholesalers and more than 30 other drug distribution companies, as well as roughly 130 manufacturers and more than 50 service providers.

AmerisourceBergen, Cardinal Health, and McKesson didn’t respond to requests for comment.

‘Market-Makers’

The role of wholesalers as a middleman deserves greater attention, Waerness and researchers argue, pointing to fees that they say could be exacerbating the pharmaceutical system’s incentives for higher drug prices.

“The wholesalers, much like PBMs, are essentially gatekeepers,” Ciaccia said.

“On the PBM side, the PBM stands in between the patient and the manufacturer. The manufacturer, as a result, has a lot of incentives to cough up big fees and concessions in exchange for the promise of market share. The same thing can occur in the wholesale channel,” he said.

Wholesalers charge manufacturers for their products based on a percentage of the list price, which Waerness said tends to run from 10% to 12% for his manufacturer clients. Wholesalers may offer manufacturers a 2% discount if they pay their bills within 30 days, but Waerness said they’ve started to see some wholesalers waiting until 60 days to issue this discount.

When manufacturers ultimately price a drug, “we look at the wholesaler fees and then the PBM fees, and we have to allow for about 50% of cost going to those two entities, which means basically you have to double the price of the drug,” said Waerness, who also serves on the board of directors for specialty pharmaceutical company Adhera Therapeutics Inc.

Generic drugmakers must compete with each other for contracts with the three main wholesalers, “which can put wholesalers in the position of being price-setters and market-makers for generic drugs,” according to a 2022 study published by the Commonwealth Fund. Generic drugs make up 90% of all prescriptions dispensed in the US, according to the Food and Drug Administration. Neeraj Sood, a senior fellow at the USC Schaeffer Center for Health Policy & Economics and professor at the USC Price School for Public Policy . . .

“Wholesalers can basically say, ‘Hey, we’re only going to distribute generic drugs from two companies, and the other 98 companies are shut out of the market.’”

Market Consolidation

Wholesalers have journeyed into the reimbursement space through PSAOs. Those entities primarily offer administrative services to independent pharmacies as they develop contracts with PBMs over how they will get reimbursed for servicing patients, according to an Avalere Health study commissioned by the HDA.

PSAOs “do not dictate the cost of medicines. That is determined by the manufacturer and in some cases by the PBM,” Kelly said.

Without PSAOs, independent pharmacies may be getting reimbursed at very low rates, which would mean “pharmacies are shutting down, and that’s bad for consumers,” Sood said.

“But if you argue on the other side that these pharmacies are already doing well, and all the PSAOs are doing is over-increasing the size of the reimbursement for pharmacies, it just enables them to make more money,” thereby increasing costs for health plans and patients, Sood said.

The US Government Accountability Office studied PSAOs in 2013, and found that the “majority of PSAOs in operation in 2011 or 2012 were owned by drug wholesalers and independent pharmacy cooperatives.”

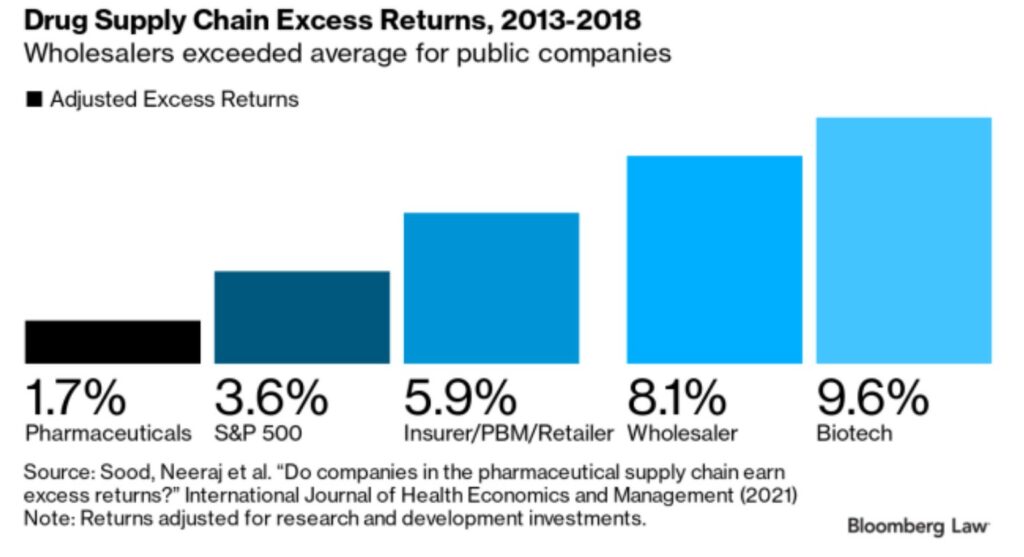

Coauthoring a 2021 study covering the period 2013 to 2018, Neeraj Sood found the excess returns for wholesalers was more than double for S&P 500 companies. Comparatively, drugmakers saw lower excess returns than the S&P 500, with 1.7% versus 3.6%, though biotech manufacturers had greater excess returns, at 9.6%, than wholesalers, at 8.1%. Neeraj Sood added . . .

“Ultimately, all the profits are going to end up as the price to consumers, as higher premiums or out of pocket costs.”

Supply Chain Transparency

Some distribution alternatives have come to the market in recent years. One is the Mark Cuban Cost Plus Drug Company, which purchases drugs from manufacturers and sells them to patients at a fixed mark-up rate of 15%.

Having gotten fed up with United Healthcare – Walgreens program, I have decided to try out the Mark Cuban Cost Plus Drug Company for our drugs. Our drugs are common. Cuban’s pricing is less. There are no copays or deductibles. There is no throwing 5 and 10 mg tablets in pill containers capable of holding 1000 tablets. “Oh, but we will give you the smaller containers . . . just remove the label from the big bottle. This is BS!

Mark Cuban in an email:

“Our approach to transparency, publishing our cost and markups, is unique on the industry. That differentiation builds trust in our service and has allowed us to grow our mail order and wholesale business.”

Wholesalers haven’t come up in conversations around drug pricing in part because they don’t have a direct role in shaping what patients and health plans, including federal government-managed plans, pay for prescriptions. Ciaccia said . . .

“It’s not to say that wholesalers have no impact on the marketplace from a pricing and affordability perspective, but it’s just that most of what they do will impact the economics of pharmacies and not necessarily impact the wallets of the end payer.”

Wholesalers maintain they have a logistical role, and don’t impact what patients pay at the pharmacy counter.

I am sorry . . . if you are a part of the supply chain and Wholesalers are such, you have an impact on costs. Ohers will tell you differently. I am not sure what Adam Fein might say to this either.

The HDA has “been very clear with what role the wholesalers play in the supply chain and the fact that they don’t really affect the price of drug products at all,” Kelly said.