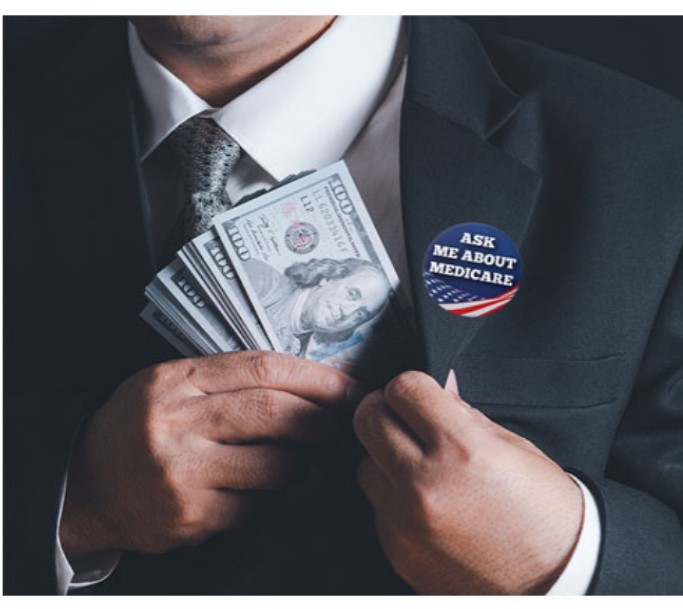

Piercing the myth: How privatizers got their mitts on Medicare, The Stand, Kip Sullivan Insurance companies decried Medicare’s fee-for-service model. But then Congress let them replace it with something much worse. (May 4, 2023) — Congress enacted Medicare in 1965 as a fee-for-service system because the insurance industry did not want to insure the elderly and the poor. Today the insurance industry spends megabucks on advertising to lure Medicare beneficiaries away from the original fee-for-service Medicare program. In 2022, 49 percent of Medicare beneficiaries were insured by insurance companies, which coveted the elderly because they are overpaid to insure them. The insurance industry has had decades to prove they can save the taxpayer

Topics:

run75441 considers the following as important: Education, Healthcare, Kip Sullivan, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Piercing the myth: How privatizers got their mitts on Medicare, The Stand, Kip Sullivan

Insurance companies decried Medicare’s fee-for-service model. But then Congress let them replace it with something much worse.

(May 4, 2023) — Congress enacted Medicare in 1965 as a fee-for-service system because the insurance industry did not want to insure the elderly and the poor. Today the insurance industry spends megabucks on advertising to lure Medicare beneficiaries away from the original fee-for-service Medicare program.

In 2022, 49 percent of Medicare beneficiaries were insured by insurance companies, which coveted the elderly because they are overpaid to insure them. The insurance industry has had decades to prove they can save the taxpayer money without harming patients. They have not done that. Congress has had decades to stop the overpayments to insurance companies. It has not done that.

It’s time to deprivatize Medicare.

Congress authorized the privatization of Medicare – the insertion of the first insurance companies into Medicare – in 1972. These insurance companies, known as “health maintenance organizations” (HMOs), were alleged to be unusually efficient compared with traditional insurance companies.

HMOs micromanaged their doctors and exposed them to incentives to deny services. HMO proponents claimed these tactics, which collectively came to be called “managed care” by the 1980s, would reduce Medicare spending by reducing the volume of services Medicare beneficiaries received. HMO advocates claimed doctors were ordering services Medicare beneficiaries didn’t need. And doctors were doing this, they asserted, because of the fee-for-service (FFS) method by which doctors were paid.

Although it’s true that the FFS method gives doctors an incentive to order unnecessary services, HMO proponents have never shown that overuse of medical services is rampant, nor that what overuse does exist can be blamed on the FFS method. Moreover, HMO proponents never demonstrated that HMOs know how to cut out unnecessary services without also denying necessary services.

The insertion of insurance companies into Medicare did not save money. It didn’t save money between 1973 and 1997, when HMOs were the only type of insurance company allowed to participate, and it hasn’t saved money since 1997, the year Congress allowed all types of insurance companies to participate in what is now called the Medicare Advantage (MA) program.

In the wake of the “HMO backlash” of the late 1990s, the term “managed care” fell out of favor and was replaced with “value-based payment” (VBP). The most prominent form of VBP is the “accountable care organization” (ACO), which closely resembles the HMO. VBP has failed for the same reasons managed care failed.

Congress has been warned repeatedly that the insertion of insurance companies into the Medicare program has raised Medicare’s costs. The Medicare Payment Advisory Commission (MedPAC) characterized the failure of the MA program in its March 2022 Report to Congress:

“The MA program has been expected to reduce Medicare spending since its inception … but private plans in the aggregate have never produced savings for Medicare….”

The MA plans have been unable to reduce Medicare costs even though a large body of research and an enormous body of anecdotal evidence indicates MA plans deny or delay a substantial amount of necessary medical care.

Rising costs for Medicare due to privatization cannot be fixed with tinkering. The most fundamental problem is (a) insurance companies have high overhead costs and (b) they are incapable of cutting utilization of medical services enough to cover their high overhead costs, make a buck, and still save money for Medicare.

MA plans are able to pay for their overhead costs and make a large profit by enrolling healthier-than-average Medicare beneficiaries, and the Centers for Medicare & Medicaid Services (CMS) overpays MA plans for those enrollees. In other words, CMS pays MA plans more for the MA enrollees than those enrollees would have cost if they had stayed in the traditional FFS Medicare program.

Consider this example: Assume the average annual cost of insuring a Medicare beneficiary in the traditional Medicare program is $10,000 (it’s a little higher than that now). Humana, one of the largest MA plans, enrolls healthier-than-average beneficiaries who would have cost $9,000 if they had stayed in traditional Medicare. But CMS pays Humana $10,000 per enrollee. Humana has been overpaid $1,000 per enrollee.

Why doesn’t CMS just reduce the premium payments to MA plans to reflect the superior health status of MA enrollees? CMS has been trying for decades to do that and has failed miserably. As if that weren’t bad enough, MA plans have learned to game CMS by “upcoding,” that is, making their enrollees look sicker (and more expensive) than they are.

Congress and CMS have made the privatization problem worse by inserting into the traditional Medicare program corporations called ACOs. Congress did this in 2010 with the enactment of the Affordable Care Act. The latest version is ACO REACH. ACOs are similar to MA plans. The major difference between them is that beneficiaries are assigned to ACOs, usually without their knowledge. Nineteen percent of Medicare beneficiaries were assigned to ACOs as of 2022. That means nearly three-fourths of Medicare had been privatized by 2022 – 49 percent via the MA program, and 22 percent via ACOs.