I think I missed this one by Michael Smith. I did not delete it out of my In-Box/ Even so it is interesting . . . Death to Farm Credit from Those on High, Farmer and Economist, Mike Smith I’m in between fall crop planting and have to focus so I am going to run this like the rancher on the clock. Farm Credit System History In 1916 when the Farm Credit System was established there were 6 million farms that employed around 30% of the US population. They each averaged 140 acres or so of land, had minimal automation investment, were manually laborious, and only included an adjustment for inflation amount of equipment investment of ,000 per farm. This was usually collection materials like baskets, and maybe a truck, ox, cart, plow, etc.

Topics:

Michael Smith considers the following as important: US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

I think I missed this one by Michael Smith. I did not delete it out of my In-Box/ Even so it is interesting . . .

Death to Farm Credit from Those on High, Farmer and Economist, Mike Smith

I’m in between fall crop planting and have to focus so I am going to run this like the rancher on the clock.

Farm Credit System History

In 1916 when the Farm Credit System was established there were 6 million farms that employed around 30% of the US population. They each averaged 140 acres or so of land, had minimal automation investment, were manually laborious, and only included an adjustment for inflation amount of equipment investment of $6,000 per farm. This was usually collection materials like baskets, and maybe a truck, ox, cart, plow, etc.

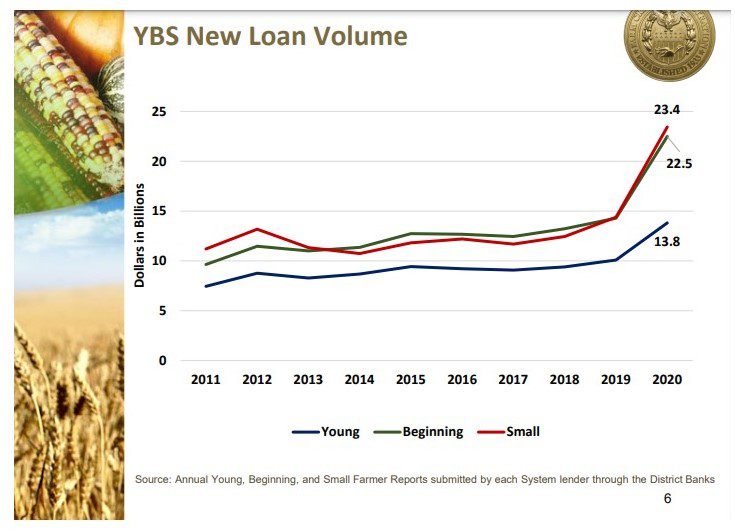

The year 1916 was huge. This was the establishment of the Farm Credit System by Woodrow Wilson that was supported by none other than Laura Ingalls Wilder. Yes, Little House on the Prairie was a government funded venture. Well, not really, but she was a big help in getting the Midwest Cooperative started. Laura and others gathered together to share the knowledge of how many farmers could get together to tap into this new government program that was intended to help smooth out the dramatic ebbs and flows of farming production through direct operating loans, but also by way of promoting farm land ownership through a separate program. Both the Midwest Cooperative and the Farm Credit System have become wildly popular and even more so with young, beginning, or small farmers as evidenced by the sheer size of the amount of loans being originated:

That’s Billion$. Our government sees the problem and is using the Farm Credit system to hopefully rectify the issue prior to climate collapse or food system collapse.

Fast forward to today and the number of farms has shrunk to 2 million, the average farmer age is close to retirement, and the total employed on farm population is less than 1% of US population. Factor in that consolidation has forced the modern farmer to now take on an average of 434 acres per farm and also incur a debt of $115,000 on average per farm in equipment. You are talking about a considerable amount of debt per farmer to grow what is essentially the necessary capacity to feed almost 400 million people in this country.

Now Arriving: The Banks

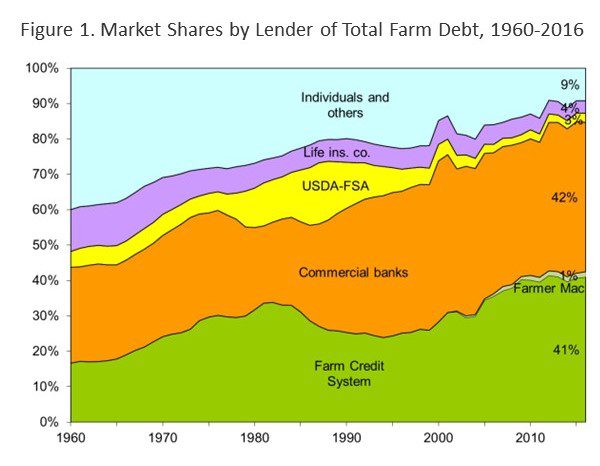

Big banks see profits in all niche programs. They search far and wide to get into how they can expand their platforms and provide increased profits to their shareholders. These are not just institutional commercial banks either, as indicated by this chart:

Image from Agricultural Credit: Institutions and Issues – EveryCRSReport.com using USDA Economic Research Service (ERS) year-end data

The bump in 1985 was actually the Reagan farm bill coming on the heels of the Farm Aid crisis, championed by our own Texas beloved, Willie Nelson. The credit system was in deep trouble, and a few amendments allowed credit collateral to be pegged at fair market value of the underlying assets, a true, capitalistic assessment of what farmers actually were holding, but also allowed big banks to see that one married couple could be holding 800-3,000 acres of land.

The commercial banks see the farmers as a commodity; a big business with high net revenues having big balance sheets. What they don’t understand is that gross revenue gets eaten up by the cost of goods almost every year. The assets they sit on are tangible, yet also are tied to the direct revenue production. There are more bad years than good.

Farmers who participate in the Farm Credit System are rewarded by that system because it is a Co-op. But the years post Farm Aid have led the industry to be cautious because of political unrest, as well as underwriting risk. Even today we see opinion pieces having no clue what they are talking about.

Queue the New Yorker Is It Time to Break Up Big Ag? | The New Yorker

Public’s Lack of Knowledge

Whew, we can get into that one another day. This shows the general public has no idea how farmers have to seek out operating loans just to plant a crop to sell into the system to feed the plants and animals feeding each of us. The borrowers are not small time guys like me who need a few grand here or there to make ends meet when we go $1,000 in the hole for seed, and 3x of that for compost. No, there are outfits of all size, including producers who sell to Sanderson, Tyson, and many, many other processors.

Credit has constrained all credit systems to be less willing to lend, and has given opportunity to outside parties to profiteer. This has caused the equipment manufacturers to offer their own credit on the equipment they sell through dealerships and to lay out the red carpet to folks like me.

There are two major players: John Deere, and Agco. John Deere is synonymous with Americana, Agco, less so. Agco is a large parent company who has been gobbling up assets such as Massey-Ferguson, New Holland, Fendt, etc. The equipment manufacturers are now eating away at the biggest lifeline farmers have.

Most people don’t realize that the Farm Credit System has also been authorized to lend to rural communities for agricultural and non-direct agricultural operations. In rural communities, the Farm Credit System is allowed to invest in dentists’ offices like the dental Eugene offices, as well as seed cleaners, packaging operations, and even residential homes. If there is a slight knock on, they can invest in us and help our community, and boy do we need it. Since 2008 there has been a steep pull back, and then constant lobbying by banks who see those commercial and residential investments by the Farm Credit System as direct competition needing to be buried six feet under. This is why most banks are lobbying against the credit system that supports us, and have been vocal in doing so for well over 20 years.

The banks want in on new profits. How much are we as a public willing to give to corporate America and their predatory practices killing our food supply?

The Future of Farming, Angry Bear, Michael Smith