Revisions to Q4 GDP made real final sales worse, a potential portent of near in time recession – by New Deal democrat A month ago, following another blogger, I took a look at real final sales, and real final sales to domestic purchasers, in the GDP – which increased less than 0.5% and just above 0% in Q4, and showed that in the past 60 years, only in the deep slowdowns of 1966 and 1987 were the numbers that low without having been followed within 1-3 quarters by a recession. Here’s a link to the full post from last month. Well, in this morning’s final revision to Q4 GDP, both got revised even lower. Here is the revision to real final sales: And here is the revision to real final sales to domestic purchasers: In the grand scheme of

Topics:

NewDealdemocrat considers the following as important: Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Revisions to Q4 GDP made real final sales worse, a potential portent of near in time recession

– by New Deal democrat

A month ago, following another blogger, I took a look at real final sales, and real final sales to domestic purchasers, in the GDP – which increased less than 0.5% and just above 0% in Q4, and showed that in the past 60 years, only in the deep slowdowns of 1966 and 1987 were the numbers that low without having been followed within 1-3 quarters by a recession. Here’s a link to the full post from last month.

Well, in this morning’s final revision to Q4 GDP, both got revised even lower.

Here is the revision to real final sales:

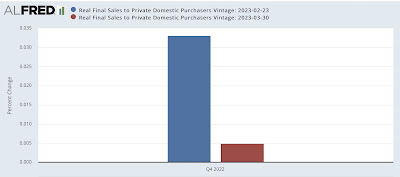

And here is the revision to real final sales to domestic purchasers:

In the grand scheme of things, these are quite small revisions. But the fundamental point is that Q4 GDP was held up by inventories, which will have to be liquidated at some point. As I pointed out last month, that process of liquidation has typically meant production cutbacks as well as layoffs of some of the workers on those production lines.

With the advent of “just in time” inventories in the 1990s, manufacturers had been doing that quite quickly, which meant without enough disruption to give rise to a recession. But I noted that the pandemic had replaced that with a “just in case” mentality; and wrote that what happened to manufacturers inventories during the months of Q1 would be important.

Well, we did get January inventories several weeks ago, and the news was not good. Inventories increased to just below their high levels of 2022:

Tomorrow we will see if real manufacturing and trade sales – one of the 4 monthly recession indicators most tracked by the NBER – continued their rebound from last June’s lows in January.