I got to this article about the Home Value Index Report after reading an Insider’s “The Fight Over Airbnbs Is Now Descending on Small American Cities,” businessinsider.com, Dan Latu. The article is about Airbnb rentals in Bozeman, Montana. Bozeman residents are trying to figure out what to do as it is driving up the prices of homes and the resulting taxes. It all started with the pandemic and people escaping the more populated areas to Bozeman a community of 54,000. Home prices rose from February 2020 to February 2023. According to the Zillow Home Value Index report, the average home value is now 7,335. Prices rose from an average of 0,000 in 2020. The average rent for a one-bedroom has nearly doubled in the same period of time, from

Topics:

run75441 considers the following as important: Airbnbs, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

I got to this article about the Home Value Index Report after reading an Insider’s “The Fight Over Airbnbs Is Now Descending on Small American Cities,” businessinsider.com, Dan Latu. The article is about Airbnb rentals in Bozeman, Montana. Bozeman residents are trying to figure out what to do as it is driving up the prices of homes and the resulting taxes. It all started with the pandemic and people escaping the more populated areas to Bozeman a community of 54,000.

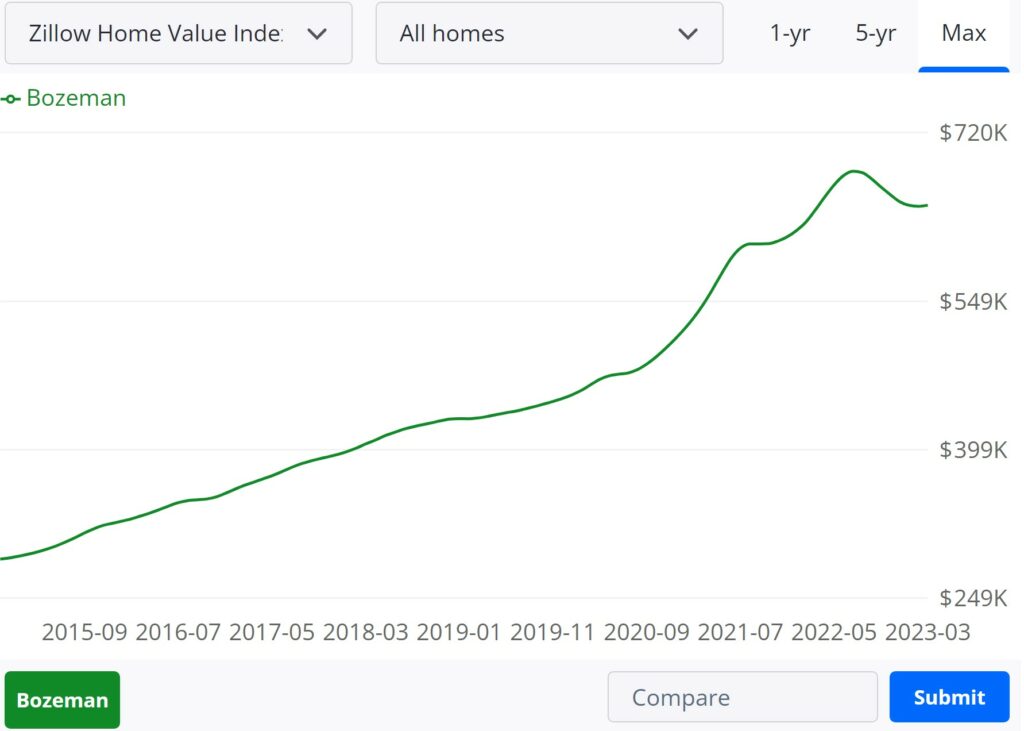

Home prices rose from February 2020 to February 2023. According to the Zillow Home Value Index report, the average home value is now $647,335. Prices rose from an average of $460,000 in 2020.

The average rent for a one-bedroom has nearly doubled in the same period of time, from $1,000 to $1,975. This is determined by a similar report, Zumper. City residents claim such numbers or increases are causing the town to lose residents. They can no longer afford living there due to burdensome housing costs.

The Zillow Home Value Index (ZHVI) measures “monthly” changes in property-levels. Zestimates, captures both the level and appreciation of home values across a wide variety of geographies and housing types. The accuracy of the report (median error rate) for on-market homes is 2.4%, while the Zestimate for off-market homes has a median error rate of 7.49%, This particular report is what drives the other two reports.

With the publication of November 2019 data, the ZHVI has been recomputed using new methodology. According to Zillow, a comprehensive and accurate property-level analysis creates accurate and timeliness to ZHVI reporting. The methodology includes calculations for approximately 90,000 regions in the United States. The November 2019 data population was backed by historical data recalculated through 2008.

The basis for the ZHVI is timeliness (monthly reporting), comprehensiveness (100 million new and older homes, and visibility (dynamics in small regions and/or among specific subsets). The new methodology will include the average Zestimate within some range of home values determines the index level, meaning the index retains its interpretation as the dollar value of a typical home; calculations using a weighted mean of the appreciation of individual homes, as proxied by changes in the Zestimate; and the ZHVI appreciation can now be viewed as the theoretical financial return gained from buying all homes in a given subset from one period to another.

I look at this and I see visions of seizing the moment. Buy low and sell high for investors. The average home seller and buyer would (probably) not be privy to the short-term results of a long-term study of the report within their region. The basis for my belief is the last line of the paragraph above. We already have realtor sharks in the water. The seller takes the $10,000 or so hit on price while it hardly impacts the commission.

The data being collected is driving home pricing.

This appears to be another run-on housing, the same at which happened pre-2008 and also collapsed when Goldman called on AIG. Yes, there were liar-loans, unregistered mortgages with the county, one-year adjustable-rate mortgages, and people over-extending themselves on prices and mortgages. Housing lost value by 50% or more with mortgages exceeding the value of the houses.

The one thing Bozeman could do is grandfather owners of their homes pre and including 2019 into a property tax more reflective of reality. This was done in Michigan. If the house was sold, property tax would be adjusted to reflect the sold pricing. I believe the thought on Airbnb should be pursued establishing owner-based residency as a requirement.

This excellent programming. However, it reflects speculation and not the reality of living in Bozeman as a resident. I would be a little bit agitated too if I was taxed out of a house I lived in for a number of years.

The Fight Over Airbnbs Is Now Descending on Small American Cities, businessinsider.com, Dan Latu

Bozeman MT Home Prices & Home Values, Zillow

Zillow Home Value Index Methodology, 2019 Revision: Getting Under the Hood, Zillow Research

What is a Zestimate? Zillow’s Zestimate Accuracy, Zillow