This commentary is along the lines of what I have been taught when I was consulting with Ingersoll Engineers in Rockford and which is now extinct. My background includes manufacturing planning at all levels domestically and internationally for US and foreign companies. Labor’s wages are a small part of the Cost of Manufacturing, etc. Spencer England and I went round and round on this topic. Manufacturing, Inventory and Throughput planning was my livelihood for decades. There was never a place where I worked that I did not deliver some type of cost save. In any case, the proportion of Overhead and Materials are far more costly and it has been that way since the sixties. To move away from that cost companies moved over seas where overhead is not

Topics:

run75441 considers the following as important: employamerica, Hot Topics, politics, Pricing, US EConomics, wages

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

This commentary is along the lines of what I have been taught when I was consulting with Ingersoll Engineers in Rockford and which is now extinct. My background includes manufacturing planning at all levels domestically and internationally for US and foreign companies.

Labor’s wages are a small part of the Cost of Manufacturing, etc. Spencer England and I went round and round on this topic. Manufacturing, Inventory and Throughput planning was my livelihood for decades. There was never a place where I worked that I did not deliver some type of cost save.

In any case, the proportion of Overhead and Materials are far more costly and it has been that way since the sixties. To move away from that cost companies moved over seas where overhead is not so large. The Overhead paid by companies then shifts to society.

One thing we learned during the pandemic was with large unmanaged influxes of inventory sitting in containers in LA and Long Beach. Someone was not planning the throughput and it took months to clear. President Biden finally told the ports t go to OT. Why did they have to be told?

Now read on and think about some of what I said.

Wage Passthrough to Prices is Minimal and Abating, employamerica.org, Preston Mui

Throughout the pandemic recovery, high inflation has been attributed to tight labor markets and high wage growth. Fed officials have, for months, maintained that the labor market needs to soften in order to bring down inflation. Commentators have pointed to high wage growth as a source of cost-push inflation:

My view is that it’s best to think of wage inflation as a core measure of inflation. Ultimately costs go back to wages. And if wage growth is high, it’s hard to see how you’re going to have enduringly low inflation. And if wage growth is low, it’s hard to see how you’re going to have enduringly high inflation. So I would be watching wage growth. Larry Summers, May 3rd, 2023

However, lately Powell has taken a partial retreat from the view that inflation is primarily driven by the labor market. In May, Powell said he did not see wages as the principal driver of inflation:

I do not think that wages are the principal driver of inflation. You’re asking me a very specific question. I think there are many things. I think wages and prices tend to move together. And it’s very hard to say what’s causing what. But, you know, I’ve never said that, you know, that—that wages are really the principal driver, because I don’t think that’s really right. Jay Powell, May 3rd, 2023 FOMC Press Conference

At the June FOMC press conference, Powell clarified that the Fed’s emphasis on the labor is because he believes that inflation specifically in core non-housing services (NHS) is attributable to strong wage growth:

As you move through ‘21 to ‘22 and now in ‘23 I think many, many analysts believe that it will be an important part of getting inflation down especially in the non-housing services sector. Getting wage inflation back to a level that is sustainable, that is consistent with two percent inflation. We have actually seen wages broadly move down but just at a quite gradual pace, and that’s a little bit of the finding of the Bernanke paper with Blanchard of a few weeks ago which is very consistent with what I think.

Jay Powell, June 15th, 2023 FOMC Press Conference

It’s heartening to hear Powell acknowledge that inflation is multifaceted and merits evaluation of the individual components of inflation and their causes. It’s a view that we have held for a long time. It’s also encouraging to hear him acknowledge that in the big picture, wage growth is not the principal cause of inflation.

However, his story about non-housing services (NHS) inflation is still too simplistic. While there may be some evidence that inflation in that sector is related to wages, it is far from the only story. Not all of core NHS inflation is wage-sensitive, and many other factors, including the supply-side factors that the Fed and commentators have attributed goods inflation to, play a role in core NHS inflation. The pass-through of wages into inflation in this sector appears to be small, and in any case, core NHS wage growth has fallen faster than overall wage growth.

If the Fed wants to commit to this story of wage-driven cost pressures in core NHS, recent core NHS wage growth trends indicate the Fed is very close to the finish line, even if price disinflation has yet to fully materialize.

Does Wage Growth Cause Inflation?

It’s natural to think high wage growth leads to inflation. After all, labor costs comprise a large share of business expenses. The basic New Keynesian model’s Phillips Curve arises from firms making prices on the basis of expected marginal costs, which arise from the marginal labor cost of production. However, the evidence that high wage growth portends further inflation does not play out in the data.

Even before COVID, there are a number of papers that investigate the relationship between wages and prices. Several studies (see Bidder (2015) for an overview of the literature) have studied whether or not wage growth provides additional information in forecasting inflation and most do not find any additional forecasting ability in models that include wage growth.

During the COVID pandemic recovery, there has been a renewed interest in this question. Alvarez, et. al (2022) compile a dataset of episodes since the 1960s where economies saw both accelerating consumer prices and nominal wages and find that after episodes with tight labor markets inflation outpacing wage growth, as we saw in 2021-2022, the normal conclusion is for inflation to fall and nominal wage growth to increase, allowing real wages to catch up.

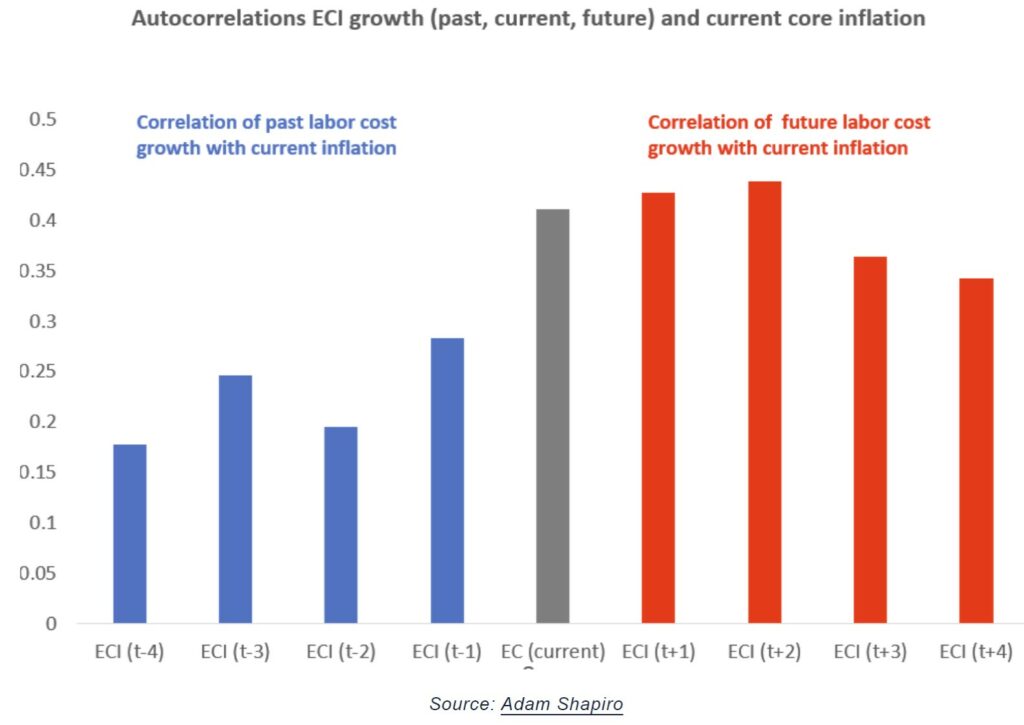

Recent Fed research also throws water on the idea that high wage growth leads to aggregate inflation. Barlevy and Hu (2023) are unable to find any evidence that unit labor costs (which some commentators have pointed to as a source of sustained inflation in the near future) helps predict changes in inflation. Shapiro (2023) estimates that the recent increase in Employment Cost Index (ECI) growth only accounts for 0.1 percentage points of the increase in core PCE inflation. Echoing earlier research, he also shows that high inflation is more correlated with future wage growth rather than past wage growth:

Despite this evidence, the notion that there is a clean causal link between aggregate wage growth and price growth is an idea that is firmly entrenched. In his press conference, Powell cited Bernanke and Blanchard (2023)’s paper to back his prediction that controlling inflation requires labor market softening. It’s important to note that the model in this paper assumes a one-to-one pass-through of wages to aggregate prices, which drives the authors’ conclusion that “balancing” the labor market will be crucial to bringing inflation back under control.

What about Core Non-Housing Services?

In fairness to Powell, he was very specific about wages being primarily important for inflation in core non-housing services (NHS). For months, Powell has talked about the importance of wages in this particular sub-aggregate:

Because wages make up the largest cost in delivering these [core NHS], the labor market holds the key to understanding inflation in this category. Jay Powell, November 30th, 2023

While the labor share of costs in services is higher than in goods, the story is not so simple. As my colleague Alex Williams has explained, the core non-housing services (NHS) sub-aggregate contains many components, such as transportation services and food services, that are susceptible to pandemic and commodity markets. Auto repair services include both parts and labor, and supply chain issues in those parts can drive (no pun intended) inflation in motor vehicle maintenance and repair. And finally, a good chunk of core NHS components like financial services and insurance are convoluted imputations derived from proxies of bank profitability.

The evidence that inflation in this sub-aggregate follows wage growth is mixed. When looking specifically at NHS inflation, Barlevy and Hu (2023) are also unable to find evidence that unit labor costs provide any predictive power. Shapiro (2023) finds that surprise changes in ECI growth do pass-through to core NHS inflation, but the effect is small: a 1 percentage point increase in ECI increases core NHS inflation by 0.15 percentage points over four years.

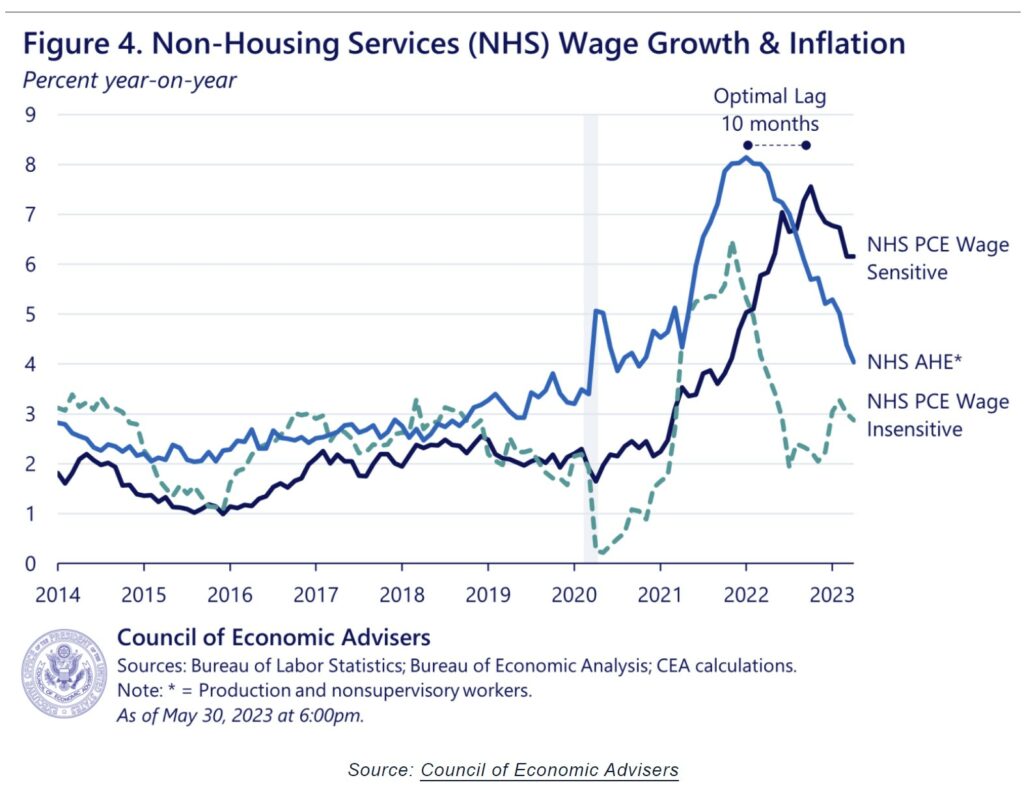

The best evidence that wage growth is a source of inflation is from the Council of Economic Advisers, who examine which components of core NHS prices are sensitive to growth in wages, specifically the core NHS average hourly earnings index. They find that about half of core NHS is wage-sensitive, and that these components currently explain 43% of excess core PCE inflation. Inflation in these wage sensitive components appear to lag growth in the core NHS average hourly earnings index by about ten months.

Implications for Fed Policy

As Barlevy and Hu (2023) point out, the lack of evidence of wage-price pass-through is not a wholesale rejection of the idea that wage costs drive inflation. If prices adjust before, and in anticipation of, wage increases, that would be consistent with the amassed evidence. However, this theory raises significant challenges for the way that the Fed is thinking about the need to kill wage growth in order to kill inflation. If much of the wage growth we are seeing is simply following price inflation, then current wage growth is not a good barometer of the trajectory of inflation.

If one takes for granted that there are parts of core NHS inflation that are elevated and responsive to wage growth, this is still problematic for the Fed’s framework. The Fed has no way of directly targeting wages in core NHS sectors, and the pass-through from wages to prices appears to be low. If this is the case, then the Fed is not likely to get a lot of disinflation out of softening the labor market, throwing into question the wisdom of pursuing this tradeoff.

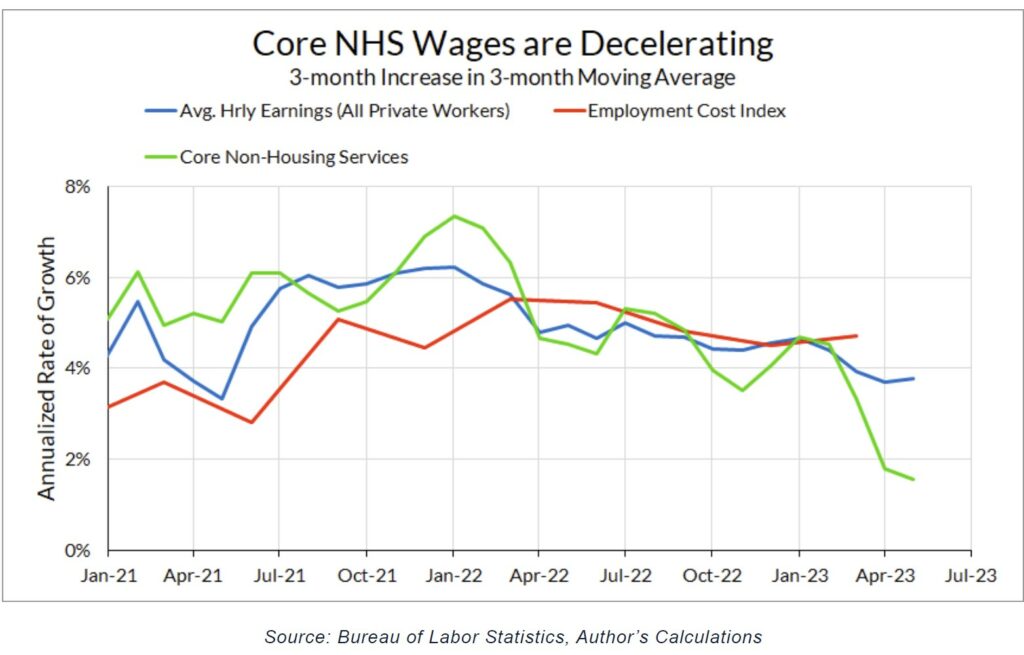

When talking about wages, Powell said that wage growth has been moving down “just at a gradual pace.” However, recent growth in core NHS average hourly earnings has slowed significantly, and much more quickly than overall wages.

What does this mean for the trajectory of core NHS inflation? Taking the Fed’s framework and the CEA’s results for granted, this means that we should see disinflation in the wage-sensitive core NHS components over the coming months. The ten-month lag between the two series means that this disinflation will take time. It will play out over the remainder of the year and well into 2024. Most importantly, disinflation in these particular components is “baked in” already due to the fall in core NHS wage growth. If the Fed looks at the price data as their guiding star, they are relying on a lagging indicator when they should be forward looking.

If wage growth in the core NHS sector continues to remain low, the Fed should be willing to declare victory on core NHS inflation, even if it hasn’t yet materialized in the inflation statistics.

Waiting for the inflation statistics to come down risks overtightening when sufficient disinflationary impulses are already present.