Normally, a sentence that begins “Donald Trump says . . . “ is not worth finishing, and that’s how a recent blog post over at jabberwocking.com begins. But finish it I did, and it turns out that DJT says he wants to eliminate all federal income taxes on Social Security. Currently, if SS is your only income, there already are no federal taxes on it. If you make additional income above your SS distributions, you can be taxed at normal federal rates on up to 85% of your SS check, depending on how much additional income. The income taxes on SS go back to the trust fund to extend its life. So why would Trump support this? Because (a) it’s a tax cut for the wealthy and (b) it depletes the SS and Medicare trust funds sooner, creating problems for

Topics:

Joel Eissenberg considers the following as important: social security, Taxes/regulation, trust fund

This could be interesting, too:

Joel Eissenberg writes Elon didn’t get the memo

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Angry Bear writes Social Security, a “pretty good program and we can afford it”

Angry Bear writes Social Security and Its Administration in 2025

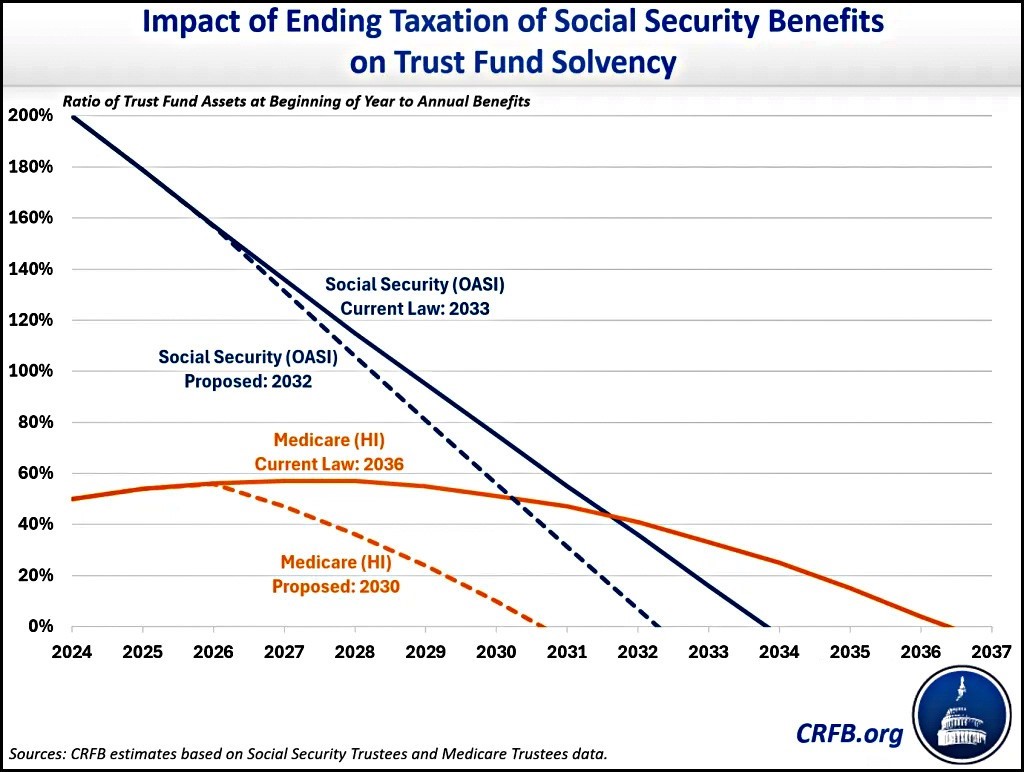

Normally, a sentence that begins “Donald Trump says . . . “ is not worth finishing, and that’s how a recent blog post over at jabberwocking.com begins. But finish it I did, and it turns out that DJT says he wants to eliminate all federal income taxes on Social Security. Currently, if SS is your only income, there already are no federal taxes on it. If you make additional income above your SS distributions, you can be taxed at normal federal rates on up to 85% of your SS check, depending on how much additional income. The income taxes on SS go back to the trust fund to extend its life.

So why would Trump support this? Because (a) it’s a tax cut for the wealthy and (b) it depletes the SS and Medicare trust funds sooner, creating problems for non-wealthy retirees who depend on these programs. For the American right, that’s a feature, not a bug.