Strictly a copy and paste of the Senate Finance Committee Chair Senator Ron Wyden Committee Report. I can not add to this other than say, repeal the 2017 Tax Act. Interim Report: Big Pharma Tax Avoidance Senate Finance Committee Investigation Reveals Extent to Which Pharma Giant AbbVie Exploits Offshore Subsidiaries to Avoid Paying Taxes on U.S. Drug Sales. The Provisions in the 2017 trump Republican tax law allows AbbVie to generate most of its sales in the U.S. At the same time, they report no income in the U.S. for tax purposes. Over 75% of AbbVie’s 2020 sales were made to American consumers. From those sales, 1% of AbbVie’s income was reported in the United States for tax purposes. AbbVie’s ability to exploit subsidiaries in offshore

Topics:

Bill Haskell considers the following as important: Healthcare, Humira, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Strictly a copy and paste of the Senate Finance Committee Chair Senator Ron Wyden Committee Report. I can not add to this other than say, repeal the 2017 Tax Act.

Interim Report: Big Pharma Tax Avoidance

Senate Finance Committee Investigation Reveals Extent to Which Pharma Giant AbbVie Exploits Offshore Subsidiaries to Avoid Paying Taxes on U.S. Drug Sales.

The Provisions in the 2017 trump Republican tax law allows AbbVie to generate most of its sales in the U.S. At the same time, they report no income in the U.S. for tax purposes. Over 75% of AbbVie’s 2020 sales were made to American consumers. From those sales, 1% of AbbVie’s income was reported in the United States for tax purposes.

AbbVie’s ability to exploit subsidiaries in offshore tax havens avoids paying billions of dollars in taxes on U.S. prescription drug sales. Such avoidance signals a clear need to reform the international tax code.

The Tax Cuts and Jobs Act of 2017 allows AbbVie to pay an effective tax rate less than half the U.S. corporate tax rate of 21% and the marginal of 22% by an American family with a combined income of $84,000. AbbVie is a multinational pharmaceutical corporation with annual sales of over $50 billion in annual sales. In comparison, it pays a lower tax rate than a postal service worker or a preschool teacher. The trump and Republican give away of 2017 creates more loopholes for big pharma to shift profits offshore.

To better understand industry practices and operations, one of the companies the Committee

contacted was AbbVie, Inc. (“AbbVie”). AbbVie is a publicly traded pharmaceutical company head- quartered in Chicago and owns the exclusive rights to several blockbuster drugs, including Humira

and Imbruvica. For several years, Humira was the best-selling prescription drug in the world. AbbVie is

an enormously profitable company that does most of its business in the United States. In 2021, AbbVie

generated over $56 billion in worldwide sales, with over 77% of those sales made in the United States.

Over the last four years, AbbVie has sold an astounding $62 billion worth of Humira in the United

States. Since AbbVie began to sell Humira in 2003, the price of Humira has been raised 27 times.

Humira is now priced at $2,984 per syringe, or $77,586 for a year’s supply, a 470 percent increase from

when the drug entered the market. Additionally, multi-million dollar bonuses for AbbVie executives

have been directly tied to rising revenue targets for Humira, creating incentives to continue raising drug

prices.

In 2018, AbbVie’s CEO Richard Gonzalez told a group of investors that the changes to the international tax regime made by the 2017 Republican tax law would cut AbbVie’s tax rate in half to 9 percent from an average of 22 percent in the years prior. That prediction turned out to be true, as AbbVie has paid stunningly low effective tax rates of 8.7% in 2018, 8.6% in 2019 and 11.2% in 2020. AbbVie estimates its tax rate in 2021 will be 12.5%. These rates are substantially lower than the current U.S. corporate tax rate of 21% and the marginal tax rate of 22% paid by an American family with a combined income of $84,000.

The Committee’s investigation focused on uncovering the extent to which AbbVie has exploited the Republican tax law to reduce taxes on U.S. drug sales through the use of foreign subsidiaries. The Republican tax law’s international provisions created incentives for drug companies like AbbVie to minimize taxes by holding intellectual property in a zero-tax jurisdiction like Bermuda and manufacturing in another low-tax jurisdiction, like Puerto Rico or Ireland.

The investigation found that the Republican tax law has enabled AbbVie to generate the bulk of their sales and profits for brand name drugs like Humira in the United States while booking those profits offshore for tax purposes. In AbbVie’s own words, “The changes made by the 2017 tax law altered U.S. taxation on foreign earnings for U.S. corporations and have had a significant impact on AbbVie’s effective tax rate.”

The maneuvers employed by AbbVie to avoid paying U.S. taxes on Humira profits involve several

key elements:

- An AbbVie subsidiary in Bermuda, AbbVie Biotechnology Ltd., exclusively owns the patents, trademarks, economic rights and all other intellectual property rights for sales of Humira in the United States. No manufacturing, packaging or distribution of Humira or related inputs takes place in Bermuda. AbbVie Biotechnology Ltd. also has no employees in Bermuda.

- Though legally domiciled in Bermuda, AbbVie Biotechnology Ltd. operates through a branch in Puerto Rico that manufactures the Humira bulk drug substance and a fill-finish operation in which the bulk drug substance is filled into syringes or injectable pens. These pre-filled syringes are then sold by the Puerto Rico branch to AbbVie Inc. in the U.S., which then packages and sells Humira to third party customers in the United States.

- In addition to facilities in Puerto Rico, AbbVie also has foreign subsidiaries in Singapore and the Netherlands related to the manufacture of Humira for the U.S. market if needed to meet demand. These entities also contract with third parties in Germany and Italy. AbbVie’s responses to the Committee indicate that no manufacturing of Humira bulk drug substance, or finishing and filling activities take place inside the continental United States.

- AbbVie Biotechnology Ltd. is effectively a tax resident in Puerto Rico and the associated income from sales to AbbVie’s U.S. operations are reported on a Puerto Rico tax return. Since income from entities based in Puerto Rico are treated as foreign for tax purposes, income from Humira is taxed not at the U.S. corporate rate of 21%, but the much lower GILTI (Global Intangible Low Tax Income) rate of 10.5% created by the Republican tax law. AbbVie can then lower its tax rate even further through the use of other tax credits.

Senate Democrats have long warned that the GILTI system gave big corporations a huge reduction in the U.S. tax rate on foreign earnings and created incentives to offshore jobs and stash profits in tax havens. For example, the use of “global blending” in GILTI provides an avenue for the aggressive use of low-tax havens. Global blending allows multinationals to reduce or eliminate U.S. taxation of a significant share of their earnings by stashing income in low-tax havens, and then blending it with income from non-tax haven foreign jurisdictions. In the most aggressive cases (such as the structure identified in this report), these stashed profits are income derived directly from U.S. sales and U.S. customers. In addition, any of the income that actually did face U.S. tax would be able to access a tax rate of 10.5 percent, just half the U.S. corporate tax rate.

Data obtained by the Committee shows that AbbVie reports virtually no income in the U.S. for tax purposes

Throughout the Committee’s investigation, AbbVie repeatedly declined to provide country – by country information regarding AbbVie’s pre-tax earnings, profit margins, employee headcount and tax paid. AbbVie also declined to provide copies of AbbVie’s IRS form 8975, an annual country-by country tax reporting for all entities that are subsidiaries of a large parent corporation with income over $850 million paid. AbbVie also declined to provide copies of AbbVie’s IRS form 8975, an annual country-by country tax reporting for all entities that are subsidiaries of a large parent corporation with income over $850 million.

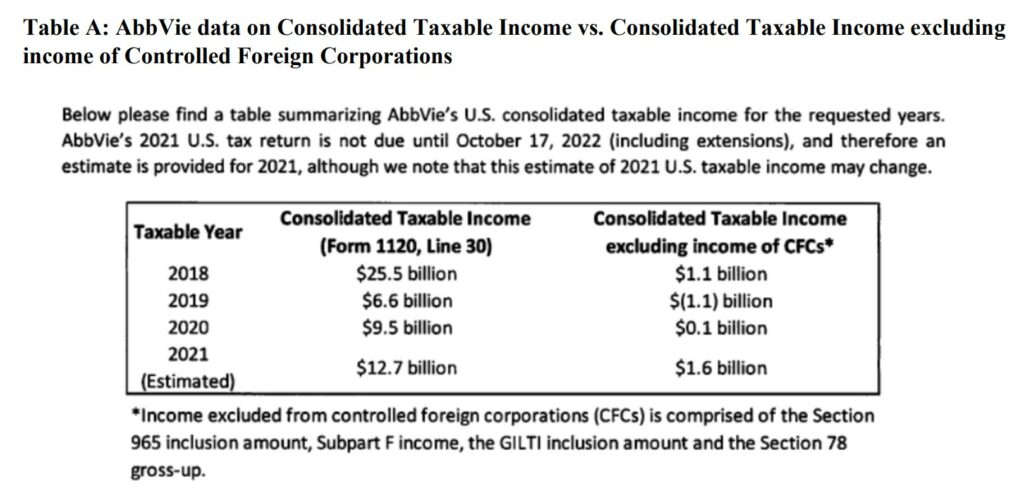

However, AbbVie did provide information related to AbbVie’s taxable income for years 2018 – 2021, including how much of AbbVie’s taxable was reported by controlled foreign corporations (CFCs). The foreign subsidiaries of a U.S. multinational corporation are generally going to be CFCs for tax purposes. Understanding how much of a company’s total taxable income is reported by CFCs provides a window into how much of a company’s income is reported offshore for tax purposes.

The data provided by AbbVie reveals the extraordinary extent to which the company has structured its operations to report minimal or no income in the United States for tax purposes, even though it is a U.S. company and a large majority of its revenue comes from U.S. customers.

In 2020, 99% of AbbVie’s taxable income was reported by offshore subsidiaries. According to data provided by AbbVie, CFCs reported 99% of AbbVie’s taxable income in 2020.17 This means that despite being head-quartered in the U.S. and generating 75% of its sales in the U.S., only 1% of AbbVie’s taxable income in 2020 was subject to the U.S. corporate income tax rate of 21%. The 99% of AbbVie’s income in 2020 that was reported by offshore subsidiaries was likely able to access the substantially lower GILTI rate of 10.5 percent. This was not an aberration. In 2018, 95% of AbbVie’s taxable income was reported by controlled foreign corporations and AbbVie estimates that CFCs will report over 87% of AbbVie’s taxable income in 2021.

The Committee’s investigation into AbbVie reveals how the 2017 Republican tax law’s international provisions rewarded large multinational corporations that shift profits overseas. The Committee believes that AbbVie’s tax structuring is an illustrative example of the broader U.S. pharmaceutical industry. To date, other entities contacted by the Committee, including Merck & Co. and Abbott Laboratories, have refused to substantively cooperate. However, the Committee intends to continue its investigations in order to provide Congress and the public with a complete understanding of the effects of the 2017 Republican tax law on the pharmaceutical industry.