By Claudia Sahm Stay at Home Macro Companies aren’t so worried that they’re letting a lot of people go, but they’re also not so confident that they’re hiring a lot of people. This post, an excerpt from my (Sahm) new Bloomberg Opinion piece, is very important to me. I worry most about the drop in the hiring rate now—not so much about it being recessionary but about the lost potential. Also, there’s some personal news at the end. The strong September print (Employment Situation Summary) was awesome after months of cooling in the labor market and reinforced other signs of economic strength. But one month doesn’t make a trend, and even with the Fed cutting rates, a sustained turnaround in hiring will take time. In the latest

Topics:

Bill Haskell considers the following as important: 2024, Finding Work, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

by Claudia Sahm

Stay at Home Macro

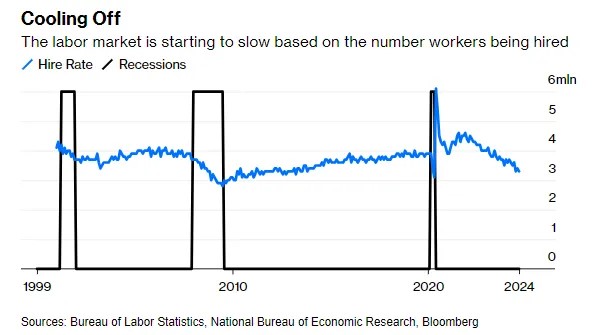

Companies aren’t so worried that they’re letting a lot of people go, but they’re also not so confident that they’re hiring a lot of people.

This post, an excerpt from my (Sahm) new Bloomberg Opinion piece, is very important to me. I worry most about the drop in the hiring rate now—not so much about it being recessionary but about the lost potential. Also, there’s some personal news at the end.

The strong September print (Employment Situation Summary) was awesome after months of cooling in the labor market and reinforced other signs of economic strength. But one month doesn’t make a trend, and even with the Fed cutting rates, a sustained turnaround in hiring will take time.

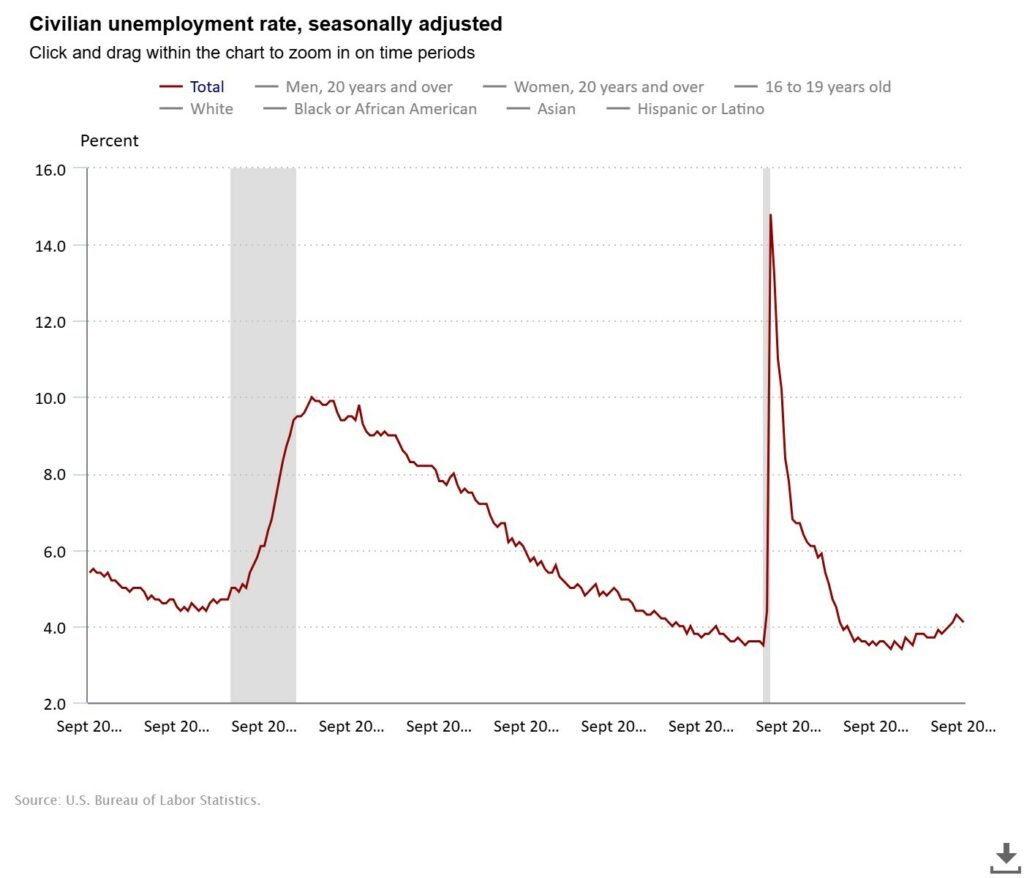

In the latest August JOLTS figures, the hiring rate fell to 3.3%—comparable to 2013, when unemployment was more than 7%. Yet, encouragingly, layoffs remain low.

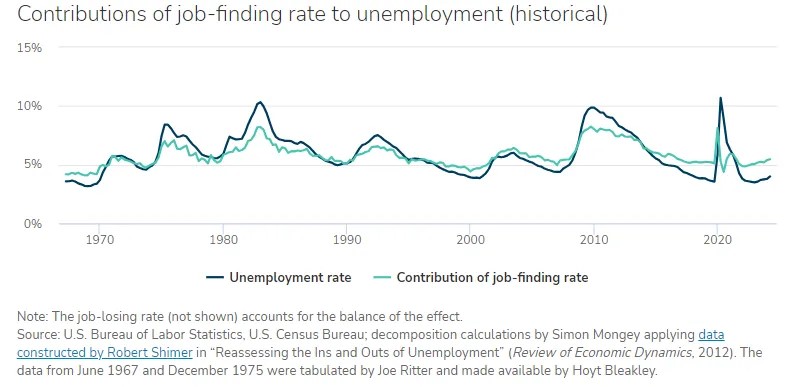

Historically, the inability of people to find jobs has had a greater impact on the unemployment rate than workers losing jobs. In 2012, a research paper found by Robert Shimer that job-finding rates explained three-quarters of the changes in unemployment since 1948. Applying its methods, Simon Mongey and Jeff Horwich at the Federal Reserve Bank of Minneapolis argue that the decline in the job-finding rate can also account for most of the increase in the unemployment rate since the second half of 2022.

Unemployment will likely rise if hiring remains soft, even with few layoffs.

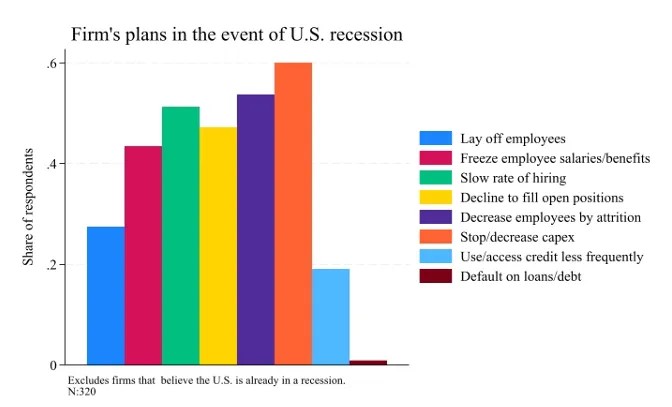

Reducing hiring is a front-line response in difficult economic times. More than half of the firms surveyed by the Atlanta Fed said they would slow hiring in a recession or a downturn in their industry. Only one-quarter of firms said they would lay off employees.

My piece discusses four reasons that hiring may have dropped off:

- Still working through echoes of the pandemic, especially in leisure and hospitality.

- Fed rates are slow to take effect; there is uncertainty over the path.

- Election / fiscal uncertainty.

- Labor-saving tech like AI.

It’s likely some mix and none clear-cut. The paradox is this:

Businesses are waiting for more clarity about the direction of technology and the economy before they hire more workers. Yet this hesitation, which could lead to further increases in the unemployment rate and softer payroll gains, will only feed worries about recession risks. So keep an eye on the labor market, but realize that until the hiring rate stabilizes, it may sometimes be hard to watch.