If we were to look at the costs of healthcare insurance for families and businesses, it has not remained the same percentage-wise for employers or employees. My initial sentence is a backwards way of saying costs are increasing faster than gains in income for either. Nothing has changed here and the foes to single payer in government and industry keep insisting this is the better way to provide healthcare. Edward Kennedy died too soon to help us with Single Payer. Such a plan should not be exposed to governmental cuts due to politics. Indeed, it should be similar to Social Security. Something politicians should not mess with unless they do not value their status in Washington D, C. There is a better way to say this. It eludes me right now.

Topics:

Bill Haskell considers the following as important: Healthcare, Healthcare insurance companies, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

If we were to look at the costs of healthcare insurance for families and businesses, it has not remained the same percentage-wise for employers or employees. My initial sentence is a backwards way of saying costs are increasing faster than gains in income for either.

Nothing has changed here and the foes to single payer in government and industry keep insisting this is the better way to provide healthcare. Edward Kennedy died too soon to help us with Single Payer.

Such a plan should not be exposed to governmental cuts due to politics. Indeed, it should be similar to Social Security. Something politicians should not mess with unless they do not value their status in Washington D, C. There is a better way to say this. It eludes me right now.

The Wall Street Journal (to which I subscribe) posted a brief commentary:

“Healthcare Premiums Are Soaring Even as Inflation Eases, in Charts.”

WSJ’s opening statement?

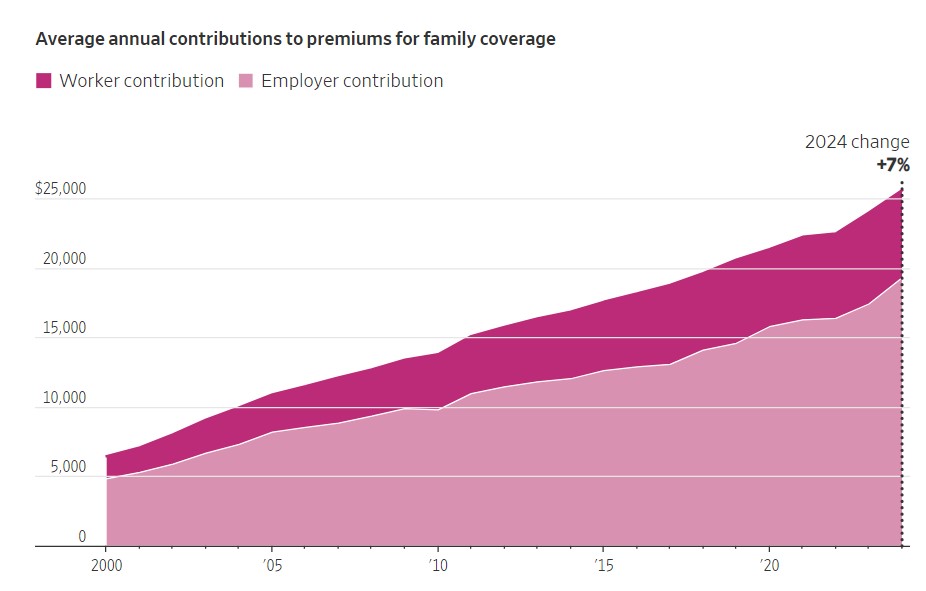

“Back-to-back years of increases in Healthcare premiums have added to the average cost of family coverage, reaching roughly $25,500 this year for employers and workers.“

To which the statement of rising healthcare costs is true. I suspect there will be no end soon to the increases in healthcare costs to labor, businesses or the profits at the other end. The following WSJ chart depicts the increasing costs to Workers and Employers.

Inflation is easing across much of the economy. For healthcare? Not yet.

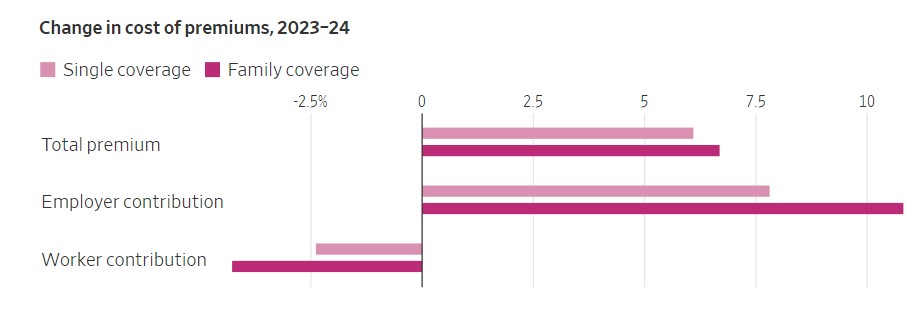

The cost of employer health insurance rose 7% for a second straight year, maintaining a growth rate not seen in more than a decade, according to an annual survey by the healthcare nonprofit KFF. The back-to-back years of rapid increases have added more than $3,000 to the average family premium, which reached roughly $25,500 this year.

Businesses did absorb this year’s higher premium costs. Doing such signals (in recent years), employers are sensitive to the limits of what workers can afford. Matthew Rae, associate director of the KFF healthcare marketplace program and an author of the survey:

Employers spent about $1,880 more this year, bringing their average cost for family premiums to $19,276. A workers’ share of the average family premium dropped by roughly $280 from last year, to $6,296.

Businesses can’t keep that up, said Shawn Gremminger, chief executive of the National Alliance of Healthcare Purchaser Coalitions, an employer group. And workers ultimately bear those higher costs in other ways, he said, including smaller raises or job cuts. Adding . . .

“That’s adding real stress to the economy.”

Outlook for 2025

Stress on the sector is expected to continue, at least for another year. Employers and benefit consultants state health-insurance costs are projected to rise rapidly again in 2025.

Healthcare costs don’t change as swiftly as in other sectors of the economy, where inflation has cooled. Prices for health services are typically locked in under multiyear contracts.

In addition, hospitals have recently won new contracts with larger price increases claiming they need such to offset raises for their workers. There is an argument to this logic which I will not include here.

Deductibles edge upward

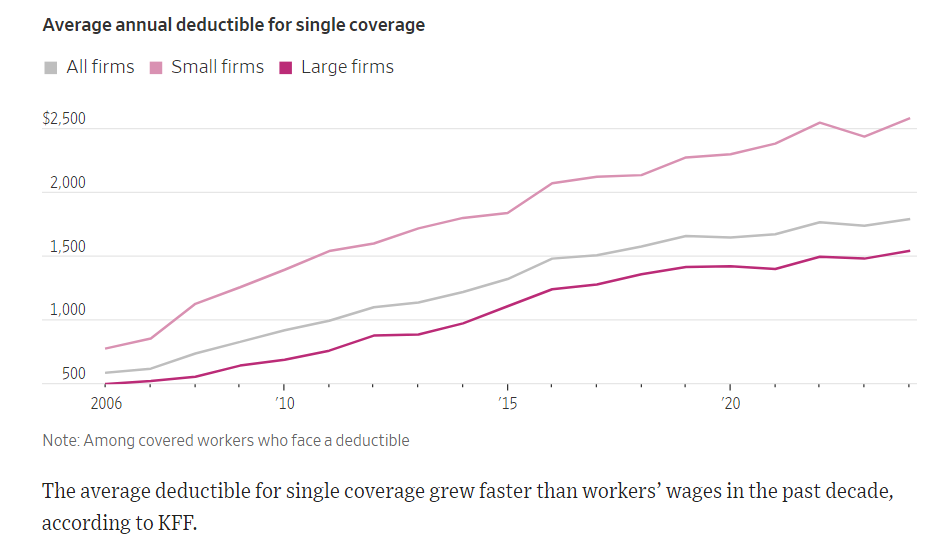

Increases in deductibles? The amounts employees must pay out of pocket before health insurance kicks in is steep and has been for years. It has eased more recently because the expense might already have been more than workers could afford according to Matthew Rae of KFF.

However, this year the average deductible for large companies inched higher by 4% for workers with single coverage. Workers in smaller companies were hit harder with deductibles rising an average 6% for single coverage deductibles annually.

Lower-wage workers might pay less

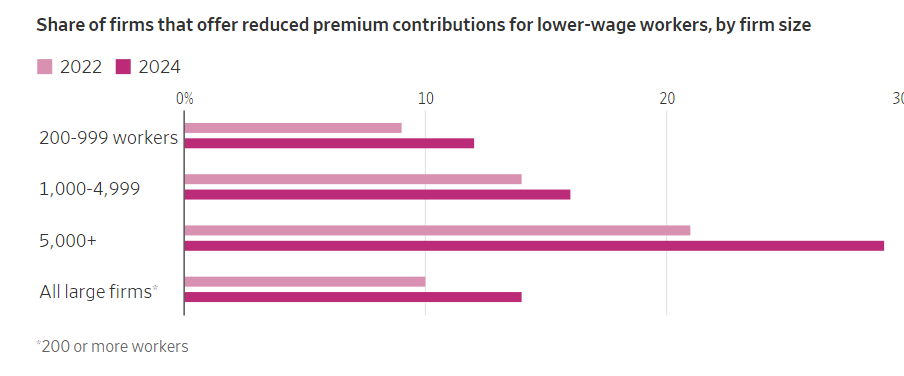

To help workers afford health insurance, some large employers are lowering the costs for workers with lower wages.

Some large employers are also offering lower-wage workers health-insurance alternatives with skimpier benefits and low premiums. Nearly one in five of the largest employers reported having these limited plans.

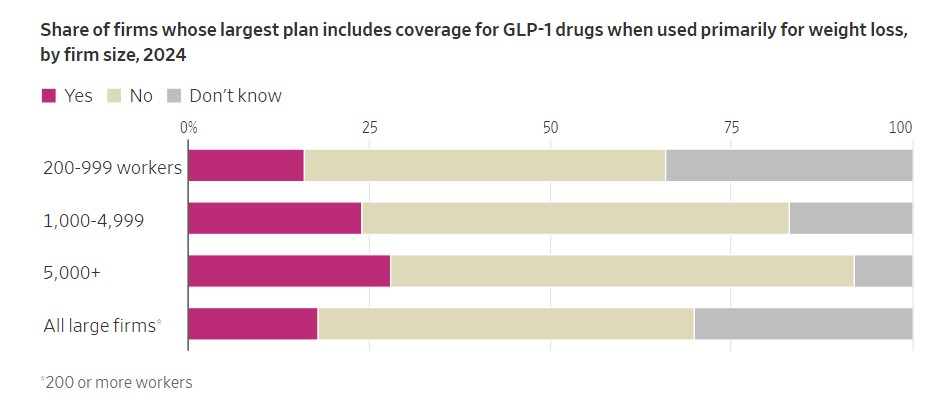

Employers hold off on weight-loss drugs

Most employers continue not to cover weight-loss drugs, according to the KFF survey. While workers are asking for the drugs, employers have balked because of high costs.

Even when firms cover the drugs, that doesn’t guarantee workers unfettered access. Roughly half of the firms require workers to clear hurdles before or while filling prescriptions. They require employees to pursue other avenues for weight loss.

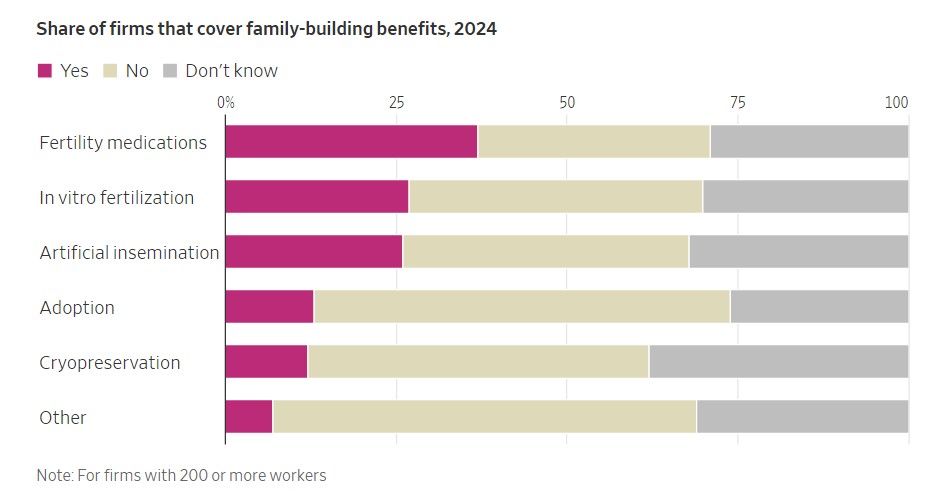

In vitro fertilization, fertility coverage are limited

Across all firms of at least 200 workers, few companies report offering fertility benefits. Thes is not the case among the biggest employers.

Roughly half of the nation’s largest employers offer health benefits for fertility medications, artificial insemination or in vitro fertilization. Companies did add the benefits to recruit workers during the recently tight labor market.

Survey respondents in some cases reported “don’t know” to questions about their coverage of the services.

The KFF Employer Health Benefits Survey was conducted in the first seven months of 2024 and included 2,142 employers that responded to the full survey.

Sources for graphics: KFF (employer survey); Bureau of Labor Statistics (inflation, workers’ earnings)

Write to Melanie Evans at [email protected] and Josh Ulick at [email protected]

How Health Insurance Costs Outpace Inflation, in Charts, Wall Street Journal.