The Biden administration will soon roll out a new student loan forgiveness proposal that could impact millions of Americans. For years, Joe Biden has been against Student Loan forgiveness. Now he is seeking forgiveness for making student loans totally unforgiveable. The proposed student loan program is smaller in scope than President Joe Biden’s first education debt relief plan which the Supreme Court ultimately blocked. Rough estimates by higher education expert Mark Kantrowitz, the new aid package could still forgive the debt for as many as 10 million Americans. The Wall Street Journal says President Joe Biden is planning to provide details of his new debt forgiveness plan during a speech Monday (April 8?) in Madison, Wisconsin. The timing of

Topics:

Bill Haskell considers the following as important: Education, politics, Student Loan Debt 2023, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

The Biden administration will soon roll out a new student loan forgiveness proposal that could impact millions of Americans. For years, Joe Biden has been against Student Loan forgiveness. Now he is seeking forgiveness for making student loans totally unforgiveable.

The proposed student loan program is smaller in scope than President Joe Biden’s first education debt relief plan which the Supreme Court ultimately blocked. Rough estimates by higher education expert Mark Kantrowitz, the new aid package could still forgive the debt for as many as 10 million Americans.

The Wall Street Journal says President Joe Biden is planning to provide details of his new debt forgiveness plan during a speech Monday (April 8?) in Madison, Wisconsin. The timing of this corresponds ahead of the election in November. In a recent survey, almost half of all voters (48%) say canceling student loan debt is an important issue to them and will help them decide who to vote for in the 2024 presidential and congressional elections.

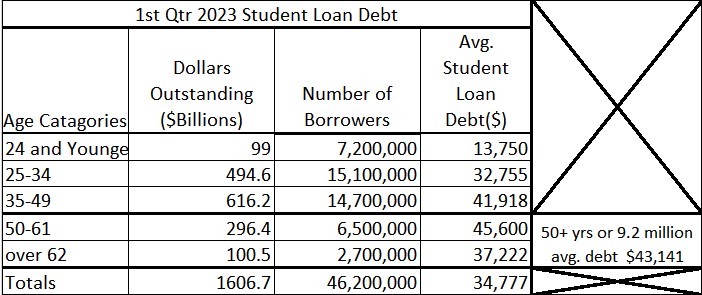

Mid 2023, June to be exact, Angry Bear posted about student loan debt. 45 and Now 46 million strong Owning Student Loans 2023 – Angry Bear. We presented this chart depicting the numbers of people by age and the amount of student loan debt of each age bracket. Portfolio-by-Age.xls (live.com).

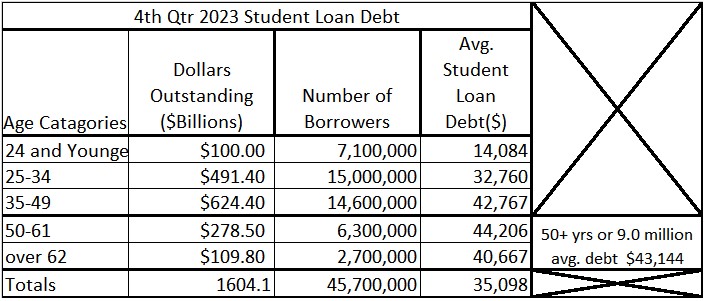

With the latest data, I have updated the chart again showing numbers and the amounts owed by age bracket and in total. Again as taken from Portfolio-by-Age.xls (live.com)

As you can see, the total numbers of borrowers did drop by 500,000. This is not a lot. However, as more people drop out, others just start college. We can see a drop from the 1st Qtr. of 2023 to the 4th Qtr. of 2023. The numbers in each age bracket have decreased.

If you click on Portfolio-by-Age.xls (live.com), you can also compare 2018 to 2023. The numbers for 24 and under in college has decreased by 1.5 million. The 25 to 34 year old age bracket also saw a small decrease of 300 thousand. It may be, people becoming of age are avoiding college and its costs. This does not bode well for colleges. Too soon to tell what the outcome will be.

The president’s Plan B for student loan forgiveness will likely target several groups of borrowers, including those who’ve been in repayment for decades and people who are experiencing financial hardship.

Immediately after the Supreme Court struck down Biden’s $400 billion student loan forgiveness plan last June, the administration began working on a revised assistance package. The administration believes its updated plan will survive legal challenges this time for several reasons. One, it’s far narrower than its first attempt, which impacted as many as 40 million Americans.

Why would Biden concentrate on those who have been in repayment for decades? In an earlier commentary “45 and Now 46 million strong Owning Student Loans 2023,” Angry Bear, I was discussing the issue of age and paying back at 50 and 62 years of age. Some verbiage . . .

Age is a factor and those in the 50+ grouping have the greatest overall average debt. If one could even snare a 5% interest loan on an average $45,000 debt, it would take a 50+year old 13 years to pay the loan off at $400 per month. At 62 years old and snaring a 5% interest loan and paying $400 per month, a person would need 10 years and would be 72 years old. This is calculated at 50 and 62 years old. Think older and is it possible to do? Not likely.

Student Loans are not that friendly. They are meant to hold student captive. Unless there is some type of relief, many will be captive for a lifetime. Could they pay it back? Four hundred dollars a month is a considerate chunk of money coming out of a budget.

You can read the rest of “45 and Now 46 million strong Owning Student Loans 2023 – Angry Bear” yourselves. I do not buy the argument SCOTUS comes back with on student loan forgiveness. If such is the case, Congress should eliminate their retirement funding. These loans are deceptive and the only loans to which bankruptcy is not allowed. For this issue, we have to look for further than Joe Biden and his campaign against student loan forgiveness.

Biden administration will soon roll out a sweeping new student loan forgiveness plan

“Biden administration will roll out new student loan forgiveness plan,” cnbc.com