By Dean Baker Center for Economic and Policy Research The inflation hawks took March’s CPI as cause for celebration, inflation may not be dead yet. There is no doubt that it was a disappointing report for those hoping we could put the pandemic inflation behind us. However, there still is not much basis for thinking the Fed needs to get out the nukes and start shooting big-time. The key point to remember is this inflation continues to be driven overwhelmingly by rent. We know rental inflation will be falling because we have data on marketed units. The ones changing hands show sharply lower rental inflation. In some cases, indicators such as the BLS index for new tenants, actually show deflation. The CPI rental indexes will follow the index

Topics:

Bill Haskell considers the following as important: Journalism, politics, Renatl Inflation, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

by Dean Baker

Center for Economic and Policy Research

The inflation hawks took March’s CPI as cause for celebration, inflation may not be dead yet. There is no doubt that it was a disappointing report for those hoping we could put the pandemic inflation behind us. However, there still is not much basis for thinking the Fed needs to get out the nukes and start shooting big-time.

The key point to remember is this inflation continues to be driven overwhelmingly by rent. We know rental inflation will be falling because we have data on marketed units. The ones changing hands show sharply lower rental inflation. In some cases, indicators such as the BLS index for new tenants, actually show deflation.

The CPI rental indexes will follow the index for new tenants, but with a lag. That lag is proving longer than had generally been expected, but there is no reason to question the basic logic. If people who change apartments are seeing lower rental inflation, it is pretty hard to tell a story where this doesn’t eventually show up in lower rental inflation for people who stay in the same unit.

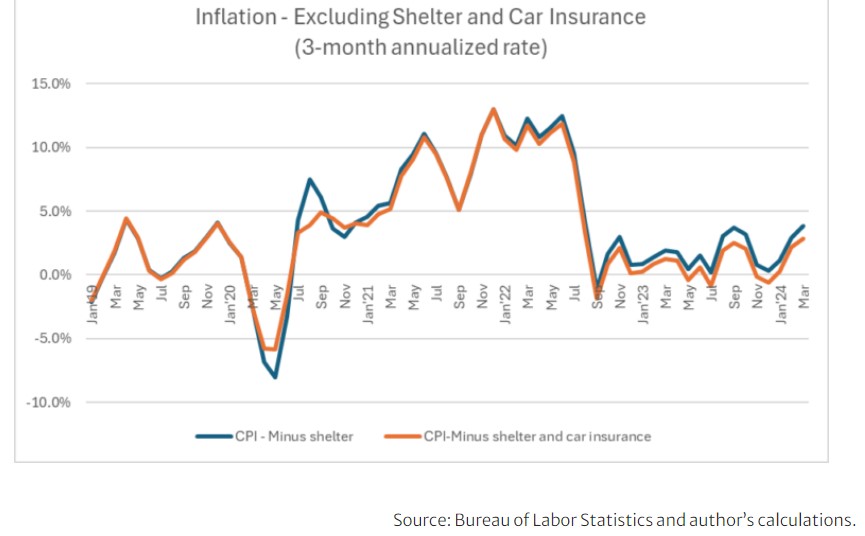

If we just look at the inflation rate excluding shelter, we have been skating close to, or even under, the Fed’s 2.0 percent target for most of 2023. The figure below shows annualized rates over the prior three months from 2019.

There definitely has been some acceleration in this measure in the last few months, but hardly an extraordinary one. We saw even larger upticks in inflation by this measure in the past, for example twice in 2019. Rent is typically a stabilizing factor in the overall inflation rate, precisely because the rate of rental inflation changes slowly.

There is another item that has played a big role in pushing inflation higher in recent years, auto insurance. The story is that premiums have risen sharply in recent years because of higher payouts in claims. (Profits have risen some as well, but we know payouts are most of the story from comparing the CPI measure which picks up gross payments, with the measure in the PCE deflator, which pulls out claims.)

Some of the story with premiums is higher costs due to higher prices for auto repairs, but much of it is simply more claims. Auto theft shot up in the pandemic but is now coming down. More long-term, people are seeing more damage due to climate-related events such as floods and hurricanes. That will be an ongoing problem.

To be clear, higher auto insurance premiums are a big deal in the sense that people have to bear these costs out of their pockets, however it is not part of a conventional inflation picture. The Fed will not be lowering auto insurance premiums by raising interest rates. The solution to climate-related damage is to try to limit climate change, but if that is off the agenda for political reasons, then people will just have to get used to higher-priced auto insurance, among other things.

Anyhow, if we pull auto insurance out of the story, in addition to rent, inflation was well below the Fed’s target for most of 2023 and actually negative at several points. We still get the acceleration in recent months to a 2.9 percent annualized rate as of March, but this hardly seems like something worth getting terribly excited over given the past behavior of this index.

In short, there is still plenty of reason for believing that the pandemic inflation is behind us. For now, the March report gave the inflation hawks some fresh meat, but a more careful look suggests that it doesn’t change the basic picture of inflation being largely under control.