Excellent piece by one of CEPR’s Domestic Program Interns . . . Alex Richwine. That name rings a bell with me. I am sure you will find this piece to be an excellent report detailing university investment returns. Quite apropos . . . give todays circumstances. ~~~~~~~~ University Endowment Returns Don’t Measure Up by Alex Richwine and Dean Baker CEPR Of the many demands made by student protestors in recent weeks, the demand to divest from companies complicit in Israel’s military assault on Gaza has attracted the most vocal resistance. A number of recent op-eds have argued that this aim is misguided and unfeasible, while some statements from university administration have directly addressed this demand with plain refusal.

Topics:

Bill Haskell considers the following as important: Education, Journalism, politics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Excellent piece by one of CEPR’s Domestic Program Interns . . . Alex Richwine. That name rings a bell with me. I am sure you will find this piece to be an excellent report detailing university investment returns. Quite apropos . . . give todays circumstances.

~~~~~~~~

University Endowment Returns Don’t Measure Up

by Alex Richwine and Dean Baker

CEPR

Of the many demands made by student protestors in recent weeks, the demand to divest from companies complicit in Israel’s military assault on Gaza has attracted the most vocal resistance. A number of recent op-eds have argued that this aim is misguided and unfeasible, while some statements from university administration have directly addressed this demand with plain refusal. The statement from the University of Michigan’s Board of Regents epitomizes the stated rationale for this refusal, as they assert the need to

“shield the endowment from political pressures” and simply “base investment decisions on financial factors such as risk and return.” emphasis by Angry Bear.

Given how fervently university administrators defend the financial prudence of their endowment portfolios, it is worth asking whether endowments do in fact maximize returns. In the case of the Ivies, that does not appear to be true. The Ivy League endowment portfolios include a large share of alternative investments — hedge funds, private equity, venture capital — which are risky asset classes that lead to significant variability in returns. A recent report from an investment analysis firm that tracks endowment funds suggests that the average Ivy League endowment portfolio fared far worse than a simple stock-bond portfolio mix last year.1 That same low-complexity portfolio had better risk-adjusted returns than many top colleges’ endowments over the past decade, suggesting that the volatility of these alternative investments is not paying off.

The Ivy League endowments’ returns are likely weighed down by the significant fees they pay to so-called active managers to engage in risky investments. If the risk-return profile of the portfolio is substandard, and the management fees are weighing down potential endowment income further, we should be skeptical of the idea that the endowment portfolio is some well-oiled machine that cannot bother itself with concerns beyond returns.

Assessing the Ivy League Endowments

The primary difficulty in assessing the endowments of large universities is the lack of transparency, an issue that has led student protesters to demand increased disclosure of investments. At the end of each fiscal year, a large university typically reports only a single annual return figure for its endowment portfolio.

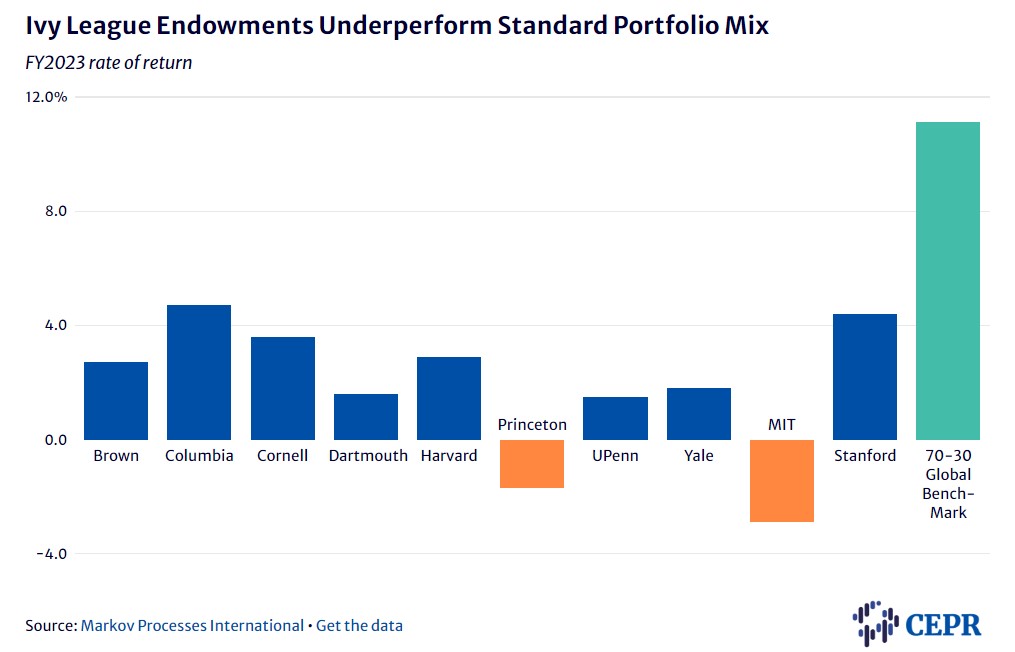

Figure 1 shows the reported fiscal year 2023 returns for each of the Ivy League endowments, alongside a benchmark portfolio of 70 percent global equities and 30 percent bonds.2 As the figure makes apparent, last year’s rate of return for the 70–30 portfolio is far superior to even the best-performing Ivy endowment. The benchmark portfolio’s rate of return is more than double that of Columbia and far exceeds the Princeton endowment, which operated at a loss in fiscal year 2023.

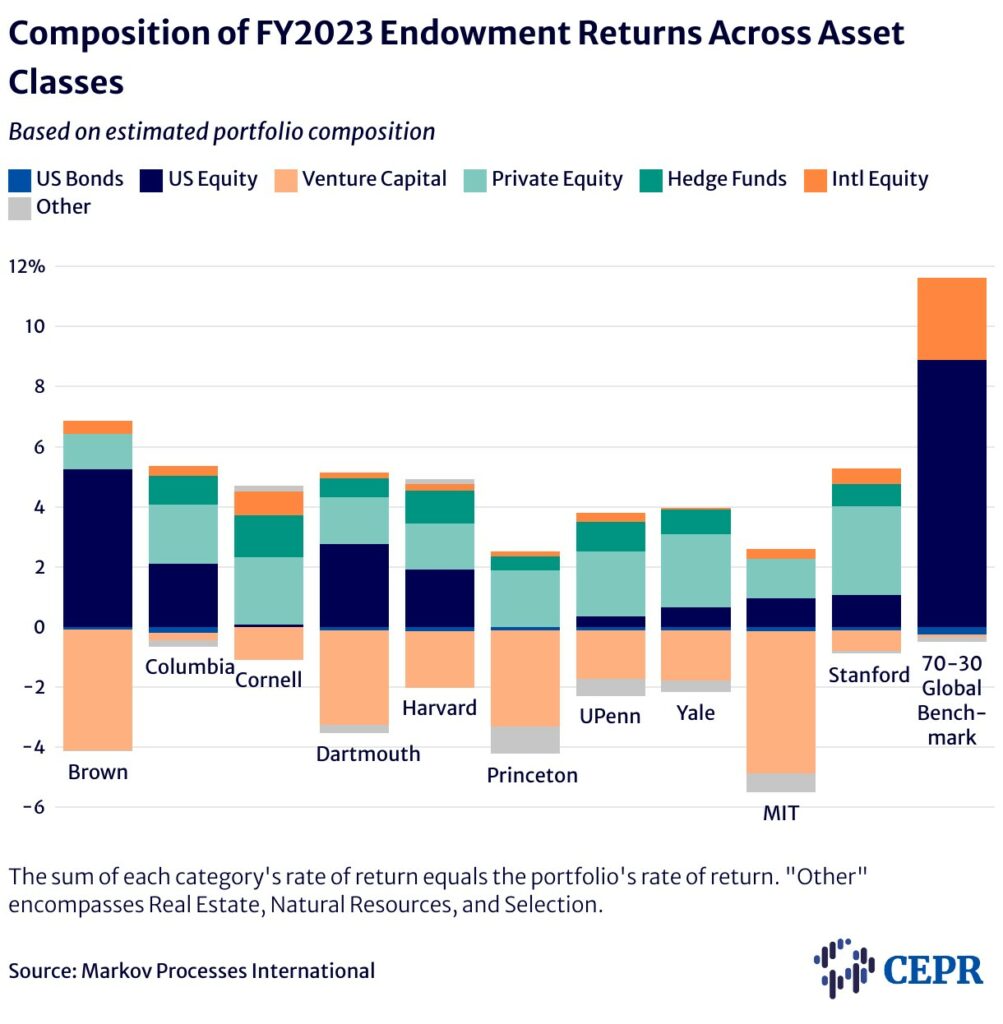

To overcome the opaqueness of these endowment funds, Markov Processes International (MPI) developed a system3 to estimate “the effective exposures of endowment portfolios to major common asset classes and their impact on the overall performance.” Their annual report card for Ivy League endowments was released in February of this year.

Figure 2 shows MPI’s estimates of fiscal year 2023 returns by asset class, based on an estimated portfolio distribution for each endowment fund. Evidently, the heavy weighting of venture capital in endowment portfolios constrained returns last year, and even brought some schools’ returns into the red.

The MPI analysis goes beyond the analysis of a single year. An analysis of 10-year returns finds that the Ivies have higher average returns than the global benchmark, but there is significant year-to-year variability. Applying a metric of long-term efficiency that considers risk and return jointly,4 the MPI authors find that the 70–30 global benchmark had better risk-weighted returns than most Ivy League endowments over the past 10 years.

So, the Ivy endowments are rather risky, and they had a bad year — so what? In fact, a slightly different comparison paints the Ivy endowments in a much less favorable light. While the report’s comparison portfolio is a global benchmark, that rate of return is dragged down by the relatively poor performance of foreign stock markets.

Comparing the returns of the Ivies with a portfolio composed of 70 percent S&P 500 stocks and 30 percent bonds, we find that university endowments generally trail this simple mix. While the average rate of return over the last 10 years for the Ivy League endowments was 9.8 percent, the average rate for this simple portfolio of domestic equities and bonds was 12.2 percent.

Endowments in the Clutches of Hedge Funds

The relationship of today’s large endowment funds to hedge funds should raise serious questions. The hedge funds that help manage many endowment portfolios charge exorbitant fees, and it is not clear their services are worth the bill. As former CalSTRS chief Christopher Ailman said in a 2021 interview, “I do not need to pay two and twenty5 to get diversification.” Though the traditional two-and-twenty model has not been the case for many years, recent data show that management fees typically exceed 1.5 percent and performance fees typically exceed 15 percent.

A simple example will illustrate the stakes. If a university hands over $1 billion of its endowment to be managed by a hedge fund with a 1.5 percent charge plus performance fees, it is giving away $15 million a year to someone who may be losing the endowment money. The illiquidity of investments entrusted to these hedge funds represents a problem as well. The Financial Times’s Robin Wigglesworth rightly identifies the risks this kind of illiquidity could pose in times of emergency. Ironically, universities have cited the illiquidity of these funds as part of the reason divestment is impractical.

The move away from public markets (equities and bonds) to “alternative” investments was pioneered in the 1980s by the late David Swensen, Yale’s longtime chief investment officer. While this strategy has yielded strong returns over the past few decades, it has brought considerable riskiness to these portfolios. Moreover, the influence of the so-called “Yale model” of endowment management goes far beyond the Ivies, as Leanna Orr documents in an excellent piece on the matter.

The apparent success of the Yale model led countless smaller universities’ endowment funds to imitate it. Armed with the idea that they simply needed to increase the proportion of the fund going toward hedge funds and private equity, these endowment managers brought university funds en masse into the arms of active managers. Evidently, it has been hard to roll back the clock on this broader shift, even though smaller endowment funds with a Yale-style asset mix typically perform far worse than Yale. Swensen was adamant about tailoring the endowment approach to the particular institution. He warned that many endowment funds that try to imitate Yale will “end up with bloated, fee-driven investment management businesses,” and that is precisely what happened.

What is at Stake in Demands for Divestment

Many elite private colleges plead poverty when activists make financial demands on them. As Adam Tooze points out in a recent blog post, this pretense is patently false in Columbia’s case; expert analysis shows that the university’s operating cash flow is nearly $1 billion per annum. But even if these institutions were hanging by a thread, the above analysis demonstrates that they may have only their own strategy to blame.

Universities could likely improve net returns on their endowments if they were willing to cut favored hedge fund managers out of the loop. They are apparently unwilling to do this, even if it could increase returns. They seem willing to sacrifice income for these hedge fund managers, even if they would not consider doing so to make a statement about Israel’s actions in Gaza.

Many other large investment vehicles (including Norway’s sovereign wealth fund and California teachers’ pension plan CalSTRS) acknowledge that politics play a role in their work. When tens of billions of dollars are in play, the idea that these funds have the same impact as a retail investor is pure deceit. Many endowment funds are beginning to incorporate “responsible investing” — such as impact investing and environmental, social, and governance (ESG) investing — into their management strategies.6 Clearly, moral and political considerations already factor into endowment management strategies.

Conclusion

The demands to divest from companies associated with Israel’s ongoing assault on Gaza are among many demands from the student protest groups. We focused here on the divestment demands because the business of endowment funds is murky and worthy of public scrutiny. Contrary to what is often claimed, many endowment portfolios fail to outperform the kind of portfolio mix your cousin might suggest. These endowment managers shell out the university’s dollars to pay hefty fees to active managers in exchange for illiquidity and mediocre returns. It is reasonable to expect better transparency from university endowments and to expect their accountability to the university constituencies they are supposed to serve.

Notes:

- This is not unique to 2023, as we observed a similar phenomenon in 2018.

- The equity index is the MSCI All Country World Index (ACWI), while the bond portion is the Bloomberg US Aggregate Bond Index.

- Their method is based on the returns-based style analysis techniques developed by Nobel laureate economist William F. Sharpe in his work from the early 1990s.

- The Sharpe Ratio is the ratio of excess returns to the standard deviation of those returns. See below. Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425-442.

- The traditional two-and-twenty model for hedge funds implies two percent fees on management and 20 percent fees on performance (gains resulting from the fund’s intervention).

- One could argue that private equity’s detrimental outcomes warrant divestment in the name of social responsibility, but that is a different conversation.