– Nadia Evangelou National Association of Realtors A good read explaining why things slowed down. Good introduction of why housing market fell apart since 2020. Much was due to the Fed Rate which was significantly higher than it normally was. People did not have the income to support a higher payment caused by a higher Mortgage Rate. Some excellent charting by NAR Calculations. Housing affordability has been a critical issue in the housing market, affecting individuals, families, and entire communities. While the challenges associated with affording a home are not new, they have remained one of the main concerns in the housing market. This, particularly as higher mortgage rates have exacerbated the situation. The widening gap between income

Topics:

Bill Haskell considers the following as important: housing, NAR, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

– Nadia Evangelou

National Association of Realtors

A good read explaining why things slowed down. Good introduction of why housing market fell apart since 2020. Much was due to the Fed Rate which was significantly higher than it normally was. People did not have the income to support a higher payment caused by a higher Mortgage Rate. Some excellent charting by NAR Calculations.

Housing affordability has been a critical issue in the housing market, affecting individuals, families, and entire communities. While the challenges associated with affording a home are not new, they have remained one of the main concerns in the housing market. This, particularly as higher mortgage rates have exacerbated the situation. The widening gap between income levels and housing costs causes homeownership to be increasingly out of reach. However, with mortgage rates recently falling below 6.5%, there has been an improvement in housing affordability. Rates below 6.5% make it possible for American families to afford to purchase a median-priced home.

This article delves into the trends in housing affordability and examines how the number of households who can afford to buy a home has changed over the years.

Housing affordability has often been associated with broader economic cycles and demographic trends. For instance, in the late ’70s, the economy was struggling significantly. Inflation surged to 14%, driving up consumer prices and home prices. When mortgage rates reached 17% in 1981, many people could no longer afford the higher mortgage payment. The higher rates were slowing down demand for housing.

Does this ring a bell?

Starting in 2022, the Federal Reserve raised its interest rates a total of 11 times to combat elevated inflation. As a result, mortgage rates have reached 7% on average in 2023, driving home buying out of reach for many people.

While there are various ways to track affordability, the National Association of REALTORS® monitors monthly housing affordability trends using the Housing Affordability Index (HAI) and the payment-to-income ratio. These two measures are critical tools used to gauge the accessibility of homeownership for average households. Specifically, they provide insight into whether the typical family can afford to buy a home and maintain mortgage payments relative to their income.

HAI definition and trends

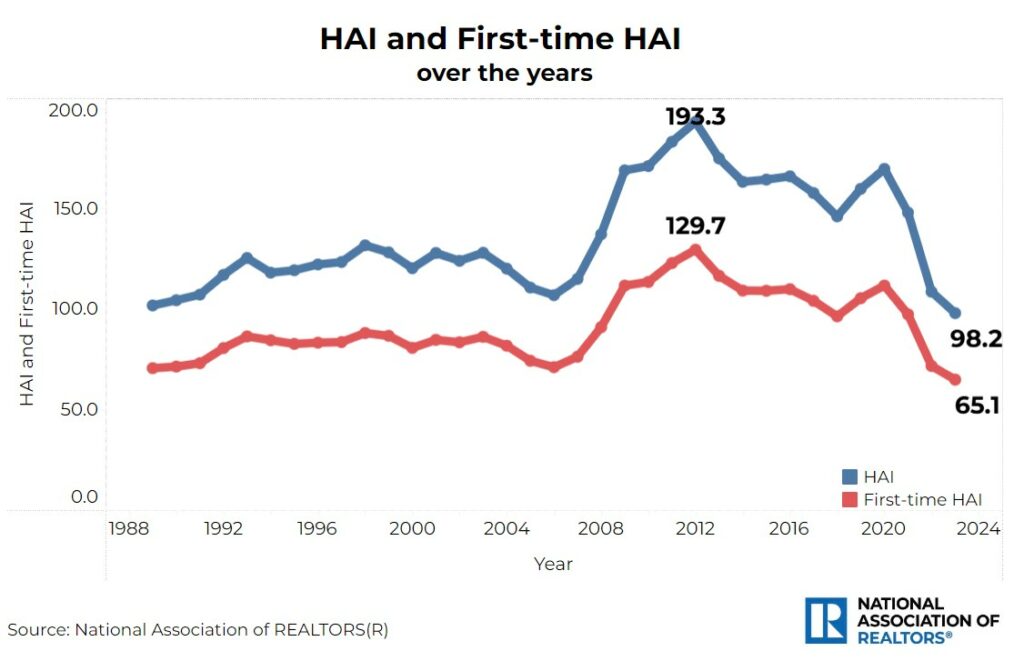

The Housing Affordability Index is a measure that reflects the relationship between median home prices, median family income, and mortgage rates. It is calculated by comparing the income needed to qualify for a mortgage on a median-priced home to the actual median family income. An index value of 100 indicates that a family earning the median income has exactly enough income to qualify for a mortgage on a median-priced home, assuming a 20% down payment. Values above 100 suggest housing is more affordable, while values below 100 indicate it is less affordable.

Looking back at the entire historical data since 1989, housing affordability hit a record low in 2023, with an index of 98.2, indicating the American family earns less than the income needed to purchase the median-priced home. Historically, however, the typical family generally earned about 40% more than the qualifying income, meaning they could afford a home costing 40% more than the median price. In 2012, as both mortgage rates and home prices dropped in the aftermath of the housing downturn, Americans could afford homes priced nearly twice the median price. Affordability has improved since the end of the first half of 2024, with mortgage rates recently falling below 6.5%. While the Federal Reserve is anticipated to begin cutting rates as early as September October, the downward trend in mortgage rates will continue. Rates below 6.5% will bring American families back to the market. There are rates, they can afford to buy a median-priced home without spending more than 25% of their income on mortgage payments.

The HAI is even lower for first-time buyers, reflecting the increased challenges they face in their journey to purchase their first home. Given that the income of first-time buyers is generally lower1 than that of all buyers, first-time buyers earn just 63% of the income needed to qualify for the purchase of a starter2 home. As of the year’s second quarter, first-time buyers can afford to buy a home priced 38% less than the median starter home.

Payment-to-income ratio definition and trends

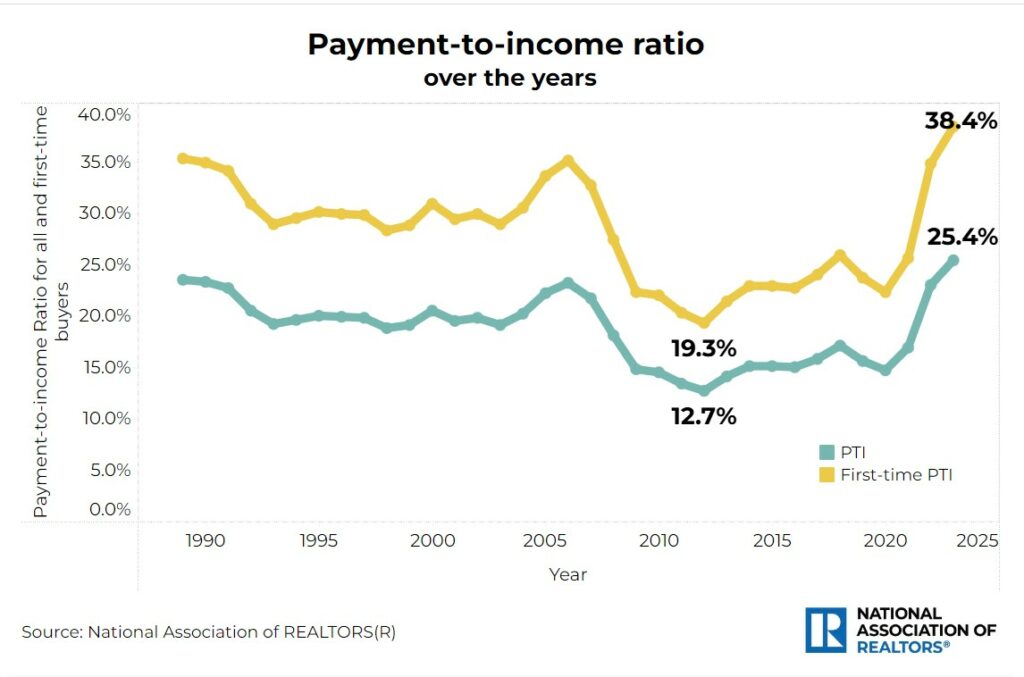

The payment-to-income ratio is another key metric the National Association of REALTORS® uses to assess housing affordability. Specifically, this ratio represents the percentage of the typical family’s gross income spent on mortgage payments (including principal and interest). While the rule of thumb indicates that housing costs shouldn’t exceed 30% of the income, NAR assumes that the payment-to-income ratio should not exceed 25%. Thus, a lower ratio suggests housing is more affordable, as a smaller portion of income is attributed to housing costs. Respectively, a higher ratio indicates that a larger share of income is required to cover the monthly mortgage payment. However, if the ratio rises above 25%, the typical family is considered “cost burdened.”

Over the years, the payment-to-income ratio has averaged 18.5%, indicating that historically, the typical family spent about 18.5% of their income on mortgage payments. However, mirroring the trend seen in the HAI, the payment-to-income ratio reached its highest level in 2023 at 25.4%. This exceeds the 25% threshold, showing that the typical family is now considered cost-burdened when purchasing the median-priced home. By contrast, in 2012, the ratio was just 12.7%, marking the lowest level ever recorded.

First-time buyers must allocate a substantially larger share of their income to the monthly mortgage payment. As of the second quarter of the year, the payment-to-income ratio for first-time buyers was 40.0%.

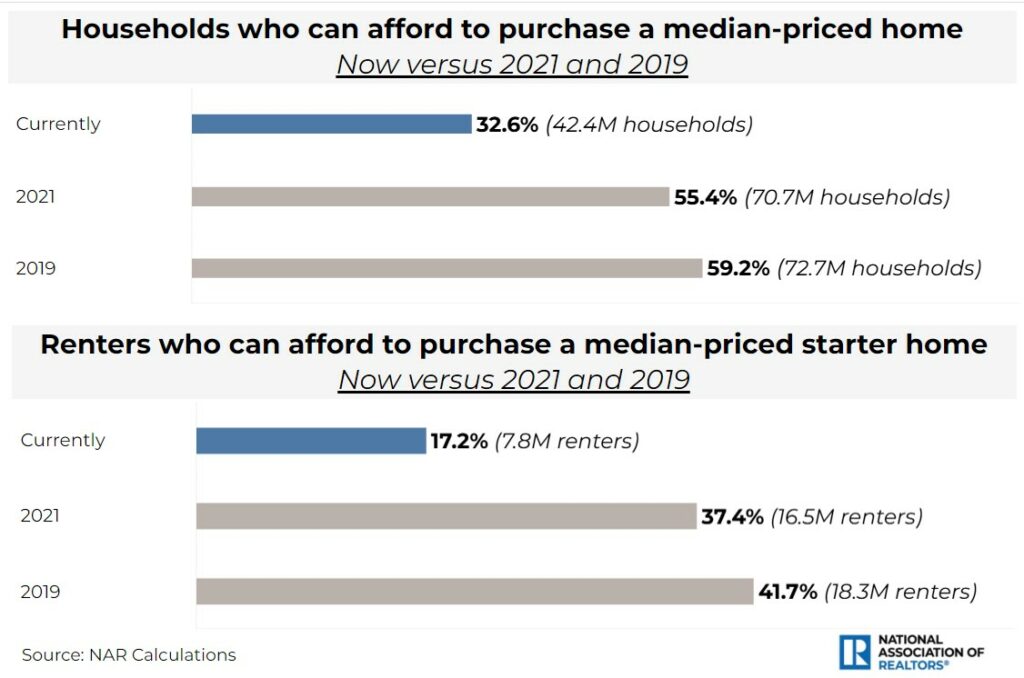

Based on the two metrics discussed, the pool of people who can afford a home has shrunk considerably compared to previous years. Households who once could comfortably afford a median-priced home are now finding it increasingly difficult. As they must allocate a larger portion of their income to mortgage payments.

Currently, one in three households (33%) can afford to purchase a median-priced home without spending more than 25% of their income on their mortgage payment. By contrast, in 2021, when mortgage rates were around 3%, 55% of households met the income requirements. In 2019, before the pandemic, housing was even more affordable, with nearly 60% of households able to purchase a home. Since 2021, 28.4 million households have been priced out of the market while 30.4 million households can no longer afford a median-priced home since 2019.

Seventeen percent of potential first-time buyers (current renters) can afford to buy the median-priced starter home. In 2021, 37% of renter households earned the qualifying income; and in 2019, 42% of renters were able to transition to homeownership. As a result, 8.7 million renter households have been priced out since 2021 and 10.6 million since 2019.

This weakening affordability in recent years has far-reaching implications for individuals and families. Homeownership has historically been proven to be one of the primary ways of building wealth as home values appreciate over time. In the last decade, homeowners built over $200,000 in wealth from price appreciation. When people are priced out of the housing market, especially first-time buyers, they miss out on this opportunity to accumulate wealth. Instead of building wealth, they spend a substantial amount of their income on rent, which doesn’t contribute to asset accumulation.

Notes:

1 The income of first-time buyers is assumed to be 65% of the median family income.

2 The value of a starter home is 15% below the median price of a single-family home.