Progressives and social democrats should be fighting them tooth and nail, not blithely embracing them. by Steve Roth Originally Posted at Wealth Economics The spreadsheet behind the tables and graphs here is available on request. Drop me a line in the comments or elsewhere. Following the community of Socks (?s) or “social democrats” out there on the interwebs (this is definitely my economic tribe), in articles, and in books, there’s a particular stance on a particular issue that I find perplexing, even anti-progressive. They’re generally quite keen on using “value-added” consumption/sales taxes (VATs) to fund a robust social-benefits or “welfare” system. (Viz: this out recently from Matt Bruenig and the People’s Policy Project. Thanks to

Topics:

Steve Roth considers the following as important: politics, US EConomics, VATs

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Progressives and social democrats should be fighting them tooth and nail, not blithely embracing them.

by Steve Roth

Originally Posted at Wealth Economics

The spreadsheet behind the tables and graphs here is available on request. Drop me a line in the comments or elsewhere.

Following the community of Socks (?s) or “social democrats” out there on the interwebs (this is definitely my economic tribe), in articles, and in books, there’s a particular stance on a particular issue that I find perplexing, even anti-progressive. They’re generally quite keen on using “value-added” consumption/sales taxes (VATs) to fund a robust social-benefits or “welfare” system. (Viz: this out recently from Matt Bruenig and the People’s Policy Project. Thanks to Matt for discussing this and disagreeing with me on it.)

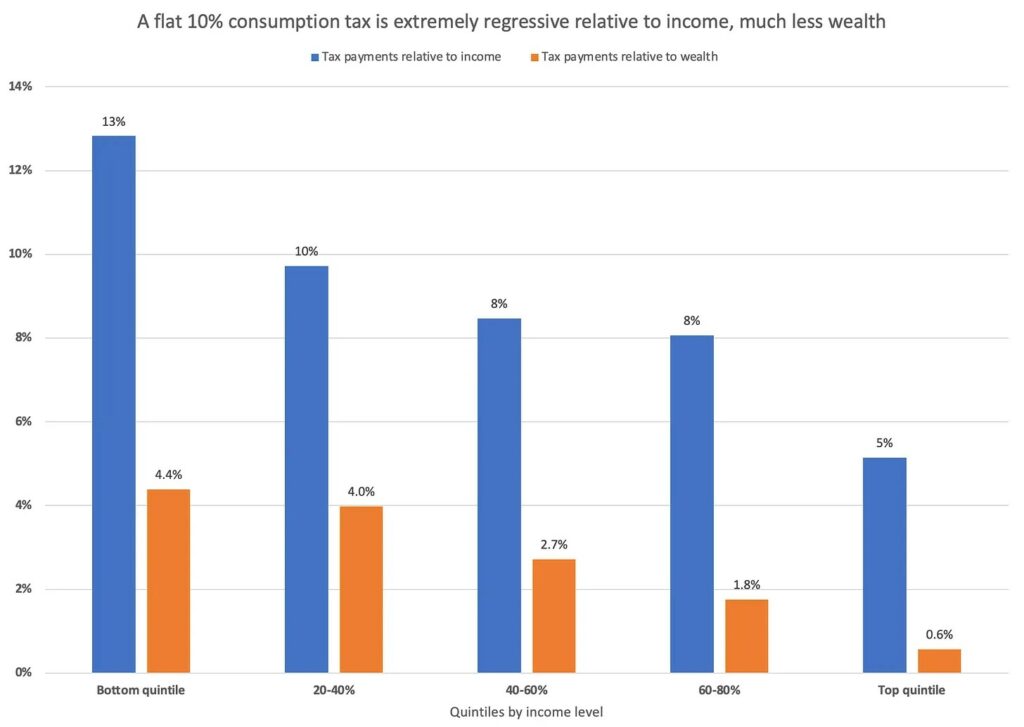

It’s perplexing to me because consumption taxes, on their face, are the most regressive taxes out there. Poorer people generally pay a higher share of their income on a sales tax, for instance (compared to richer people), than with an income tax, much less a wealth tax. Why would full-throated progressive Socks support and embrace that?

When I ask, I get four main answers.

Financial/economic: “There’s just not enough money at the top to fund the scope of the programs we need.”

Political: “Without broad participation (read: contributions) across the income/wealth spectrum, you can’t assemble or maintain the political coalition to support robust social democracy.”

Historical: “All the robust, successful social democracies out there are heavily funded by VATs.” Think northern Europe, especially Scandinavia.

Policy-analytical. “The goal is a total tax/transfer system that’s progressive. Focusing on the progressivity of particular tax or transfer programs misses the point.”

For me, that last point misses the point, which is not just providing high levels of material well-being at the bottom of the spectrum (which I of course strongly support). It’s about addressing and reversing the world’s extreme and increasing concentrations of income and especially wealth. That’s the core, long-term structural issue that needs fixing. VAT-and-transfer’s laser-focus on the bottom leaves the top to happily go along on its very merry way.

That reality exists even (especially!) in strong social democracies that used to have very progressive taxes, but abandoned them for VATs starting in the ’60s. Socks are fond of saying that every billionaire is a policy failure, but . . .

To address that structural issue, we need to, quite simply, seize the wealth and income. (Fuggedabout “the means of production.” That overwhelmingly consists of.…people. Are you gonna “seize the people”?) Willie Sutton’s line pertains here in spades, especially on top-end wealth: “That’s where the money is.”

If reducing the concentration of wealth, income, and hence power is an important progressive goal (or even the progressive goal), then the preference for VATs crashes on some very simple facts, and some very simple arithmetic. In the US as an example, the top 20% of households holds 74% of financial assets and 68% of total assets, receives 50% of income, but only does 35% of spending.

Do the arithmetic. Flat consumption taxes are inevitably regressive relative to income, much less wealth.

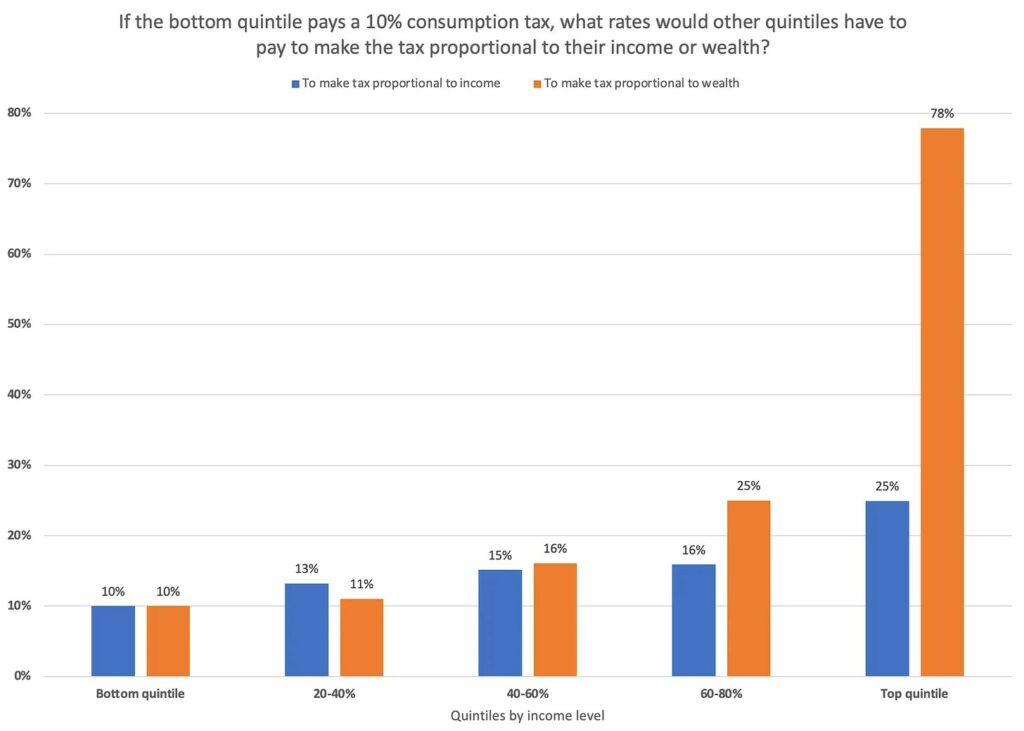

There are ways to make VATs less regressive. Don’t tax food purchases, for instance. But it’s a very deep regressive hole to climb out of. To get a sense of that: if the bottom quintile pays a 10% consumption tax, what rate would other quintiles have to pay, to make the tax merely proportional (non-progressive) relative to income and wealth?

Should we tax top-earners 25 cents for every dollar they spend? 78 cents? Good luck with that. And that’s before we even start to make the tax progressive, to arrest or (gasp) reverse the increasing wealth and income concentration that’s been delivered unto us by The Glorious Reaganomics Revolution. Markets on their own inevitably concentrate wealth, up to some very high level where open violent war and revolt break out. VAT-and-transfer can ameliorate that, but it can’t ever correct or reverse it — even over decades, as the world pictures above make clear.

Are the Socks right, that we can’t fund a full welfare state by taxing the rich? Absolutely. But “that won’t solve everything” is never, ever, or anywhere a valid argument for “we shouldn’t do that.” Can’t we, shouldn’t we start by taxing the rich, then fill in with taxes farther down the spectrum?

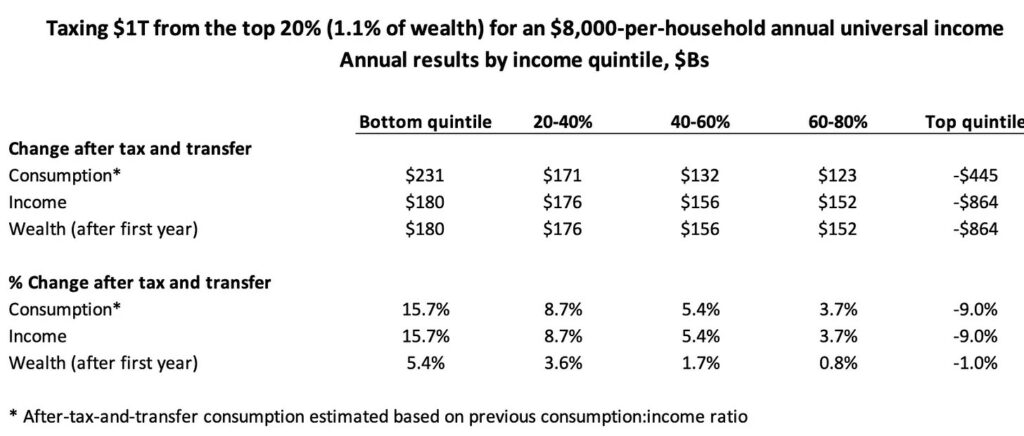

To get a sense of what we could do, imagine taxing $1T a year from the top 20% — just 1.1% of their wealth. (To compare: portfolio holders’ unearned total returns are generally in the range of 5% a year ++. They’d still keep getting richer if we pared off 1.1%, just more slowly.)

That $1T could deliver a modest universal income of $8,000 for every U.S. household, reliably, every year. It would completely transform tens of millions of lives. And because bottom-80 households turn over their wealth in annual spending 3–4 times as fast as top-20 households, the transfer would increase total national spending, economic activity, production, and…wealth accumulation.

Here’s a look at how that tax and transfer would play out.1

After receiving their $8K UI payments (and paying taxes on them), the effective tax rate on top-20% wealth would only be 1%. Higher marginal propensity to spend would increase total consumption spending by 2%, every year (compared to the current status quo).

If you compound that 2% annual growth over ten or twenty years, you have a very big increase in GDP. And much of that increase would devolve to the top 20%. All boats rise. Funding the welfare state with progressive taxes, first, certainly looks like a better option — for all but the very richest.

How did Socks get to this point, focusing on regressive taxes to fund a robust welfare state, with progressive taxes more of an afterthought? (Afterthought at best, as it’s turned out.) The core story centers on postwar theories of “welfare backlash.” It’s well-described in Harold Wilensky’s 2003 Rich Democracies, in particular Chapter 10, “Tax-Welfare Backlash: How to Tax, Spend, and Yet Keep Cool.”

In short form, with a U.S. focus: the huge buildout of the welfare state under F.D.R. and his labor secretary, Frances Perkins, hit a wall after WWII, with the rise of “neoliberalism” or whatever you choose to call it.

Socks’ both-sides-ism on the progressive/regressive question (“all taxes are good!”) can at least be seen as a capitulation to the counterattack launched by the Mount Pellerin Society in 1947, the 1971 Powell Memo, and zillionaire-funded astroturf propaganda campaigns that very much persist to this day. Democrats first abandoned their full-throated New Deal economic populism (that delivered four resounding Presidential wins for FDR) with Kennedy’s massive tax cuts for the rich in ’64 — proleptically surrendering to “trickle-down,” fifteen years before that term emerged.

And in the half-century post-LBJ (Medicare and Medicaid), the only significant economic-policy win for Socks has been the Frankenstein-monster “shopping will save us all” free-market-hybrid abomination that is Obamacare.

American Socks also point out that the robust social democratic countries pretty much all rely on VATs. But a less-than-charitable description of how that happened in northern European social democracies starting in the ’60s bears consideration. They ran screaming away from their progressive taxes in favor of VATs, effectively embracing and at least implicitly endorsing the “optimal taxation” notions of “The Washington Consensus.”2

It was a political/electoral decision: if we (try to) tax the rich, they’ll fight back. So we should, in Wilensky’s words, “keep cool.” Considering the outcomes, it’s not all clear that Socks are such great experts on branding, political marketing, strategy, tactics, and the prediction of electoral results. There’s never even been a noticeable “Social Democracy” faction much less party in the U.S., postwar, outside of academia. Meanwhile the electorally disastrous brand “Democratic Socialists” has surged as the only prominent voice of the full-throated left.

Coming back to the key takeaway here: if you think (highly) progressive taxes are a necessary or at least a good thing, and if you favor consumption/sales/VAT taxes, you’re going to have to plan on taxing top-quintile consumption spending at (high) double-digit or triple-digit rates. It’s the only way the arithmetic works. The political/electoral math on that doesn’t seem promising.

1 This doesn’t consider every interacting effect. The UI, for instance, would reduce the need (and eligibility) for existing programs, which generally involve pernicious mechanisms for means-testing the poor. (This means-tests the rich instead, something we already do for income at least, on their annual tax returns.) That might reduce the need for the regressive taxes that generally fund those programs. A full workup is needed. But this presentation does accurately impart the magnitude, scale, and beneficial effects from such a tax-and-transfer setup.

2 Their basic argument: GDP = consumption spending plus investment spending. Y = C + I. If (profligate, irresponsible) C goes down because of a consumption tax, then (industrious, responsible) I must go up! See the logical error? Lower C will obviously cause producers to invest less. I and Y will both decline.