[unable to retrieve full-text content]– by Steve Roth Originally posted at Wealth Economics “Capital” is polysemous; it has multiple meanings. People, notably including economists (who should know better), constantly muddle those meanings together even within a single sentence, so that nobody including the speakers and writers themselves knows, or can know, what the speaker is saying. It’s a centuries-old dumpster fire — conceptual and […]

The post We Should Abolish “Capital” appeared first on Angry Bear.

Articles by Steve Roth

Capital Gains: Realization

December 15, 2024[unable to retrieve full-text content]Capital Gains: Realization Does Not Matter – by Steve Roth Wealth Economics You’re looking at your asset portfolio and decide to sell or buy some ETF shares. Click. The transaction is a dollar-for-dollar asset swap between you and your counterparty, at current market prices: M assets (bank deposits) in exchange for ETF assets, and vice versa. Equal […]

The post Capital Gains: Realization appeared first on Angry Bear.

How Units of Account “Came About”

November 26, 2024[unable to retrieve full-text content]– by Steve Roth Originally posted at Wealth Economics This post is in response to a very brief Bluesky exchange I had with Dan Rohde and DT Cochrane about the origins of “The Dollar” (specifically U.S.). It led me to read about the U.S. Coinage Act of 1792. Here’s the Wiki, and the Act itself — which I can’t believe […]

The post How Units of Account “Came About” appeared first on Angry Bear.

There But For the Grace of God Go I

October 17, 2024By Steve Roth

Originally posted at Wealth Economics

Please excuse two paragraphs of a personal insight up front here. I think it’s pertinent. What follows are some serious research results, just out, that I think are hugely revealing about the ways of the (economic) world.

I had a visit from an old and good friend recently: dad of one of my kids’ best childhood friends, and in more recent years a business/investing colleague. We both had very prosperous upbringings, way beyond anything you’d call just “economically secure.” And while both of us worked hard (sometimes very hard) in our lives, made good decisions, and generally lived within our means, our lives were easy, and very pleasant.

My friend and I have also been very successful. He

Read More »The Fed and the Press Should Stop Inflating Inflation Expectations

September 12, 2024By Steve Roth

Originally Posted at Wealth Economics (June 2023)

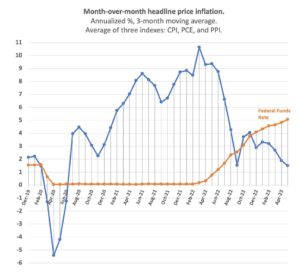

Recent headline inflation prints are below the Fed’s target, and falling. That news is a powerful tool for controlling expectations, but the Fed’s not using it.

1.5%. That’s the latest headline inflation rate in the U.S. per the May CPI release, and also according to a three-month average of three different inflation indexes that use somewhat different data, baskets, and weightings.

It seems like this low inflation should do much to tame people’s inflation expectations: the Fed’s bugbear. They should be shouting this from the rooftops, right?

By this multi-index quarterly measure, which smooths out volatile, random, and “head-fake” results without resorting to the

Read More »Actually Understanding Corporate Share Buybacks

July 26, 2024Who gets the money? Follow the assets.

by Steve Roth

Originally Published at Wealth Economics

This post by Judd Legum at Popular Information (read and subscribe!) prompts me to revisit the issue of share buybacks. This passage in particular:

It seems eye-popping. But is it? Even (especially?) finance and econ types don’t really understand buybacks from a big-picture, macro, national-accounting perspective. Here’s a shot at explaining it.

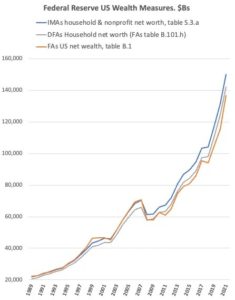

Corporate “Wealth” is Household Wealth

As is our wont here at Wealth Economics, let’s start with the household-sector balance sheet. It’s the only measure we’ve got of our collective, national wealth: assets and net worth. It’s the top of the accounting-ownership pyramid. Everything else

Read More »Why Consumption Taxes (VATs) are Insanely Regressive

July 22, 2024Progressives and social democrats should be fighting them tooth and nail, not blithely embracing them.

by Steve Roth

Originally Posted at Wealth Economics

The spreadsheet behind the tables and graphs here is available on request. Drop me a line in the comments or elsewhere.

Following the community of Socks (?s) or “social democrats” out there on the interwebs (this is definitely my economic tribe), in articles, and in books, there’s a particular stance on a particular issue that I find perplexing, even anti-progressive. They’re generally quite keen on using “value-added” consumption/sales taxes (VATs) to fund a robust social-benefits or “welfare” system. (Viz: this out recently from Matt Bruenig and the People’s Policy Project. Thanks to

Read More »Where Does Wealth Really “Come From”?

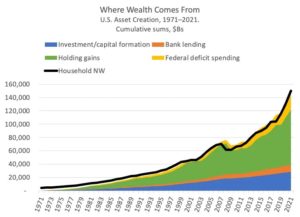

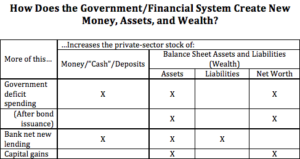

July 1, 2024Short answer: Lending, government deficits, capital formation, and holding gains

by Steve Roth

Originally Published at Wealth Economics

I ended my last post with an apparent conundrum: “One person’s spending is another person’s income.” It seems to imply that spending and income must be equal. And since saving equals income minus spending, saving must be…zero? That’s obviously not the case.

As I pointed out, other people’s spending is not the only source of our income. I listed four mechanisms that create new assets and expand our collective stock of wealth, and promised that I’d explain them in my next post. Here are those four mechanisms. (Ignoring liabilities and net worth for the moment; just focusing here on the assets for simplicity

Read More »Ten Fundamental Economic (Mis)understandings

June 18, 2024It’s all about the words . . .

by Steve Roth

Originally Published at Wealth Economics

This article was first published on Cameron Murray’s great Fresh Economic Thinking. It’s slightly revised here.

Maybe I’m just dense, but when I started studying economics roughly twenty years ago, I immediately ran into a bunch of basic concepts that just didn’t make sense to me. It was mostly a problem with economists’ words. They have different, shifting, overlapping, and contradictory meanings, that often collide even within a single sentence.

As Noahpinion says, it’s a dumpster fire. A tower of Babel.

I’m not the first to raise this flag, of course. Here’s Paul Romer in his landmark “Mathiness” paper.

Even the formal language often

Read More »Another Look at the Bottom-50% Wealth Runup: Meh

June 13, 2024By Steve Roth

Originally Published at Wealth Economics

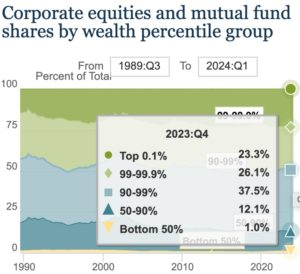

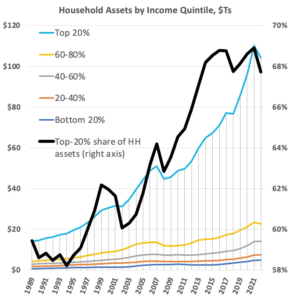

Wealth concentration got just a tiny bit less extreme.

The bottom 50% of American wealth holders got richer in the last three years: in 2021, ’22, and ’23 — not just in absolute dollar terms, but relative to richer folks. The percentage growth was faster than it was for wealthier groups, so wealth inequality went down — but only by a smidge.

The first thing to know is that the Bottom 50 start 2021 with a pretty tiny slice and share of total assets: $7.8T, 5.6% of households’ $140T total. End of 2023, they’ve got $9.6T, 5.8% of the total.1 A welcome development, but not exactly a massive shift in wealth inequality.

But still, the Bottom 50% is a bit better off, in both relative and

Read More »The “Wealth Effect” on Spending from Stock-Market Price Changes

May 21, 2024By Steve Roth

Wealth Economics

This post is prompted by Matthew Klein’s (very wonky) post about recent changes in QE/QT, and the Fed’s balance sheet. It prompted me to do a quick calculation that I’ve been meaning to get to: when household wealth increases (due to stock-market price runups or really anything else), what effect does that have on household spending in the next year?

I’m going to start with a bald two-part claim.

A. The overwhelming effect/mechanism/transmission-channel for QE/QT is via equity prices. QE gooses share prices. It “fills up the punchbowl.” QT takes it away, or at least restrains those runups.

B. There’s a resulting (weak) “wealth effect.” If people have more money/assets/wealth, they spend more.

The

Read More »How Did Under-40s Get So Much Richer During Covid?

May 2, 2024By Steve Roth

Wealth Economics

This picture from the Center for American Progress, and variations, have been making the rounds on the interwebs lately, eg here, here, and here. The headline is that younger households got 49% richer during/since Covid, in inflation-adjusted “real” terms.

But some drill-down is in order here. What actually happened? Start with background.

There are about 38 million households with under-40 heads of household — 30% of all households.

Those households only held 4% of total household net worth in 2019; that jumped to 6.5% in 2023. They definitely captured a bigger piece of the wealth pie, but the piece is still quite small.

Here are the nominal numbers (total, not per-household) from the DFAs1, CAP’s

Why Unlimited Wealth Is an Unassailable Advantage

April 22, 2024By Steve Roth

Wealth Economics

Imagine a five-player poker game. Assume all the players have equal skill, so the flows across the table over the course of the game are just a random walk. “It’s just how the cards fall.”

All the players start with the same number of chips. But there’s one difference: four of the players don’t have any more assets/money to buy new chips. If they lose all their chips, they’re out.

The fifth player has unlimited assets. No matter how much or how often they lose, they can always buy more chips and stay in the game.

If the game continues indefinitely, the fifth player will always at some point end up with all of the other players’ chips, just due to the random flows across the table.

I’ll leave the

Read More »Personal Income and Personal Saving Make More than 40% of Households’ Property Income…Invisible. Think Total Return.

April 16, 2024By Steve Roth

Wealth Economics

Matthew Klein and Joey Politano have been singularly responsible in their discussions of “excess saving” in the covid era — not least by always putting that term in “so-called” quotes. It’s saving in excess of what would have happened if pre-covid linear trends had continued (with the trend based on some chosen range of preceding quarters or years). It’s an estimate. Great.

They sometimes also discuss the accumulated stock of “excess savings,” which can only mean assets (in excess of what would have been accumulated sans covid). There is no national-accounts measure of any stock of “savings.” There’s just assets.1

Here’s a shot at untangling that, starting with the standard measure of household or “personal”

Read More »Where Does Wealth Come From?

March 24, 2024Wrong answers only: “saving”

Originally Published at Wealth Economics

In my last post, I tried to say precisely what the words “wealth” and “assets” mean as they’re used in this blog. This post tackles the question of wealth accumulation. Where does wealth come from? What are the mechanisms that create assets?

Households and the accounting-ownership pyramid

I realize first, though, that I left out an important issue in the last post: what I call the accounting-ownership pyramid. The household sector sits at the top; households ultimately “own” everything (that’s ownable and measurable), in accounting terms. The market-cap value of all firms, for instance, is an asset on the household-sector balance sheet. We can think of the firms’ sector

Read More »What is Wealth?

March 20, 2024The wealth of people and the wealth of nations

Originally Published at Wealth Economics

If you read this blog much, you’ll find many careful definitions of terms — something that the economics profession is terrible at. A blog called Wealth Economics really has to start at the top, with wealth. So here it is.

“The only real, true wealth is…”

You hear that sentence a lot — from economists, pundits, and all sorts of everyday people. It has lots of different endings. All of them are in some sense true and valid. The only “true” wealth is…friends, family, and loved ones. The only true wealth is “real,” productive goods. The only true wealth is land, or the whole environment. Or the discounted (“capitalized”) net present value of all future

Read More »Biden Says Billionaires Pay an 8.2% Tax Rate. What Do Other Households Pay?

March 9, 2024Let’s compare apples to apples here.

Originally Published at Wealth Economics

Uncle Joe has thrown out this 8.2% figure a couple of times, including in last night’s SOTU. Multiple folks have unpacked it; it’s not the standard “tax rate” measure. The usual “tax rate” is taxes divided by personal income, which doesn’t include accrued holding gains.

The alternative that Joe’s using is based on Total “Haig-Simons” income, which does include holding gains. Economists for many decades have been referring to H-S income as the “preferred” income measure, because it actually explains changes in households’ balance-sheet assets. Personal income, and thus Personal saving, don’t even come close to explaining households’ asset accumulation, and

Read More »Earned Labor Income Is a Small and Weak Lever. Unearned Property Income, and Wealth, Rule

March 7, 2024Reversing extreme wealth concentration means going after property income.

Originally Published at Wealth Economics

Economists and pundits have been cheered of late by the labor-share increase during the first couple of years of the Covid era. And even, for a moment, lower-income workers were making progress vs higher-income folks. This is good news. In the long view, though, these happy developments are just a minor blip in the half-century decline post-Reagan, which drove off a cliff from the Dot-Bomb through the Global Financial Crisis.

These measures are meaningful, but they don’t put across the sheer volume and magnitude of the disparity, and the shift. And they don’t impart the end result: extreme and increasingly concentrated

Read More »Is More Work Better? Think Again?

February 26, 2024Is More Work Better? Think Again?

The freedom of free time, branded as unproductive “leisure,” gets no respect.

Originally published at Wealth Economics

This post is prompted by a recent tweet from the excellent Joey Politano, but it’s not singling out Joey in particular.

“We could be working so much more.” It’s hard to come away with any other message. This tweet’s just one example of a lurking, largely unspoken, and quite likely unconscious value assumption that seems nearly universal among economists, pundits, politicians, and…people: more work is better.

Sure: if people need to work for wages to make a living, and they can’t get a job, that’s a bad thing. Hence the “jobs” focus of politicians and people in general. But do

Read More »John Maynard Keynes Doesn’t Seem to Know What He Means by the Word “Spending”

February 16, 2024Is investment spending “spending,” or isn’t it?

Steve Roth (@ Wealth Economics)

J.M. Keynes’ brief Preface to the French edition of General Theory is sometimes held up as the most concise, cogent, and coherent expression of his economic understandings. It achieves that, but in doing so it also reveals a core incoherence in that thinking.

An obligatory nod here to the importance of many pieces of Keynes’ thinking, notably the rather magisterial dismantling of a fundamental error in the thinking of the “English Political Economy” or “classical” “orthodoxy.” In the third paragraph of the Preface he explains that his orthodox predecessors have been engaged in a massive error of composition.

.…important mistakes have been made through

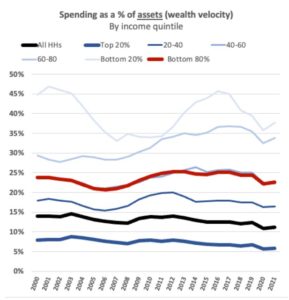

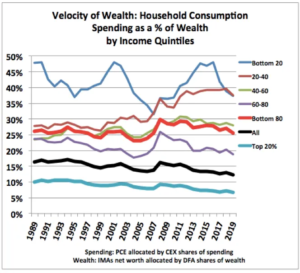

Read More »The Bottom 80% of U.S. Households Persistently Dissaves, Spending more than Income.

February 5, 2024Only the top 20% saves.

Originally published at Wealth Economics

Newly released data series from the Bureau Economic Analysis have revealed a pretty eye-popping economic reality that’s been invisible in the national accounts…forever. Subtract households’ Personal Taxes and Personal Outlays from Personal Income to yield Personal Saving, and it turns out that the bulk of U.S. households don’t save. Quite the contrary: the bottom 80% spends more than its income, year in and year out. Only the top 20% consistently saves.1

This reality was invisible before publication of the Distribution of Personal Income Accounts (here, the “DPIAs”), first released in December 2020 and now in its fourth (greatly improved) prototype version, released December

Read More »(Not) Thinking About Money

January 31, 2024(Not) Thinking About Money, Wealth Economics, Steve Roth (substack.com)

It’s tempting to abolish the word entirely.

Reprint from Wealth Economics.

J.W. Mason offers a bang-up post on economists’ thinking about “money,” how economists have thought and talked about it over decades and centuries. There’s even a class syllabus and reading list from his class for his John Jay MA econ students. It’s a very deep dive. (“Thirteen Ways of Looking at Money,” eek.) Highly recommended.

But as one who’s spent nigh-on two decades struggling and studying to understand all these writers using that key term in different, overlapping, and conflicting ways, I’d recommend starting with simple, clear definitions (plural) for that vexed word. It’s multivalent

Read More »MMT and the Wealth of Nations, Revisited

January 29, 2024Steve Roth (at Asymptosis)

I just had occasion, in replying to a correspondent, to reiterate much of the thinking in my recent MMT Conference presentation. I thought it might be a useful and comprehensible form for some readers, so I’m reproducing it here.

I’ve also explained this at somewhat painful length here.

Correct me if I am wrong but what you are saying extends MMT into the private sector. The govt boosts balance sheets with stimulative fiscal policy. The private sector boosts balance sheets through asset price appreciation. Each creates “money” out of nowhere.

That’s one way of saying it. It adds a mechanism for asset (money) creation beyond “outside” (gov) and “inside” (bank) money issuance.

I’d say: MMT largely and

Read More »How Redistribution Makes Us All Richer

January 25, 2024Modeling the numbers on bottom-up and middle-out economics.

How Redistribution Makes Us All Richer, Wealth Economics, Steve Roth

You hear a lot about bottom-up and middle-out economics these days, as antidotes to a half-century of “trickle-down” theorizing and rhetoric. You’re even hearing it, prominently, from Joe Biden.

[embedded content]

They’re compelling ideas: put more wealth and income in the hands of millions, or hundreds of millions, and you’ll see more economic activity, more prosperity, and more widespread prosperity. To its proponents, it seems downright intuitive or even obvious, a formula for The American Dream.

But curiously, you don’t find much nuts and bolts economic theory supporting that view of how economies work.

Read More »Total Income, and the Collapse of the Household Labor Share

January 17, 2024The decline in workers’ share of the total pie is far more extreme than standard measures suggest.

Total Income, and the Collapse of the Household Labor Share, Wealth Economics, Steve Roth

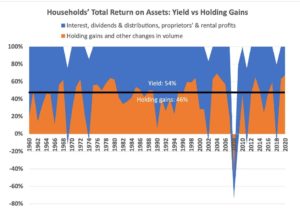

The best way to start this post is with a graph that many will find surprising, even eye-popping. The graph kind of speaks for itself — pretty dismayingly, especially post-covid. The rest of this post just explains it.

This graph answers a question that standard measures of labor share don’t and can’t answer. As households accumulate new assets, wealth, how of much of that newly-created wealth goes to workers, for working? As the wealth pie got bigger, what happened to labor’s slice of that pie? Did all the wealth boats rise together?

To answer that

Read More »Economic Origin Stories and the State of the World

January 11, 2024Asymptosis » Economic Origin Stories and the State of the World, Steve Roth.

Origin stories and creation myths pack a pretty hefty weight of import in human understandings of the world. Examples are too numerous to mention. What I’ve noticed in the field of economics is such origin stories are often taken (mistakenly) to fully explain the current state of affairs. I’m going to discuss two examples here.

1. Why Money Has Value. The “double coincidence of wants” money-origin story, retailed by Adam Smith among many others, has been quite thoroughly debunked over the past century. But the better stories that have emerged continue to be seen by many economists — problematically in my opinion — as significant explanations of how things work right

Read More »Personal Saving Makes More than 40% of Property Income . . . Invisible. Think Total Return

January 9, 2024Personal income, so Personal saving, ignore a huge part of Total Return — the income-from-assets measure used by every modern portfolio investor. Guess what’s missing?

Personal Saving Makes More than 40% of Property Income . . . Invisible. Think Total Return, Wealth Economics, Steve Roth

Matthew Klein and Joey Politano have been singularly responsible in their discussions of “excess saving” in the covid era — not least by always putting that term in “so-called” quotes. It’s saving in excess of what would have happened if pre-covid linear trends had continued (with the trend based on some chosen range of preceding quarters or years). It’s an estimate. Great.

They sometimes also discuss the accumulated stock of “excess savings,” which can only

Read More »Actually, Only Banks Print Money

January 6, 2024Asymptosis » Actually, Only Banks Print Money, Steve Roth

I’m thinking this headline will raise some eyebrows in the MMT community. But it’s not really so radical. It’s just using the word money very carefully, as defined here.

Starting with the big picture:

You can compare the magnitude of these asset-creation mechanisms here. (Hint: cap gains rule.)

The key concept: “money” here just means a particular type of financial instrument, balance-sheet asset: one whose price is institutionally pegged to the unit of account (The Dollar, eg). The price of a dollar bill or a checking/money-market one-dollar balance is always…one dollar. This class of instruments is what’s tallied up in monetary aggregates.

A key tenet of MMT, loosely

Read More »Government is Not the Problem. Bad Government is the Problem

January 4, 2024Having gone from trump to Biden. a person who I thought would never make a good president makes Steve’s argument on Bad Government being the problem when trump was the president.

Asymptosis » Government is Not the Problem. Bad Government is the Problem, Steve Roth.

And the solution to bad government is … good government.

A lot of people — maybe even most Americans — think that making government smaller will make it better.

But that reminds of the time when I was little kid that I got in trouble for pouring water out of a glass down a heat register in our house.

Why down a heat register? I can only say that it seemed like a good idea at the time.

Why was I pouring water out of a glass? Because the water was warm, and I wanted cold

Read More »Do We Wildly Underestimate GDP?

December 29, 2023Been looking around for a few, new, and good writers to add to Angry Bear. I know we have Robert, New Deal democrat, and Joel amongst us now. I ran into Steve Roth since he posted to Tom Walker’s post. He is allowing me to poach from his new substack Wealth Economics and an older blog site Asymptosis. Happy about this as it allows me to write more freely too. Anyway, this commentary of Steves’ I like.

Do We Wildly Underestimate GDP? Wealth Economics, Steve Roth.

Our production minus our consumption doesn’t come close to explaining our wealth accumulation. Do the asset markets know better?

In national accounting, there are two ways of estimating what all our real-world stuff is worth. They’re both market measures, based on what people pay for

Read More »