The decline in workers’ share of the total pie is far more extreme than standard measures suggest. Total Income, and the Collapse of the Household Labor Share, Wealth Economics, Steve Roth The best way to start this post is with a graph that many will find surprising, even eye-popping. The graph kind of speaks for itself — pretty dismayingly, especially post-covid. The rest of this post just explains it. This graph answers a question that standard measures of labor share don’t and can’t answer. As households accumulate new assets, wealth, how of much of that newly-created wealth goes to workers, for working? As the wealth pie got bigger, what happened to labor’s slice of that pie? Did all the wealth boats rise together? To answer that

Topics:

Steve Roth considers the following as important: Household Labor Share, Taxes/regulation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

The decline in workers’ share of the total pie is far more extreme than standard measures suggest.

Total Income, and the Collapse of the Household Labor Share, Wealth Economics, Steve Roth

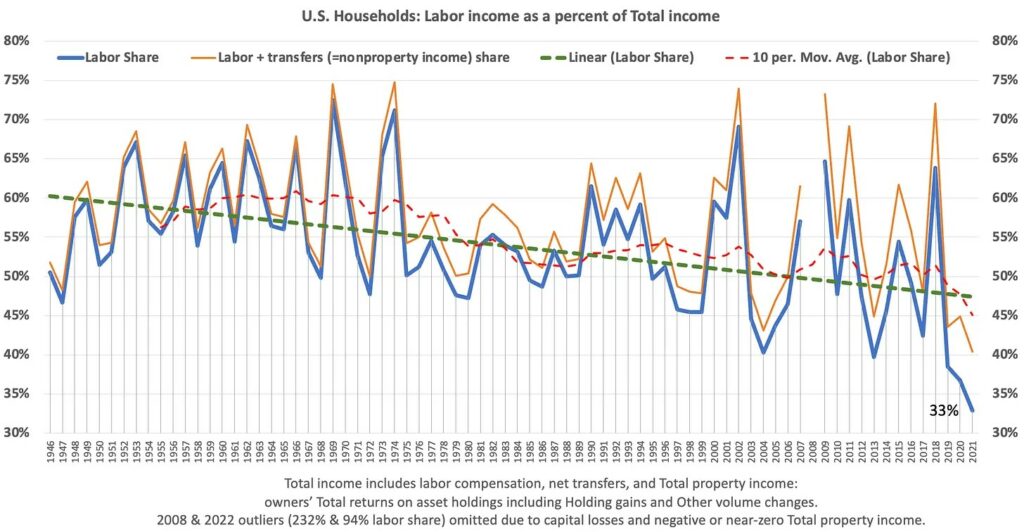

The best way to start this post is with a graph that many will find surprising, even eye-popping. The graph kind of speaks for itself — pretty dismayingly, especially post-covid. The rest of this post just explains it.

This graph answers a question that standard measures of labor share don’t and can’t answer. As households accumulate new assets, wealth, how of much of that newly-created wealth goes to workers, for working? As the wealth pie got bigger, what happened to labor’s slice of that pie? Did all the wealth boats rise together?

To answer that question, we need a measure of Total income — contributions to household wealth. And we need to answer another question: did that Total income come from 1. labor income/compensation, 2. property/ownership income, or 3. transfers (mostly from government)?

Wealth increases come from income, after subtracting spending, interest payments, and taxes to derive “saving.” The accounting arithmetic is fairly simple, detailed in a previous post. But as that post points out, the income measure is not (quite) so simple. Ditto saving.

The standard measure of household’s “Personal Income” ignores a big part of households’ asset accumulation — their holding or “capital” gains on asset holdings over years, decades, and generations. If we add that to Personal income (plus some other, small adjustments), we get a measure of Total income (and what we can call Total saving), that does explain wealth accumulation.1 In particular it includes households’ Total Return on assets, while Personal income only includes dividends, interest, and rental profits received — the asset “yield.”

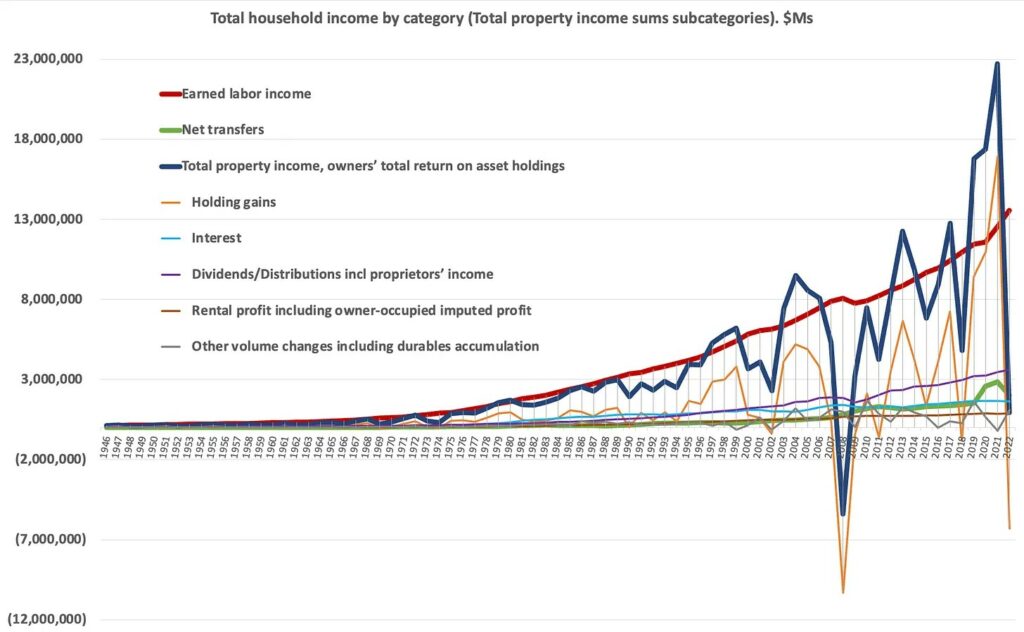

Here are the sources of households’ Total income over 75 years.2

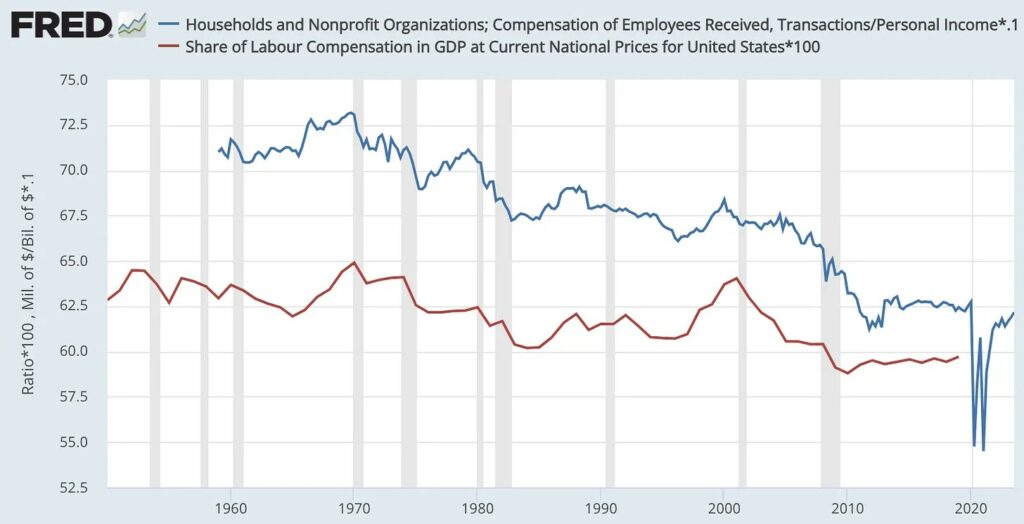

Standard labor-share measures use less-complete or sectorally different measures as their denominators: labor compensation as a percent of GDP, as a percent of corporate “Value added,” etc. These measures can be pretty arcane (“National income” for example, which by the way also ignores holding gains). The accounting can get quite abstruse. Here are two fairly simple measures.

These measures also show a multi-decade decline, but to nowhere near the low levels of the Total income graph (especially post-covid). And since those measures ignore holding gains, they can’t explain different groups’ changing wealth shares over time.

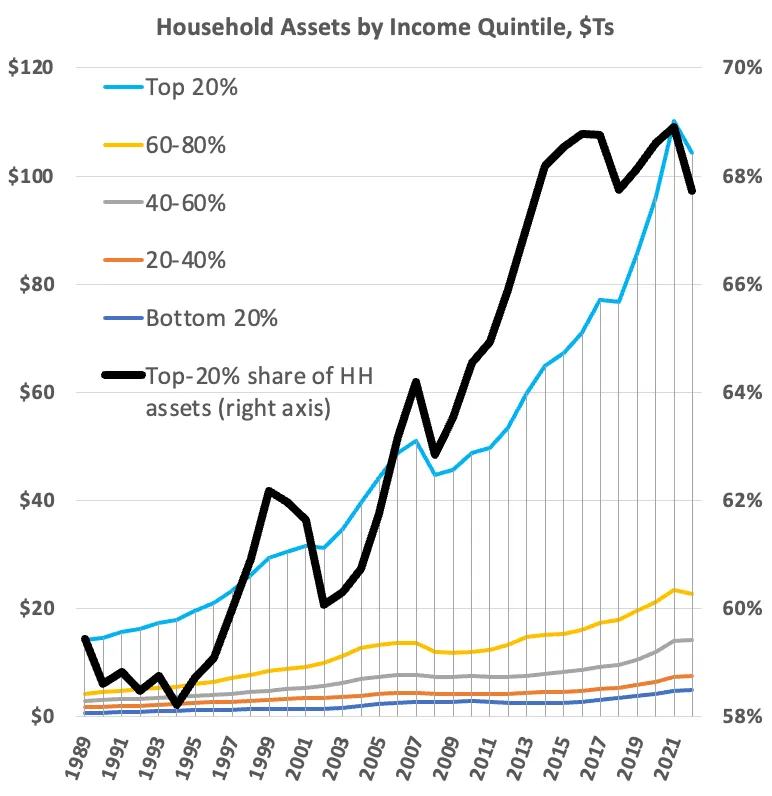

Here’s that: the cumulative result of the labor-share decline and property-share increase over 33 years, revealed in household quintiles’ total wealth.3

It’s the Matthew Effect in spades: “To him who has will more be given, and he will have abundance.”4 The magnitude of that effect in the U.S. over past decades is impossible to see using standard, balance-sheet-incomplete measures of household income, “saving,” and labor share.

For my gentle readers who might like to get the sources and data for these graphs, they’re happily provided on request.

Footnotes:

1 This Total income measure is commonly known as Haig-Simons income. Over many decades, income and wealth economists have been referring to it as the “preferred” measure of income because it explains balance-sheet changes. But still, this measure is rarely employed by economists.

2 Some proprietors’ income (~10% of total income) can and arguably should be classified as earned labor income instead of property income, as it’s treated here. But determining the “value” of proprietors’ labor is inevitably subjective. Should it include the value/profits derived from their accumulated “social capital,” for instance?” Some researches say yes. Piketty/Saez/Zucman and other researchers like Matthew Klein often, necessarily somewhat arbitrarily, allocate 50% of proprietors’ income to labor income. Because proprietors’ income is only ~10% of total income, though, this only increases the labor share of (Personal or Total) household income by one or two percentage points. At the same time, though, since ~87% of proprietors’ income goes to the top 20%, the adjustment delivers a significant dollar increase to that quintile’s attributed labor earnings, and an offsetting decrease in its property income dollars.

3 This graph uses income quintiles because the Distributional Financial Accounts provide that granularity, from bottom to top. The breakouts by wealth percentile only give the bottom 50%, next 40%, and top 10%.

4 It’s interesting to note that even in the 2008 wealth drawdown, unprecedented since the Great Depression, top-quintile wealth recovered in only five years. More recently: top-20% households recovered from the 2022 asset drawdown within nine months, by the end of Q3 2022.