Since the beginning of the Covid epidemic, the US economy has performed better than European economies and the Eurozone average. This comparison is useful, and not just for boasting rights. Fiscal policy in the USA and in the Eurozone has been dramatically different – The US Federal Government implemented Six very large fiscal stimuli: The CARES act signed into law by Donald The bipartisan (Manchin) stimulus enacted In December 2024 signed into law by Donald Trump which included 0 per working family. The American Rescue plan which included 00 dollars more signed into law by Biden (who actually kept his 00 campaign promise amazing as that might be) The bipartisan Infrastructure Bill the Bipartisan information technology sector

Topics:

Robert Waldmann considers the following as important: politics, US EConomics, US economy

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

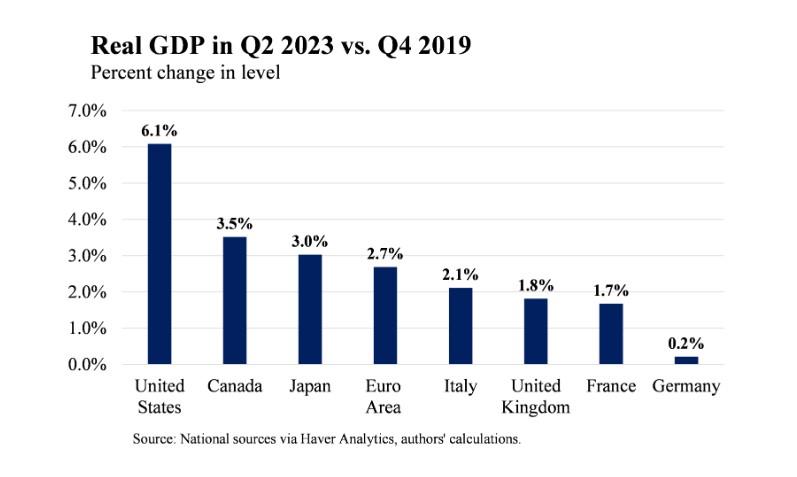

Since the beginning of the Covid epidemic, the US economy has performed better than European economies and the Eurozone average. This comparison is useful, and not just for boasting rights. Fiscal policy in the USA and in the Eurozone has been dramatically different – The US Federal Government implemented Six very large fiscal stimuli:

The CARES act signed into law by Donald

The bipartisan (Manchin) stimulus enacted In December 2024 signed into law by Donald Trump which included $600 per working family.

The American Rescue plan which included $1400 dollars more signed into law by Biden (who actually kept his $2000 campaign promise amazing as that might be)

The bipartisan Infrastructure Bill

the Bipartisan information technology sector subsidizing CHIPS

and the very oddly named Inflation Reduction Act which was mostly anti global warming subsidies and incentives.

According to standard models, these (including the oddly named inflation reduction act) should have caused higher GDP (check) and inflation (nope). The pattern of inflation is surprising (plus most people in the USA will be reluctant to believe it) but it is very clear in the data, provided the definitions of inflation are harmonized (a lot of US reported consumer price inflation is Owner Equivalent Rent, a price which no one actually pays and which is not included in European consumer price indices).

The extreme similarity strongly suggests a common cause — Covid related supply disruptions. It shows almost no hint of the massively expansionary US fiscal policy.

In contrast, real GDP data shows a major difference between the USA other G7 countries

The authors are Eric Van Nostrand and Tara Sinclair. This suggests an effect of fiscal stimulus.

I’d say that fiscal stimulus wins again.

Appendix: This is a problem for Paleo Keynesians such as myself. Keynes said a boom was the time for austerity and the US economy was booming, or at least clearly about to boom, when the American Rescue Plan was enacted, Keynes strongly cautioned against believing one had found a Phillips curve (21 years before Phillips reported his scatter but I swear it is clear enough). But since 1960 orthodox paleo Keynesians have warned that too much stimulus causes increased inflation. In practice it was followed by a rapid reduction in inflation.

Hint of future action. I will discuss this absense of an economic problem which is a problem for economists tomorrow (really not as Trump promises something will be written and released to the public in two weeks).