I think the title makes it clear that this will be a rambling confused post. I am typing on with the thought that something is better than nothing and no one has to read this. The first topic – house prices, is in fact one that interests me a lot. I have a regression which suggests that a high ratio of house prices to the general price level is terrible news, because it indicates a housing bubble which will burst and be followed by a prolonged recession. Currently the ratio of the Case-Shiller housing price index to the CPI is higher than it was in 2006. I don’t want to jinx the economy (my predictions are almost always wrong) but I am not terrified. I think that this time it’s different. This time there has also been a huge increase in

Topics:

Robert Waldmann considers the following as important: housing, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

I think the title makes it clear that this will be a rambling confused post. I am typing on with the thought that something is better than nothing and no one has to read this.

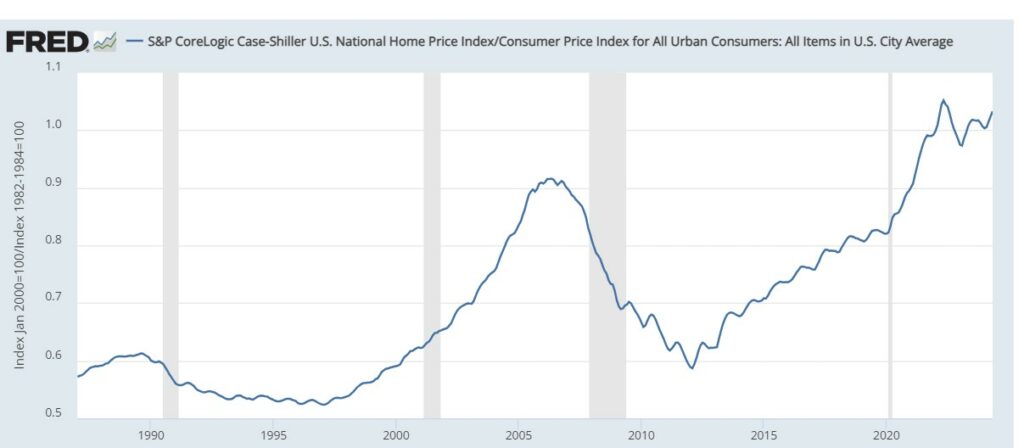

The first topic – house prices, is in fact one that interests me a lot. I have a regression which suggests that a high ratio of house prices to the general price level is terrible news, because it indicates a housing bubble which will burst and be followed by a prolonged recession.

Currently the ratio of the Case-Shiller housing price index to the CPI is higher than it was in 2006.

I don’t want to jinx the economy (my predictions are almost always wrong) but I am not terrified. I think that this time it’s different. This time there has also been a huge increase in rent also relative to the rapidly increasing general price level. This suggests that high housing prices are due to a genuine shortage not speculation.

HIgh rents also mean that the value of housing services is high. People paying a high down payment and very high mortgage payments due to the combination of a high house price and high mortgage interest rates have unatractive alternatives. In econospeak the value of the housing services they obtain is high.

I rely more on vibes than numbers (and I admit it). There aren’t the usual symptoms of a bubble which include a lot of talk about capital gains, people explicitly buying planning to sell soon for a higher price (flip) people entering the market who didn’t participate before (where here the market is for second homes).

Also people complain about the high prices. A high price is bad for the buyer and good for the seller, and also bad for someone who plans to buy in the future and good for someone who can sell. I read about the complaints of desperate buyers not the gloating of sellers.

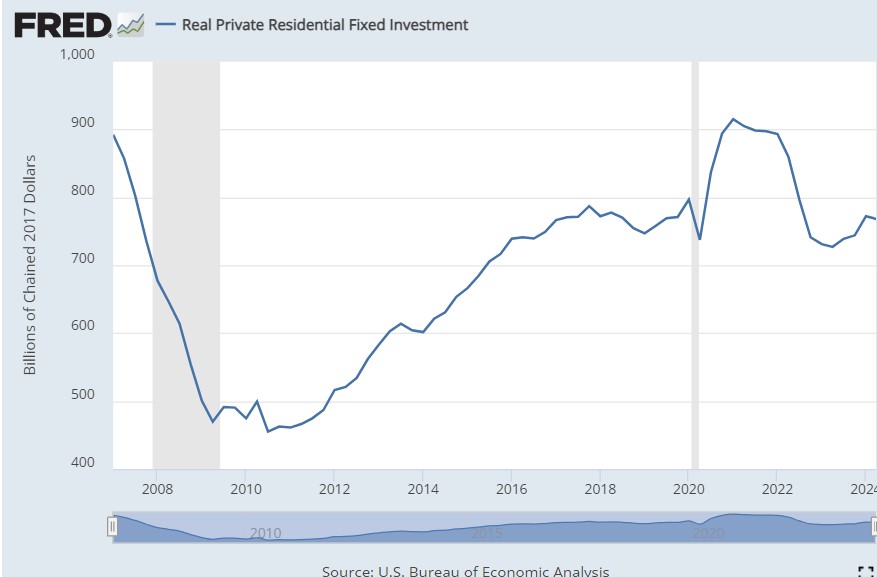

The high demand at high prices is also very important right now. It means residential investment has remained fairly high in spite of high interest rates (including the mortgage interest rate which is the one what matters for housing demand).

This is very important. The main ways in which monetary policy affects the real economy is through residential investment which is low if interest rates are high and through exchange rates. Given the simultanious shift to tight anti-inflation policy in rich countries, the way that the FED’s anti-inflation efforts would affect real GDP and employment is mostly residential investment.

The third channel is investment in non-residentia structures which are mostly office building and shopping malls (factory buildings are large but cheap).

But wait, if high interest rates did not affect aggregate demand, how did they cause the dramatic decline in inflation? I think they didn’t. I think that high inflation was due to Covid disruptions and not extremely high aggregate demand and that it declined even though the housing shortage caused monetary policy to be ineffective.

That is I follow Krugman (as always — it’s really embarrassing) and call the high inflation long termporary – something that lasted years but was destined to fade away on its own.

This means that I ascribe the FED’s soft landing triumph to pure luck.

It also means that I hope with some confidence that the landing will be soft

(RJW confidence is a very alarming leading indicator – I am almost always wrong).