From Dean Baker

The Republicans and Donald Trump seem set on establishing a strategic crypto reserve. They are claiming this will somehow be an important source of economic security for the country. It’s clear that establishing the reserve will be an important way to give tens of billions of dollars to Donald Trump’s campaign contributors, but it is much harder to see how it will provide any economic security to the country.

To better understand the logic of a strategic crypto reserve, it is useful to consider a strategic baseball card reserve. Instead of the U.S. government investing $100 billion in crypto, imagine Donald Trump announced plans to put $100 billion into a strategic baseball card reserve.

Now just to quell those skeptics saying that the entire stock of baseball cards is

Articles by Dean Baker

The elites’ big lie on inequality

March 3, 2025From Dean Baker

(I saw that Jeff Bezos wants the Washington Post’s editorial page to run pieces touting the merits of free markets. Here’s my submission.)

There are not many issues on which there is largely bipartisan agreement, so the story we tell about the origin of economic inequality stands out. Both sides agree that the increase in inequality of income and wealth is driven by an unfettered market. The difference is that conservatives say it is wise to accept the outcomes of the ‘free market,’ while people on the left believe the government should ameliorate the effects of the market.

But both sides accept that inequality is caused by the market. This is nothing but a Big Lie that bolsters elite interests.

The reality is that there is no “the market” out there generating

Businesses and DEI: Corporations don’t maximize shareholder value

February 24, 2025From Dean Baker

CEOs and other top management in the U.S. are far more highly paid

than their counterparts in Europe and Asia.

NYT columnist Jeff Sommer had an entertaining piece on how many of the business leaders who eagerly embraced DEI a few years back are now being very quick to abandon it. This is not terribly surprising to those of us who never took the commitment to DEI very seriously, but there is an important aspect to his discussion that he leaves out.

Sommer spends much of the piece on the views Milton Friedman expressed in an article more than half a century ago. In that article, Friedman said that it is the job of corporate executives to maximize profit, not to try to do things they consider good for society. While it is foolish to imagine that corporations will ever be

Real corruption that could meet republican cost-saving targets

February 15, 2025From Dean Baker

The news has been filled with stories in recent days about Republicans desperately hunting for $2.0-$2.5 trillion (2-3 percent of the budget) in budget cuts over the next decade to cover the cost of extending tax cuts to the rich. While Elon Musk and his DOGE team have been screaming about corruption all through the government, they actually have found little that can be helpful here.

They appear to have found virtually nothing by way of actual corruption. Most of what they have been screaming about are small-budget allocations having to do with race, gender, or sexual orientation that they don’t like. Individually these programs are nickel and dime stuff, and even collectively they won’t come close to covering the cost of the tax cuts that Elon Musk and his billionaire

Donald Trump is badly nonfused # 67,218: The story of supply and demand

February 1, 2025From Dean Baker

Donald Trump is the world’s leading expert in getting things wrong and one thing he gets wrong bigly is the value of the U.S. domestic market. Trump seems to believe that our domestic market is incredibly valuable to the rest of the world and that access to it should allow him to extort large concessions from the rest of the world. This is a seriously wrong understanding of the world economy.

The basic point is a simple one, when other countries sell us things, they are essentially giving us a portion of what they are able to produce for dollar bills. Because they give us a portion of what they produce, they have less to consume or invest domestically. It’s sort of like if you bake a cake and give a slice to your neighbor, that leaves less for you and your family. In

Health insurance killing: Economics does have something to say

December 17, 2024From Dean Baker

I’m not one to generally tout the wisdom of the economics discipline, but it actually does offer some useful insights into the likely motive for the murder of Brian Thompson, the CEO of United Healthcare (UHC). According to media accounts, the suspect, Luigi Mangione, was angered by his own and others’ experiences being turned down when submitting claims for healthcare service. United and other insurers make a profit by restricting the claims they pay, so their profit motive goes directly against people’s need to get healthcare.

That simple story is undeniably true, but the picture is more complicated. Many of the claims being submitted are outlandishly high, due to high prices for drugs and medical equipment, as well high fees for medical specialists and

Read More »Capitalism and Democracy: The market is far more flexible than Christopher Caldwell imagines

December 1, 2024From Dean Baker

New York Times columnist Christopher Caldwell devoted his Thanksgiving piece to describing the German sociologist Wolfgang Streeck’s views on capitalism and democracy. I have not read much of Streeck’s work, but as recounted by Caldwell, he gets many of the basic facts about the U.S. economy badly wrong.

According to Caldwell’s account, capitalists were willing to sacrifice profits in the decades after World War II for stability. This meant less dynamism but allowed for broadly shared prosperity and thriving democratic institutions.

“Between the end of World War II and the 1970s, he reminds us, working classes in Western countries won robust incomes and extensive protections. Profit margins suffered, of course, but that was in the nature of what Mr. Streeck calls

Automation is called “Productivity Growth”

October 13, 2024From Dean Baker

It is more than a bit bizarre reading pieces that talk about automation or job-killing AI as something new and alien. These are forms of productivity growth. They allow more goods and services to be produced for each hour of human labor.

Productivity growth is usually thought of as a good thing. It’s the reason that we don’t have half the U.S. workforce employed in agriculture growing our food. Instead, it is around 1.0 percent of the U.S. workforce, and we grow enough to be huge food exporters.

Productivity growth allows for workers to have higher wages. The period in our history where we had the most rapid productivity growth was in the post-war boom from 1947 to 1973. Productivity growth averaged almost 3.0 percent a year. This was passed on in the form of higher

Automation is called “productivity growth”

October 7, 2024From Dean Baker

It is more than a bit bizarre reading pieces that talk about automation or job-killing AI as something new and alien. These are forms of productivity growth. They allow more goods and services to be produced for each hour of human labor.

Productivity growth is usually thought of as a good thing. It’s the reason that we don’t have half the U.S. workforce employed in agriculture growing our food. Instead, it is around 1.0 percent of the U.S. workforce, and we grow enough to be huge food exporters.

Productivity growth allows for workers to have higher wages. The period in our history where we had the most rapid productivity growth was in the post-war boom from 1947 to 1973. Productivity growth averaged almost 3.0 percent a year. This was passed on in the form of higher

Diverting class warfare into generational warfare

September 3, 2024From Dean Baker

In the last-half century, productivity has outpaced the growth of real compensation for the median worker by more than 40 percent. This means that if workers’ pay had kept pace with productivity, as it did in the three decades after World War II, it would be roughly 40 percent higher than it is today.

This would mean that instead of a typical worker earning $34 an hour, they would be earning close to $48 an hour. That implies an annual wage of $96,000 a year for a worker putting in 40 hours a week for 50 weeks a year.

Getting workers their fair share should be, and to some extent has been, a central issue in political debates. However, there is a continual effort by the media to pull the focus away from within generation inequality, and instead tell young people that

Manufacturing jobs: unions made them good, not the factories

August 13, 2024From Dean Baker

The effort to bring back manufacturing jobs has been a major theme in the 2024 election. Both parties say they consider this a high priority for the next administration. However, there is a notable difference in that the Biden-Harris administration has actively supported an increase in unionization, while the Republicans have indicated, at best, neutrality if not outright hostility towards unions.

This distinction is important in the context of manufacturing jobs. Many people seem to assume that manufacturing jobs are automatically good jobs, paying more than non manufacturing jobs.

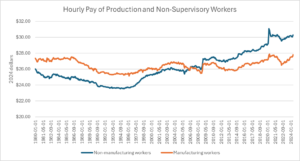

While that was true four decades ago, before the massive job loss of manufacturing jobs due to trade, it is not clear this is still the case. The figure below shows the average hourly pay,

AI, guaranteed income, and the “Which way is up?” problem afflicting our elites

July 24, 2024From Dean Baker

Leading media outlets like The New York Times, The Atlantic, and The New Yorker have about as much concern for intellectual consistency as TikTok videos. In very serious and somber tones they will warn the rest of us about a major problem and then in the next issue, or the next article, present a story that is 180 degrees at odds without ever realizing the contradiction.

My favorite example of this “Which way is up?” problem is the simultaneous concern expressed that AI will eliminate all the jobs and that declining birth rates will lead to worker shortages. We got a taste of the former in an NYT article about efforts by OpenAI’s CEO Sam Altman to promote guaranteed income programs.

According to the piece, Altman and other tech types who share his views, are concerned

We can’t have a new paradigm as long as people think the old one was free-market fundamentalism

June 23, 2024From Dean Baker

The belief in free-market fundamentalism runs very deep. When I say that, I don’t mean that support for the concept runs deep, I mean the belief that we had been pursuing free-market policies in the years before the Trump and Biden presidency runs very deep. I was reminded of this fact in a New York Times column by Farah Stockman, touting the development of a new post-free-market fundamentalist paradigm.

To be clear, the period of so-called free-market fundamentalism was one in which we saw a massive upward redistribution of wealth and income as has been extensively documented in numerous studies. It is understandable that the people who are happy about this upward redistribution would like to attribute it to the natural workings of the market.

Read More »The productivity/pay gap and phony debates

June 13, 2024From Dean Baker

New York Times columnist Peter Coy did a piece yesterday questioning the existence of a gap between productivity growth and the typical worker’s pay. This gap was established decades ago by my friends and former colleagues at the Economic Policy Institute (EPI). The fact that it is now being questioned says a lot about economics and even more about politics in this country.

First, let me be clear, my purpose is not at all to beat up on Coy. I’ve known him for many years and consider him a very good reporter/columnist who tries to get things right. The fact that he could be caught up in this mud-throwing effort speaks volumes about the influence of well-funded conservative think tanks and their ability to push their agenda even when it has no basis in reality.

The

Global warming and the threat of cheap Chinese EVs

May 27, 2024From Dean Baker

Suppose the G-7 finance ministers sat down and worked out a plan to spend tens of billions of dollars a year to subsidize developing countries in their transition to a green economy. Many of us might think this is a good idea since global warming poses a real threat to the planet.

Unfortunately, the G-7 finance ministers seem to have done the exact opposite. According to the coverage in the New York Times, they discussed ways to retaliate against China over its own plans to subsidize the transition to a green economy.

The article tells us:

Policymakers worry that a flood of heavily subsidized Chinese green energy technology products will cripple the clean energy sectors in the United States and Europe, leading to lost jobs and reliance on China for solar panels,

Read More »The problem with electric vehicles

May 15, 2024From Dean Baker

For the last quarter century, those of us hoping we could slow global warming were anxious to see a quick conversion to electric vehicles (EVs). If we could get most people using electric vehicles, and have the energy coming from clean sources, we could radically reduce greenhouse gas emissions.

The problem was that EVs were considerably more expensive than their conventional counterparts. There were savings in operation due to lower maintenance, and the electricity generally costing less than gas, but that usually was not enough to offset the higher purchase price.

This was the motivation for the tax credit that the Biden administration included in the 2022 Inflation Reduction Act. The idea was to bring the price of EVs closer to the price of conventional cars.

After

With a modest financial transactions tax, Jim Simons would not have been superrich

May 13, 2024From Dean Baker

The New York Times reported that Jim Simons, the founder of Medallion hedge fund, died this week. As a result of his fund, according to the article, he accumulated more than $20 billion over his lifetime.

Simons was a math genius who had made many important breakthroughs in various areas of math. Back in the 1980s, he decided that he could make far more money on Wall Street than in doing math at a university. He thought that with sophisticated algorithms and cutting-edge computers, he could beat the market by finding patterns in trading.

This meant literally making trades seconds or even fractions of a second before other traders became aware of a price shift. If a trade could make a margin on even a few fractions of a percentage point on trades, hundreds of times, that

There ain’t no libertarians, just politicians who want to give all the money to the rich

April 3, 2024From Dean Baker

David Wallace-Wells had a column discussing the trip by Javier Milei, Argentina’s new president, to the World Economic Forum (WEF) in Davos, Switzerland. The WEF is an annual gathering of many of the world’s richest people, where they also invite politicians, academics, and others who they think may amuse them. According to Wallace-Wells, Mr. Milei definitely fits into that category.

The piece talked about how Milei calls himself as an anarchist, with the government just doing basic functions, like defending the country and running the criminal justice system. Otherwise, Milei would eliminate any role for government, if he had his choice.

It is humorous to hear politicians make declarations like this. As a practical matter, almost all of these self-described anarchists

In a free market, drugs are cheap, government-granted patent monopolies make them expensive

March 14, 2024From Dean Baker

This simple point was left out of a Washington Post article on the legal battle surrounding the Biden Administration’s efforts to negotiate lower prices for drugs purchased by Medicare. This point is important because the drug companies are definitely not trying to get the government out of the market, as the industry claims.

The industry is effectively insisting that the government is obligated to give it an unrestricted monopoly for the period of its patent duration. Also, since patent monopolies provide enormous incentives for corruption (they are equivalent to tariffs of many thousand percent, or even tens of thousands percent), drug companies often find ways to game the system and extend effective protection beyond the original patent life.

Anyhow, portraying this

Is “greedflation” over?

March 11, 2024From Dean Baker

Peter Coy used his column yesterday to beg President Biden not to use the term “greedflation” to explain the runup in inflation since the pandemic. I am sympathetic to much of his argument, most importantly, the idea that corporations suddenly turned greedy is a bit far out.

As Coy notes, corporations are always greedy. The real question is whether something unusual was going on with corporate profits in the pandemic. There clearly was an increase in profit margins in the pandemic. This was largely due to real shortages created by supply chain problems worldwide.

We can say this with a high degree of certainty because inflation was a worldwide story. This means that the idea that it was due to Biden’s “excessive” stimulus is silly.

While the U.S. is a huge part of the

Do you want to subsidize rich people’s political contributions?

February 9, 2024From Dean Baker

In prior decades we in the US used to try to restrict the ability of the rich and very rich to buy elections. We have limits on campaign contributions to candidates and political parties. Until the Supreme Court’s 2009 decision in Citizens United case, corporations were prohibited altogether from contributing to politicians and political campaigns.

This is no longer the case. The rich have found ways to largely circumvent campaign funding restrictions with independent campaign committees. And corporations can support whatever candidates or causes they want.

But the problem of money is even worse than it seems. Not only do the rich get to spend as much as they want to advance their interests, they can actually get taxpayer subsidies for pushing their political agenda.

The great economy Trump left Biden

January 16, 2024From Dean Baker

We have been seeing numerous stories in the media about how people support Donald Trump because he did such a great job with the economy. Obviously, people can believe whatever they want about the world, but it is worth reminding people what the world actually looked like when Trump left office (kicking and screaming) and Biden stepped into the White House.

Trump’s Legacy: Mass Unemployment

The economy had largely shut down in the spring of 2020 because of the pandemic. It was still very far from fully reopening at the point of the transition.

In January of 2021, the unemployment rate was 6.4 percent, up from 3.5 percent before the pandemic hit at the start of the year. A more striking figure than the unemployment rate was the employment rate, the percentage of the

When it comes to prescription drugs, the Washington Post can’t even conceive of free trade

November 28, 2023From Dean Baker

Like many self-imagined “free-traders,” the Washington Post editorial board cannot even conceive of free trade when it comes to prescription drugs. They demonstrated this fact yet again in discussing ways to deal with the high price of effective weight-loss drugs like Wegovy. These drugs carry price tags of more than $1,000 a month, making them costly for insurers, governments, or individuals who have to pick up the tab themselves.

The Post throws out a couple of ideas that could allow for a lower price, but never considers the fact that these drugs would be cheap without the government-granted patent monopolies that prevent generic manufacturers from entering the market. The monopolies are of course to provide an incentive to undertake the research, but there are other

Will China’s demographic crisis look like Japan and Korea’s?

November 7, 2023From Dean Baker

The New York Times seems to really love telling readers that China is facing a demographic crisis because its population is falling. It is not clear why the NYT thinks this amounts to a crisis for China, since many other countries have declining populations without experiencing any obvious crisis.

The most obvious examples are two of China’s neighbors, Japan and Korea, both of which are seeing modest drops in population. In both countries, per capita income is continuing to rise, in spite of a shrinking workforce. In fact, in South Korea, per capita income has risen at a 2.0 percent annual rate in the last four years, a faster pace than in the United States.

This growth figure actually understates improvements in living standards, since a smaller population also means

Fighting billionaires’ control of the media, individual news vouchers

October 26, 2023From Dean Baker

Mark Twain famously quipped that everyone always talks about the weather, but no one ever does anything about it. (This was before global warming.) In the same vein, it is common for people to rant about billionaires, like Rupert Murdoch and Elon Musk, controlling major media outlets and using them to advance their political whims. But, no one seems to do anything about it.

There is a reason for inaction. For the foreseeable future, it is hard to envision a political scenario in which the ability of the rich and very rich to own and control major news outlets will be restricted. That means that if the goal is to prevent Elon Musk from owning Twitter (or “X,” as he now calls it), then we will likely be able to do little more than rant. (That is not entirely true.)

Read More »The big three’s CEOs are ripping off their companies

October 3, 2023From Dean Baker

Robert Reich posted a table that tells us a huge amount about the U.S. economy.

CEO pay of the largest carmakers in the world

Honda: $2.3M

Nissan $4.5M

Toyota: $6.7M

BMW: $5.6M

Mercedes: $7.5M

Porsche: $7.9M

Ford: $21M

Stellantis: $25M

GM: $29M

The reason this table is so informative is that the performance of these foreign automakers would certainly stand up well in comparison to the U.S. Big Three. (In fairness, Stellantis is largely a European company, headquartered in Amsterdam. But, its CEO gets U.S.-style pay.) So, the question is, why do U.S. companies have to pay so much more to get good help at the top?

The disparity in CEO pay does not reflect pay patterns in the economy more generally. The Bureau of Labor Statistics stopped publishing data showing hourly

A high national debt can be bad news, sort of like a high stock market

September 28, 2023From Dean Baker

The media have been giving considerable attention to the national debt in the last year or so. They have some cause, it has been rising rapidly, and more importantly, the interest burden of the debt has increased sharply since the Fed began raising rates last year. But, if we want to be serious, rather than just write scary headlines, we have to ask why the debt is a problem.

The first concern to dispel is the idea that the country somehow has to pay off its debt. Our national debt is in dollars, which the government prints. Unless something truly bizarre happens, we will always be able to print the dollars needed to pay interest and principal on government bonds.

We could have some story that if our economy collapses people could lose confidence in our debt. That is

Crypto and finance are waste and a drag on the economy

September 6, 2023From Dean Baker

As everyone learns in Econ 101, and immediately forgets, the purpose of the financial sector is to facilitate transactions and allocate capital. This seems like a simple and obvious point, but you would never know it in most discussions of the financial sector.

The point here is that we need finance for these purposes. We don’t need finance to develop elaborate betting games and complex financial instruments. Financial instruments are only useful when they serve the purpose of better facilitating transactions or improving the allocation of capital.

In this context, an efficient financial sector is a small financial sector. We want to use as few resources as possible to serve its function, just as we want to use as few resources as possible in the trucking industry.

Like

Job loss from going green is nothing like the loss of manufacturing jobs due to trade

August 19, 2023From Dean Baker

The United States suffered from a massive loss of manufacturing jobs in the 00s. This has come to be known as the “China Shock,” since it was associated with a flood of imports, especially from China, and a rapid rise in the U.S. trade deficit.

In the decade from December of 1999 to December of 2009, the economy lost more than 5.8 million manufacturing jobs, or more than one in three of the manufacturing jobs at the start of the decade. The vast majority of this job loss took place before the start of the Great Recession in December of 2007.

This sort of job loss was not typical for the manufacturing sector. While it lost jobs in the 1990s also, the drop was just 601,000, a bit more than one tenth as much as in the next decade. Since 2009, the manufacturing sector has

U.S. manufacturing jobs and trade: A tale of two graphs

August 7, 2023From Dean Baker

The first decade of this century was pretty awful for U.S. manufacturing workers. In December of 1999 we had 17.3 million manufacturing jobs. This number had fallen to 11.5 million by December of 2009. This amounted to a loss of 5.8 million jobs, or one-third of all the manufacturing jobs that had existed at the start of the decade. That looks like a pretty big deal.

It’s also worth pointing out that most of these jobs were lost before the onset of the Great Recession. We had lost almost 4 million jobs by December of 2007, the official start date of the Great Recession. The obvious culprit here is the explosion in U.S. trade deficit that we saw in this decade. If we’re buying more goods from other countries, in general, that means we are producing fewer goods here.

It’s